Holding Steady

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

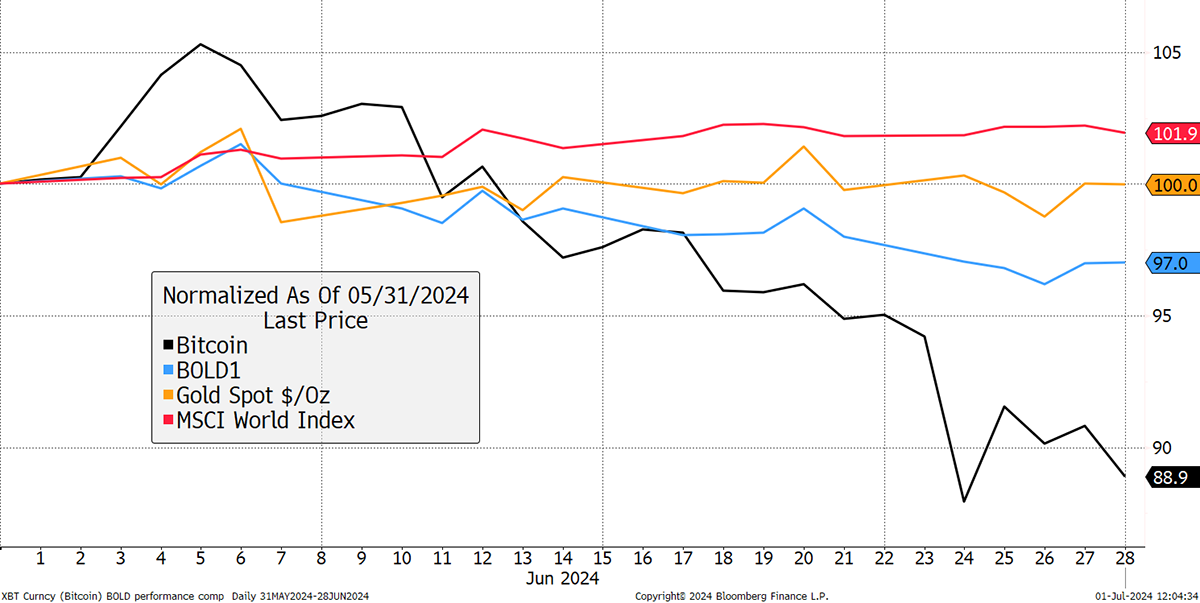

In June BOLD fell by 3.0%, Bitcoin fell by 8.5%, Gold was flat, while equities rose by 1.9% in USD terms. The target weights last month were 24.3% for Bitcoin and 75.7% for Gold. Price changes over the month led to the last day’s weights at 22.5% and 77.5%. This means the latest end-June rebalancing has seen 2.6% added to Bitcoin, and correspondingly reduced from Gold, to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities – June 2024

BOLD Performance

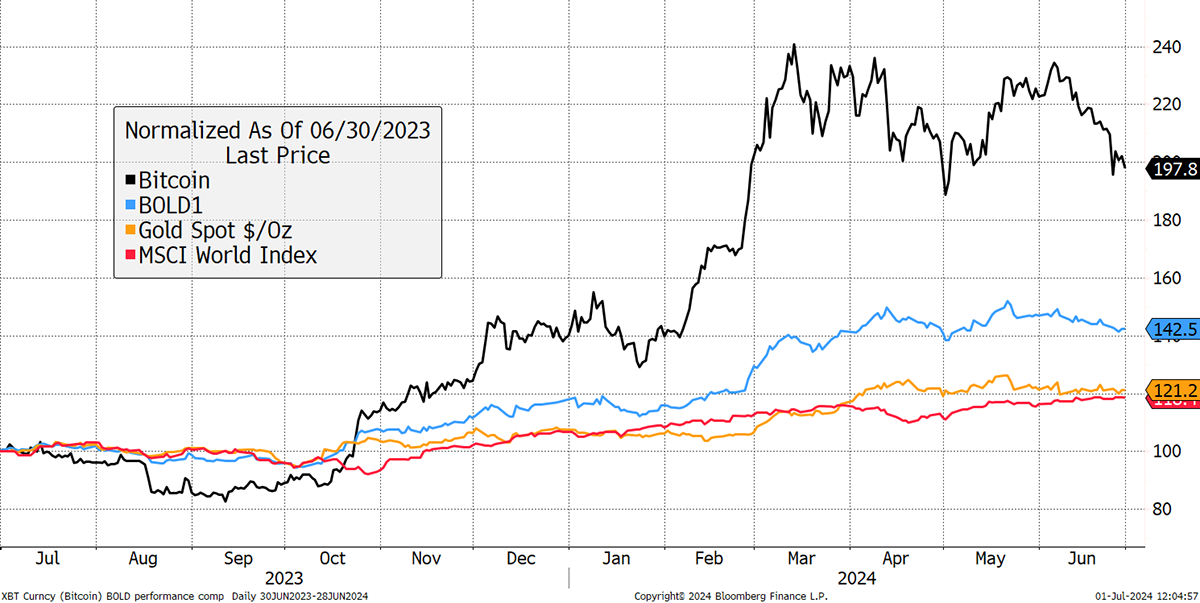

Over the past year, Bitcoin’s performance has returned 98%, in contrast to Gold with 21%, which was alongside equities. BOLD managed a respectable 42.5% return.

Bitcoin, Gold, BOLD, and Equities Over the Past Year

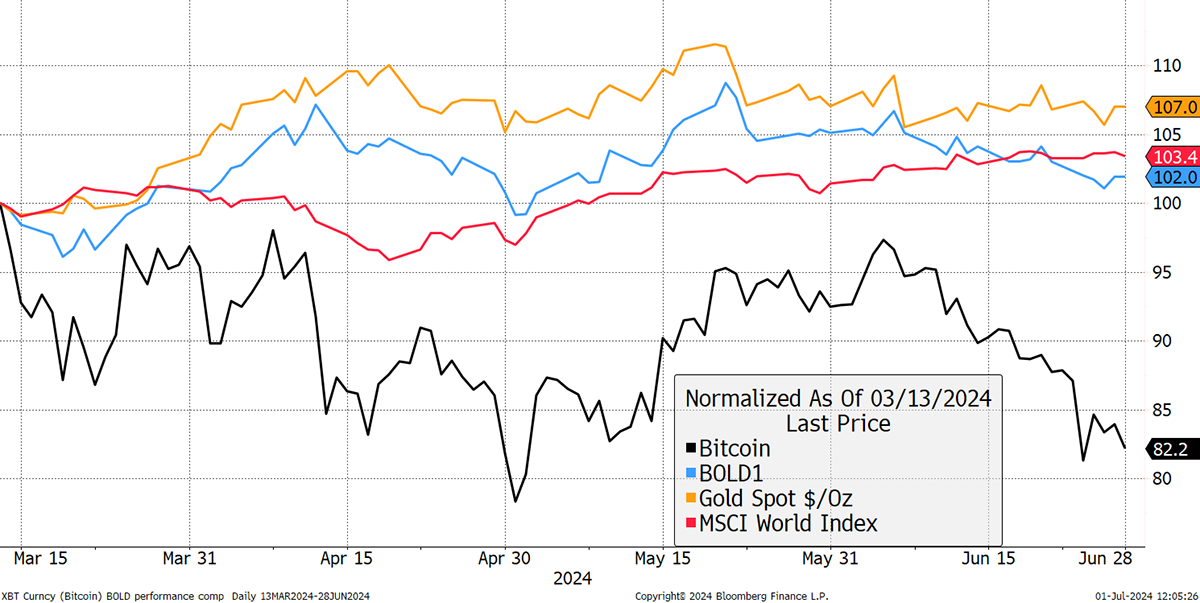

The all-time high for Bitcoin took place on 13th March this year, and since then, it has fallen by 18%, while Gold is up 7%. This has meant BOLD is up 2%, again close to global equities.

Bitcoin, Gold, BOLD, and Equities Since Bitcoin’s All-time High

In the short term, BOLD is at its best when Bitcoin disappoints. Not only does it hold less Bitcoin (typically 25%), but it goes on to accumulate more at lower prices so that BOLD is amply exposed when the Bitcoin recovery comes. That is why, over longer time frames, BOLD, in the 25/75 split, routinely beats the returns of Bitcoin and Gold in isolation. The reason for this is the monthly rebalancing transactions.

