Trade in Soda;

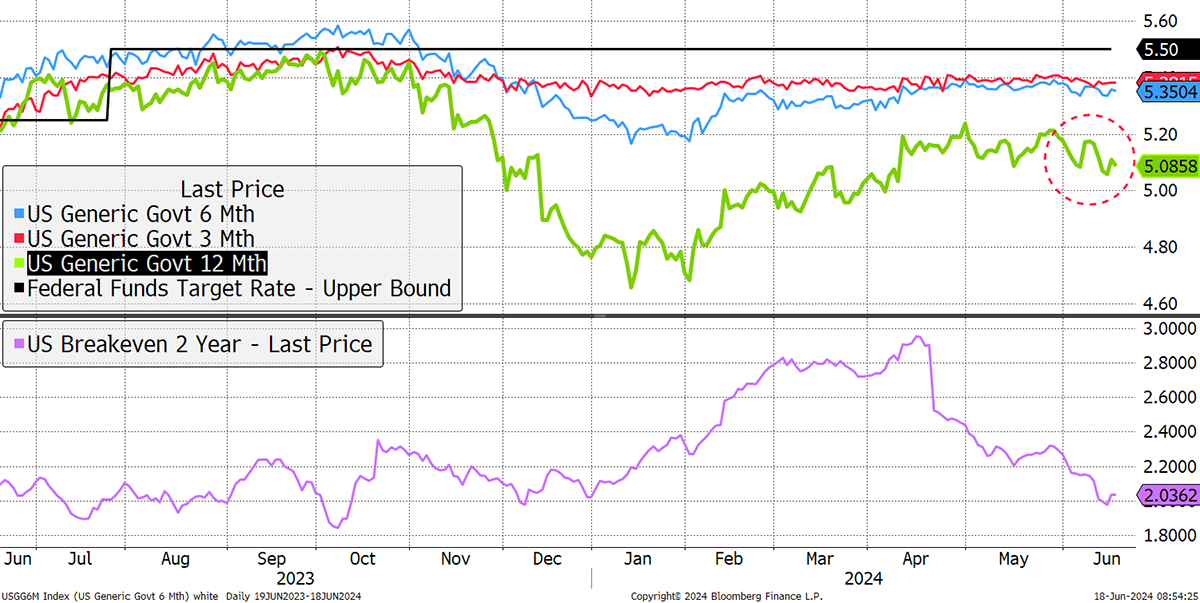

Following the recent inflation data falling to 3.3%, down from 9% two years ago, the bond market is signalling that US interest rates will fall within a year as the one-year yield (green) turns down. There was hope this would happen last autumn, but inflation expectations rose, and that was that. This time looks more promising, and given the ECB has already cut rates, it is fair to assume the UK will follow.

US Bond Market Forecasting Rate Cuts

Naturally, things change, and markets don’t always follow the plan. The economy is slowing so that is unlikely to hold back rate cuts, leaving inflation as the potential spoiler. That could rise, but more likely, it remains stubborn. I see rate cuts coming, but I would be surprised to see them slashed as we have become used to in recent cycles.

