Predictions for Bitcoin’s Fifth Epoch

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 96;

The last two halving cycles saw post-halving October breakouts, but it happened in 2013 as well, albeit a second run on that occasion. Little wonder it’s called Uptober. If I had to guess, I would go with a repeat of that thesis in 2024, as it would provide just enough time for the bulls to get bored and catch them off-guard. I rarely make predictions, but let’s give it a go.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Predictions | Going Mainstream Is Less Exciting |

| Technicals | Cooling Off |

| Investment Flows | Pause |

| On-chain | Bullish |

| Crypto | The Bitcoin Renaissance? |

Halving is now behind us. Last month, we went against the grain with the title, “Bitcoin Halving: The Great Anti-Climax”, and I’m glad I did. The event itself takes time to impact the market, and I shall repeat what I wrote on Monday in ByteFolio.

Bitcoin’s 840,000th block passed without incident. The new block reward is 3.125 BTC, which has dropped from 6.25 BTC last cycle, 12.5 BTC pre-2020, 25 BTC pre-2016, and 50 BTC pre-2012. They don’t pay the miners like they used to. As for price, we have always seen a post-halving rally, but last time, it took around five months, and the time before, three months. In any event, in both cases, the big break came in October.

On the face of it, the miners will see their revenues halve, except that fees will increase as a partial offset; we just don’t yet know by how much. The bullish thesis is that there will be less bitcoin for the miners to sell, which is true. But we mustn’t forget that anyone can sell bitcoin, not just the miners, and so the price is perfectly capable of collapsing regardless of the miners’ actions.

Yet we rightly assume that the Bitcoin Network continues to make steady progress over time, i.e. it grows. If that’s the case, the miners are the only leakage within the system, and that selling pressure has been significantly reduced. This means that provided the network grows, the price can only rise, but the space is still overhyped, so be patient.

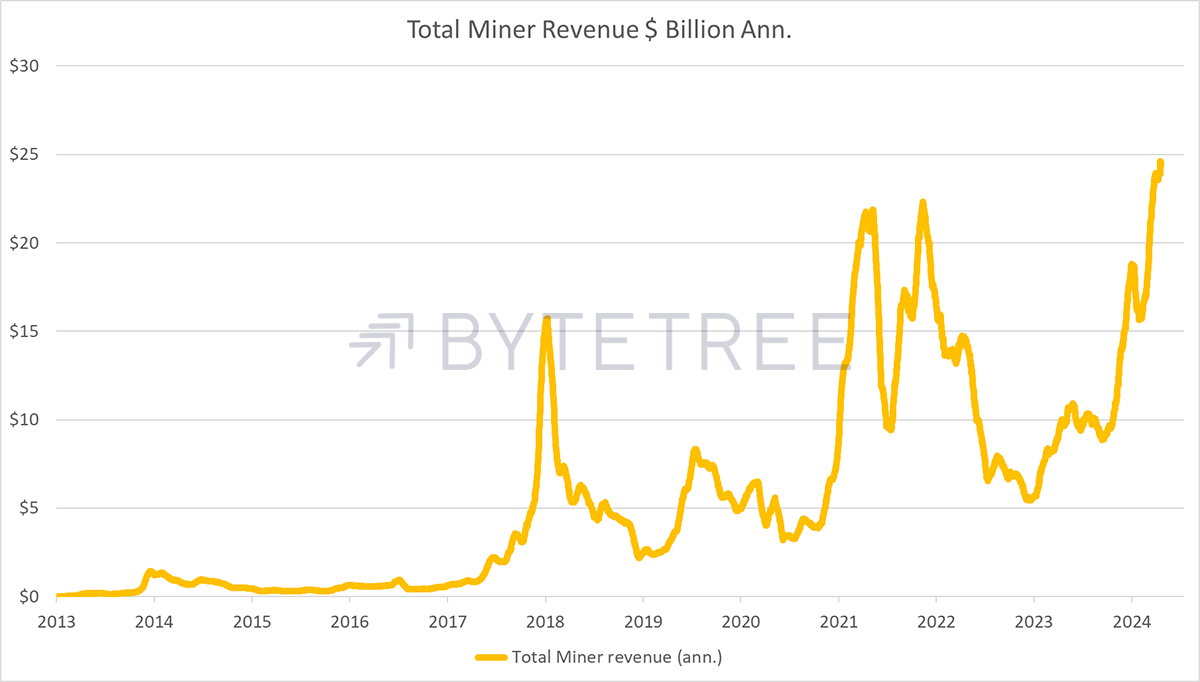

It is important to understand that as the price rises, so does the miners’ revenue. To see a 10x Bitcoin price means 5x miners’ revenues post-halving, which is around $125 billion of annual revenue. That would require wholly unrealistic inflows to sustain. What makes it even more unlikely is that the total miners’ revenues since 2009 amounted to $64 billion - $46.05 billion over the past four-year cycle. I don’t think many Bitcoiners realise that miners’ revenue acts as a ceiling for the price, and that will become more important as the Bitcoin ecosystem explores very large numbers.

Bitcoin will achieve high prices, but it will take much longer than the bulls currently expect. Strong flows will accelerate this, and so the single most important potential development would come from mainstream portfolio allocation. These days, it takes big money to drive the Bitcoin price.

As I said, the last two halving cycles saw post-halving October breakouts, but it happened in 2013 as well, albeit a second run on that occasion. Little wonder it’s called Uptober. If I had to guess, I would go with a repeat of that thesis in 2024, as it would provide just enough time for the bulls to get bored and catch them off-guard. That’s not dissimilar to what just happened with gold.

Bitcoin Halving Cycles

I rarely make predictions, but let’s give it a go.