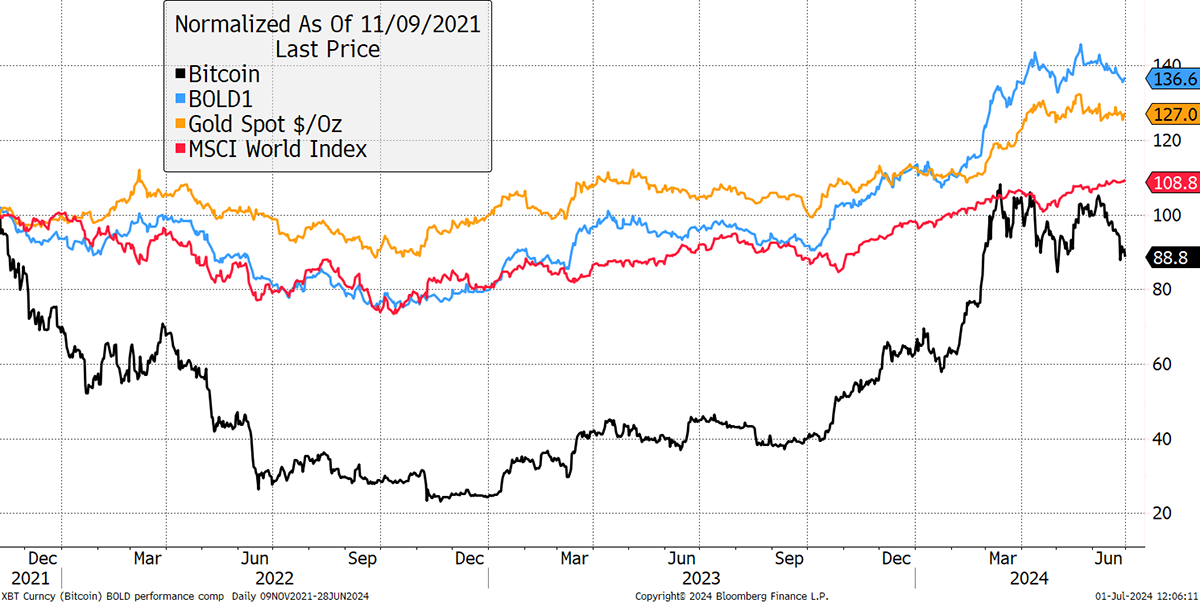

Bitcoin, Gold, BOLD, and Equities Since 9 November 2021

It is odd to think that Bitcoiners are down over nearly three years, whereas BOLD holders are ahead of both Gold and the stockmarket over the same period.

June Rebalancing of the BOLD Index

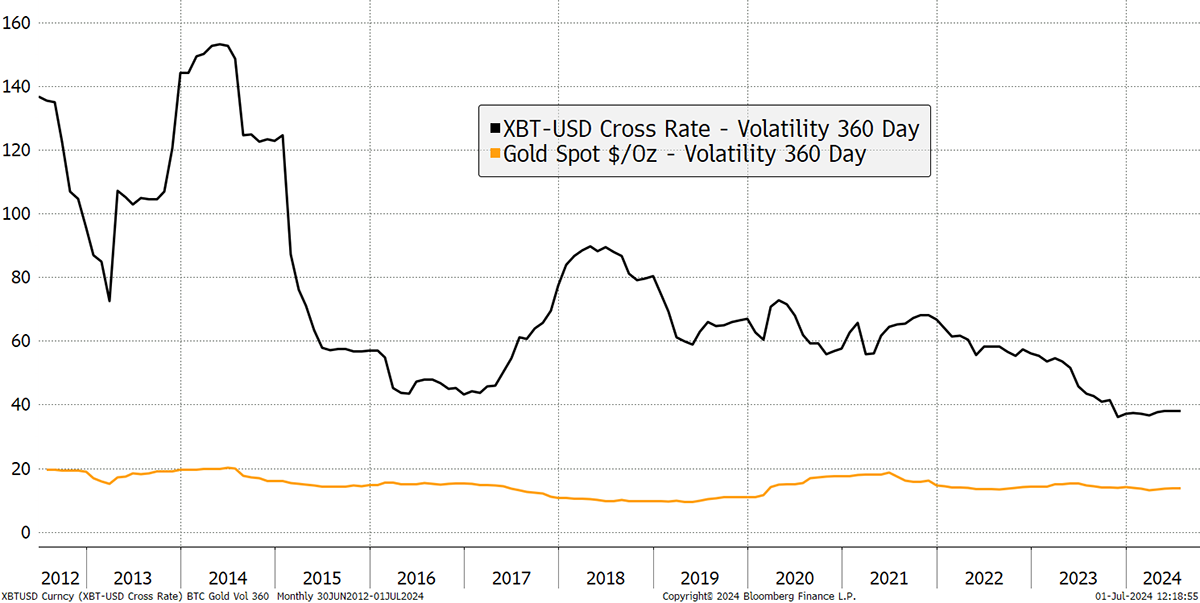

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold’s Past 360-day Volatility

