Bonds, Deficits, and Weird Shit

Disclaimer: Your capital is at risk. This is not investment advice.

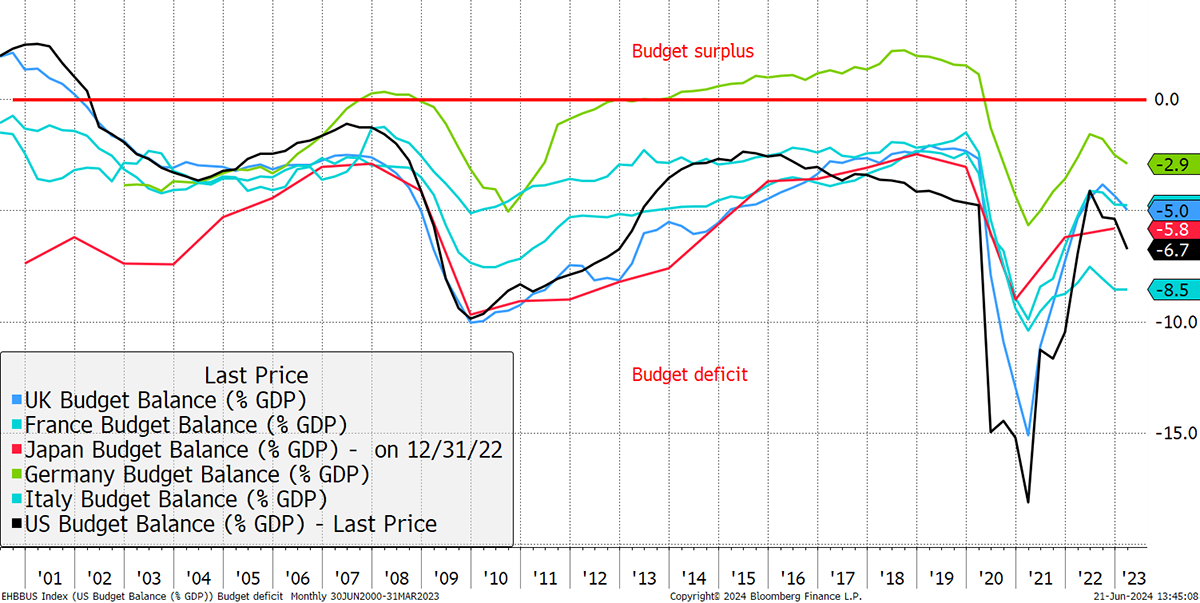

We have seen lower inflation, which has led to expectations for lower interest rates. There has already been a cut in Europe and Canada, yet there’s a problem, and given there are elections all around us, you have probably spotted it. No one who is planning to lead our great nations is talking about debt and deficits. They are at record levels seen during the history of peacetime, and they are getting worse.

