Gold Driven by Geopolitics, not Macroeconomics

💡We have received reports that Gmail and Hotmail users are having trouble with images. If that’s you, please use

Atlas Pulse (est. 2012) is a monthly report on the gold market, written by Charlie Morris

💡We have received reports that Gmail and Hotmail users are having trouble with images. If that’s you, please use

Gold is probably the simplest of all investments, yet is widely misunderstood. It is a store of value with a 5,000-year track record that transcends borders and cultures. Gold is the world's most liquid alternative asset and provides genuine portfolio diversification, especially during troubled times. Despite huge Central Bank ownership, many believe gold can't be valued because it doesn't pay a yield. It is often described as a "barbarous relic" or a "pet rock", with no productive purpose.

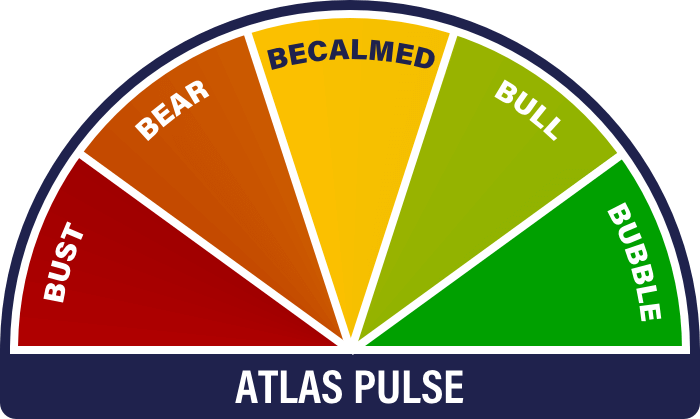

Atlas Pulse gives an unbiased view on the gold market. It looks at the fundamental drivers behind the gold price, as well as risks and flows, with a valuation model based around inflation and interest rates, which has been remarkably accurate.

The report advises on where we are in terms of the gold market regime, providing a strong guide to long-term investors.

Charlie Morris is the Editor and Creator of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Bullion Market Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Charlie is also the Chairman and Chief Investment Officer of ByteTree, which he founded in 2014 as a platform to deliver independent, robust and thought-provoking market analysis.

Charlie has 25 years of fund management experience and is a pioneer of multi-asset investing. At HSBC Global Asset Management, he launched the Absolute Return Service in 2002, which grew to over $3 billion. Much of that success came from moving away from the crowd and embracing a wider range of asset classes that traditional investors were not familiar with at the time.

Subsequently, Charlie managed the Total Return Fund at Atlantic House Fund Management until June 2020, at which point it was ranked number 1 out of 48 funds in the Trustnet Target Absolute Return Sector. He sits on the investment committee for the Society of Technical Analysis and on the Board of Halkin Services, a renowned investment think tank. He has regularly been featured in leading news publications and has given numerous presentations to investment bodies and Universities.

Prior to a career in finance, Charlie served as an officer in the Grenadier Guards, British Army, having graduated from the Royal Academy Sandhurst in 1994.

No doubt these are exciting times for silver investors, and the set-up is fabulous. An all-time high after a 55-year wait should certainly be celebrated.

Gold remains overbought, and a consolidation would be the best outcome we can hope for. The best bull markets are long-lasting.

This gold bull market is about price, rather than excessive speculation. The market is hot, but it’s not red hot.

This year, long-dated government bonds have been selling off, and as that has happened, the price of gold has risen. Gold’s correlation with bonds (prices, not yields) has turned negative for the first time since 2011.

Atlas Pulse Gold Report Issue 105; …maybe, just maybe, inflation is the new elephant. I say that because inflation expectations

Atlas Pulse Gold Report Issue 104; The notion that gold is a crowded trade is greatly exaggerated. After this enormous