ByteTree Market Health Update; Issue 58

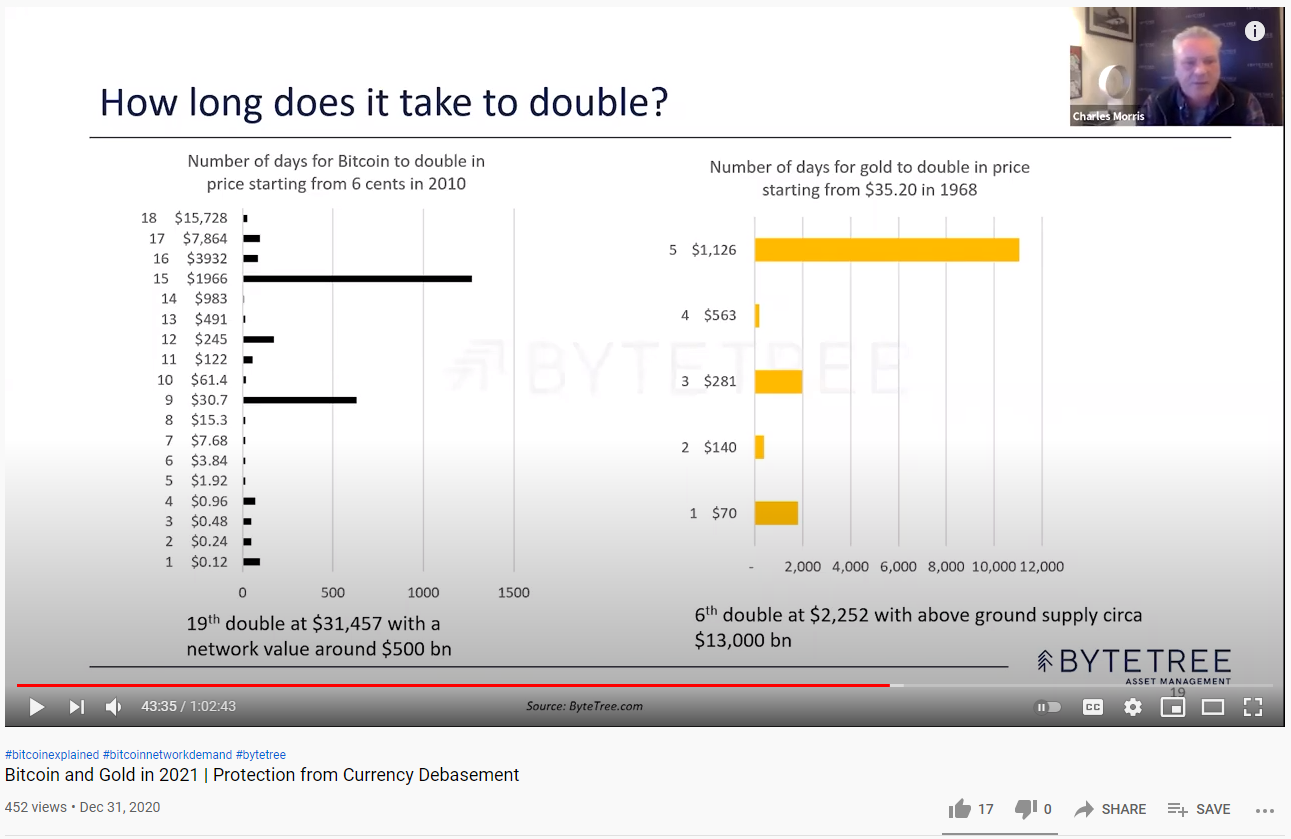

Thank you to the many that joined our webinar last week. Judging by the turnout, Christmas was a quiet affair for most. I briefly covered Bitcoin’s monumental doubling events since it was first seen at 6 cents in July 2010 (first recorded price is debatable but it’s close to that). I said the next double would come at $31,457, which was 10% away. Little did I know, that would be reached within days.

The first double came at 12 cents, then 24 cents and so on. Any experienced investor knows how satisfying it is to see an investment double. 2020 might make that seem easy, but I promise you, it isn’t. Microsoft is one of the best-performing stocks of all time, yet has only doubled 11 times since the IPO in 1986. Gold has doubled five times since 1968 and is very much looking forward to the 6th at $2,252. Soon I hope.

A big difference between traditional assets and Bitcoin is that it came to market at a low price. It didn’t surpass a billion-dollar network value (mkt cap if you insist) until the spring of 2013, which coincided with its 10th doubling. I show the past doubles and dates below. Notice the lengthy gaps between 8 and 9, 14 and 15, and the latest.

| Doubling | Price | Date |

|---|---|---|

| 1 | $0.12 | 25 Oct 2010 |

| 2 | $0.24 | 05 Nov 2010 |

| 3 | $0.48 | 31 Jan 2011 |

| 4 | $0.96 | 09 Feb 2011 |

| 5 | $1.92 | 28 Apr 2011 |

| 6 | $3.84 | 09 May 2011 |

| 7 | $7.68 | 13 May 2011 |

| 8 | $15.36 | 06 Jun 2011 |

| 9 | $30.72 | 26 Feb 2013 |

| 10 | $61.44 | 20 Mar 2013 |

| 11 | $122.88 | 02 Apr 2013 |

| 12 | $245.76 | 06 Nov 2013 |

| 13 | $491.52 | 18 Nov 2013 |

| 14 | $983.04 | 27 Nov 2013 |

| 15 | $1,966.08 | 21 May 2017 |

| 16 | $3,932.16 | 13 Aug 2017 |

| 17 | $7864.32 | 16 Nov 2017 |

| 18 | $15,728.64 | 07 Dec 2017 |

| 19 | $31,457.28 | 02 Jan 2021 |

| 20 | $62,914.56 | ? |

The next double will be the 20th at $62, 914.56. This could take weeks, months or years, or dare I say it, might never happen at all. My personal view is months because I am a long-term bull, but as I’ll explain later, the market is a little overcooked and would benefit from a bucket of cold water.

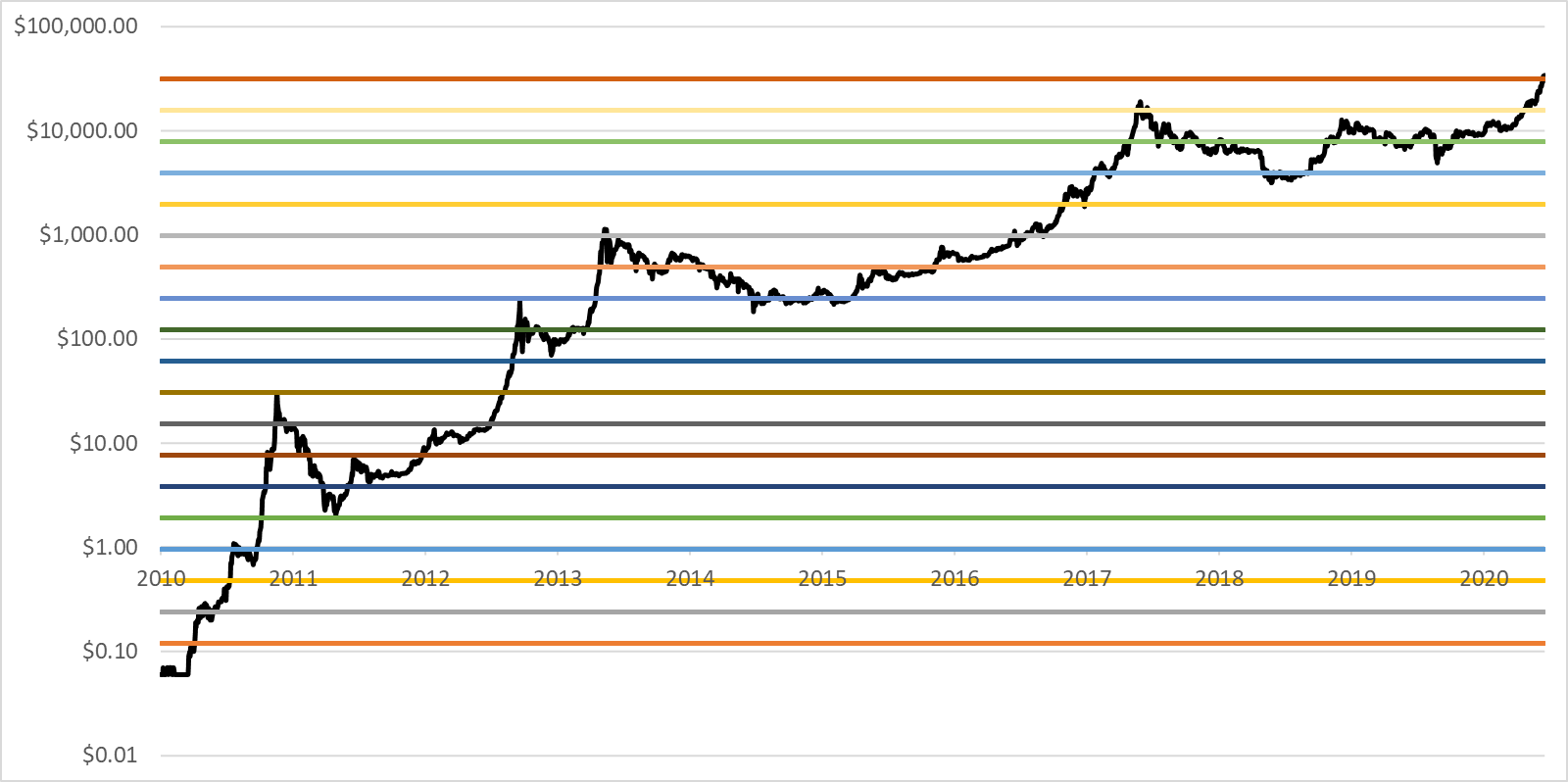

On a log chart, doubles are equidistant (spaced equally), as shown below.

Bitcoin Doubles

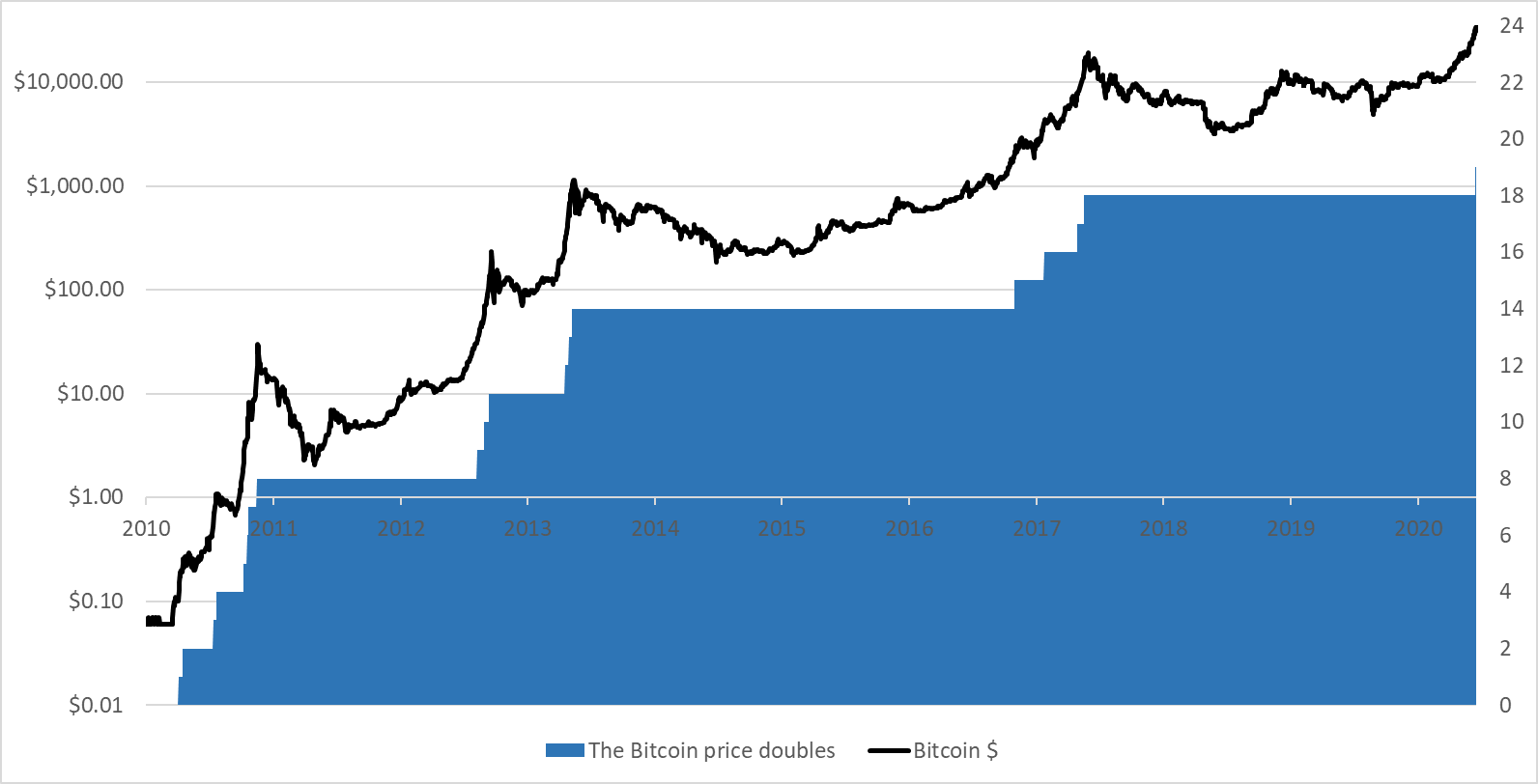

And here with a doubling counter, where I have left room for five more doubles.

The Bitcoin Doubling Counter

Doubling will get progressively harder because we are talking about real money. The 20th doubling will have to carry over a trillion dollars of network value. This is becoming serious.

As we enter the new year, macro conditions remain tailwinds. Inflation is rising as seen by buoyant commodity prices, and (somewhat) rising bond yields are even causing the banks to bounce. The real economy is poised to recover in 2021, as soon as the vaccine can be distributed. There is massive pent-up demand for everything, just as there was after the Spanish flu in the 1920s. Overheating is becoming a real risk.

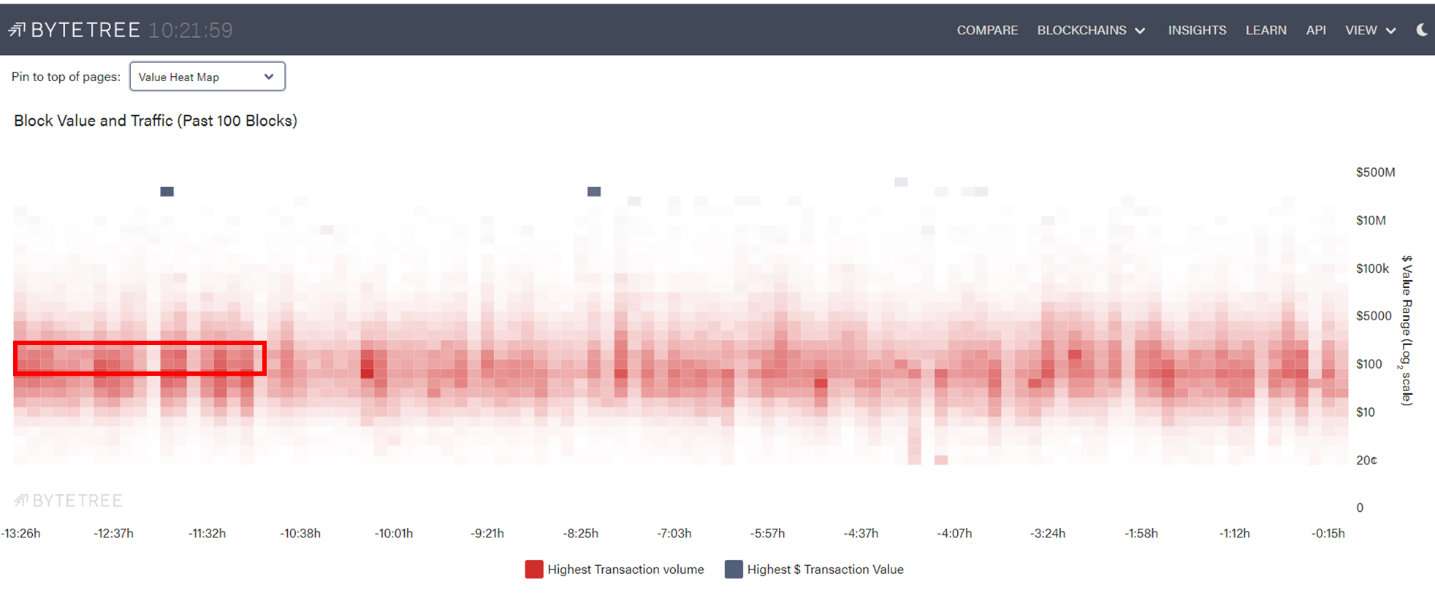

Then there’s the $600 “stimmy check”, a payment to low and middle-income US citizens which have been arriving over the holidays. It seems plenty of this is headed straight for Bitcoin. You can see in yesterday’s US session a little more activity than usual in the $600 zone. If you ever wondered how central bank money printing ends up in the likes of Bitcoin, there it is.

Stimmy Checks Showing Up

Then there’s the statementfrom the Office of the Comptroller of the Currency (OCC) which allows US banks to use public blockchains and even stable coins as settlement infrastructure. This is huge and highly relevant to the Bitcoin entering the mainstream narrative. Bitcoin and crypto are officially being accepted. But with acceptance comes scrutiny, and one cloud is the stable coin, Tether. Let’s see what Tom has to say.

The Cloud Over Tether

Tether is a US stablecoin that aims to mimic (or peg) the value of the US dollar. According to CoinGecko, it is the largest stablecoin and 3rd largest digital asset with a $21bn market cap.

Tether has been the centre of transparency issues for a while. More recently, Bitcoin’s parabolic price increase has caused bears to wonder whether there is foul play at hand. This short piece aims to outline the issues which investors must know when holding or trading Tether.

Counterparty Risk - Pre-2020

Tether’s opaqueness warrants skepticism. For the less versed in Tether’s previous mishaps, the stablecoin promised 100% currency reserves, meaning that a ‘real’ dollar would be redeemable for each Tether coin. However, as many realised in May 2019, Tether changed their small print to state that cash, cash equivalents, and loans backed each coin.

Essentially, Tether changed to fractional reserve banking in 2019, which creates an absolute counterparty risk should liquidity drain out of Tether, due to loss in confidence. Investors must bear this in mind. Should a run on Tether occur, and it cannot meet redemptions, then there is a significant risk to digital assets, just as there was to stockmarkets during the banking crisis of 2008. Naturally, it would not impact Bitcoin’s long-term potential, but you might want to sit on the sidelines while that storm passed.

Tether’s Peg - Pre-2020

Regarding Tether’s ability to keep its peg, Bitfinex (a Tether founder) provides a zero fee 1USDT:1USD pairing that incentivises arbitrage between exchanges, enabling the stablecoin to keep a stable peg. However, should a liquidity drain occur, it is unlikely Tether will maintain its peg. This is a risk for Tether holders regardless of this current narrative.

Unbacked Circulation - Pre-2020

The most topical issue relates to speculation that Tether has been printing un-backed stablecoins for themselves and manipulating its trading pairs through ‘fake’ liquidity. There is absolutely zero empirical evidence supporting these claims; however, we recognise that these are a natural part of a bear’s tool kit.

If uneasy, investors should look to more strictly regulated stablecoins. With the incoming STABLE Act, and USDC’s USOCC guidance showing optimism, investors have regulated and transparent alternatives.

Ultimately, no audits have been commissioned to identify the state of Tether’s reserves since 2018. Therefore, we suggest investors proceed with caution as regulators are apt in choosing winners and losers.

We very much hope Tether will fall into line and the time to do that is now. This is a subject we will be watching closely as it has the potential to become a systemic risk within the digital arena.

Bitcoin Risks

Thank you, Tom. Tether is one risk, but another is just that price is seemingly ahead of events. Just to remind you of the obvious: good news occurs at tops while bad news occurs at bottoms. In particular, overly buoyant markets will eventually cause the stimulators to withdraw. And we don’t want that.

The top-notch market strategist, Albert Edwards, recently tweeted,

“Central bankers cannot control which bubbles inflate due to their money printing. The money sloshes into whichever momentum trade the market choses.”

He’s right and that begs the question whether Bitcoin is a momentum trade or a lifeboat against debasement at this juncture?

I remind you that gold had a 44% correction in 1975/6 before moving 8x higher (that’s 2 doubles) by 1980. Large corrections are normal, even in great bull markets. Four things currently concern me:

- Mainstream media have noticed that Bitcoin is not dead and doing rather well.

- There is a bull market in newly qualified Bitcoin experts.

- Volatility is back to high levels which will discourage institutional investors.

- Price is over-extended from short and long-term moving averages.

Simple stuff but tried and tested. There are two ways to cool a market, one is sideways, and the other is down. We vote for sideways. I would think it is certainly a good time to reign in leverage, and possibly take a few Satoshis off the table. That said, on-chain activity is thriving, which you can read more about in the Network Demand “jukebox” section.

While tactically cautious, I remain very bullish on a ten-year view for Bitcoin and the digital space in general. Its success seems inevitable.

Bitcoin and Gold in 2021

If you missed our recent webinar, you can watch it back in full by clicking the image below.