Government Deficits

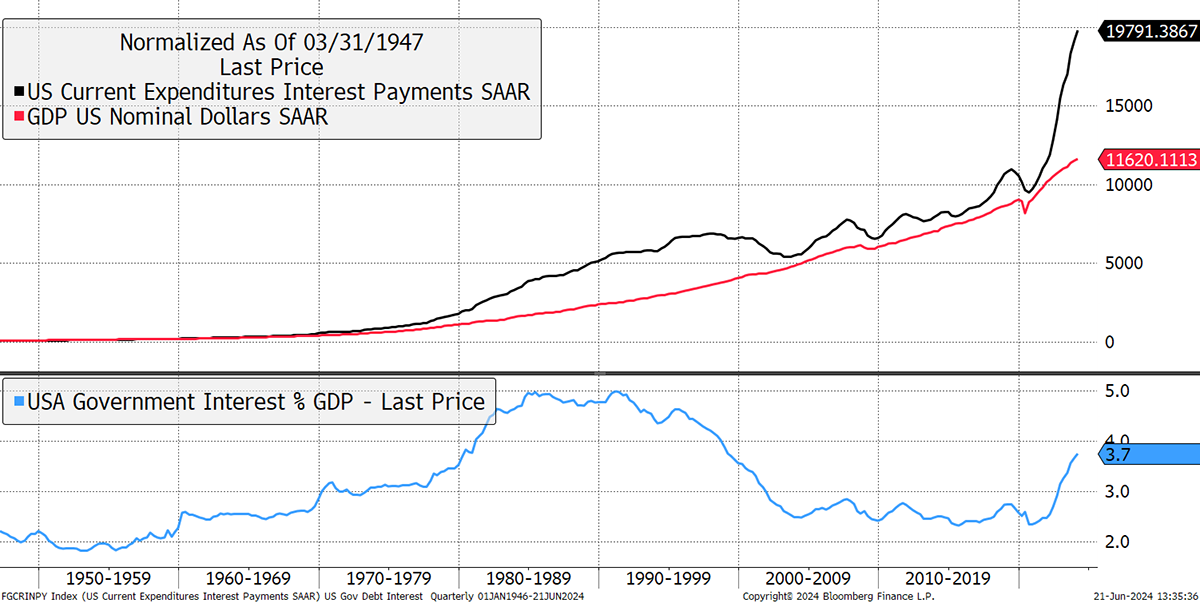

The trouble with debt is that eventually, it is supposed to be repaid, and in the meantime, the interest bill mounts up. Nominal GDP includes inflation, and it has been rising (red). However, with interest rates rising in recent years, the high level of outstanding debt must be refinanced at higher rates. That has caused a squeeze in government spending as interest payments (black) grow. They now amount to 3.7% (blue) in the USA and are on their way to the 5% high seen in the 1980/90s.

Debt Interest Squeezes Government Expenditure

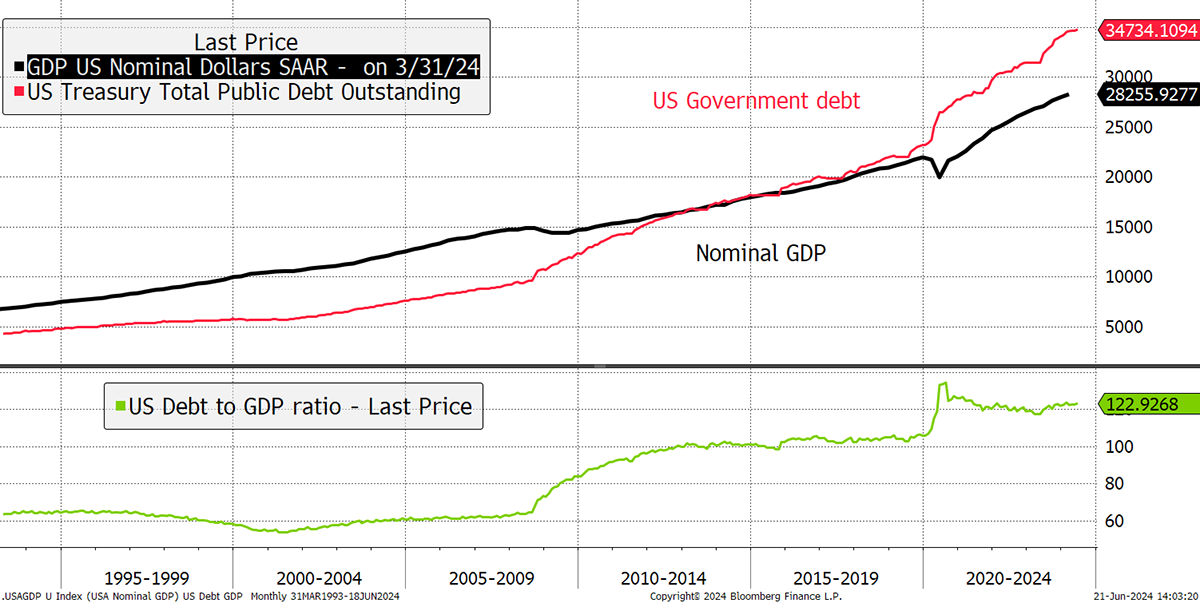

The trouble is that in the 1980s/90s the ratio of debt to GDP was roughly half the current level, while interest rates were even higher. It means that the interest payments (not rates) as a percentage of GDP will keep on rising until something breaks. This is happening at a time of heavy demands on public expenditure.

Government Debt Is Out of Control

The numbers are similar in other developed countries, except for Scandinavia, and there are no plans to solve the problem. I cannot think of a mainstream political candidate, other than Argentina’s Milei, who even mentions this, let alone does something about it. If we keep on ignoring it, we will all end up like Argentina, and everyone will want a Milei.

Moreover, the political divisions in the world, brought on by the War in Ukraine and the sanctions that followed, have led to countries questioning their reserve assets. We have seen less demand for developed government bonds. Precisely at the same time, there has been a massive issuance. Instead, they buy gold.

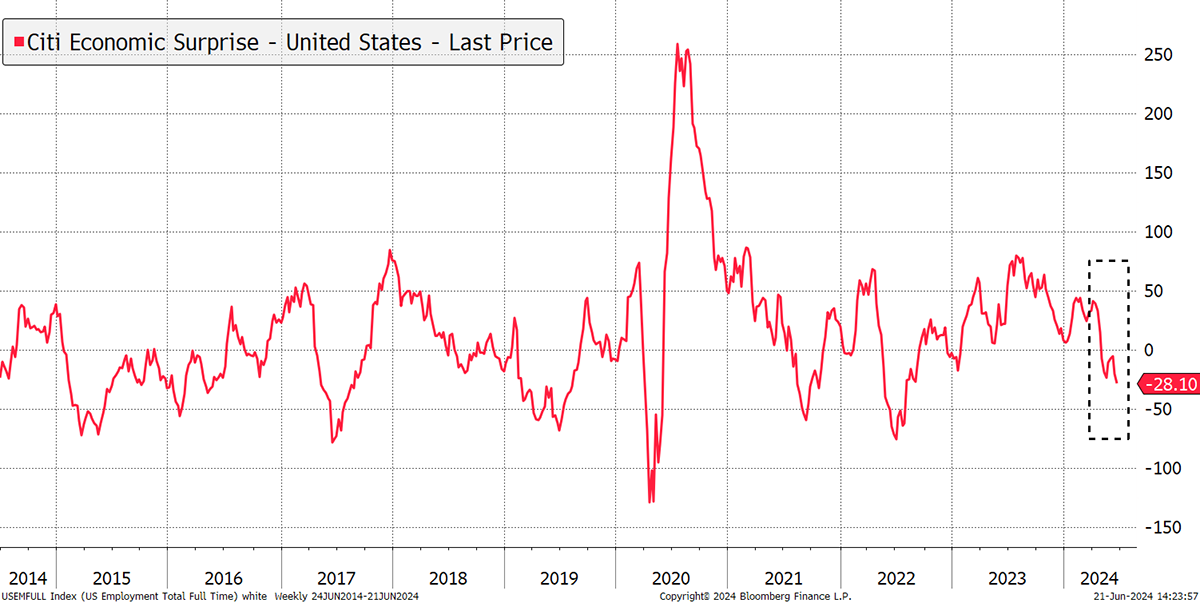

Furthermore, the US deficit is $1.7 trillion, but that’s not all that needs to be raised each year because the old debt needs to be refinanced, which amounts to further trillions. Worse still, when the next slowdown comes, governments will be looking to increase borrowing even further to prop up the economy. And that slowdown is coming, as the economic data is now finally slowing.

Slowdown Coming

Rate cuts are not necessarily something to celebrate as they are enabled by a highly efficient economy where inflation is absent or by a slowing economy where demand is weak. I suspect we are more aligned with the latter. The question is whether bonds can really perform in an era with such high bond issuance. It is a question the emerging markets have had to live with and the developed markets have ignored.

There is no suggestion that bonds will crash in the short term (prices down, yields up), but we really should be questioning whether they can provide the offset that they have in past cycles.

A Week at ByteTree

These topics were covered in the Atlas Pulse Gold Report, where I looked at the impact from Chinese demand. Some worry that the PBOC has stalled purchases after a huge run, but the Chinese people remain active.

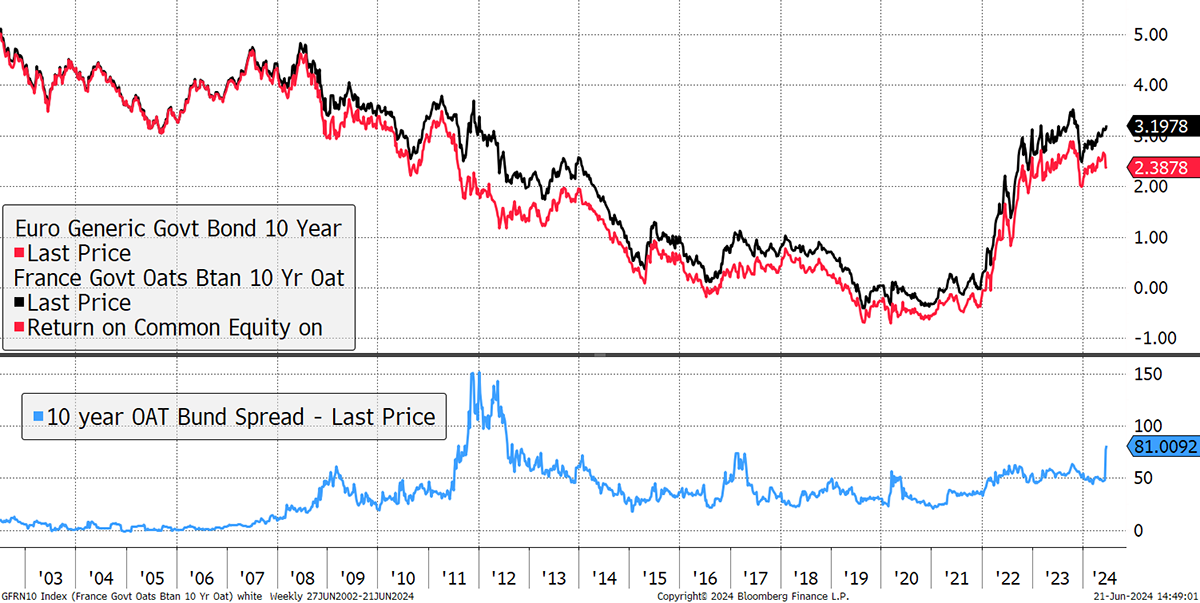

In The Multi-Asset Investor, I was asking the bond questions, highlighting the risks to bond spreads. In France, yields are rising, while in Germany, they are falling. Might this catch on?

European Spreads Widen

In Venture, I wrote up the Weird Shit Investment Conference, which I attended last week. It was hosted by pro investor Swen Lorenz. The conference was so named because someone suggested he hosted a conference focused on all the “weird shit” investment ideas they liked to discuss in his circles. That often meant small and mid-cap stocks in faraway places or special situations that were complex.

I attended the London event, and there were around 19 presentations over the course of the day. They were generally small and mid-cap stocks, trading on major markets and so not too difficult to access. However, some were small and hard to trade. There was another event in New York that I did not attend.

I have reviewed the companies that I found to be the most interesting and provided a brief overview. I have also selected the best of the best, the company that I felt was the most compelling opportunity I heard about at the conference. More about that at the end of the note.

Finally, in crypto, we were once again ahead of the curve. Bitcoin has long been seen as a leading indicator, and the price has rolled over to $63k from $73k in March. The bulls will have to wait until Uptober.

Have a great weekend,

Charlie Morris

Founder, ByteTree