Celebrating Our 100th Issue of ByteFolio

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 100;

On 30th March 2022, ByteTree Research launched ByteFolio. We had been covering Bitcoin for a long time, first in Atlas Pulse (2013) and later in ATOMIC (2021). As the crypto industry evolved, ByteFolio took us into the world of tokens which were becoming ever more credible.

We never saw them as threats to Bitcoin, but as part of the Web3 revolution. They are tech stocks that live in CryptoLand. The idea was simple: we wanted to identify the big winners, and at the heart of this process was our unique trend-following system, ByteTrend.

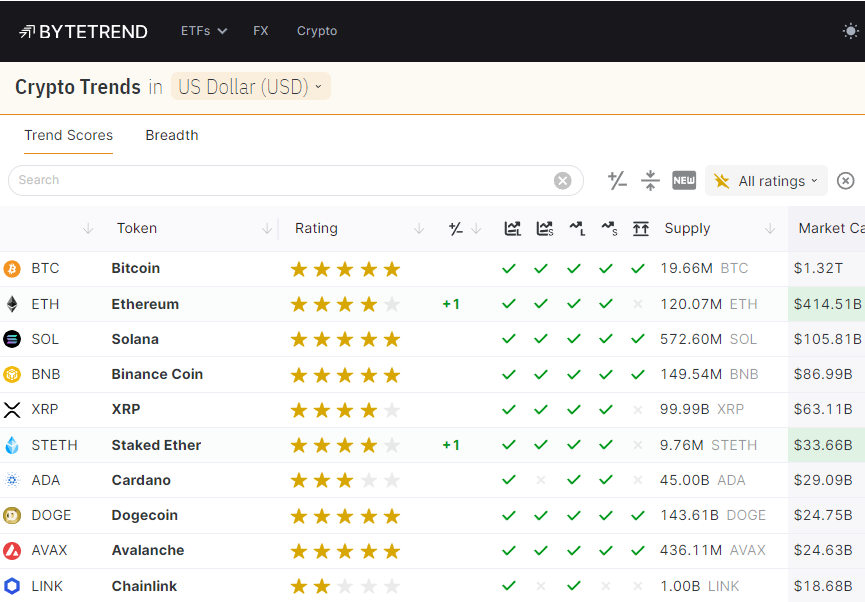

With tens of thousands of crypto tokens, ByteTrend cuts to the chase. First, we recognised that being in the top 100 by market cap was a useful natural selection process. It is why index funds are built that way. But we knew that crypto needed more because so many highly valued projects, such as meme coins, were clearly not suitable for serious investors.

Trend-following is poorly understood because it highlights things that are already doing well. Human nature believes it’s too late to buy because they want a bargain, which implies a low price. Yet a low price is only ever known in hindsight.

More to the point, crypto is a high-growth technology investment, and traditional valuation metrics cannot be applied. The point about trend-following is that it isn’t so much a market timing signal, it’s more about stock selection. Trend followers identify market leadership from the price action. In other words, the leading trends are beating the market. For stocks we would normally use the S&P 500 or the World. In crypto, we use Bitcoin as our benchmark.

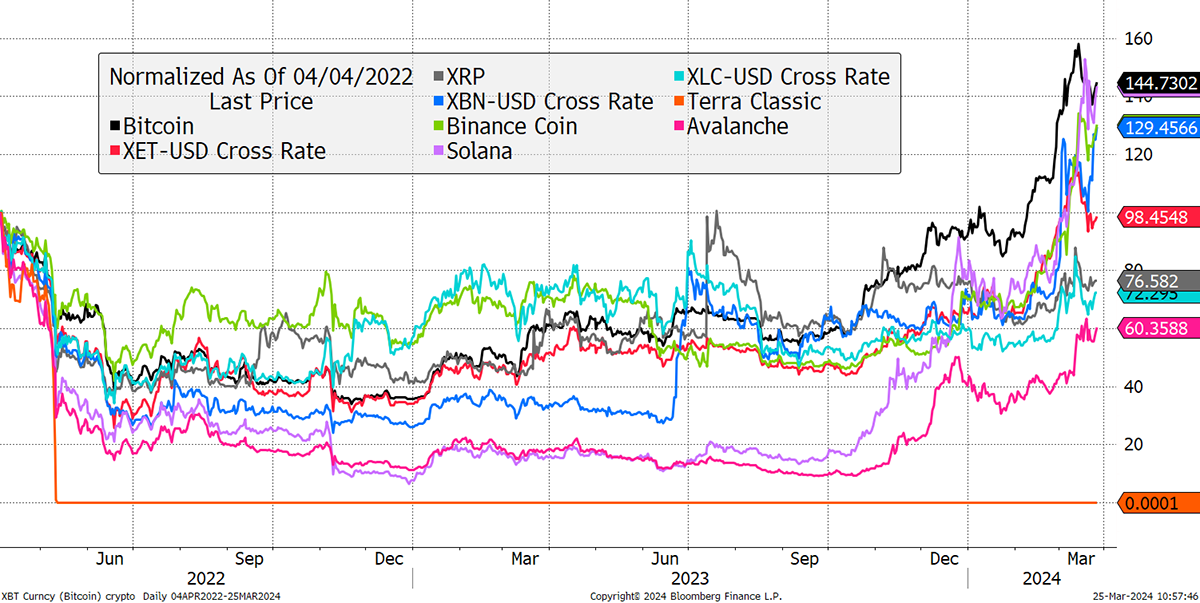

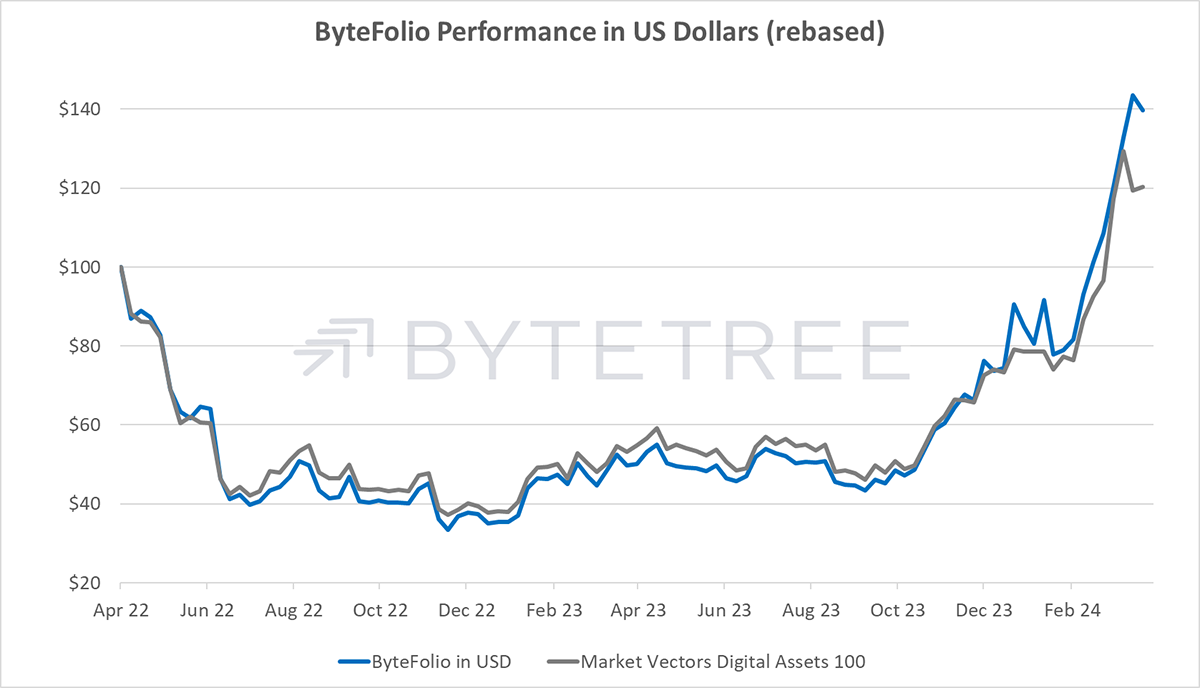

This should make it clear. Starting on 4th April 2022, I show Bitcoin with the leading crypto tokens. $100 in Bitcoin would today be worth $144. Solana (SOL) comes next with $132, followed by Binance Coin (BNB) at $130. Over the period, Bitcoin was the best-performing crypto asset. The worst? Terra LUNA, which was wiped out shortly after we launched ByteFolio.

100 Issues of Bull and Bear Markets

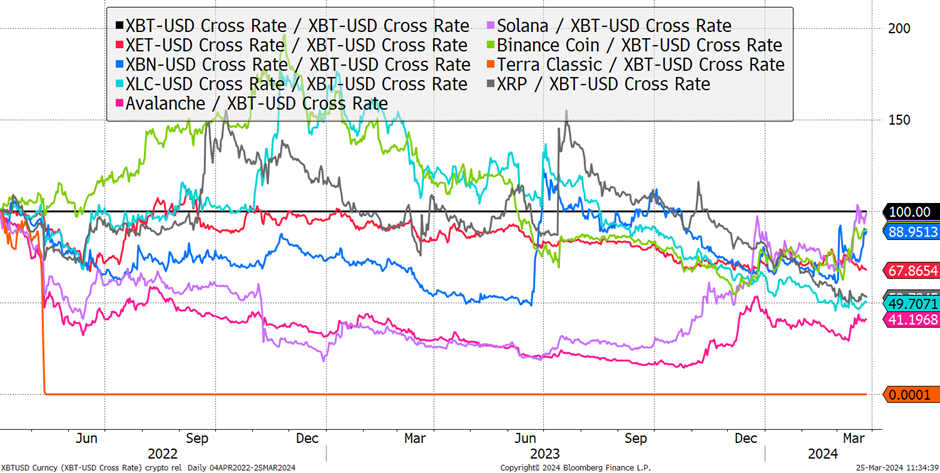

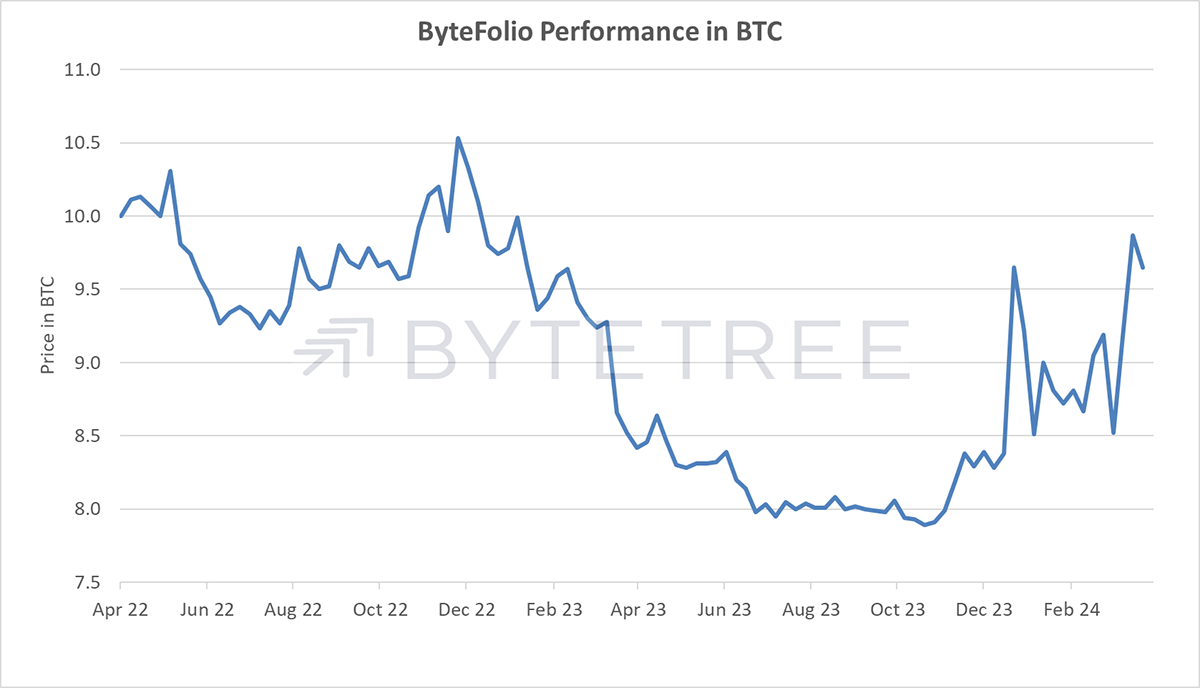

The same data is now shown in BTC rather than USD. Bitcoin in BTC is always 1, hence the horizontal black line. BNB was leading in the early days, but most tokens were lagging. ByteFolio held some BNB, but most of the portfolio was kept in Bitcoin in the early stages.

Nothing Beat Bitcoin in 100 Issues

Studying these trends enables us to identify leadership and lock onto their market-leading performance. Notice how Solana (SOL) and Avalanche (AVAX) turned up late last year, and more tokens have recently followed. It’s not just about identifying and holding the leaders but avoiding the laggards too.

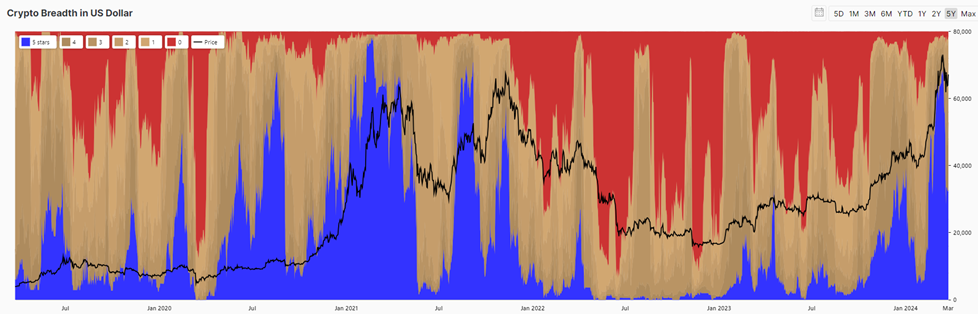

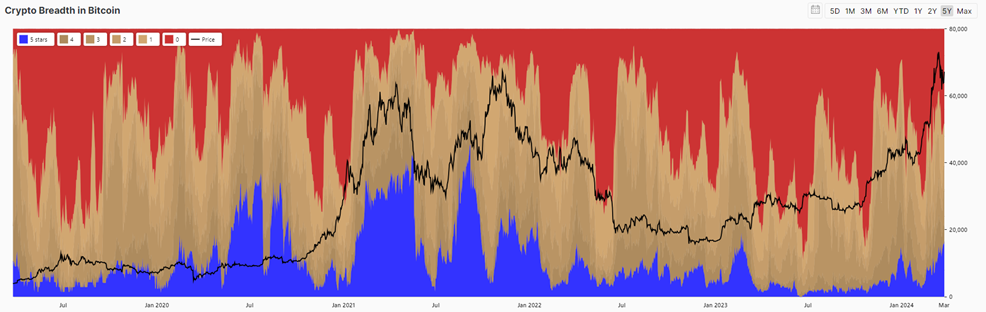

We also built the breadth indicator to measure market strength. Apologies for the small numbers (we’ll fix that), but the chart shows the token trend strength in USD over the past five years. Lots of blue means most tokens are leading the market, which we call blue seas. Red skies show weakness.

Market Breadth in USD since 2019

The same data, but this time in BTC, and there are far fewer tokens that are beating Bitcoin. That number appears to be rising but is still quite low. Moreover, the last two years have been a tough period to be a token investor.

Market Breadth in BTC since 2019

ByteTrend has been a powerful tool in helping us understand where the trends are. Now we have identified them, we wanted to know whether the projects were credible, which is where Token Takeaway comes in. Token Takeaway is the deep dive into the projects, where we look at the tokenomics, network, funding and competition. That was started in October 2020 by our analyst Tom Salter, now an entrepreneur in marketing. A few months later, we were joined by Aun Abbas (now a top city lawyer), and then Shehriyar Ali and Seran Dalvi, who remain with us. It has been fun working with all of them; each a genuine enthusiast for the space. Let’s not forget Charlie Erith, who held the reins from issue 34 in November 2022 to issue 62 in June 2023 before leaving for his new role at Wiston Capital, where he manages the Bitcoin and General Fund.

We also looked for metrics that could measure demand and the underlying project growth. Having pioneered this type of research with Bitcoin back in 2013, we were keen to see how this could broaden out. Collecting reliable data providers has been a huge task, and it is far from over, but our understanding of the space improves each month, and we share that knowledge with our clients. The 91st issue of Token Takeaway will be published later this week.

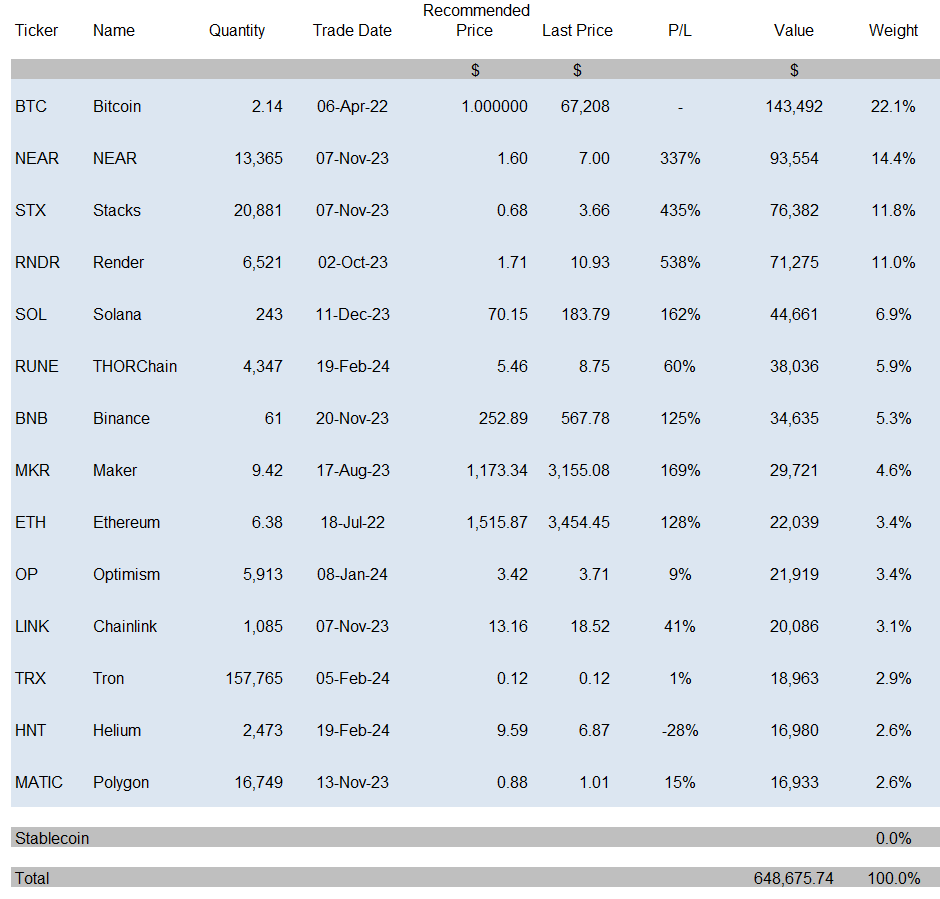

By identifying the leading trends in crypto and then analysing the quality of the project, we created a model portfolio. Throughout the 99 weekly issues, buying here and selling there, we have ended up with a robust and diversified crypto portfolio.

ByteFolio as at Issue 100

How did we do?

Since issue 1 on 6th April 2022, we started a model portfolio with 10 bitcoins with the aim to beat the market. $100 invested became $140 against the market portfolio, which became $120.

Given that our portfolio choices were decisive, it is surprising the performance was so close to the market. The MVDA 100 Index is 57.7% Bitcoin, 18.2% Ethereum and 3.8% Binance. It is heavily skewed towards the big two, as is the market. Bear in mind that most crypto investors would have done very badly indeed. Many smaller projects are still down 90%.

Measuring success against Bitcoin, we’ve just about ended up with the 10 BTC initially invested. The weak period came about in the first half of 2023 when there was a large position in Ethereum, which lagged the market. From the summer, we diversified into the new trends as they emerged, and things picked up.

Our aim is to not only beat the market, but Bitcoin too. I want that 9.65 BTC to be much higher!

I hope you enjoyed the 100th issue, which we have opened up for all to see. I am not sure when we will do this again. Maybe for issue 200, but who knows. These past two years have been hugely rewarding for us all in our understanding and appreciation for crypto markets. There is so much going on and it is a fast-moving and exciting space to work in.

Sorry to cut you off here, but the analysts have some important trades to suggest.