China and the Gold Price

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 94;

While it may be disappointing that the People’s Bank of China stalled gold purchases in May, we can now add the Chinese gold ETFs to the mix. They hold 2.3 million ounces, which is small compared to the PBOC’s 72.8 MoZ, but growing.

Highlights

| Chinese Reserves | PBOC Halts Purchases |

| Chinese Investor | 12 Chinese Gold ETFs Grow to 2.3 MoZ |

| Global Flows | Accumulation Begins |

| Macro | Rates and the Money Supply |

| BOLD | The BOLD.report |

PBOC Halts Purchases

On 26th April, Alexander Stahel, founder of Zug-based Burggraben, posted the longest tweet on gold I have ever seen. He made some good points, and this one stood out.

“Today, one must focus on real rates but also on the Chinese gold market to understand the marginal buyer of gold.”

The Chinese gold market is growing quickly, and their increased activity is driving the gold price. Unlike western investors, Chinese investors have few choices how they invest their savings, and with yields so low, and property and the stockmarket in the doghouse, gold has become a credible alternative for the world’s largest middle-income population. Gold is also insulated from a future potential devaluation of the Renminbi.

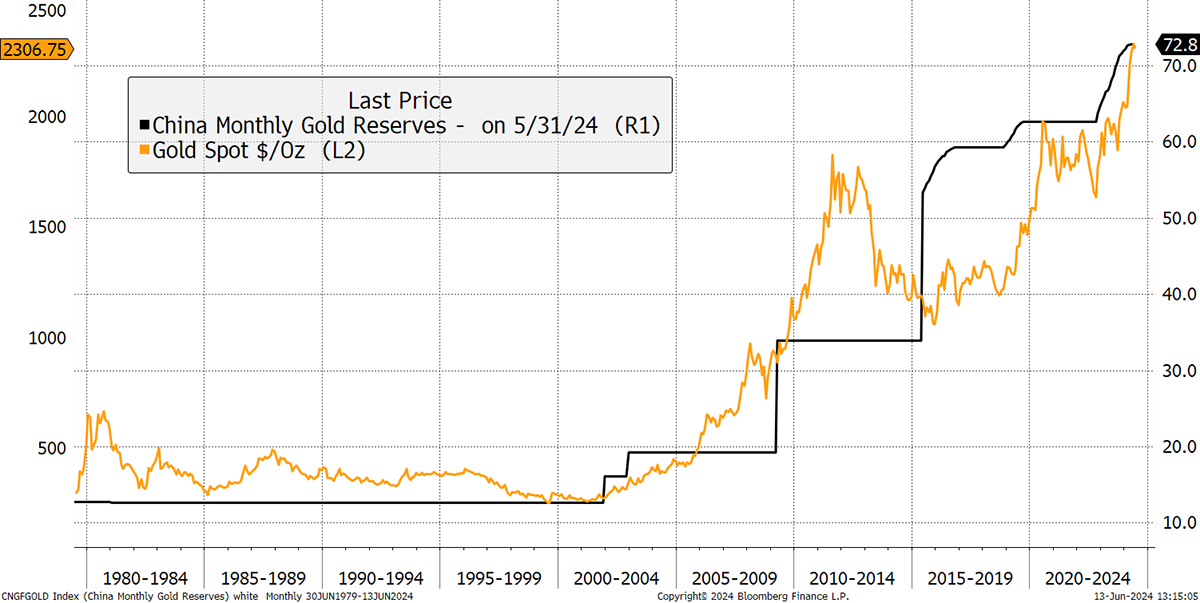

It is well known that the People’s Bank of China (PBOC) has been accumulating gold since 2001, and that has been supportive for the gold price, along with other factors. Yet, since 2015, when gold itself was last in the doghouse, China took the opportunity to add cheap gold to their reserves, thereby significantly increasing their presence in the market. Those purchases have carried on but at a slower pace. Little wonder there was disappointment when they announced zero new purchases in May.

PBOC Gold Reserves

We shouldn’t be concerned about the PBOC’s halt in purchases, as they have a pattern of moving in steps, and accumulation programs tend to follow a dip in price. Now that gold is riding high, they’ll likely sit back and wait for another opportunity.

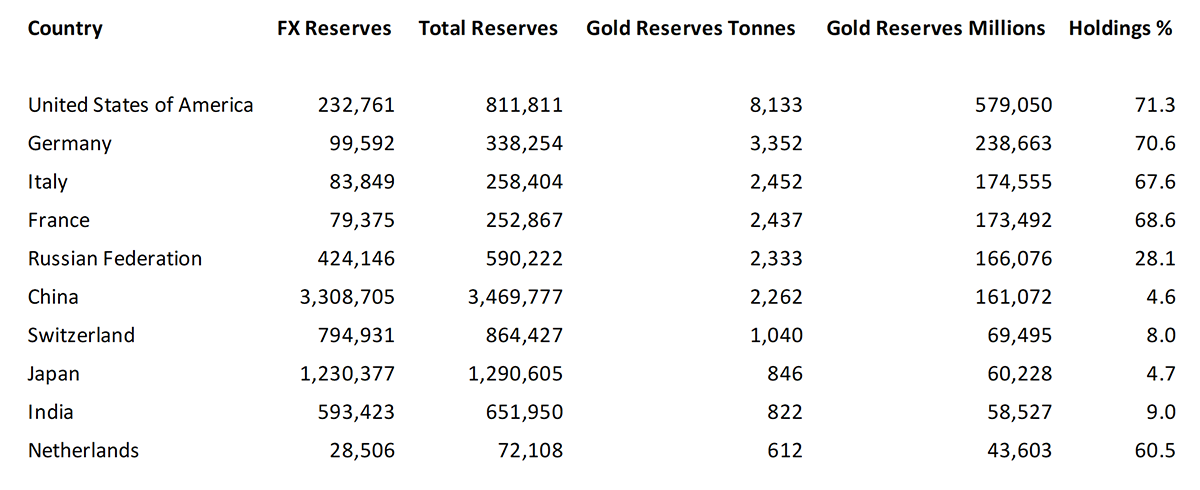

The PBOC officially holds 72.8 million ounces (MoZ), making it the sixth largest gold holder and a similar amount to Italy, France, and Russia. Germany holds a little more, while the USA is the largest holder with a hoard three times larger. This data is reported in tonnes.

Top 10 Countries Gold Reserves

Add in the FX reserves, and China is way ahead in terms of total reserves with gold having a 4.6% share. The potential for China to increase that holding is clear. Analysts such as Jan Nieuwenhuijs believe the PBOC holds roughly twice the amount of gold that they claim, in the world’s “worst kept secret”.

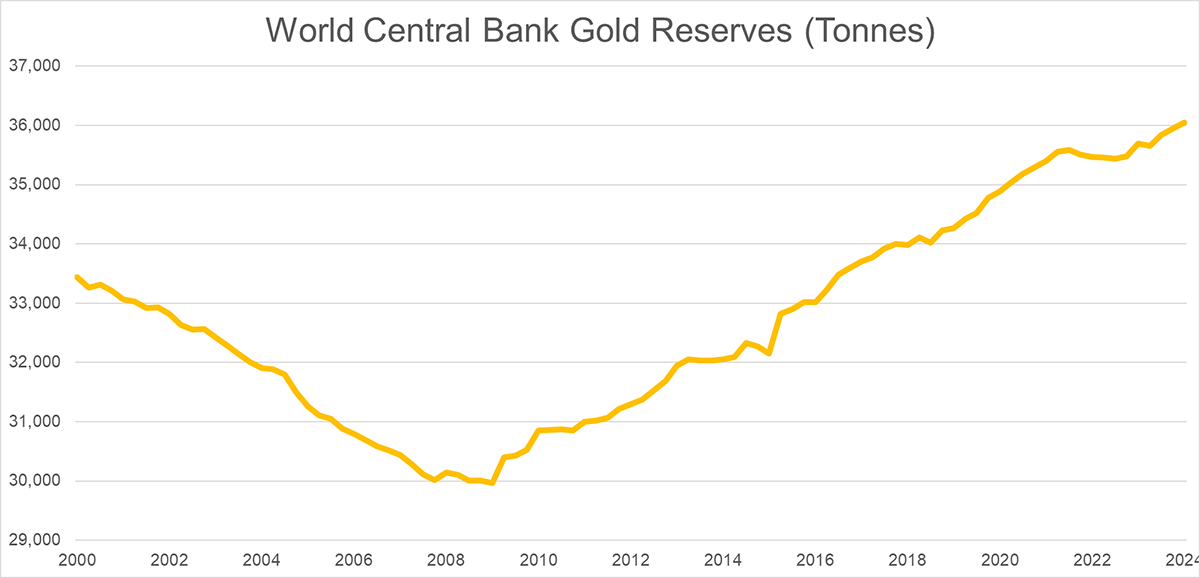

In case you were wondering, the UK ranks 18th in terms of gold reserves, just below Kazakhstan, as it was an enthusiastic seller in the 1990s - a policy that has never been satisfactorily explained. But pre-2009, the UK wasn’t the only country selling, as central bank gold reserves were in decline. In the aftermath of the credit crisis, that trend reversed, and the central banks now hold 36,000 tonnes (1,157 MoZ) or 14 times what is held in the ETFs.

World Central Bank Gold Reserves

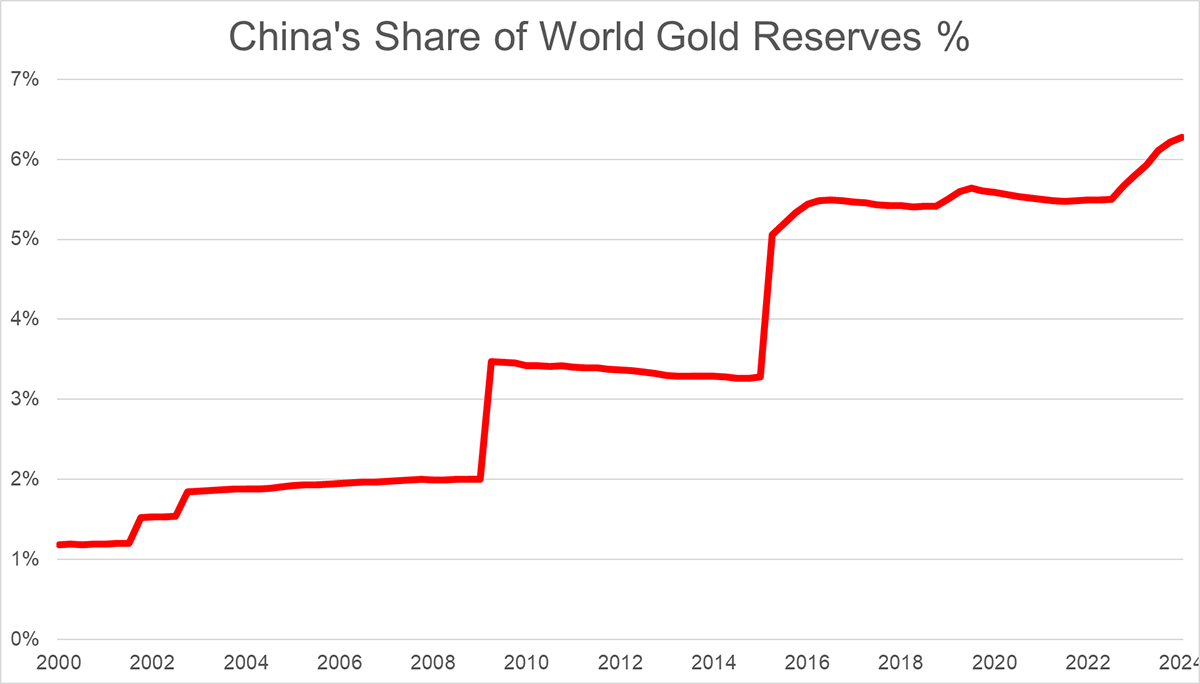

The increase in reserves comes from the emerging nations, with China in the lead. Their official share of reserves in 2001 was 1%, which has grown to over 6%. Using Jan’s numbers, that would look more like 12%.