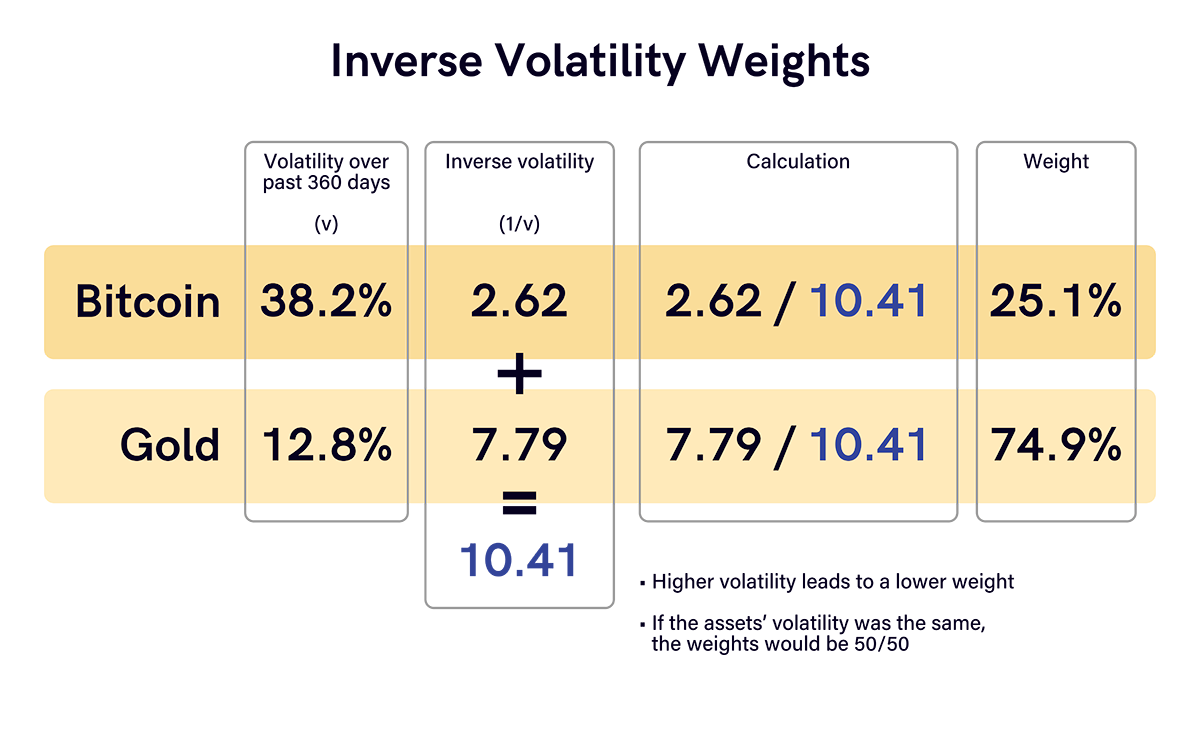

The volatility for Bitcoin and Gold over the past 360 days was observed to be 38.2% for Bitcoin and 12.8% for Gold. That means Gold’s volatility is slightly higher than last month, while Bitcoin is slightly lower. This has resulted in new target weights of 25.1% Bitcoin and 74.9% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. It is, hence, “risk-weighted”.

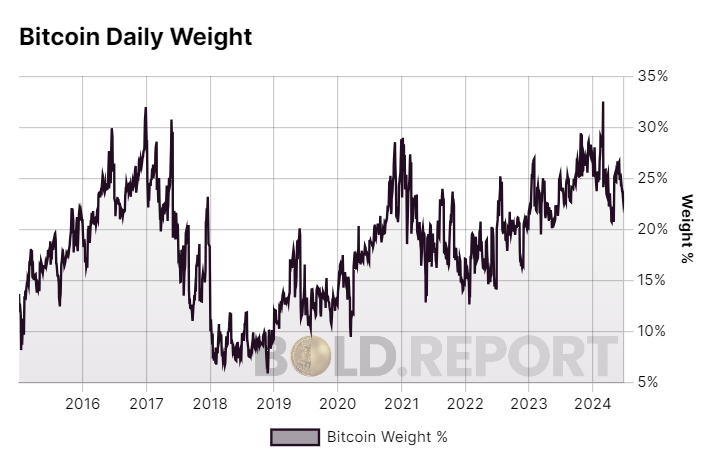

The history of the BOLD allocation to Bitcoin and Gold is now available on our website with daily and monthly target weight data. The key points are how the monthly target data are calculated according to the methodology above. When Bitcoin has been volatile, such as in 2018, the exposure fell markedly. It rose again in 2019/20 as Bitcoin’s volatility cooled. Having low exposure during periods of uncertainty added value and reduced risk.

BOLD’s Bitcoin and Gold Weights

The daily data are dictated by the price movements of Bitcoin and Gold, having been reset at each month’s target weight. The spikes indicate months when there has been significant price dispersion between the assets. Bitcoin’s lowest ever weight was 5% in November 2018 when the price collapsed by 50%. Its highest weight was 33% in late 2017, which was the market high, and in February this year, ahead of rebalancing. On both occasions, BOLD “took profits” at high prices.

BOLD’s Daily Bitcoin Weight

This data will soon be freely downloadable from the BOLD.Report website. We welcome external analysis and feedback.

Atlas Pulse and ATOMIC

ByteTree.com publishes monthly publications on Gold, Atlas Pulse, and Bitcoin, ATOMIC. I shall share the highlights from the June issues.

In Atlas Pulse, I looked at Chinese Gold demand, which is becoming an increasingly important factor in setting the Gold price. There has been much focus on the People’s Bank of China (PBOC), which has been an enthusiastic buyer in recent years, but their latest drive has ground to a halt, as they tend to move in steps. Over the past 18 months, the PBOC have added 10.2 million ounces of Gold to their reserves, having taken advantage of an attractive entry point, following price weakness, at the outset. That purchase program is now complete, and no doubt they’ll be back if or when the gold price cools.

In the meantime, just as the PBOC takes a break, the Chinese Gold ETFs keep on growing as investors look to diversify their savings in a country where interest rates are low, and the stock and property markets are troubled. The Chinese Gold ETFs now hold 2.4 million ounces. Interestingly, this now amounts to 3.6% of the global Gold ETF market and is growing. Chinese demand seems to have turned into the leading driver for the Gold price.

Chinese Gold Demand Has Influenced the Gold price

In the latest ATOMIC, titled Bitcoin Loves Hot Money, I looked into the recent price weakness, which boils down to a post-halving cooling off and the prospect of lower interest rates. However, I felt the most important observation, which is unrelated to recent price movements, tells a more important story: the lack of crossover between Bitcoin and Gold.

Looking at the Bitcoin and Gold ETFs, the owners couldn’t be more different. I chose the $28 billion iShares Gold (IAU) vs the $19 billion iShares Bitcoin (IBIT) as a sample. They are run by the same company and have the same salesforce selling into the same client base. Yet, for some reason, the customers are completely different.

The flows into the Bitcoin ETFs have been dominated by hedge funds, private investors, and family offices. There are few institutional investors that are active in the Bitcoin world. Contrast that with Gold, and it is dominated by institutional investors. I show the top 20 holders of each ETF to illustrate the point.

| iShares Gold (IAU) | iShares Bitcoin (IBIT) |

|---|---|

| Bank of America Corp | Millennium Management LLC/NY |

| FMR LLC | Schonfeld Strategic Advisors LLC |

| Morgan Stanley | Aristeia Capital LLC |

| Sumitomo Mitsui Trust Holdings Inc | Boothbay Fund Management LLC |

| Charles Schwab Corp/The | Bracebridge Capital LLC |

| Empower Advisory Group LLC | State of Wisconsin Investment Boar |

| Wells Fargo & Co | Graham Capital Management LP |

| JPMorgan Chase & Co | Pine Ridge Advisers LLC |

| AllianceBernstein Holding LP | Rubric Capital Management LP |

| LPL Financial LLC | Titan Global Capital Management US |

| Mizuho Financial Group Inc | Symmetry Investments LP |

| Bank of Montreal | Pinpoint Asset Management Ltd |

| Ameriprise Financial Inc | Fortress Investment Group LLC |

| WealthNavi Inc | Sculptor Capital Management Inc |

| Raymond James Financial Inc | Yong Rong HK Asset Management Ltd |

| Northwestern Mutual Wealth Mgmt | Murchinson Ltd |

| HighTower Advisors LLC | Alyeska Investment Group LP |

| Genstar Capital LLC | Horizon Kinetics LLC |

| Packer & Co Ltd | CTC ALTERNATIVE STRATEGIES LTD |

| BlackRock Inc | Maplelane Capital LLC |

Source: Bloomberg

This highlights an important difference between the assets. Gold is held by the financial establishment, whereas Bitcoin is held by hedge funds and traders. Assuming Bitcoin has a bright future, which we believe it does, the names on the left will start to appear on the right in the coming years. It will take a long time for this to happen, just as it did with the internet stocks, which took time to be accepted, but it is inevitable. This long and slow process will drive Bitcoin demand for years to come.

There is another advantage for BOLD, and that comes from the correlation between the assets. The excess return that comes from rebalancing transactions works because the assets are uncorrelated, which means they tend to move independently from one another, often in opposite directions. If they moved in sync, there would be minimal added value. This is important because we estimate that excess return to be between 5% to 7% per annum. So long as the correlation remains low, BOLD not only reduces risk but it increases return. Correlation will only come when the investor base is matched, which will probably be several years away.

Those pieces can be found on the ByteTree website:

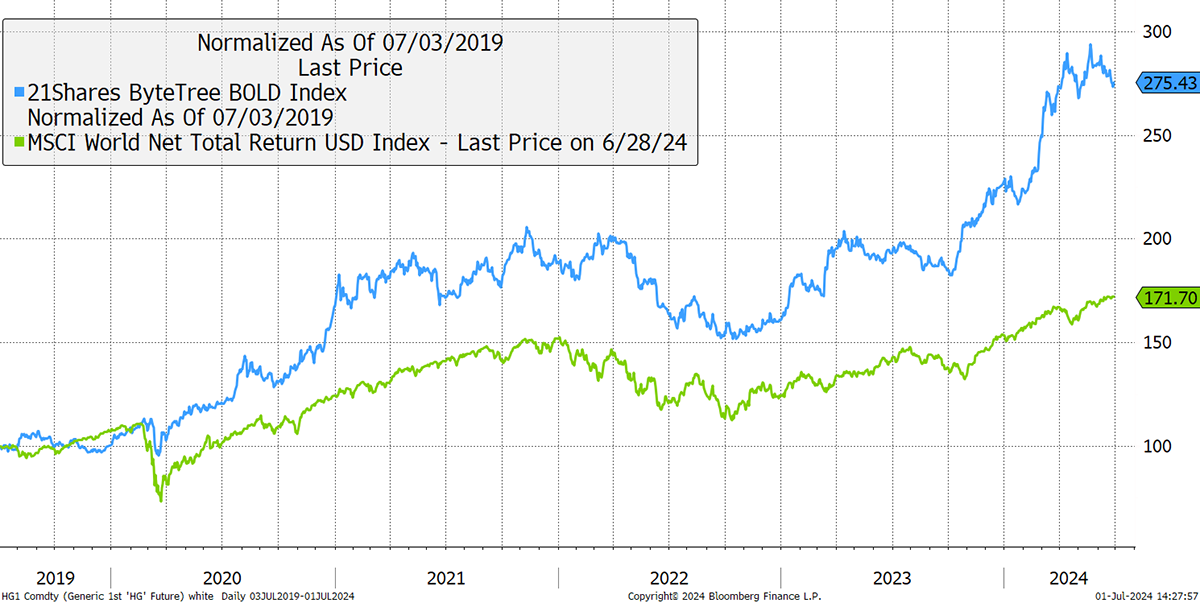

Summary

Once again, BOLD demonstrates steady long-term outperformance over and above the stockmarket even after accounting for dividends. Despite Bitcoin having recently suffered a significant correction, the resulting BOLD drawdown has been modest. The long-term outlook for both Bitcoin and Gold remains positive.

BOLD Leads Global Equities

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

BOLD.report

Research

ByteTree provides more in-depth research on Bitcoin and Gold for free on our website.