Fifth Cycle Predictions

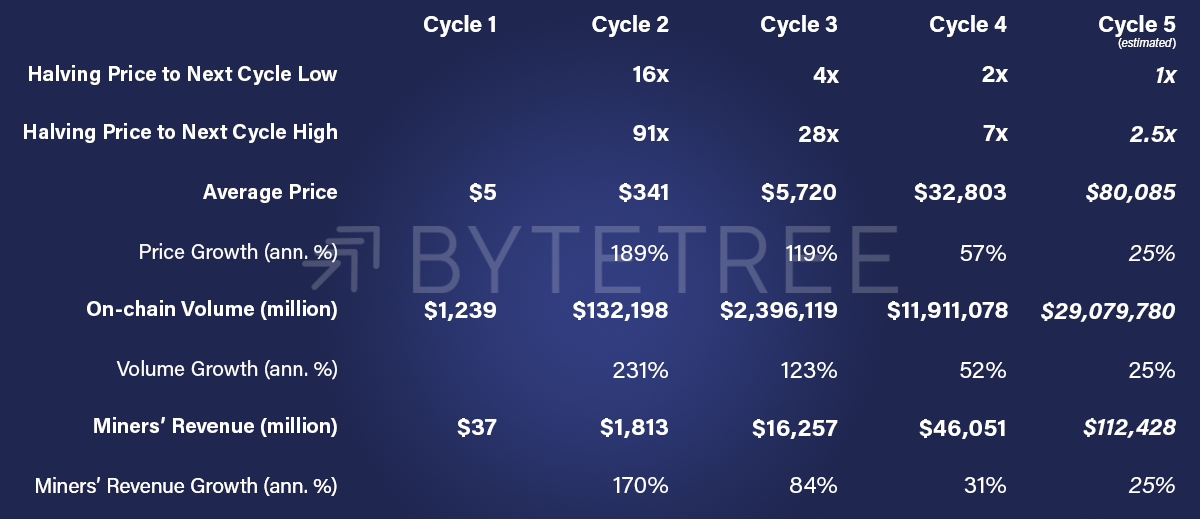

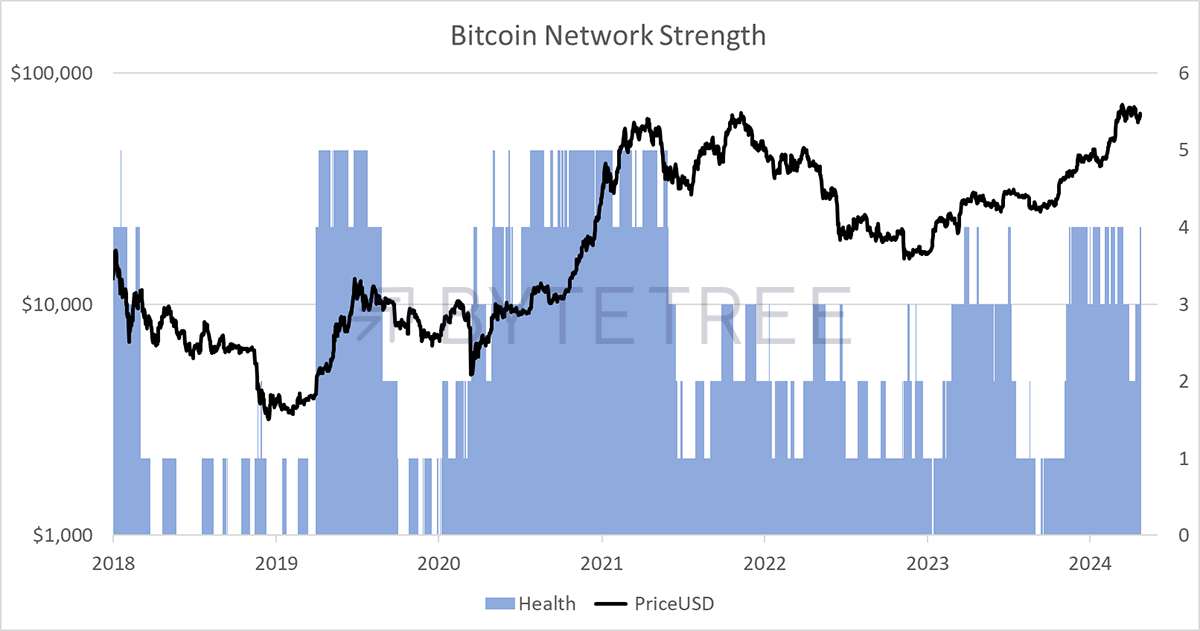

With four cycles behind us, patterns are emerging. For example, the range between the highs and lows is narrowing, and the average price appreciation has cooled from an 189% annualised IRR in cycle 2 to 57% in cycle 4. The growth in on-chain transaction volume has also drifted to 52% and miners’ revenue, 31%. The scale of these numbers has shifted from being beautifully outlandish, to something approaching normal.

I have added my estimates for the 5th cycle, which are dull compared to past cycles, but that is where the trends take us. On-chain metrics grow 25% p.a. with a cycle high of around $160k and a low similar to current levels. The next four-year average price, I predict, will be $80,085, which is in line with the growth on the blockchain. If I am right, regulators will be scratching their heads as to why they ever banned this. Hopefully, the fallout will result in a ban on regulators banning things.

Bitcoin is far from ex-growth, but as institutional interest in Bitcoin increases, expect a breakout of normality. Bitcoin will calm down over the 5th cycle, just as it has each cycle in the past. This is what the bulls should hope for because if it doesn’t, then it won’t be entering the mainstream. Those still expecting 10x moves will be disappointed.

We will see liquidity and interest continue to build and a further fall in price volatility, which should increase the weight in ByteTree’s BOLD Index at the expense of gold. One thing I do not expect to see change is that Bitcoin will remain risk-on, while gold will remain risk-off. I reiterate that Bitcoin and gold are not in competition.

Technicals

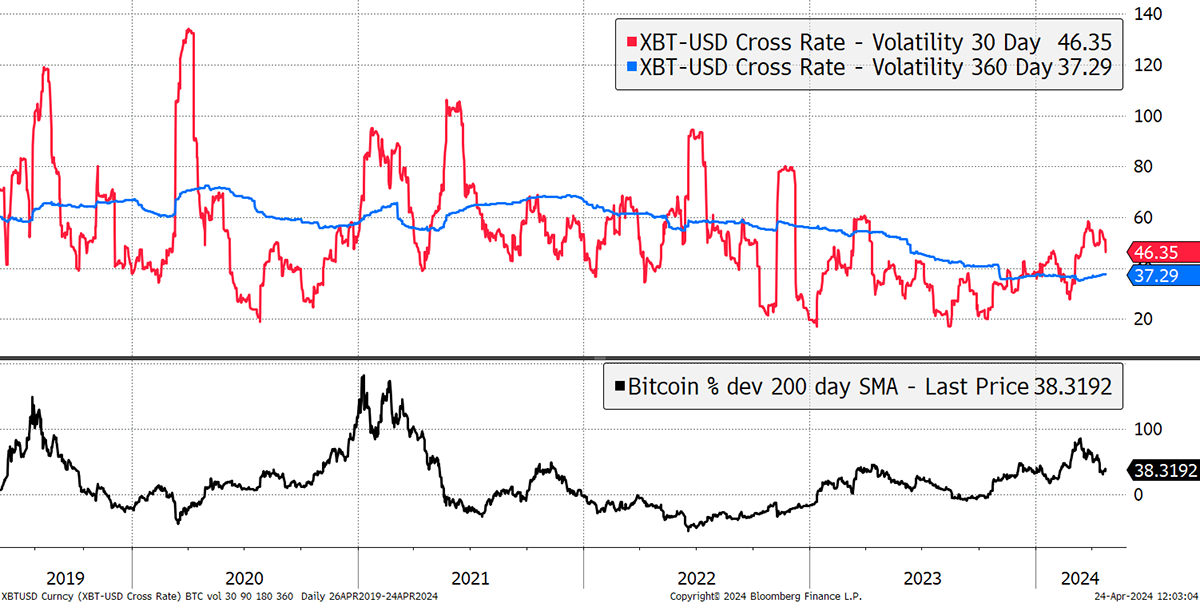

Bitcoin is slightly overbought, but a 40-day sideways move helps. The short-term uptrend needs to be rebooted, but I suspect with inflows flattening, this may take time. We need to see the 30-day moving average sloping upwards and the price above. Still, it’s a bull market for sure.

Bitcoin 2/5 trend score

The long-term volatility has been falling, but the hype of the ETF launches and halving have boosted it in the short term (red). The price was 85% ahead of the 200-day moving average (black), now 38%, which is better. I would like to see the short-term 30-day volatility ease back to the 360-day levels (blue).

Bitcoin Price Volatility and Deviation

The technicals are fine, but after a good party, we all need a rest.

Investment Flows

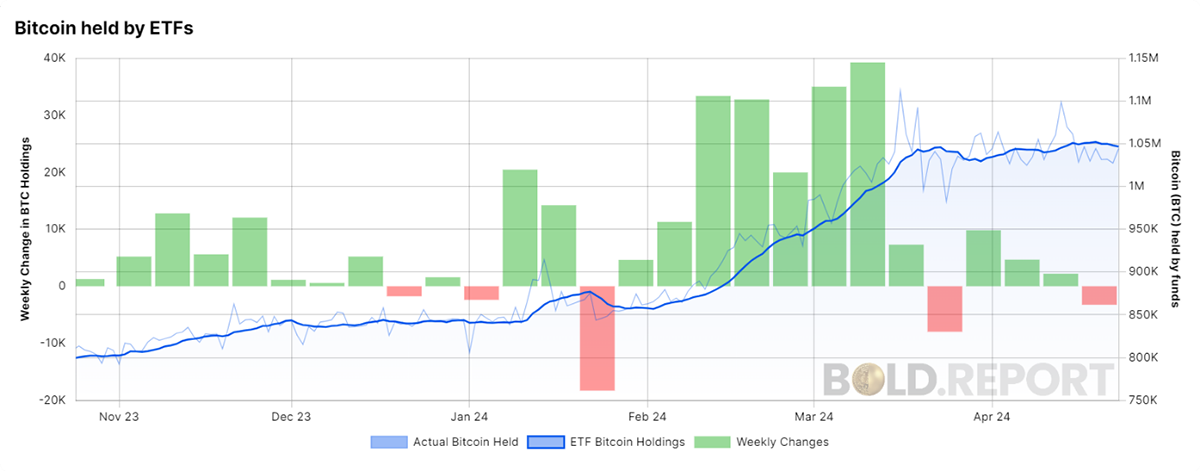

The inflows into Bitcoin were huge in Q1, but that has now cooled. There is not much more to be said here, but the next round needs a trigger.

In my opinion, the next big thing will be the end of the shadow ban, i.e. Bitcoin becomes accepted as a mainstream asset across the board. For internet stocks, it took a decade after the 1999 peak. If Bitcoin’s 1999 was in 2017, then we are halfway there, and this cycle will see steady progress, with cycle 6 seeing it widely included in portfolios.

On-chain

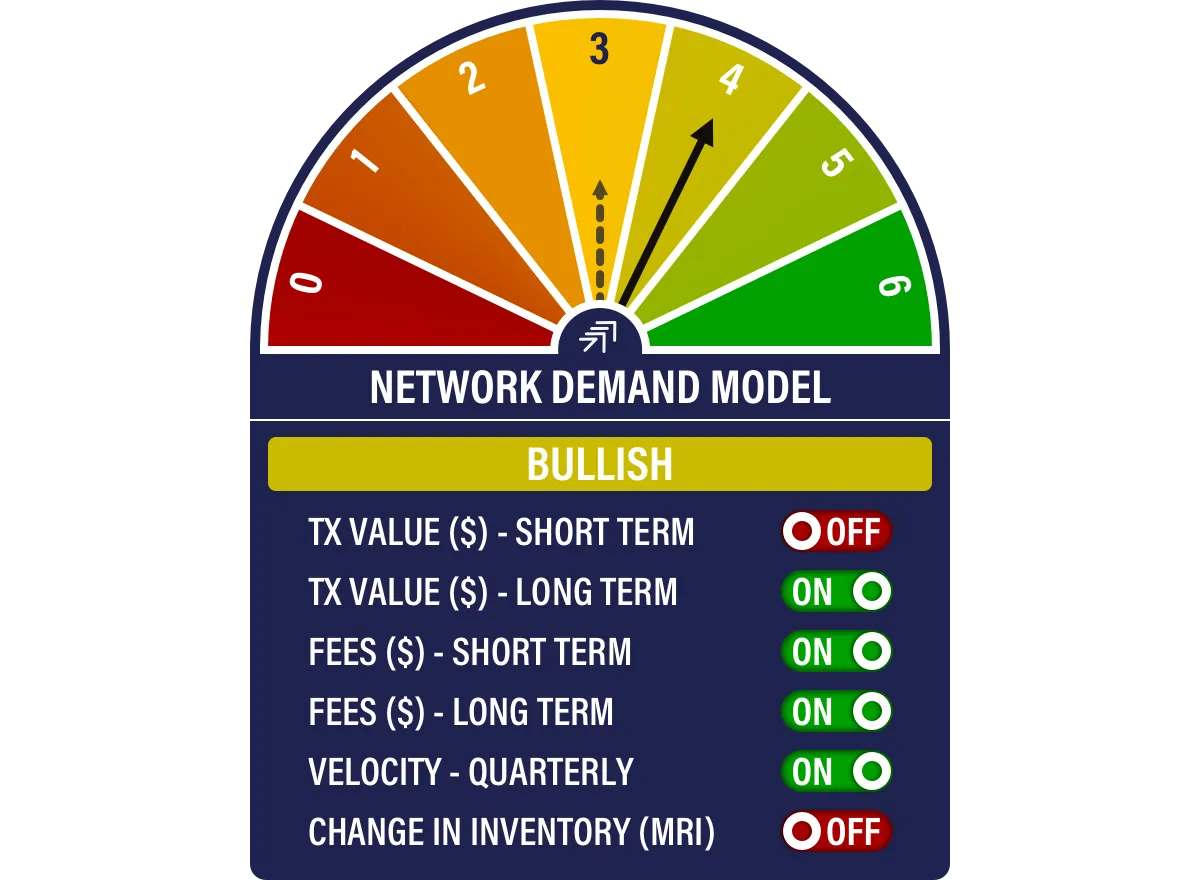

The Bitcoin Network Demand Model scores 4/6, which is strong.

The fees have turned up again, which is what we would expect to see around halving.

With a lower block reward paid to the miners, a hike in fees is inevitable. Halving day (last Saturday) saw an almighty fee spike of 1206 BTC, breaking the 22 December 2017 record of 1,495 BTC. To put that into perspective, the last cycle’s average was 55 BTC in fees per day. The days since halving have all seen total fees exceeding 300 BTC, which may slow the network. I believe the fees are extremely important, and if they go too high too soon, the network will slow. This makes layer-2 solutions, which facilitate low-cost off-chain transactions, ever more critical.

Over to Laura, who will discuss this in some more detail.

The Bitcoin Renaissance?

By: Laura Johansson

Bitcoin’s 840,000th block was mined on 20 April 2024, bringing about Bitcoin’s fourth halving event. As Charlie predicted in last month’s ATOMIC, it was an anticlimactic affair, and for most people, it went unnoticed. (I may have briefly thought about it while I was filling up my car at the garage.) Instead, what really drove the conversation over the weekend was the launch of Bitcoin Runes, which coincided with the halving.

Runes was created by developer Casey Rodarmor, who is also the creator of Ordinals and Inscriptions, launched in January 2023. According to data from Ordinals.com, over 70 million inscriptions have been made as I write this.

Recent Inscriptions

This is not going to be a tech-heavy explainer of the difference between Ordinals, inscriptions, and runes. If you want to learn more about it, I highly recommend watching Bankless’s recent interview with Casey Rodarmor. But briefly, Ordinals is a protocol for tracking satoshis (sats), i.e. the smallest unit of a bitcoin (1 BTC = 100 Million sats). Inscriptions can assign digital content in a bitcoin transaction to a satoshi, essentially minting a non-fungible token (NFT). Runes, on the other hand, can add fungible tokens by extending the UTXO, and they are, essentially, an improvement on the BRC-20 token (developed separately by somebody else). So, in very simple terms, inscriptions are for NFTs, and runes are for fungible tokens. What’s important is that they both get inscribed directly into the bitcoin block, i.e. there are no third-party protocols involved.

As a Bitcoiner, the thought of having jpegs and memecoins on the bitcoin blockchain really appalled me at first. I am bullish on many different crypto protocols, but Bitcoin is in its own league, and I couldn’t understand why someone would want to bring all of that into Bitcoin. That was before I learned that Casey is a Bitcoiner who generally dislikes the wider crypto space - I will get back to this point.

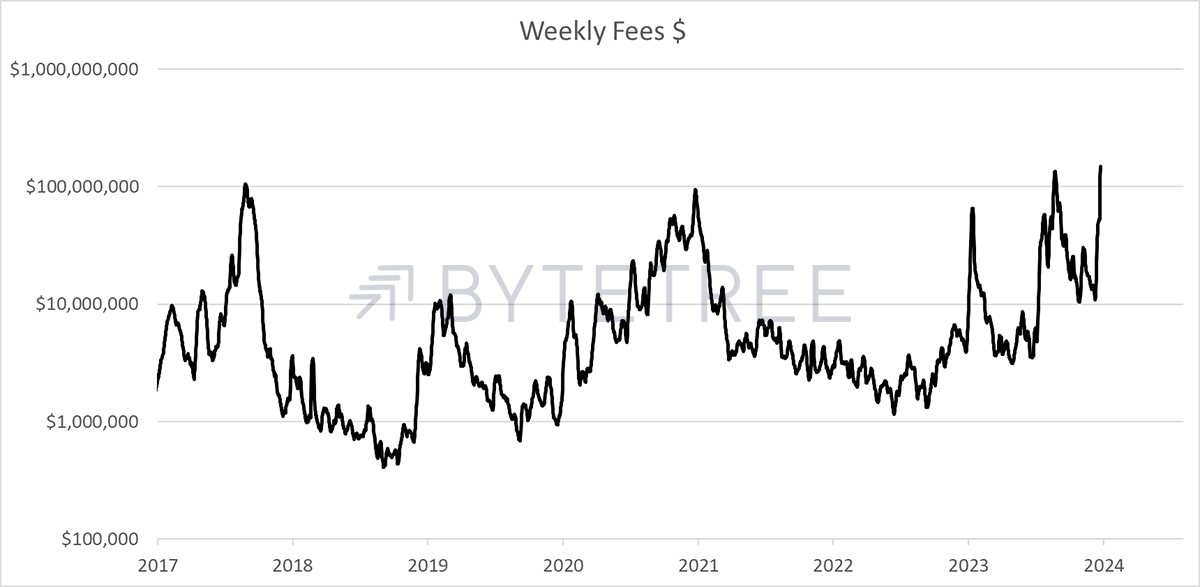

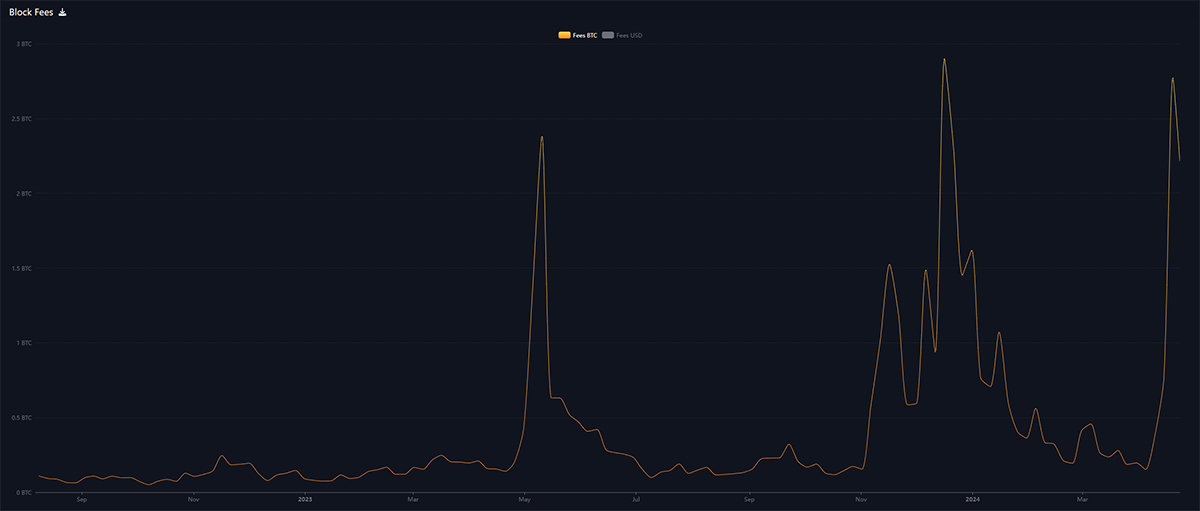

The launch of Ordinals and inscriptions really took off in May 2023, and soon, crypto degens (i.e. someone involved in high-risk crypto trading) started referring to this as the start of Bitcoin’s Renaissance era. Naturally, the Bitcoiners responded by saying how unnecessary it is to have jpegs on Bitcoin. This consequently fuelled FOMO amongst readers, who went on to mint new inscriptions. We can see how this rolling snowball adoption effect played out by looking at the block fees.

Bitcoin Block Fees in BTC

As more halvings come to pass, the block reward will diminish by half every time. This means that the block fees will increasingly become the more important source of revenue for the bitcoin miners. With new crypto protocols launching every year, the DeFi market has been moving away from Bitcoin and into the wider crypto space, and Bitcoin is no longer the entry point for new crypto users. What Casey realised was that by enabling ordinals, he could bring some of that revenue back into the Bitcoin Network, thereby giving the miners another source of fee income.

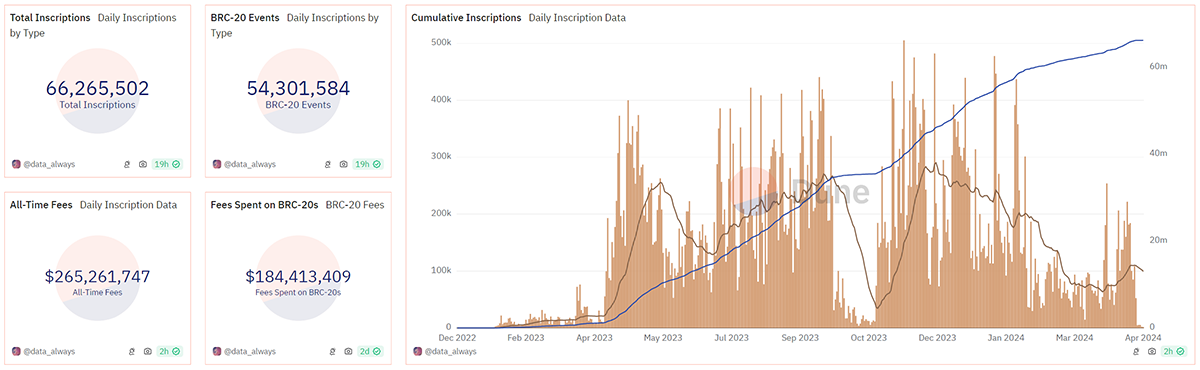

Inscriptions, BRC-20 and Fees

And it worked. The mempool, which is the queue of pending and unconfirmed transactions, began to fill up. In non-technical terms, this means the Bitcoin Network got busier.

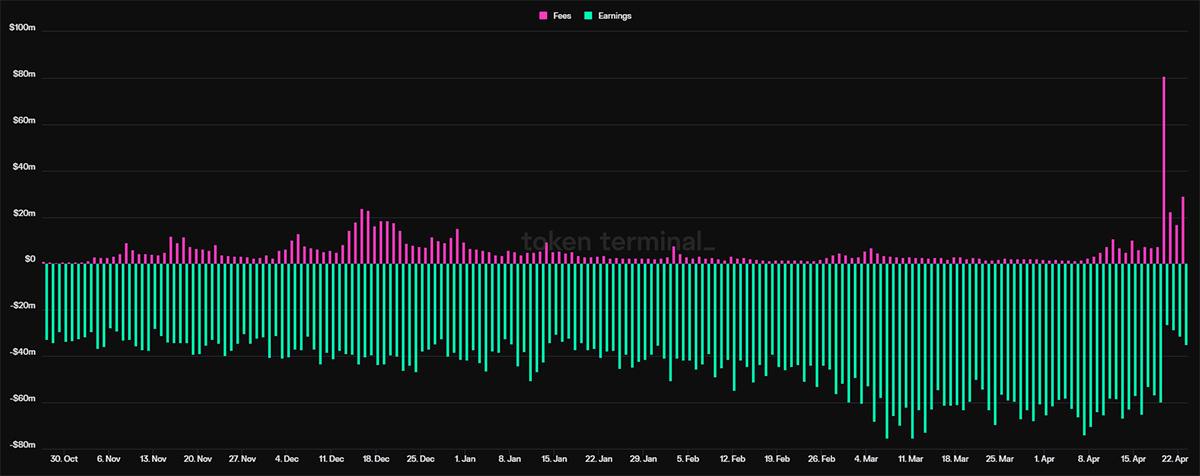

While a busy network and high fees are good for the Bitcoin miners, the latter is not particularly welcomed by Bitcoin users. As Runes launched over the weekend, the fee revenue surpassed the block rewards for the first time, with miners earning $80.74 million in fees (pink) and $26.28 million in rewards (cyan) on 20 April.

Miner Revenue in USD

At one point, the average transaction fee hit a new all-time high of $127.97, but this has now dropped to $28. Admittedly, the fees are still high, but things will settle as the mania passes by. Notably, this is where Bitcoin layer-2s like Stacks (STX) and the Lightning Network could take on some of the congestion.

Ordinals, inscriptions, and runes are not part of a revolutionary technology, but they have changed the conversation around Bitcoin. Prior to the launch of Ordinals, the Bitcoin conversation had gone stale because all the exciting new things were being built elsewhere in the cryptoverse. Bringing memes onto Bitcoin has also brought the interest back. Now, there is newfound energy to build new things that could drive more revenue into the Bitcoin Network. Regardless of what you think about Inscriptions, Runes and similar, they can co-exist with all other Bitcoin use cases. And they will have to because, like everything else in crypto, you can’t put it back in the box once it is out. As a Bitcoiner who now understands the point of these, I am quite content with that. Long live the Bitcoin Renaissance.

Summary

Halving was never supposed to be a media event, but it has become so. The simple point is that if Bitcoin was simply a tulip, the price could bounce wherever it likes. It’s not; it’s a network, and each action impacts something elsewhere. In the case of high prices, the miners are heavily rewarded, which needs to be counterbalanced by high inflows. We should celebrate the longer-term impact of this halving and future halvings, but accept that as this network matures, so do its users. It’ll end up becoming a game for old men.

Too busy to worry about it? There’s always BOLD.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.