China’s Share of World Gold Reserves

While the PBOC takes a break, the rest of the world’s central banks carry on. According to the World Gold Council Central Bank Gold Survey, 81% of respondents indicated they expect reserve managers to continue to increase their gold holdings in the next 12 months. This is the highest reading ever recorded.

12 Chinese Gold ETFs hold 2.3 MoZ

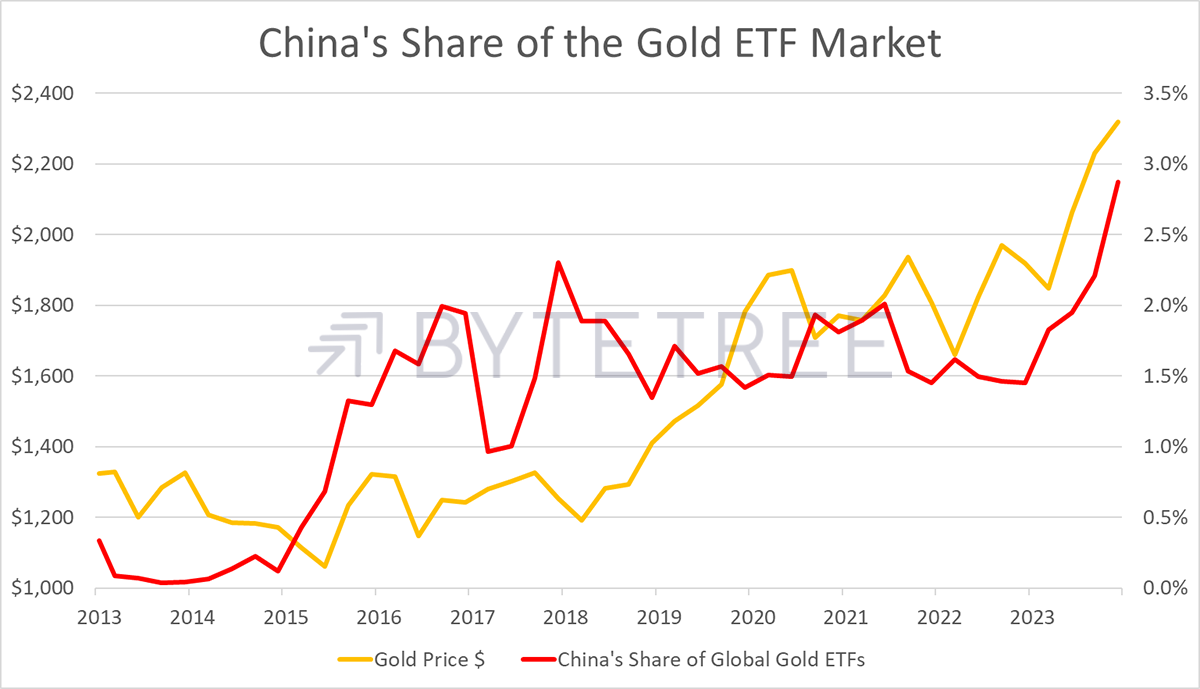

However, it isn’t just the central banks increasing their holdings, as China now has 12 gold ETFs, 9 more than in 2020, which hold 2.3 million ounces. These have seen strong inflows in the past year.

China Gold ETF Holdings

The non-China gold ETFs have seen outflows in recent years, which I’ll come to. But, looking at the Chinese Gold ETFs as a percentage of Global Gold ETFs, their share is now close to 3%. Note how the Chinese Gold ETFs did not drive the gold price in the past, but in recent months, they seem to have gained more influence.

China’s Share of the Gold ETF Market

This isn’t all the gold held by Chinese investors, as there are significant sales of structured products, gold coins, taels, bars, and beads, but I would suggest that the increase of Chinese Gold ETF demand would be indicative of increased demand for other gold investments. China has caught gold fever.

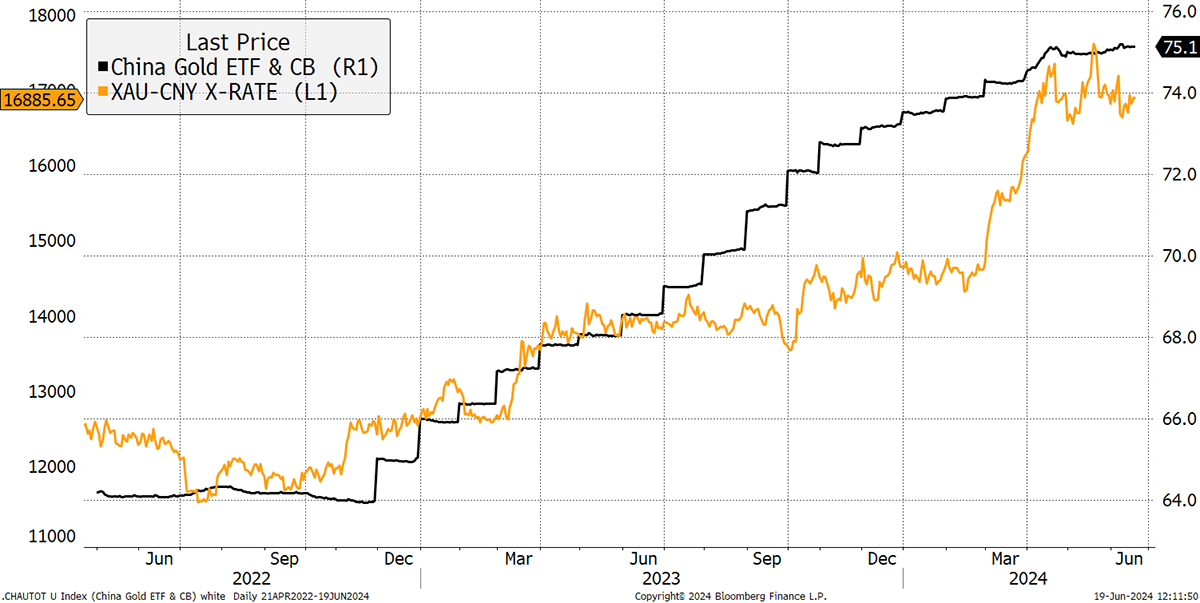

While it may be disappointing that the PBOC stalled gold purchases in May, we can now add the Chinese gold ETFs to the mix. They hold 2.3 million ounces, which is small compared to the PBOC’s 72.8 MoZ, but growing. I will be adding these to the ByteTree data set, which can be found on the BOLD.Report website. The combined official gold holdings of the PBOC and the Chinese ETFs are shown against the price in Renminbi.