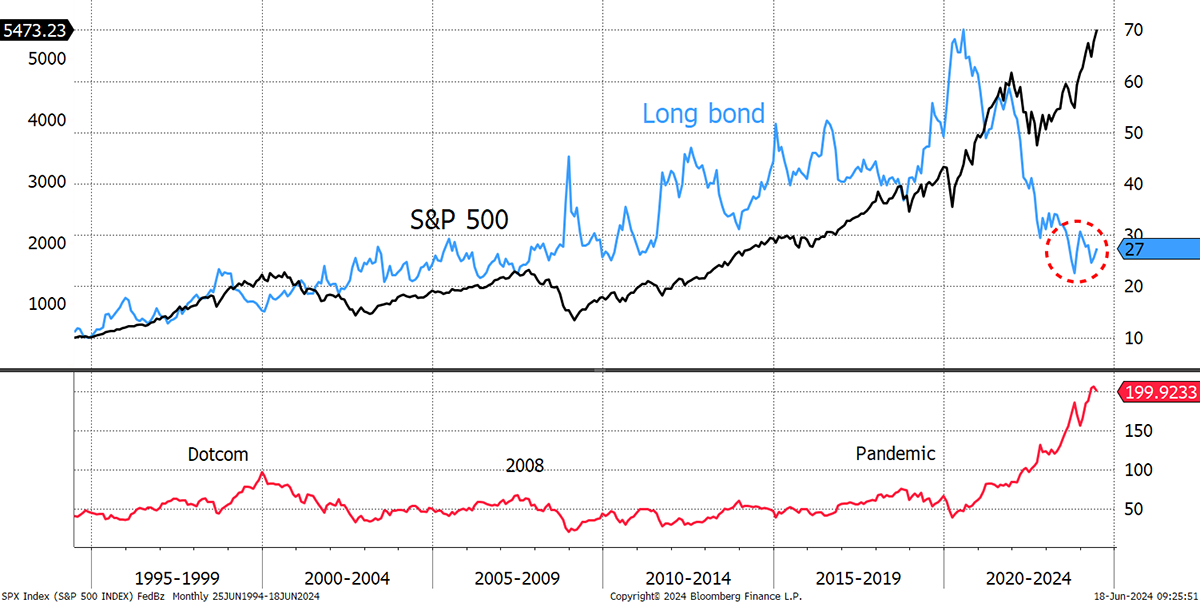

More importantly perhaps is that it may have put a floor under the bond market, which would increase investor confidence to diversify away from equities. We shouldn’t forget that the last three bond rallies led to equity bear markets. More importantly, undervalued companies, with strong balance sheets and cashflow, were well insulated from the market troubles.

Equities vs Bonds

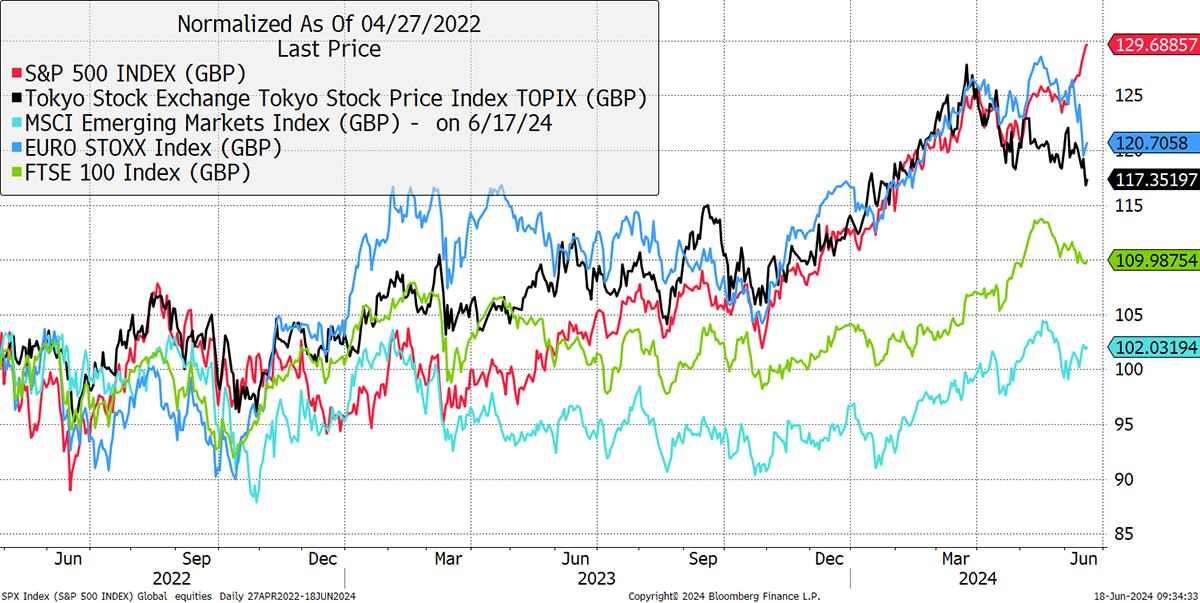

The recent bull market began in October 2022. It was born around the time of the mini-budget bond crisis, which marked the peak in yields. Markets stabilised after that and have risen, but not that much. Emerging markets are up just 2%, and the FTSE 100 is up 10%, plus dividends. It really isn’t very much compared to normal bull markets. Europe and Japan fared better, but today, it is just the S&P 500 that has kept on going.

