Sunny Solana ETFs

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 114;

Query: Does Solana have an ETF?

Google: Two asset managers, VanEck and 21Shares, filed to launch Solana ETFs this week.

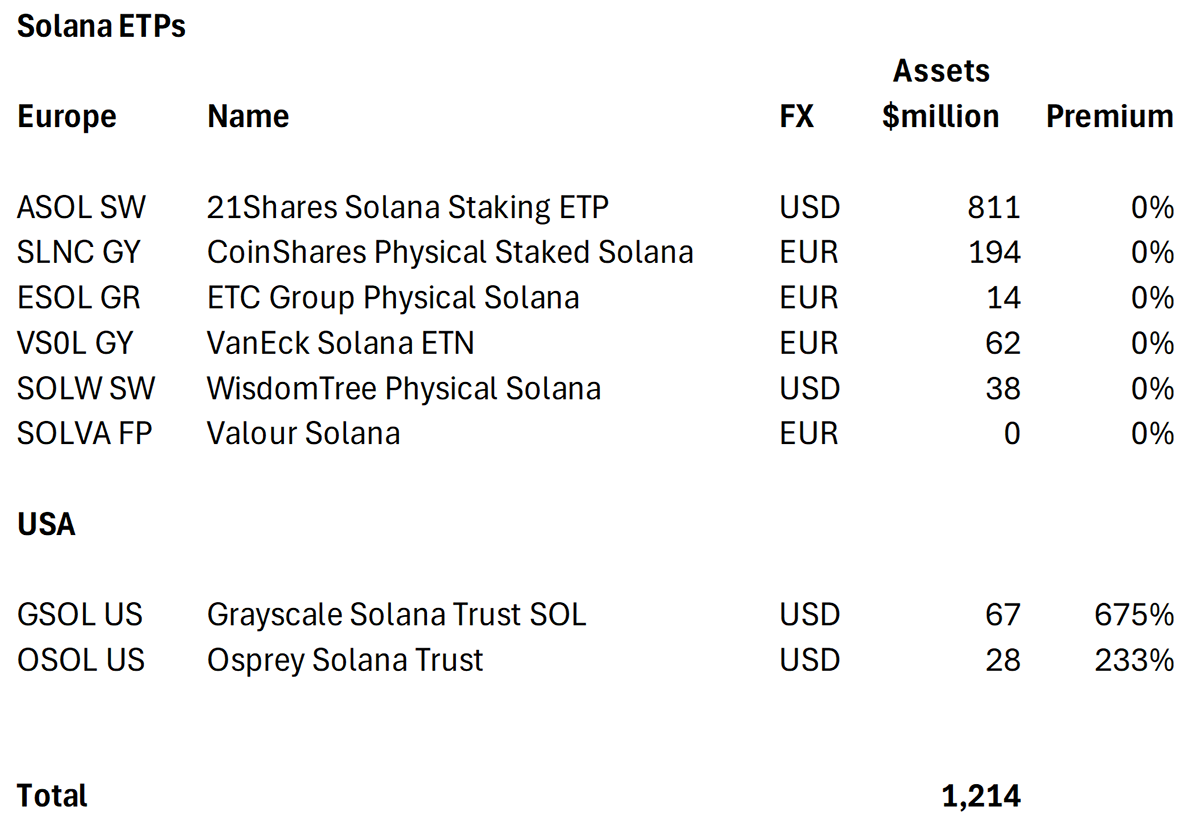

What Google failed to point out was that there already are six active Solana ETFs (or ETPs, ETNs etc.) in Europe and two closed-ended funds in the US. 21Shares is the market leader and has the most memorable ticker.

Solana ETPs

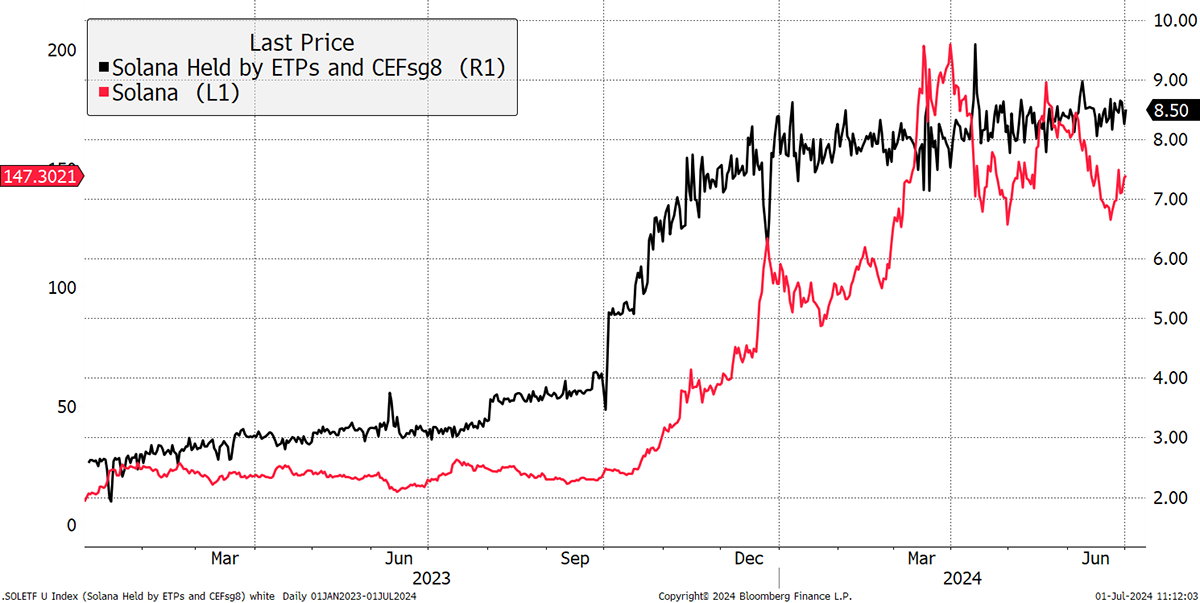

Collectively, they hold 8.44 million SOL worth $1.21 billion. Last September saw significant growth in funds held, which led the price of SOL.

SOL Held by Funds

It is clear that improved market access for crypto has a positive impact on price. Consequently, we can conclude that the increasing number of US ETFs will be supportive. ETF launch chasing will remain a theme.

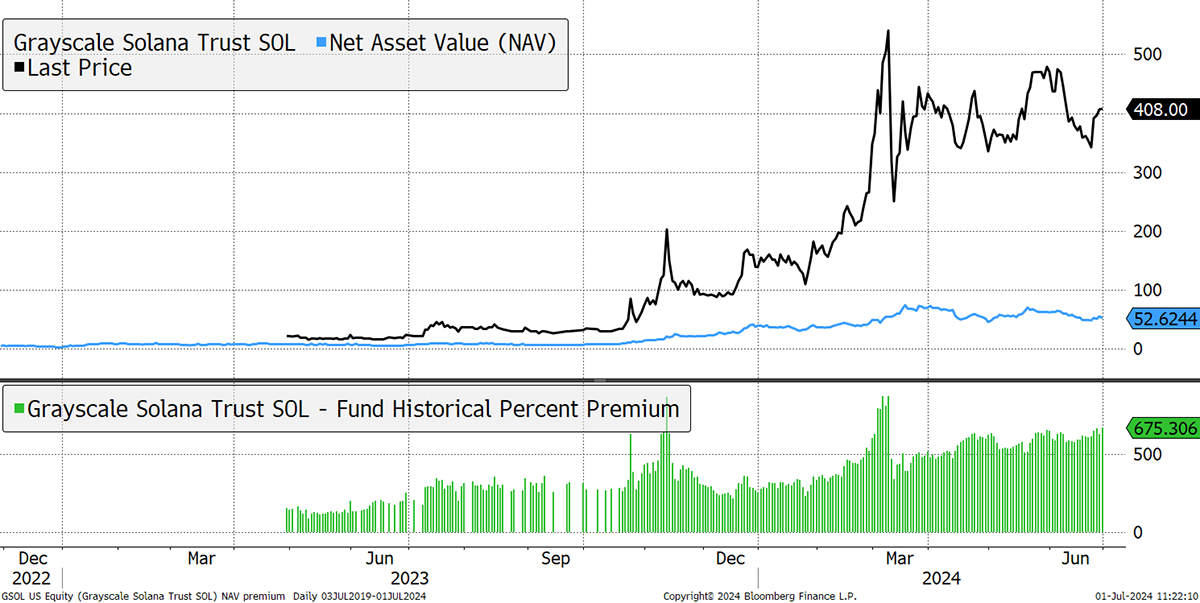

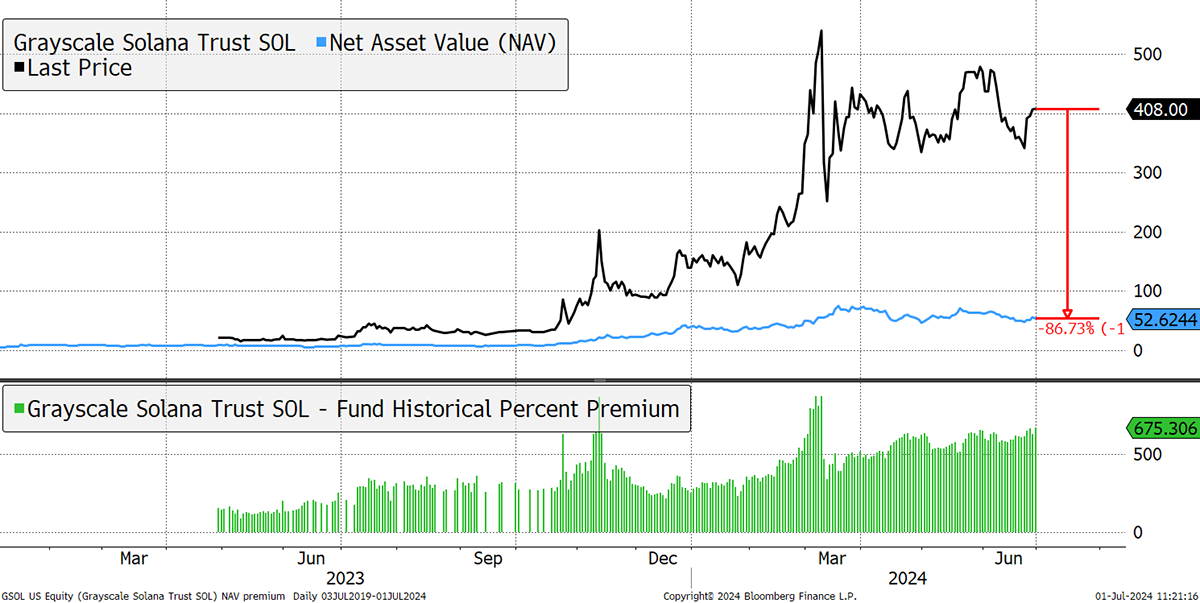

In the case of SOL, it is remarkable that the two US closed-ended funds trade on eye-watering premiums. Grayscale Solana (GSOL) trades at a 675% premium, and Osprey, 233%. I assumed the data were wrong but the factsheet confirms it. GSOL holds $66.7 million of SOL yet has a market cap of $518 million.

GSOL Trades at a 675% Premium to NAV

No doubt, GSOL will also convert to an ETF as it did with its Bitcoin product (GBTC). That resulted in the price trading at net asset value (NAV). If this happens to GSOL, shareholders will lose 86% + or – whatever happens to SOL. I cannot imagine why anyone would buy this, as a positive outcome is highly unlikely.

GSOL Has an 86% Downside Should it Convert to an ETF

VanEck's recent filing for a Solana (SOL) exchange-traded fund (ETF) marks the first registration of its kind in the United States. This comes only a few days after 3iQ filed for a similar ETF in Canada, indicating a growing interest in Solana's potential as a major digital asset. VanEck’s filing has already boosted SOL's market performance, positioning SOL as a strong competitor to Ethereum.

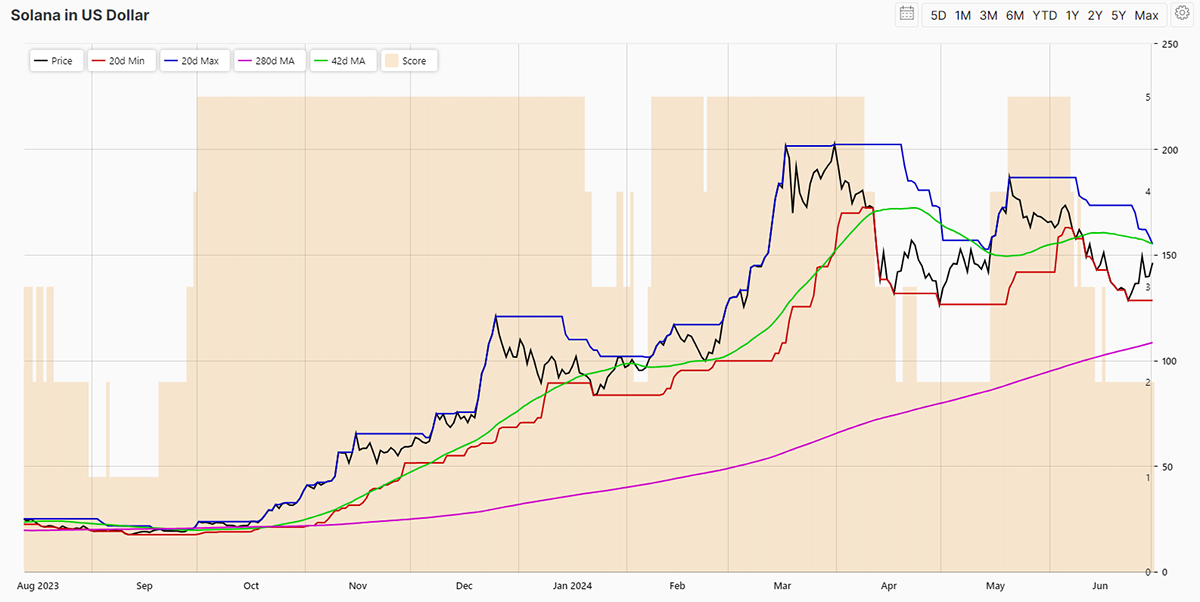

SOL in USD

However, when comparing the potential Solana ETF with existing Bitcoin and upcoming Ethereum ETFs, several factors stand out, especially the potential market adoption and performance. Bitcoin ETFs, approved in the US in early 2024, have seen substantial market adoption, becoming a preferred investment vehicle for both retail and institutional investors. These ETFs offer exposure to Bitcoin's price movements without the complexities of directly holding the cryptocurrency.

The regulatory landscape presents another critical comparison point. Bitcoin ETFs' approval set a precedent, easing the path for other digital asset ETFs. However, regulatory scrutiny remains stringent, with the SEC closely monitoring market manipulation and investor protection issues. Although Ethereum ETFs are anticipated to be trading soon, they will face similar regulatory challenges.

Despite its advantages, Solana's path to ETF approval is fraught with challenges. Solana offers a unique value proposition with its high throughput and low transaction costs, making it suitable for a wide range of decentralised applications. This technological edge is a significant factor in its favour compared to Bitcoin and Ethereum. However, regulatory hurdles remain a significant barrier. Substantial regulatory changes, possibly aligned with shifts in the SEC's leadership, will be necessary for a Solana ETF to materialise by 2025.

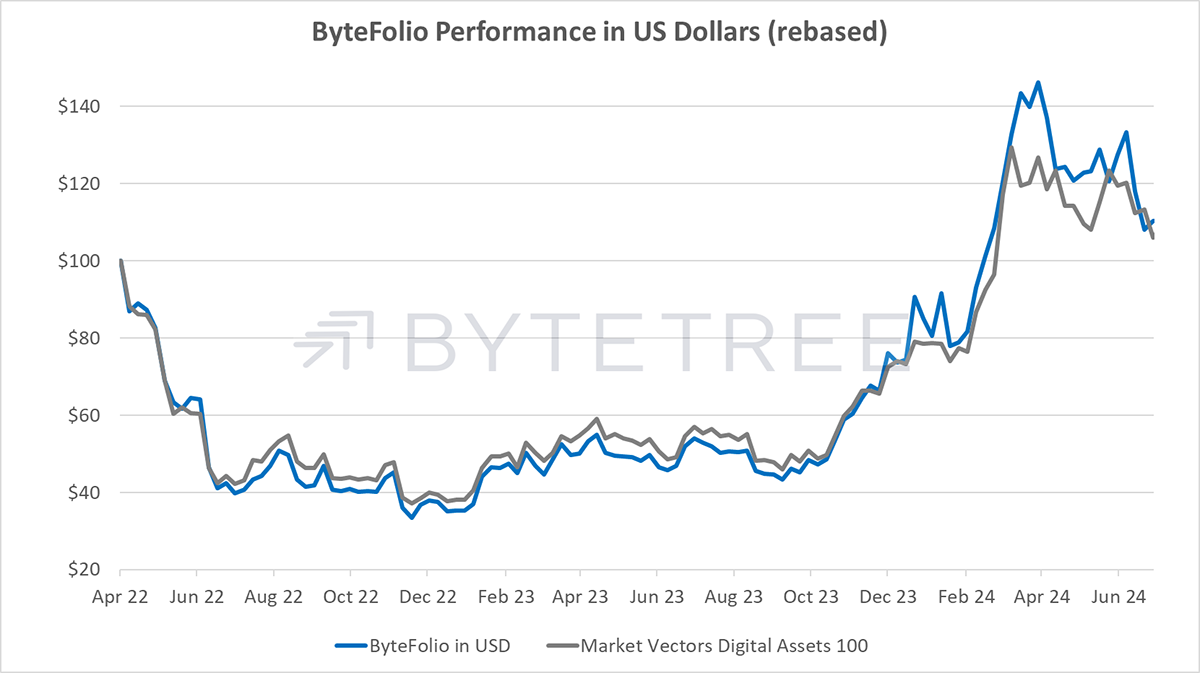

ByteFolio Performance in USD