China Gold Holdings PBOC and ETFs

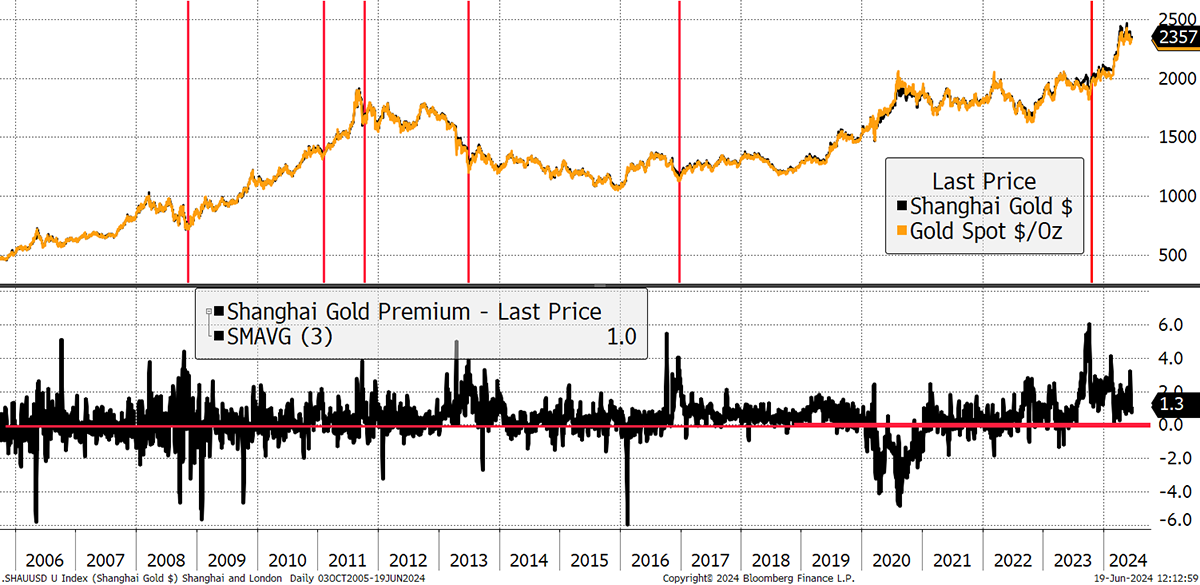

Demand for gold in China is likely to remain strong because the price in Shanghai is higher than on the world market.

The Shanghai Premium

The Shanghai Premium has been going for the past year, and along with previous observations, tends to be a bullish force for the gold price. In simple terms, it means the gold is heading from the West and to the East, incentivised by a higher price. That says much about the shifting balance of power around the world.

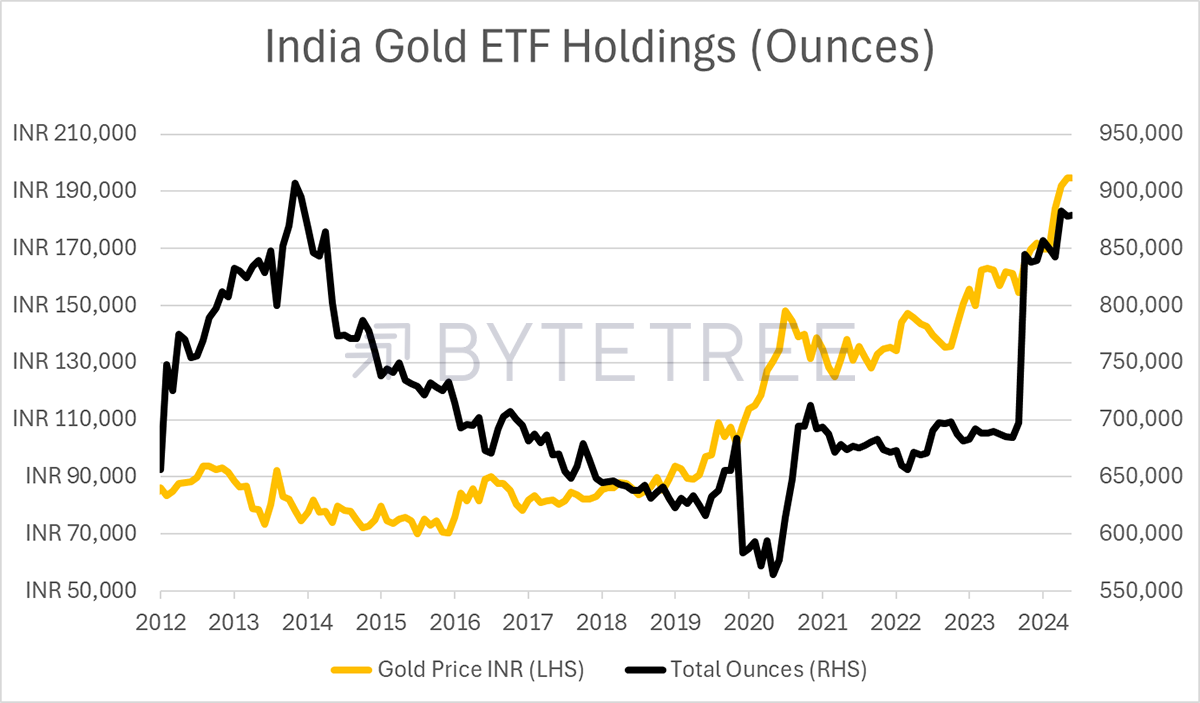

Before we leave the East, there is an emerging gold ETF story in India as well, where the eight ETFs now hold 879,000 ounces, which has been growing since 2020. Two new gold ETFs were launched in recent months. This data will be added to the BOLD.Report as well.

India Gold ETF Holdings

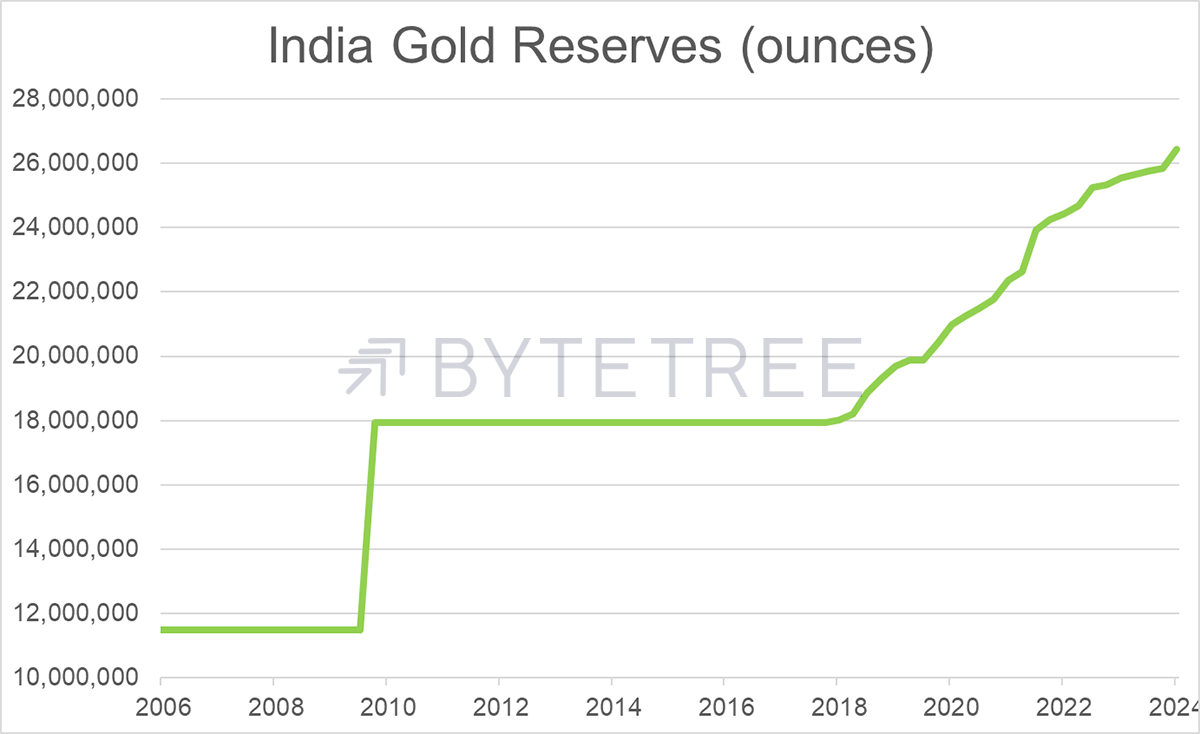

India’s reserves have also been growing at pace, recently passing 26 million ounces. That’s a third of China but over twice the UK.

India Gold Reserves

China and India now hold 102.4 million ounces of gold in their central banks and domestic ETFs, which is more than the rest of the world’s gold ETFs combined.

Accumulation Begins

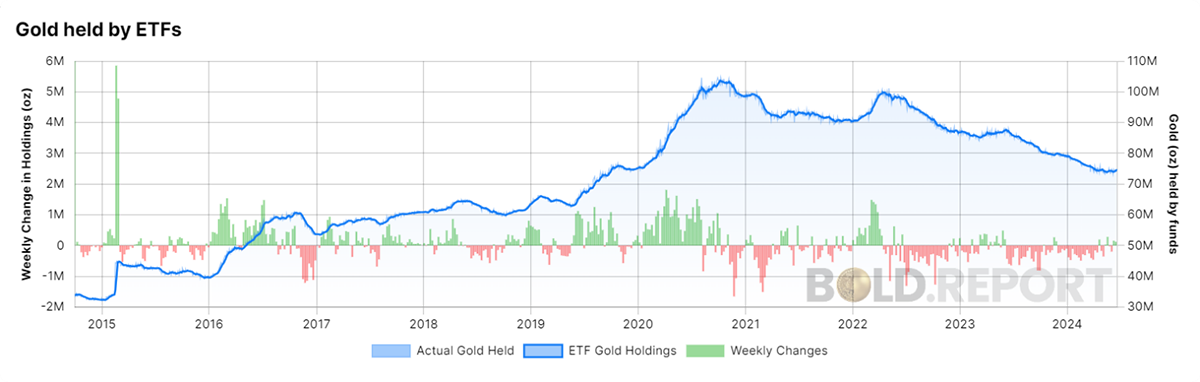

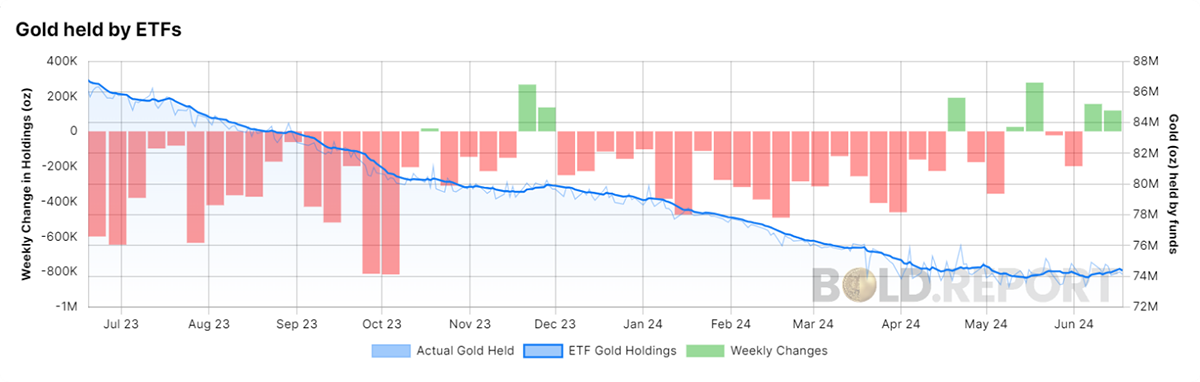

It has been well flagged that while China and India have been accumulating gold, the West has been selling, mainly by wealth managers. The gold ETFs peaked in 2020 with over 100 million ounces, and now hold 75 million ounces.

More recently, there have been flows into the ETFs and we can reasonably expect these to increase. With last week’s US inflation data falling, we can now assume that lower interest rates lie ahead, and that will increase demand for gold in the West as well.

Gold Held by ETFs

Rates and the Money Supply

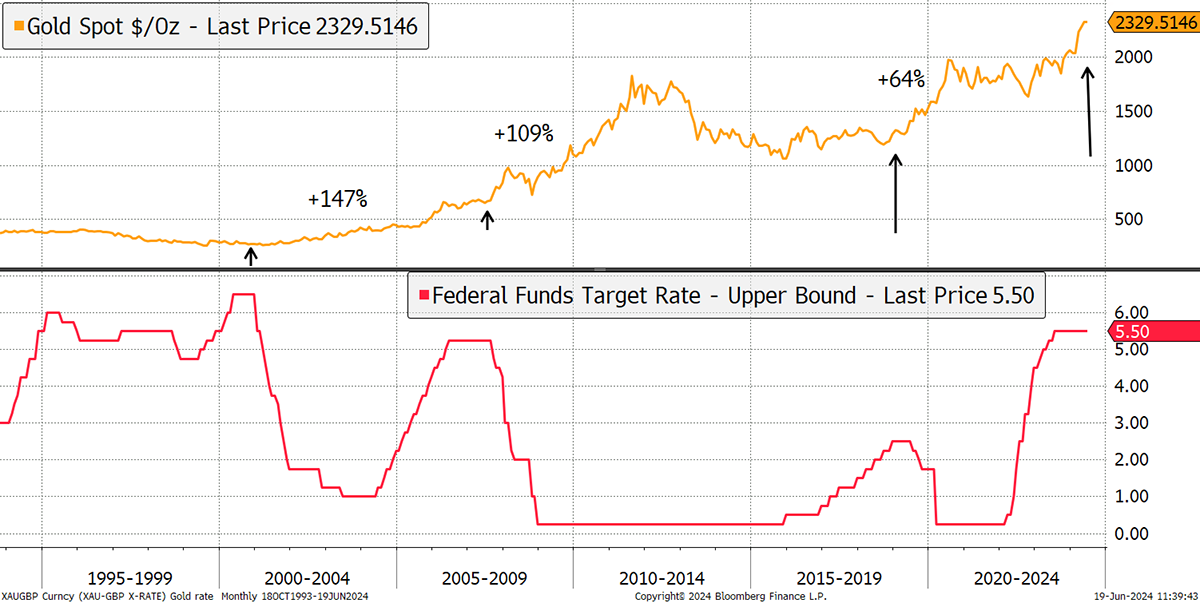

As bond yields fall, alternative assets, such as gold, start to look more interesting to investors. The last three interest rate-cutting cycles began in 2000, 2007 and 2019. All of them worked out well for gold and I suspect the next one will too.

Gold Surges on Rate Cuts

One difference is that it seems unlikely that rates will return to zero unless we have another major financial crisis or depression. That remains possible, but more likely, perhaps, is that rate cuts turn out to be modest as inflation is slow to fall. Goods, food, and energy have played their part, but wages are proving to be sticky. Furthermore, the global economy seems to be supported by outsized government deficits. This excessive issuance of bonds will weigh on the bond market, and perhaps elevate yields.

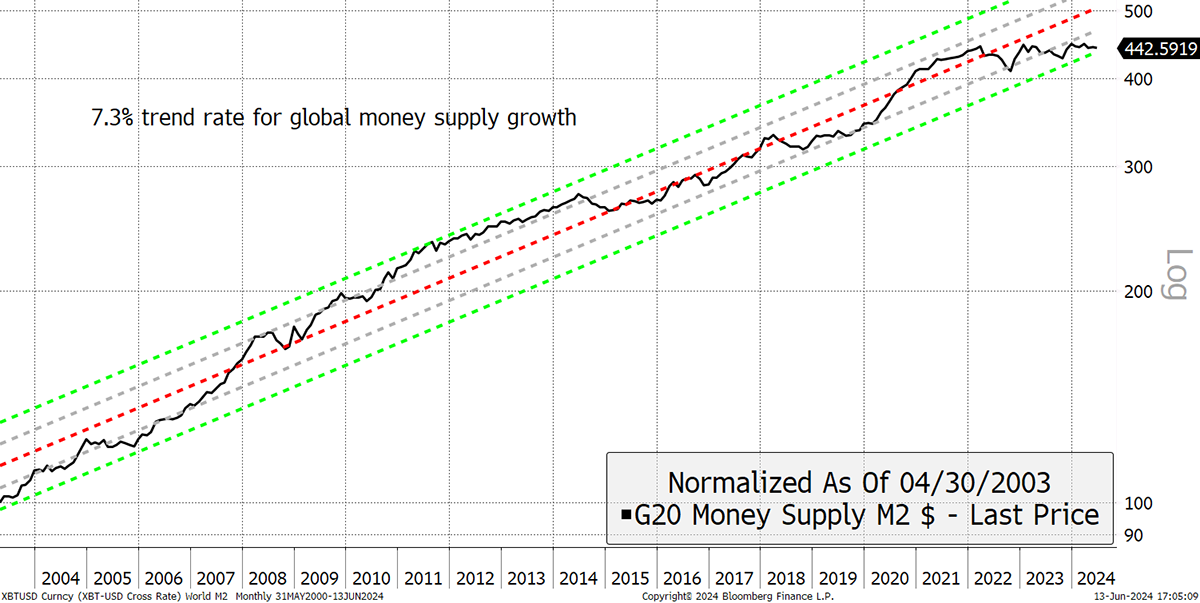

There’s the money supply, which following the 2020 surge, has been flat for three years. One suspects that could change as it accelerates again following renewed stimulus. The last time it went from the lower band to the upper band between 2006 and 2011 the growth rate was an almighty 12% per annum.

Money Supply Growth

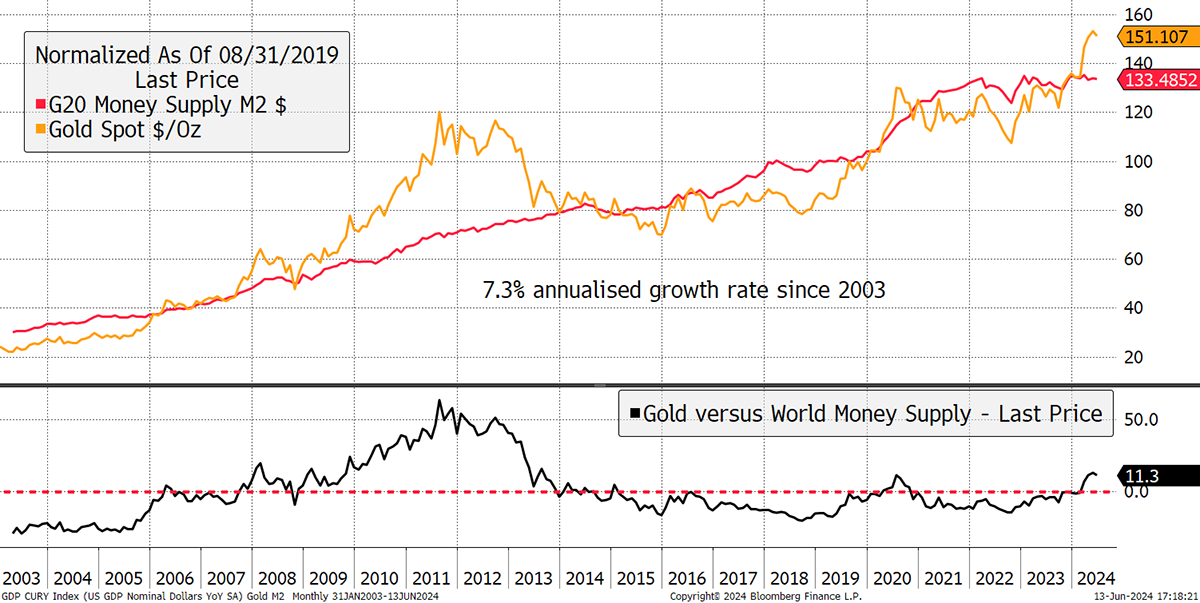

Little wonder we saw gold surge from $500 to $1,900 at that time. The gold price got ahead of itself for sure, but a parallel with today would see the money supply double over the next five years and the gold price treble. Bring on the money supply!

Gold and the Global Money Supply

BOLD

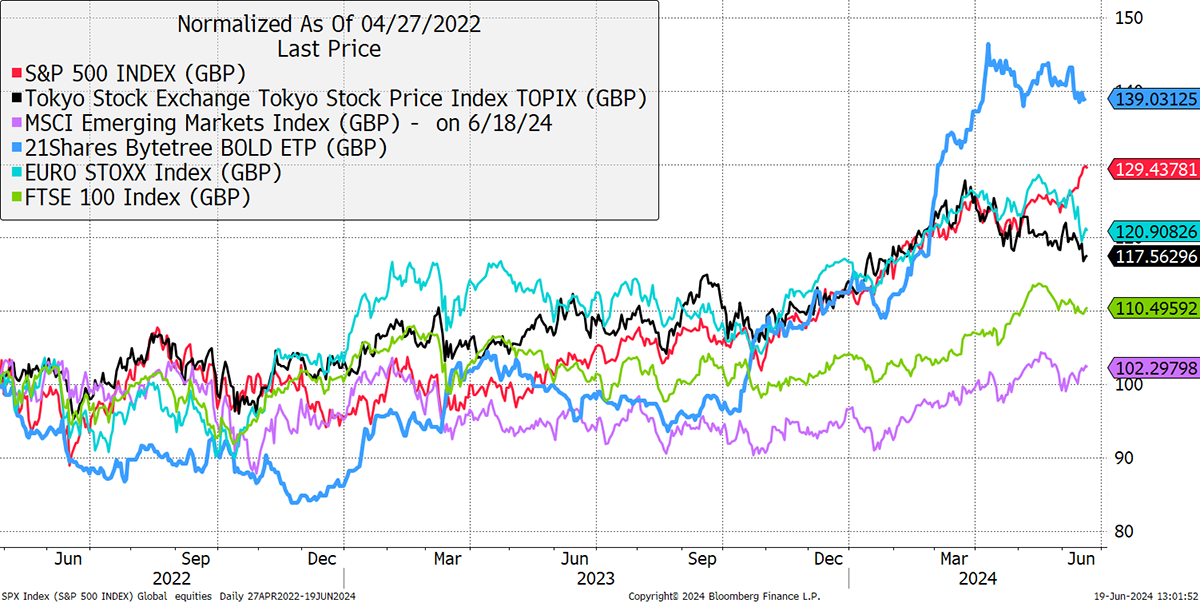

At ByteTree, we are big gold fans, and the beauty of our BOLD Index is that it accumulates gold over time. By investing a small weight in Bitcoin and regularly rebalancing, the result has been impressive. Not only has BOLD beaten the world’s stockmarkets, but with similar volatility, having shaken off a brutal Bitcoin bear market in 2022.

Global Equities and BOLD Since Launch

If you would like to learn more, then please visit BOLD.report. You will also find the flow data for the gold and Bitcoin ETFs around the world.

From Sean…

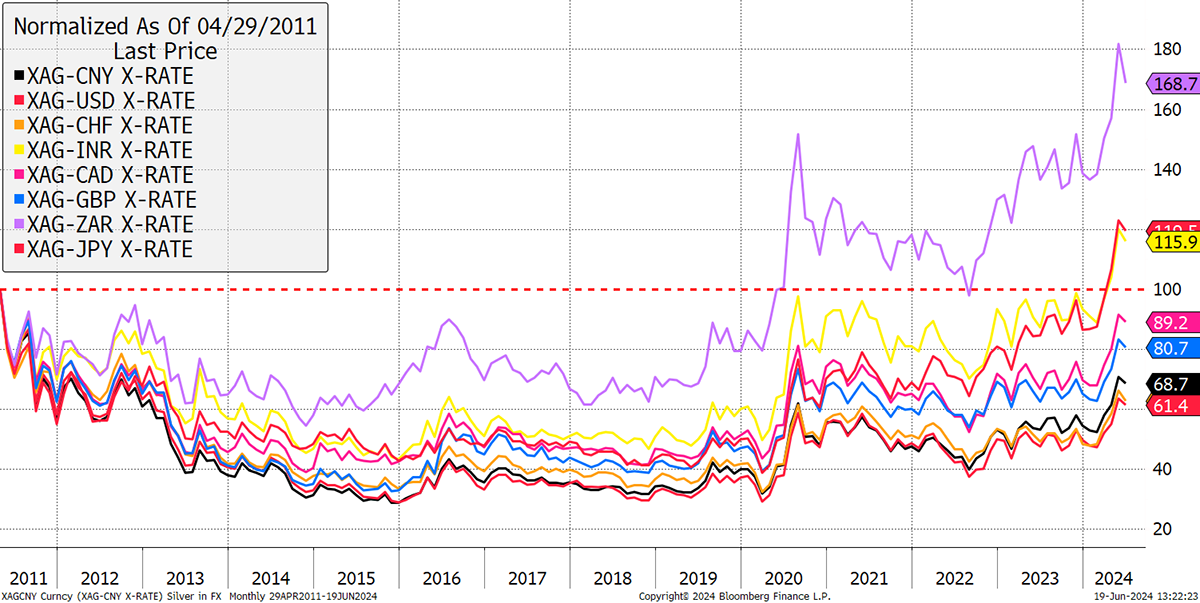

Sean from Australia wrote in saying thanks for letting me know the price of silver is at a new high in Aussie dollars. That’s also true in yen, Rupees and several EMs. Evidence that silver is winning perhaps.

Silver in Various Currencies since the 2011 High (rebased)

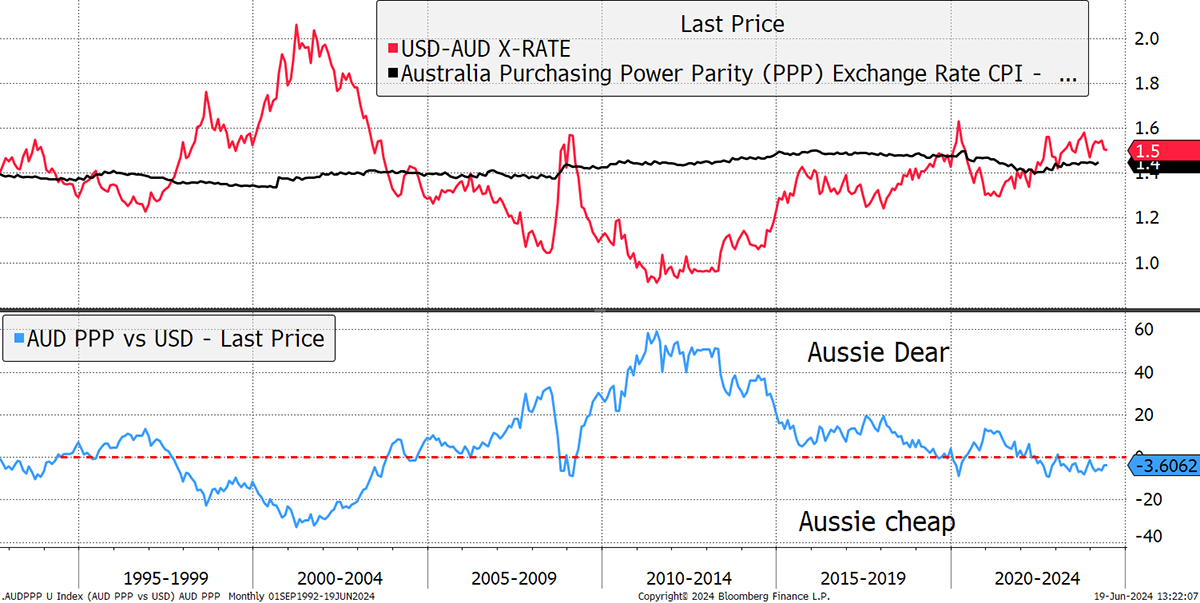

Sean also says the Aussie is undervalued. My daughter is on a GAP year down under and says it’s super expensive, having moved from Central London. Who’s right? According to purchasing power parity, the Aussie is 3% cheap against the dollar, but let’s not forget that the dollar is pricey.

Aussie Dollar PPP

$12 for a pint! I’m with my daughter.

Summary

The world’s government deficits are unsustainable, meaning that bonds are riskier than they ought to be. Gold is moving east because they get it. When the West gets it too, the gold price will only surge. Every conversation about the risks and uncertainties brings you back to gold.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Editor and Creator of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.