But Gold Has Done Nothing

Disclaimer: Your capital is at risk. This is not investment advice.

Gold doesn’t get the credit that it deserves. Despite having a 5,000-year history in finance, it remains a controversial asset and widely misunderstood. Central banks hoard it because when things go wrong, there’s nothing better. The super-rich hoard it, admiring the diversification benefits and long-term inflation protection. People in the developing world also hold it, trusting it more than they do cash.

Yet, for some reason, the majority of Western middle classes shun gold. It is fine to have some gold jewellery, but the minority do not take it seriously as an investment. It is a message sent out by the greatest offenders of them all, the financial professionals. As one Wall Street wag put it, “there are no fees in gold.”

The price of gold is surging, and the investment community are scratching their heads and selling into the rally. The gold they have sold since 2020 amounts to $70 billion. More fool them.

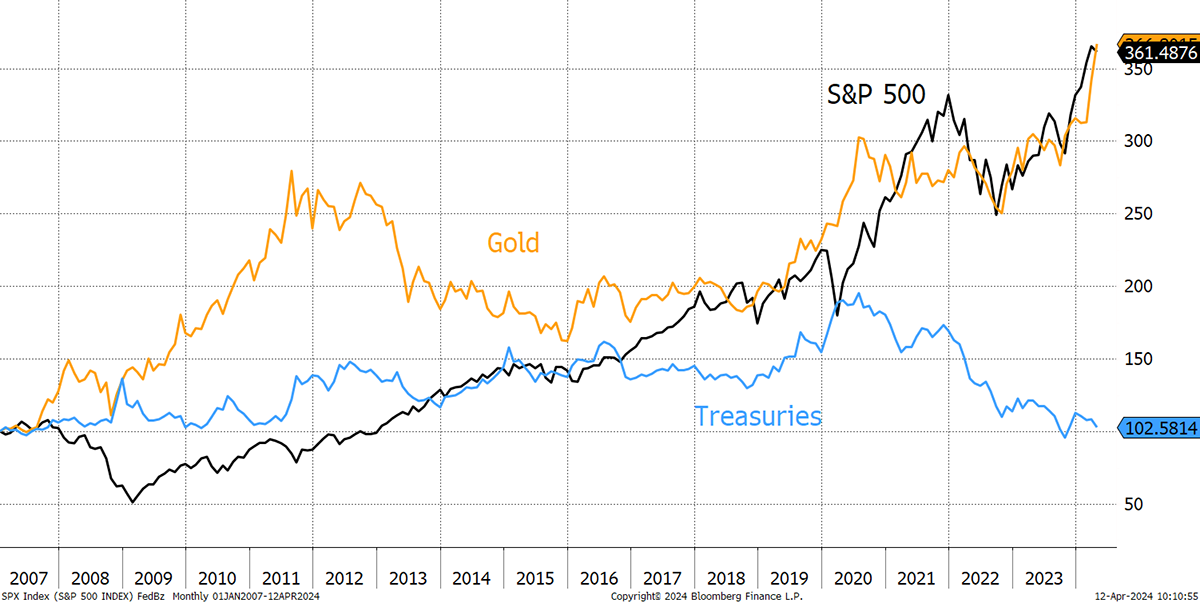

A little over a decade ago, gold was the talk of the town. It was one of the few great assets that sailed through the credit crisis and was deemed must have thereafter. Then it went too high too soon, and by November 2011, that was that. It wouldn’t make the next new high until the pandemic in 2020. I show gold against equities and bonds, capital only, since 2007, just before the credit crisis.

Gold, Equities and Bonds since 2007 – Capital Return

It is remarkable how perceptions are that the S&P did so much better and gold has done nothing. But in reality, the S&P hadn’t made a new high until 2012 and didn’t catch up with gold until 2018, at which point gold took off again. Since 2007, gold and the S&P are about the same. The dividends would boost the S&P by around 2% p.a., which is significant over time.

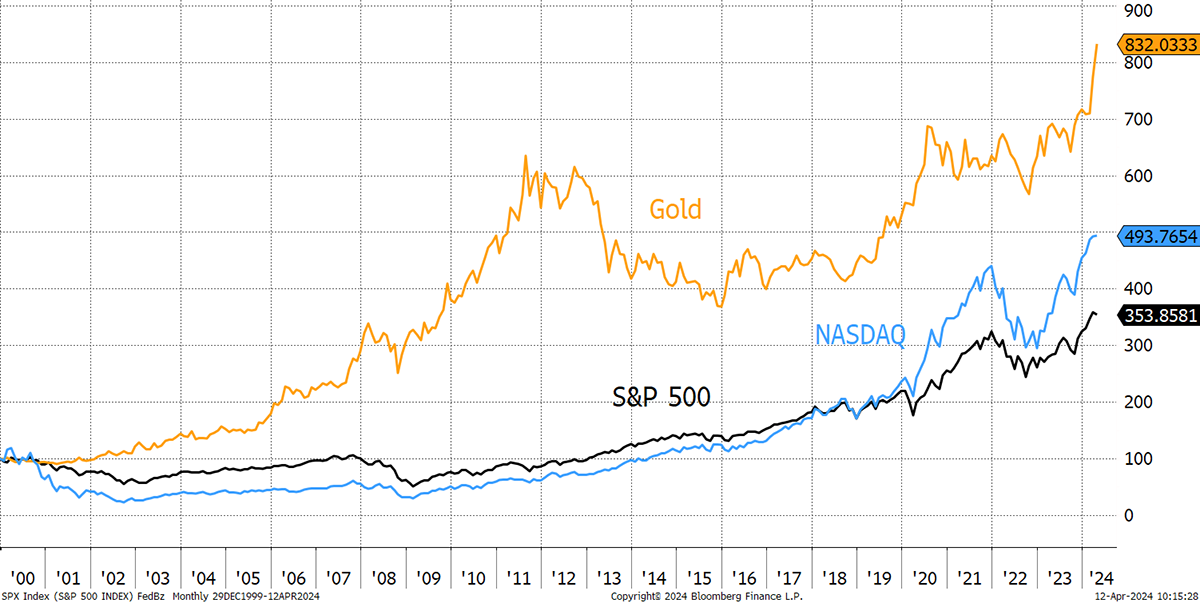

Going back to 2000, gold is not only ahead of the S&P, but the NASDAQ too; putting $100 into gold then is $832 today. Yet, not many people have noticed.

Gold, Equities and NASDAQ Since 2000 – Capital Return

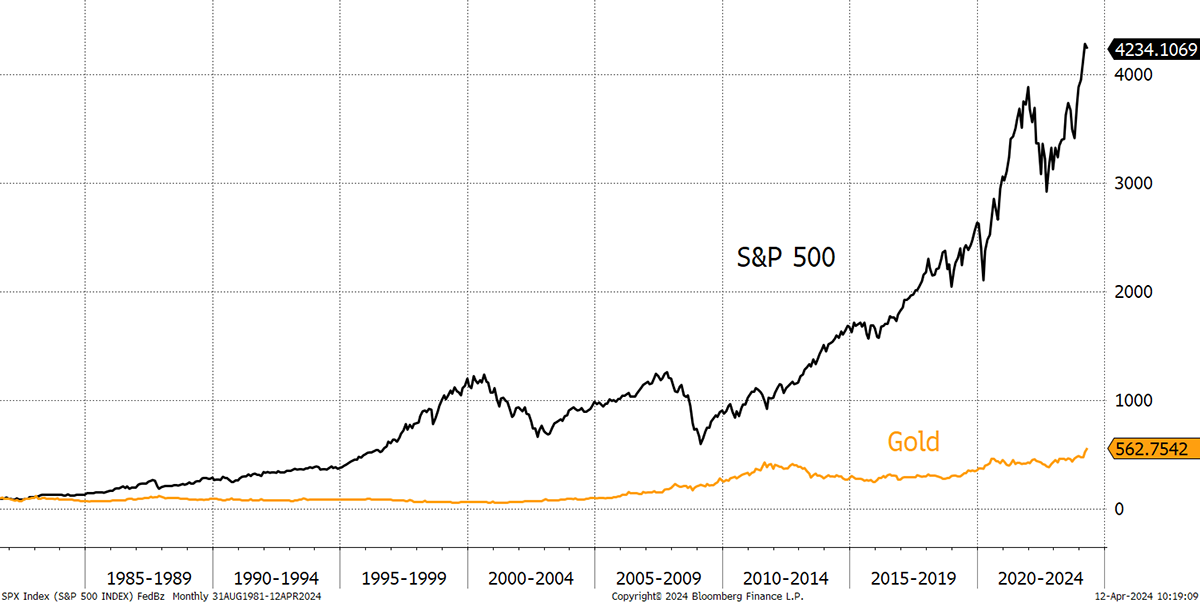

Naturally gold hasn’t always been a high-return asset. If you started in 1981, when equities were dirt cheap, and gold dear, it has been appalling. After dividends, equities would be nearly 30x better off. But the starting point is one of gold’s greatest historical peaks and equities’ troughs.

Gold and Equities Since 1981 – Capital Return

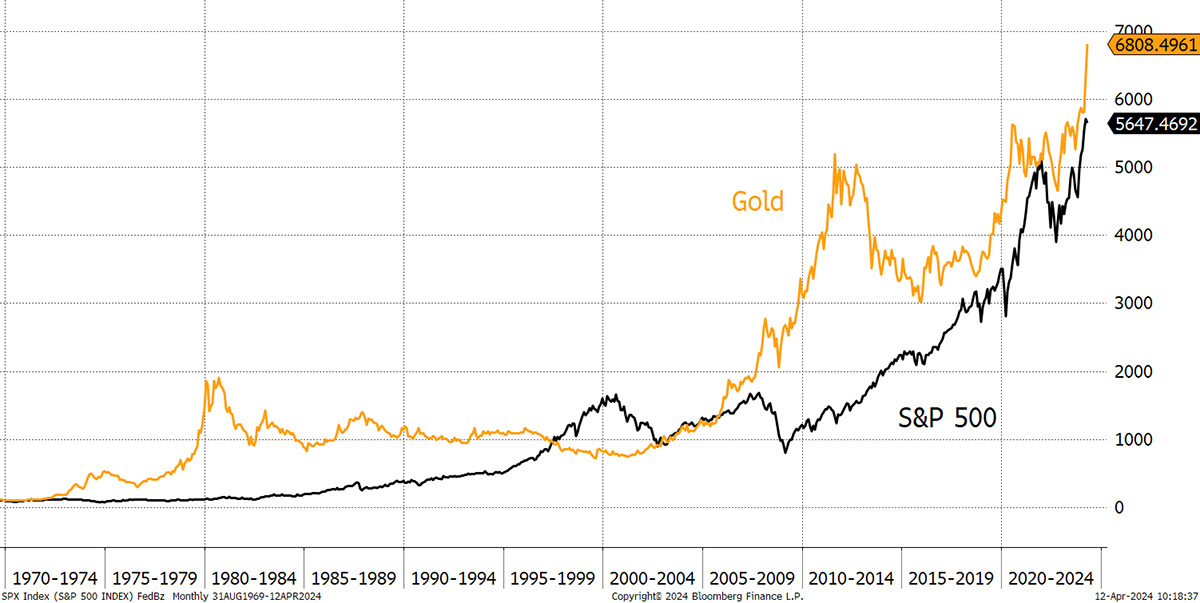

Finally, I show the same chart since 1970, the start of the gold run at the end of the gold standard. Dividends heavily favour equities, but it is interesting to see the capital value of gold and companies being so similar over 54 years.

Gold and Equities Since 1970 – Capital Return

I show these charts to remind you of the big picture. I am most certainly in the camp that believes equites are productive assets and deliver long-term excess returns, but the starting point really matters. With a 13-year pause, and a strong breakout, it certainly feels like gold’s time. Best to own some.

A Week at ByteTree

Carry on reading about gold. Yesterday, I wrote Atlas Pulse and dived into the details behind this rally and asked why the UK wealth managers were such heavy sellers?

In Venture, I looked at a steel company and couldn’t resist the headline Blue Horseshoe Loves Anacott Steel. If you are under 40, you might have to look it up. With the UK closing Port Talbot, what’s left in Europe? I examine a conglomerate awash with cash yet struggling to find its way ahead.

In The Multi-Asset Investor, The Great Reflation was a theme of the week. I enjoyed digging into the miners.

Finally in Crypto, it’s Bitcoin’s halving (halvening in the speak) on 20th April at 08:23 GMT. The short-term impacts are negligible, but the long-term will be powerful. Don’t give up on digital gold. As we keep on saying at ByteTree: own both via the BOLD strategy.

I am about to hop onto a plane to Uzbekistan. Did you know that flights from London to Tashkent are fully booked until the autumn? Tomorrow, I will be eating plov.

Have a great weekend,

Charlie Morris

Founder, ByteTree