Bonds Back in Decline

Trade in Soda;

An uptrend is a series of higher highs and higher lows. In contrast, a downtrend is a series of lower highs and lower lows. The great hope was that the bond bear market was over and interest rates would decline. Yet, in the few weeks of this year, bonds are back in decline, and I can only describe what I see to be a downtrend.

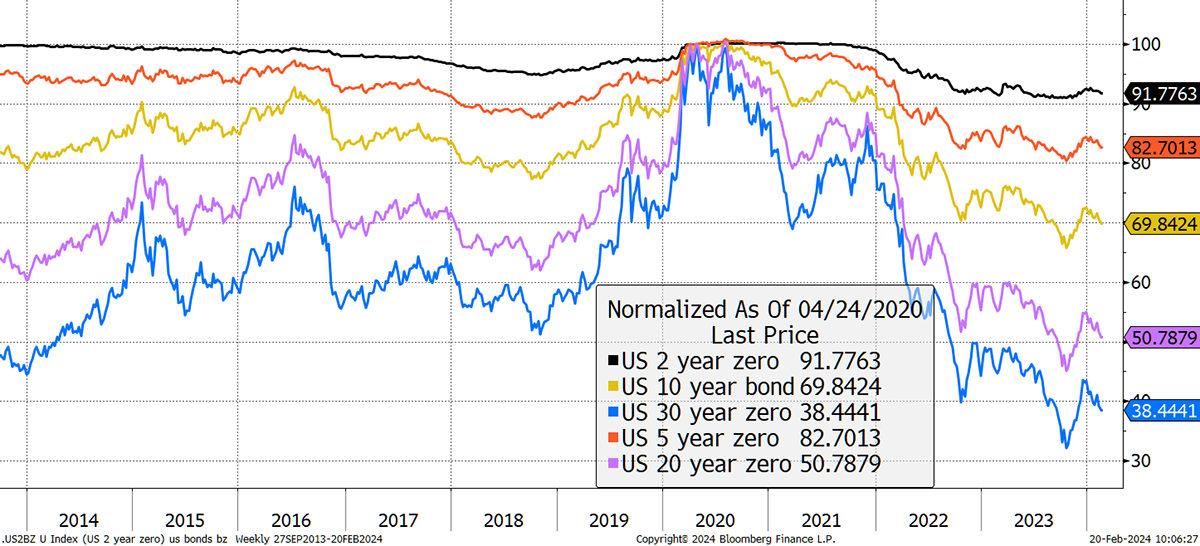

At ByteTree, we have a trend-scoring system that measures trends across commodities, crypto, equities and FX. Sadly, we don’t cover bonds (yet). But using our trend definitions, calculated from 30-day and 200-day moving averages, with 20-day max min lines, the 30-year, 20-year, 10-year, and 5-year bonds score 0 out of 5, with the 2-year managing a 1 out of 5. That’s not good, and it tells us that bonds are back in decline.

Bonds Are Back in a Bear Market

The thing I like about ByteTrend is the unbiased nature of the signals. Investors will often look at charts and see what they want to see rather than what is actually happening. In financial analysis, it is important to stay objective.

I am using my favourite hypothetical zero coupon bonds, which turn a yield into a price. The 30-year is much more volatile than the 2-year and has lost a lot of money since 2020. The 2-year is calm, but it still lost 8.3%, which is about the same as the interest income received.

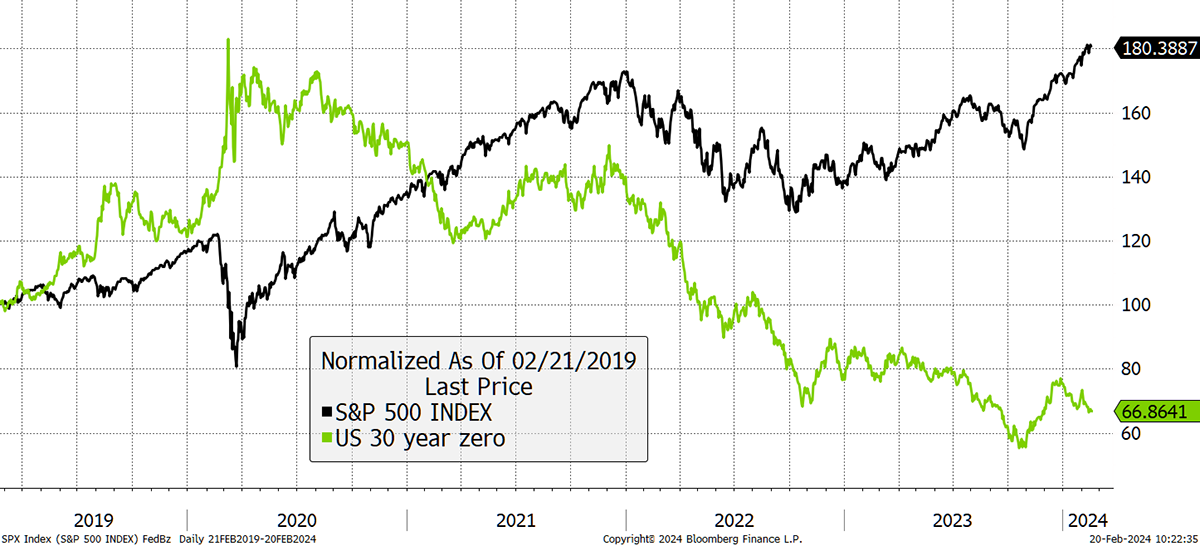

The hope was rates would fall and support equities. After all, we keep being told that inflation is coming down. But is it? Short-term inflation expectations score 5 on ByteTrend (an uptrend), long-term 4, and oil 5. Gold scores 4, Bitcoin 5 and copper 4. A falling inflation environment doesn’t look like this.

It’s time to wheel out the bond vs equity charts and see where we are. Recall that something changed during the pandemic, where bonds and equities were uncorrelated on the way in, only to become correlated on the way out. Today, they remain correlated.

Bonds and Equities Moving Against Each Other

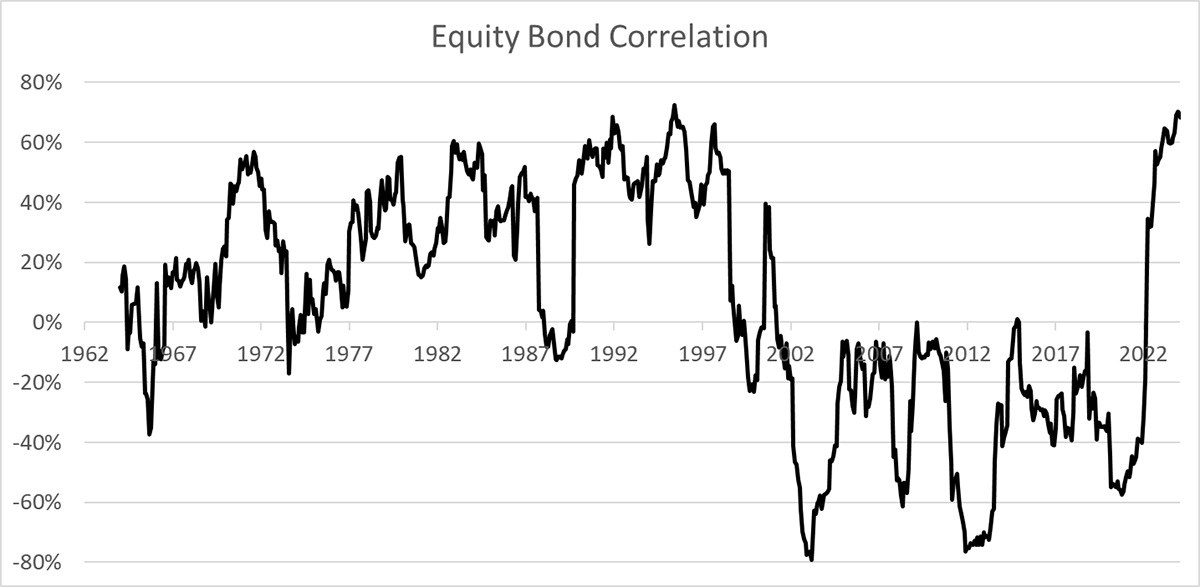

You can see that since 2021, something has changed, and that is shown since 1962 in the chart below. Equities and bonds were correlated pre-2000, only to become uncorrelated in the low inflation era between 2000 and 2021.

It’s back to the olden days, and by investing in bonds, investors are no longer receiving the diversification benefits. That simple idea that you hold a 60/40 (equity/bond) portfolio and have a backstop whenever the stockmarket goes down is no longer true. They both go up and down together.

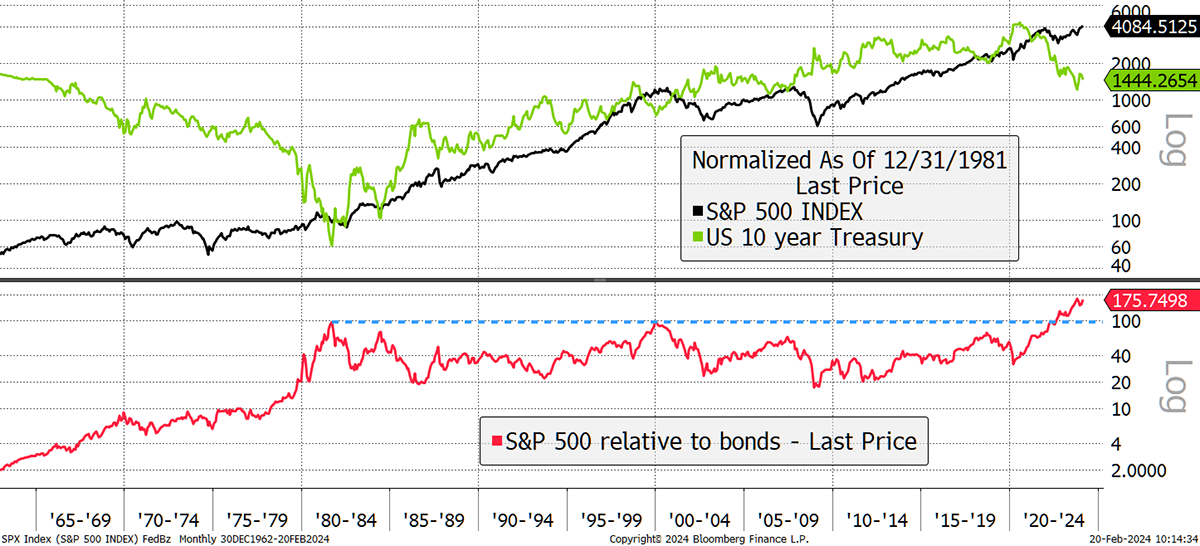

Observing this over the much longer term reminds us how higher rates, and therefore bond yields, can block progress in the stockmarket, for years, as we saw in the 1970s. That doesn’t have to stop the economy, as businesses and profits can keep on growing. It just means investments get cheaper and, therefore, deliver greater rewards later on.

Equities Surge, Bonds Stall

We should be deeply suspicious of cries to buy the long bond as if it’s still 2007. It may prove useful, but I doubt it. With the yield 1% below cash, it would have a long way to fall (even from here), should interest rates rise rather than fall. It may not be the consensus view, but it’s not unthinkable. Especially when you consider government funding requirements, a topic that will become increasingly important.

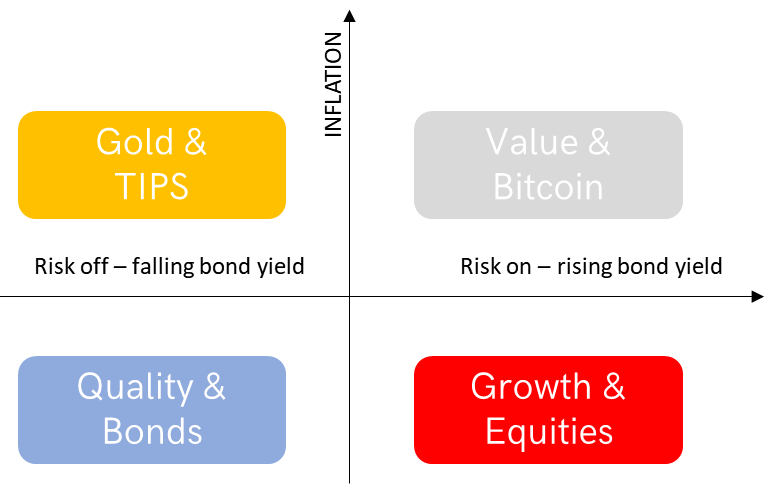

Thinking about the Money Map, it means the value investor wins, while the growth investor, extrapolating exponential profits, loses. This is a reminder that these are not normal times, and markets have structurally changed. It keeps me long-term bullish on gold and cautious on bonds.

Switch WisdomTree Gold (PHGP) to iShares Gold (SGLN) in Soda

I was asked if there was a good reason why we hold our gold in Soda via WisdomTree Gold (PHGP) as opposed to iShares Physical Gold (SGLN). PHGP charges 0.39% p.a., whereas SGLN charges just 0.12%, so SGLN is the cheaper option. I agree and thank the reader for pointing it out. According to ETF Stream, SGLD recently halved its fees from 0.24% to 0.12%. I hadn’t been aware of that.

To be clear, you do not need to carry out this trade, but I feel I owe it to new readers to buy the cheaper gold ETF, and so that is what should sit in the portfolio. There are no differences in terms of custody and security. This is simply market forces bringing down prices. PHGP are being complacent by not dropping prices, and many investors are switching to cheaper products. SGLN trades in GBP and is the most liquid Gold ETF on the London market.

Risk

This trade is risk neutral as both funds have the same exposure to gold. I deem gold to be medium risk.

Action

Sell WisdomTree Gold ETF (PHGP)

Buy 10.9% iShares Physical Gold ETF (SGLN)

Postbox

Last week, I mentioned that my postbox was on the light side. You responded with some excellent questions on Asia, Ruffer, Capital Gearing, Personal Assets, the yen, the yuan, Argonaut, Alliance Trust, and dividends. Here goes.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd