FTSE All-Time High on a Weaker Pound

Trades in Whisky and Soda;

I joined "the city” (London financial district) in April 1998, when the FTSE 100 was flirting with the 6,000 level for the first time. Yesterday, it breached 8,000 some 26 years later. Luckily, I found other things to invest in over the years. The new high comes after the pre-pandemic high, which was brutal for an old economy stockmarket full of oil and banks.

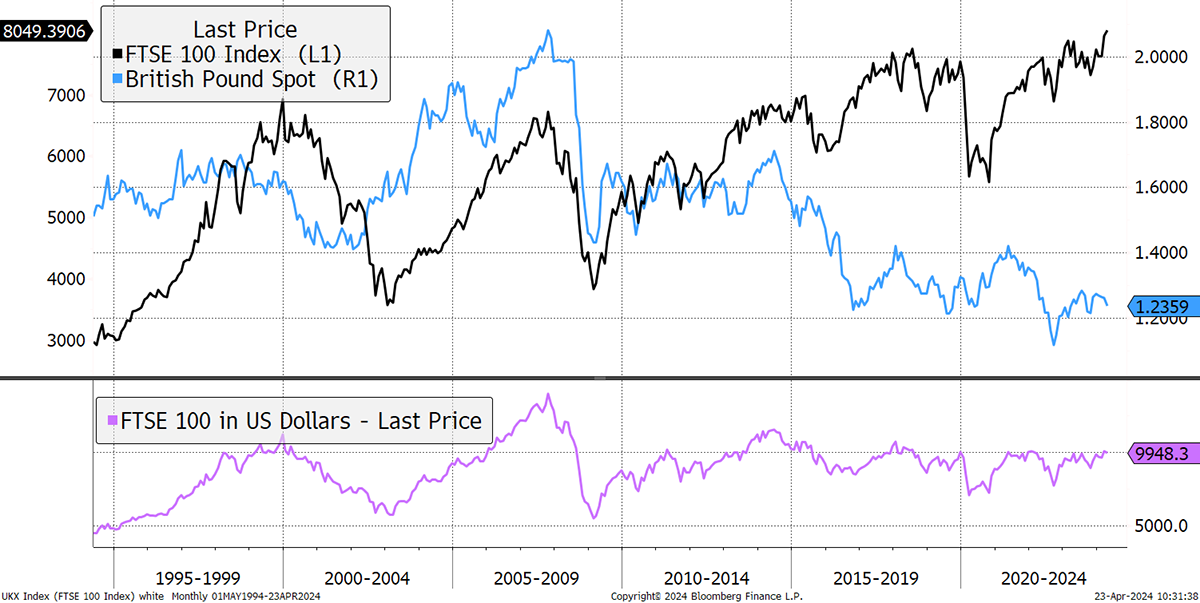

It’s been a real struggle getting here, but a soft pound helped the FTSE over the edge. Currency weakness helps a little in the short-term, but devaluation is never a route to riches as shown by the lower chart, the FTSE in dollars. On that measure, the last high was in October 2007.

The FTSE 100, the Pound and the FTSE in US Dollars

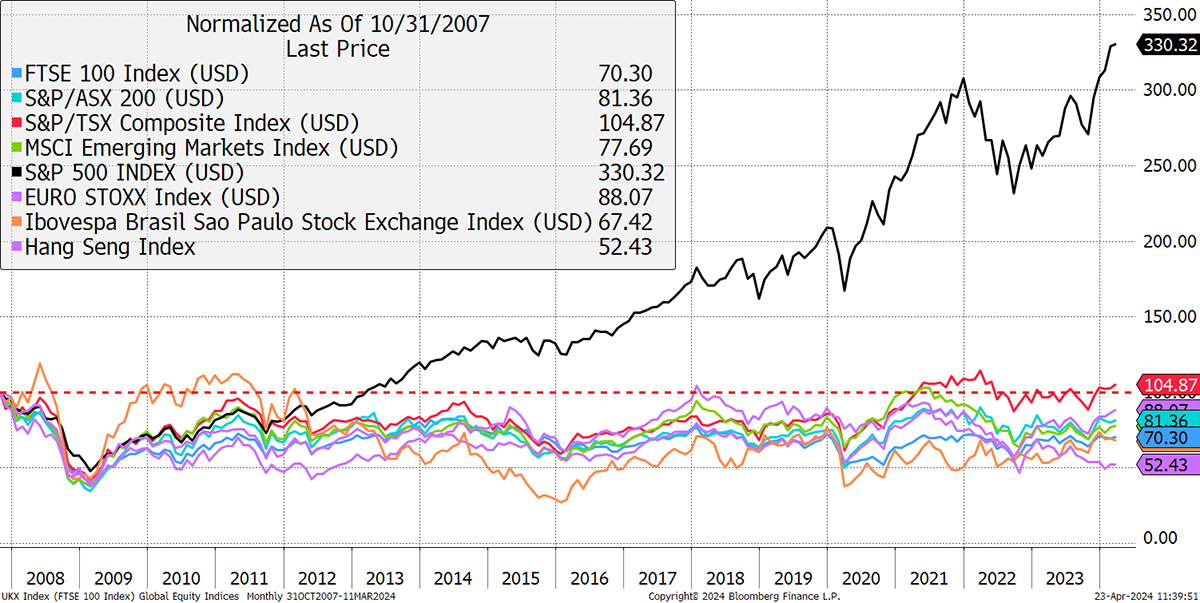

The FTSE wasn’t the only market to peak back then. In that same month, we saw long-term highs for Asia and the emerging markets. There were also notable highs for Continental Europe and the USA. The big difference is that most of these places haven’t made new highs since. The US divergence from the world is the largest in history. See how many major markets have failed to deliver a single dollar of capital return since October 2007.

USA Surges While the World Lags

It’s an important consideration because here in the UK, we blame the government, the regulator, and everything else for our lousy stockmarket, but should we take comfort in knowing that we are in good company? I mean, China and the emerging markets are growing quickly, yet they still can’t seem to make a buck.

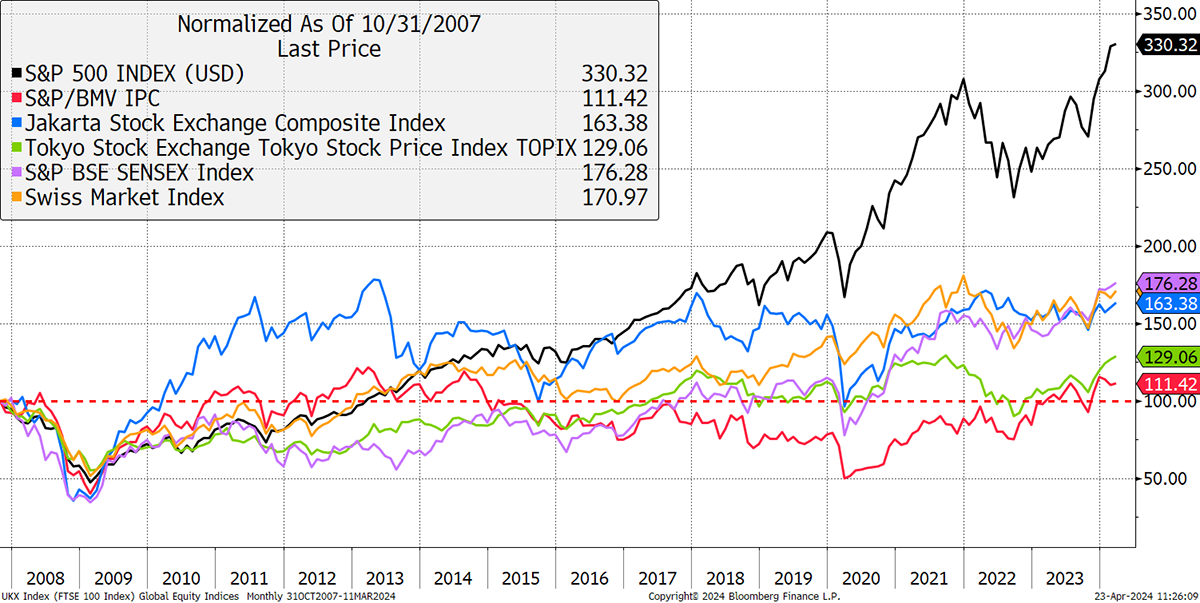

There were some indices that made progress but still not much compared to the USA. Indonesia, Switzerland and India all received silver medals, with Japan and Mexico receiving bronze.

Some Markets Made Progress

It is easy to see that the US stockmarket acceleration came courtesy of the pandemic, at which point, no one could keep up. The reason is simple: their big tech giants just kept powering on. In which case, the question becomes, how and why did computer and internet-related tech become a US monopoly? For that, we can certainly blame our governments and regulators.

Still the FTSE made an all-time high, and that is mainly due to strength in banks and oil. Oh well.

Investing in Latin America

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd