Arweave: Pioneering Indefinite Data Storage

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: AR;

Arweave is a fully decentralised data storage network that provides permanent data storage, making it one of the most groundbreaking innovations of the digital age. Supported by a sustainable economic model, it functions as a universal hard disk that stores information indefinitely. This Token Takeaway will explore the data storage space, examine Arweave and its economic framework in detail, and evaluate the value propositions of its native token, AR.

Overview

Initially introduced as Archain in June 2017 by Sam Williams and William Jones, the Arweave mainnet went live in June 2018 with a mission to make cost-effective, permanent data storage a reality. Arweave connects individuals and institutions in need of storage (clients) with those who have excess storage space (node operators). In essence, creating a marketplace for decentralised cloud data storage. According to CryptoRank, Arweave has raised $21m since its inception. It is backed by some of the biggest venture capitalists in the industry, including A16z, Coinbase Ventures, and Multicoin Capital.

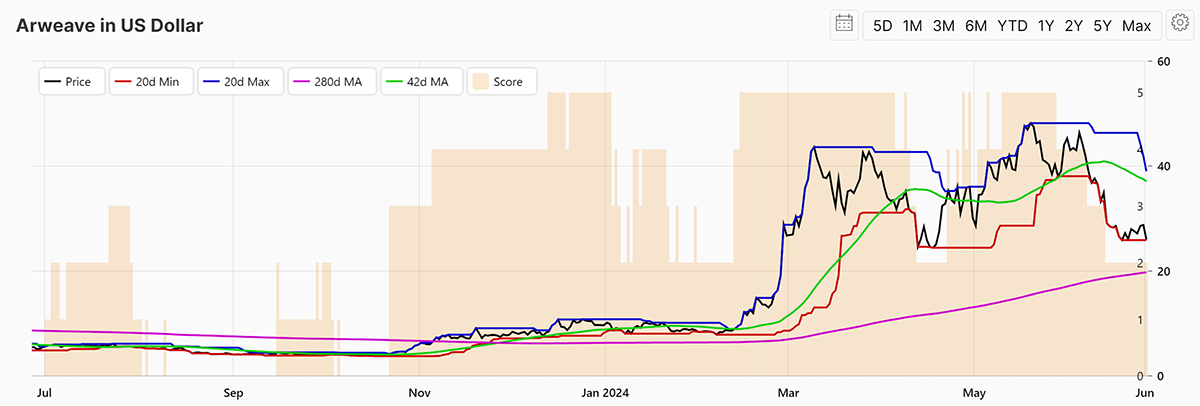

After a year-long decline and consolidation phase, the AR token price started to catch a positive trend in Q4 2023. From its low in February 2024 to the end of June, the AR token has appreciated by over 240%.

AR in USD

The AR token’s dormant phase was linked to declining platform metrics, like reduced data uploads and a drop in the number of clients. The overall crypto winter also played a role, as did AR token releases. However, the industry's adoption of ChatGPT and various other AI applications sparked a new AI/Computing trend. This trend led to increased activity on platforms like Render and Fetch.AI, which positively impacted their tokens. Arweave, falling into a similar category, also capitalised on this trend. It saw a surge in data uploads and active clients, driving up demand for the AR token and causing its value to skyrocket.

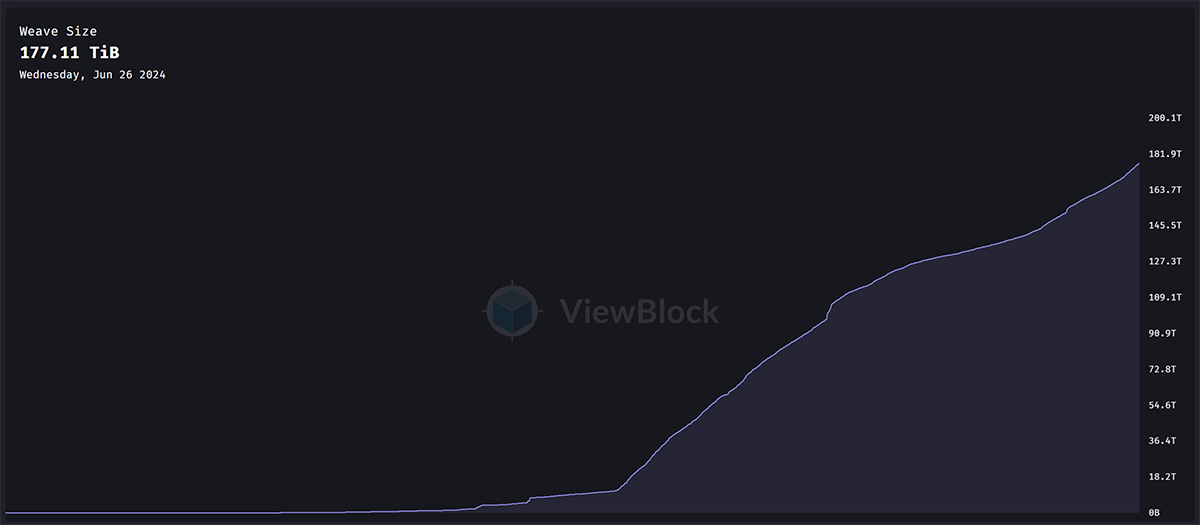

The Growth in the Amount of Data Stored on Arweave

Despite what began as short-term profit booking, crypto tokens are currently experiencing significant downturns across the board. Nevertheless, the current AR price action seems to be largely influenced by external factors and remains buoyant while the platform activity remains strong.

Data Storage Market

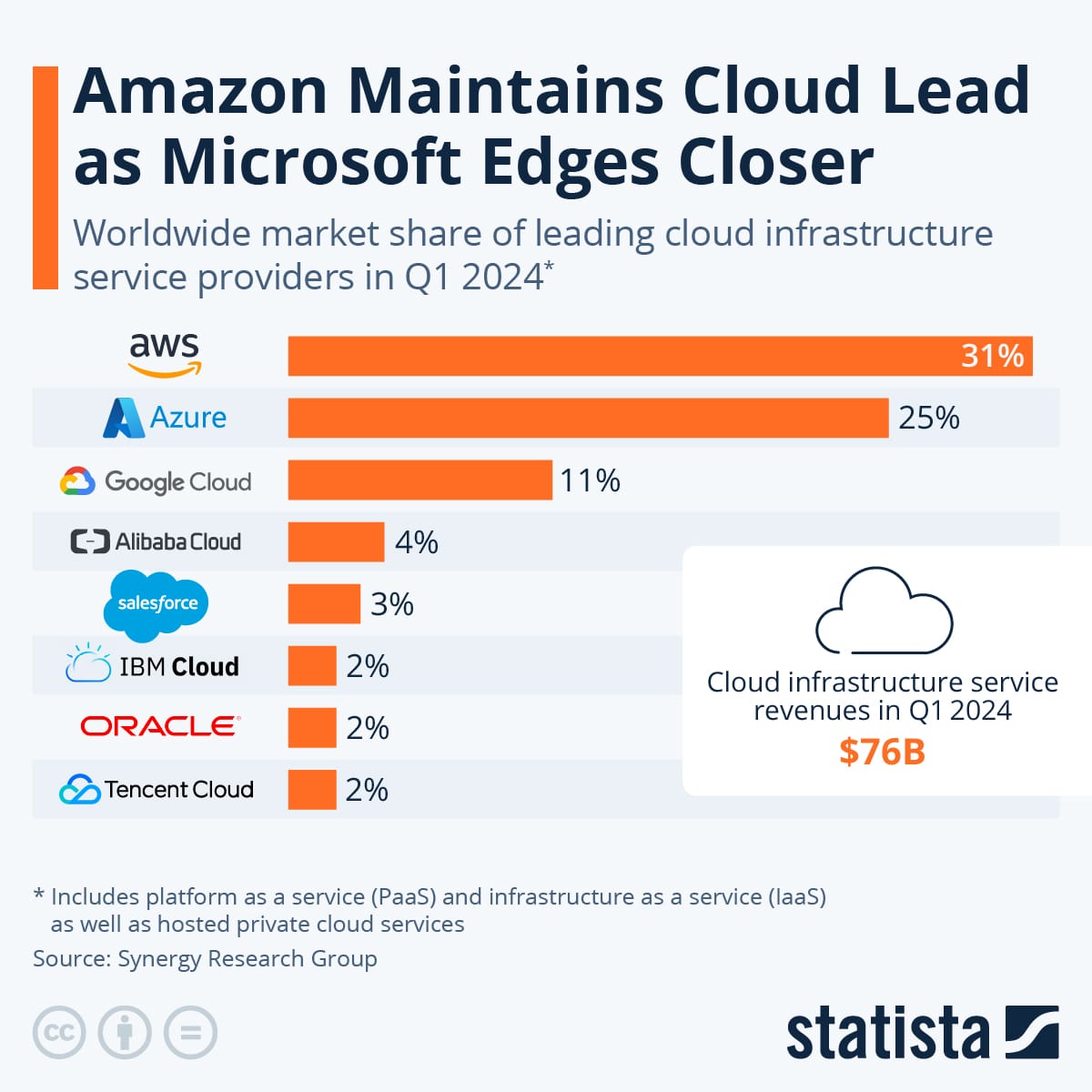

The Web2 cloud storage market is a monopoly dominated by three giants: AWS (31%), Microsoft Azure (24%), and Google Cloud (11%). Collectively, they account for 66% of the overall market share.

Centralised Cloud Storage Market Overview

These companies control an incomprehensible amount of data. In Q1 2024, this sector generated $76bn. If the same value is generated for every quarter, it would add up to over $300bn in revenue in 2024 alone. This rapidly growing industry not only presents an opportunity for centralised companies but also for decentralised ones like Arweave and others.

In the Web3 landscape, Filecoin stands as the largest decentralised cloud storage platform with a $2.5bn market cap. Arweave is currently the runner-up with a $1.74bn market cap. Filecoin became successful early on, with its native token FIL peaking at $237 in 2021. However, FIL is presently valued at $4.40, a 98% drop from its all-time high and down 10% since February 2024. As noted earlier, the AR token has contrastingly risen by 240% since February. Although external factors may have had some impact, Filecoin’s prolonged downturn is likely due to declining platform metrics.

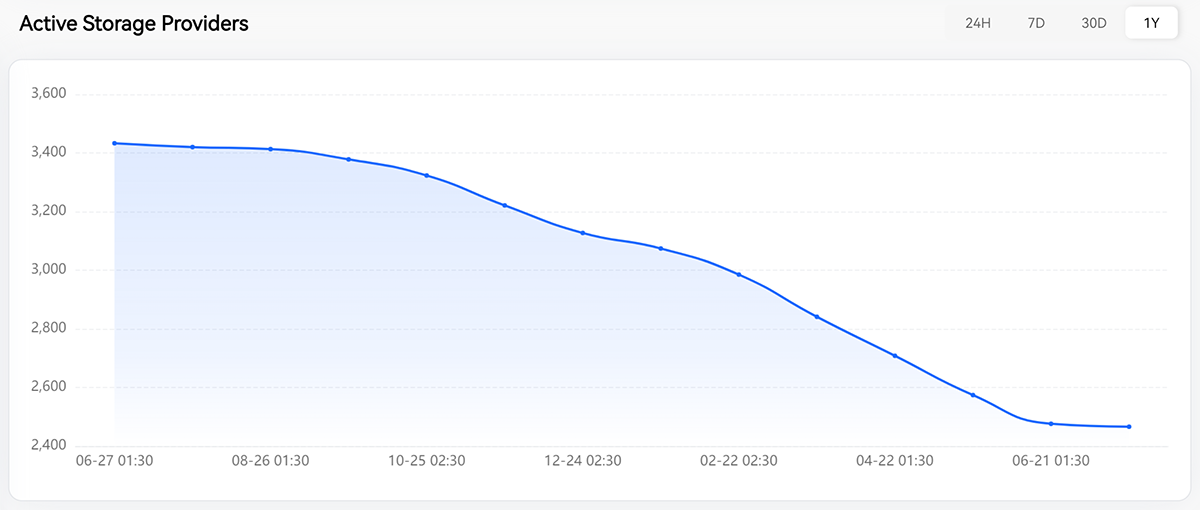

Active Storage Providers on Filecoin

As illustrated in the above chart, the number of active storage providers declined by nearly 1000 in just one year. Although there could be multiple factors behind this, profitability is likely a primary catalyst. Unfortunately, none of the Filecoin explorers display the amount of data currently stored or the system's utilisation rate. Why would a platform hide such crucial information? This suggests that the data is likely unimpressive. Consequently, Arweave is well-positioned to outshine Filecoin and become the leader in this sector, offering AR's market cap an immediate 43% growth potential.

Filecoin and most of the other Arweave competitors employ a recurring fee model to store data. Arweave, on the other hand, stores data permanently for a single upfront fee. This is possible due to a sustainable endowment-based economic model and “blockweave”, a framework derived from blockchain technology. In the next section, we will take a closer look at how Arweave works and analyse its key platform metrics.

How Does Arweave Work?

At Arweave’s core, two main components run the overall system: a technical component called blockweave and the aforementioned endowment-based economic component that powers the system for at least 200 years.