Major Markets Over the Past Two Years

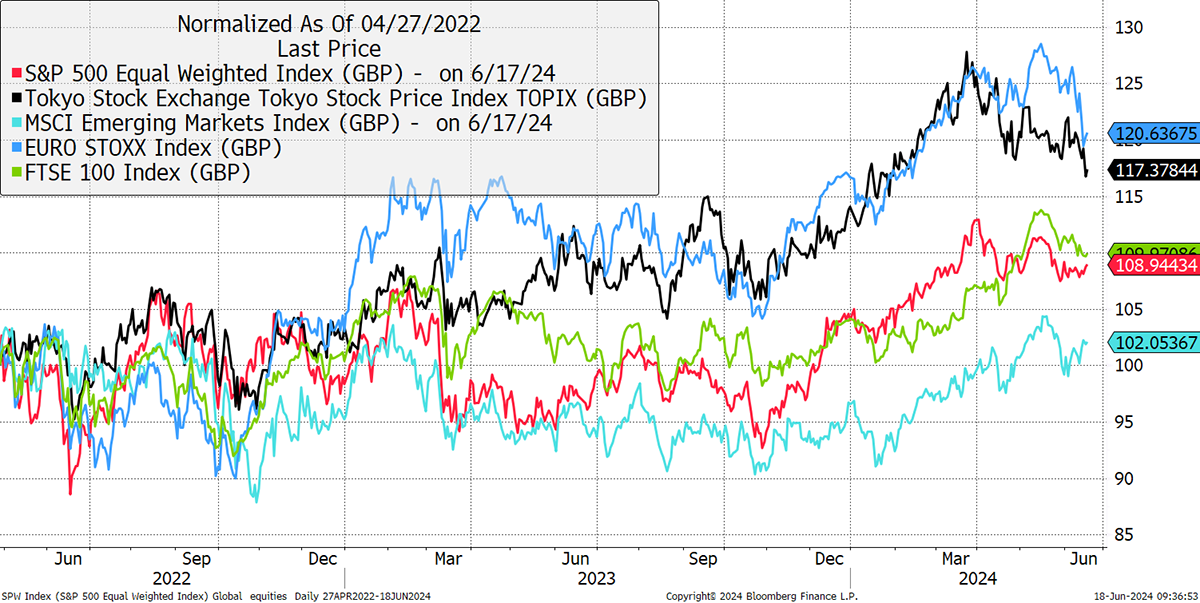

I show that chart again using the S&P equal weight index, which reduces the weight of the largest 7 technology stocks from 33% to 1.4%. Suddenly, the US market matches the UK. Doesn’t it make you feel better about life?

Major Markets Over the Past Two Years (S&P 500 Changed to S&P 500 Equal Weight)

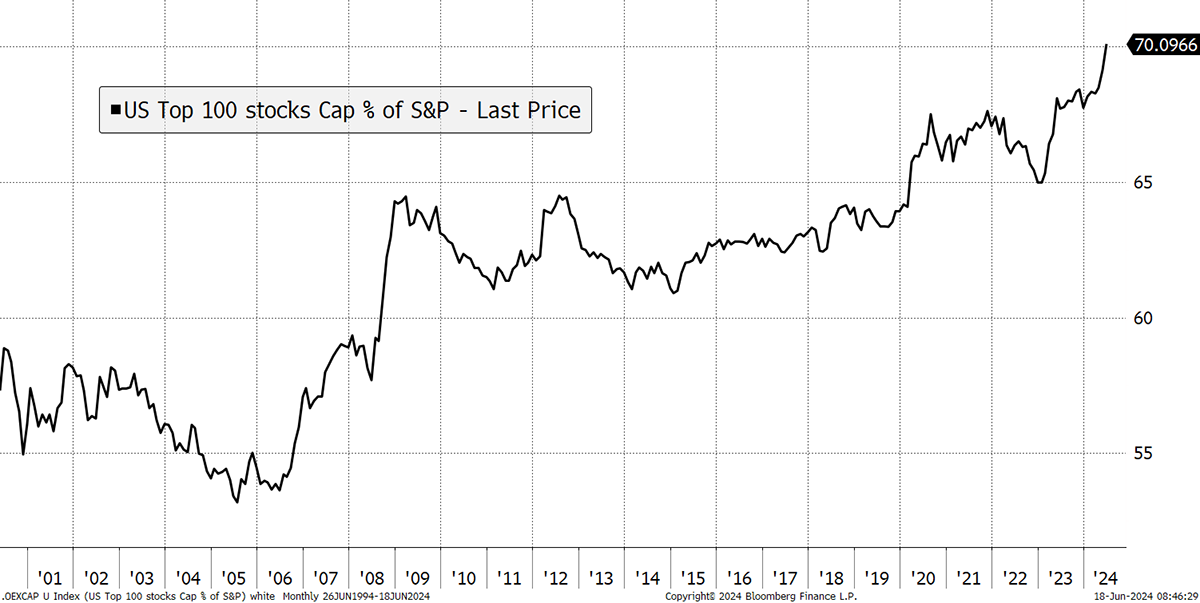

Notice also how markets have turned down, especially in Japan and Europe. Yet, US large caps keep on rising. The level of concentration is extraordinary, and it keeps going. I showed the flows into the S&P 500 last week in our Friday roundup, which showed how profits weren’t keeping up with prices. Now, I show the concentration using the market cap of the top 100 stocks as a percentage of the Top 500 stocks. Since 2005, it has risen by 17% to 70%. I am not sure what the January 2000 level was, but we could assume around 60% or slightly higher.

Extreme Concentration in Large Caps

At some point, this will reverse, and I reiterate that it will probably see the major indices fall, but more importantly, it will see capital flow from the expensive land of hope to the resilient value stocks, just as it always does. That is a quick reminder why the stocks held in Whisky and Soda are undervalued good companies. We are not chasing the technology bubble.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd