Week 34 2021

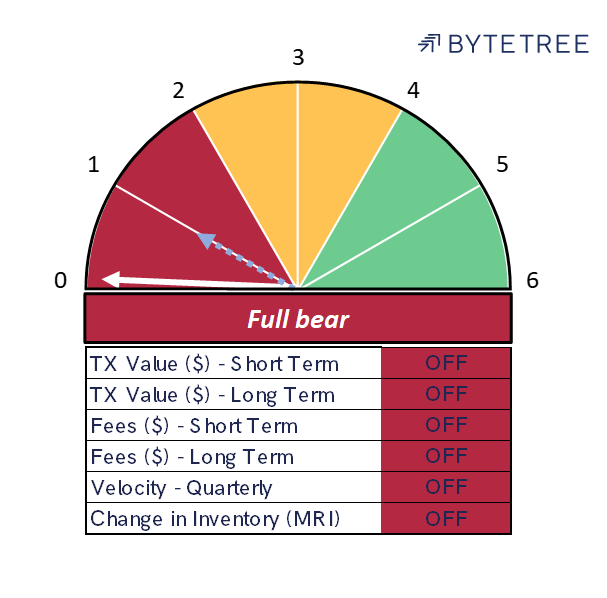

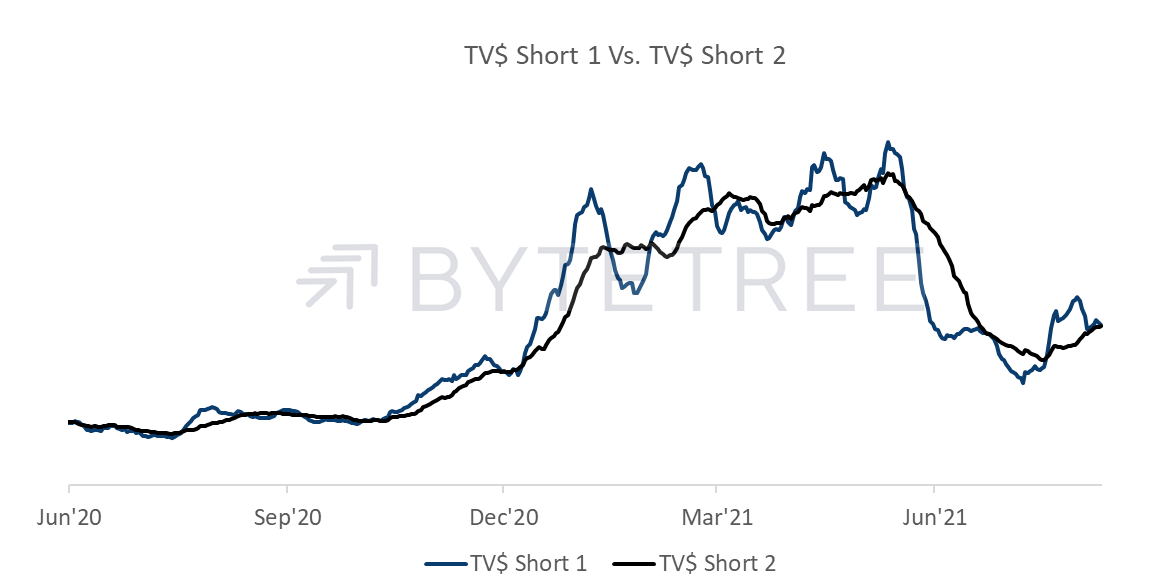

The Network Demand Model closed the week on 0/6, down from 1/6. The short-term transaction value metric has turned off, which is surprising given that this is a price-driven indicator, and we have seen such a substantial price bounce. It suggests that “buying and holding” is very robust at this point.

If this were a sustainable recovery, it would be counterintuitive as we would expect the price recovery to be confirmed by network activity. This either tells us that the market is becoming complacent or, alternatively, that we are in the early stages of a major asset-gathering phase.

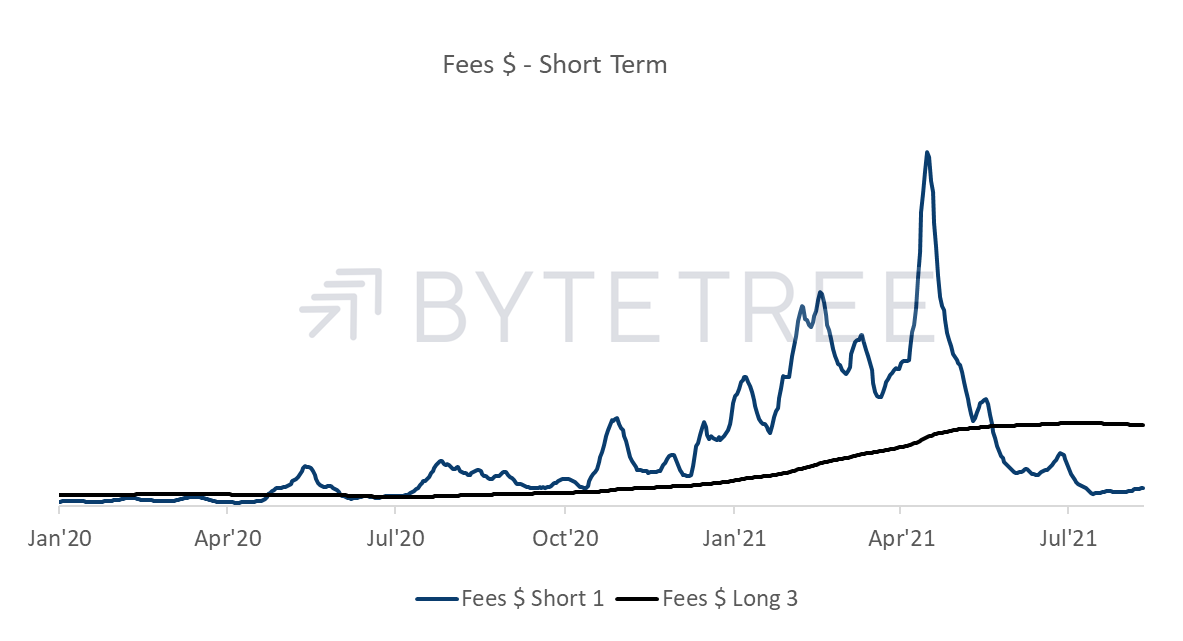

Of the other metrics, Miner behaviour and Velocity remain depressed, although confirming the “buy & hold” thesis. Fees are at least showing tentative signs of bottoming out, but any meaningful uptick in the overall model remains some weeks away.

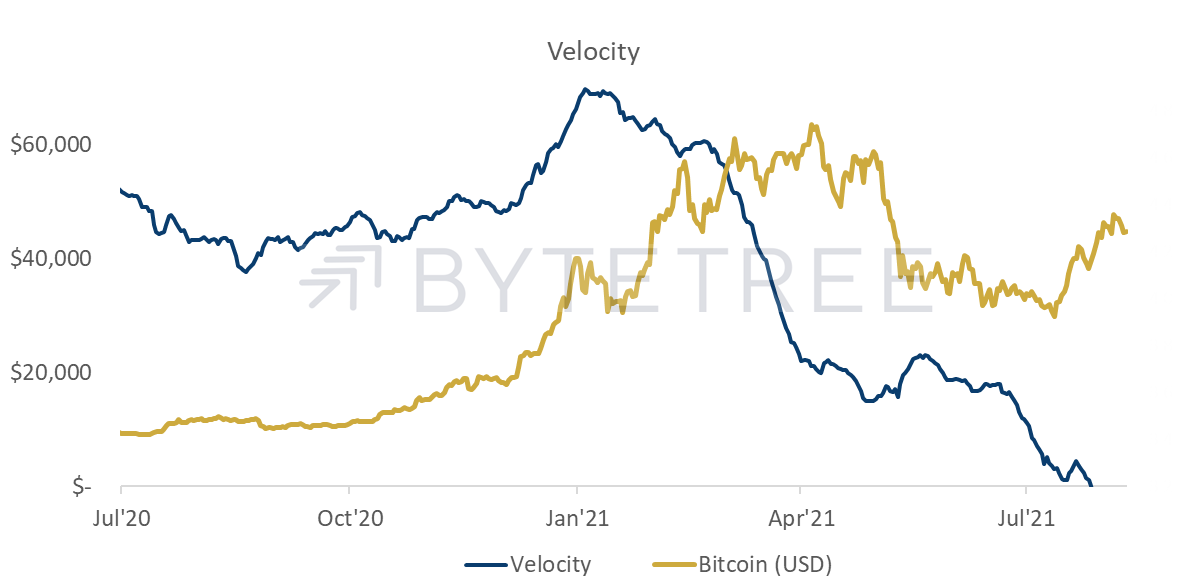

Velocity, which measures the frequency with which coins circulate through the ecosystem, remains low, which is negative from a network effect perspective, but also suggests that the ecosystem is far from euphoric.

Fees continue to show signs of recovery. While far from confirming a bull market, the bottoming out is encouraging.

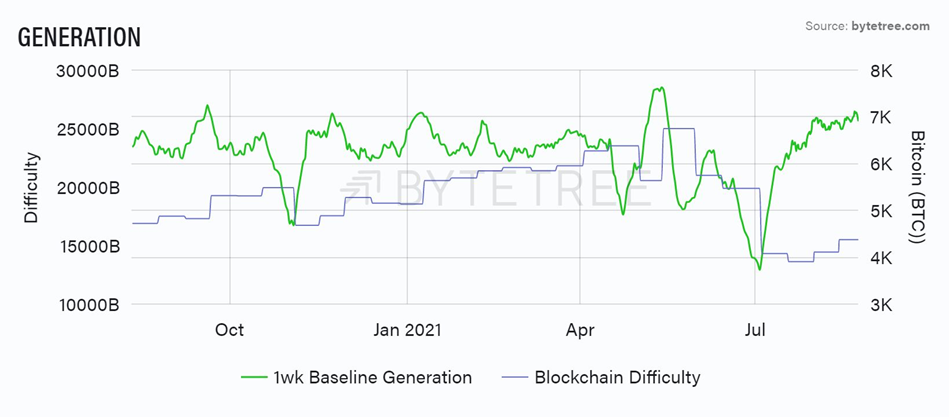

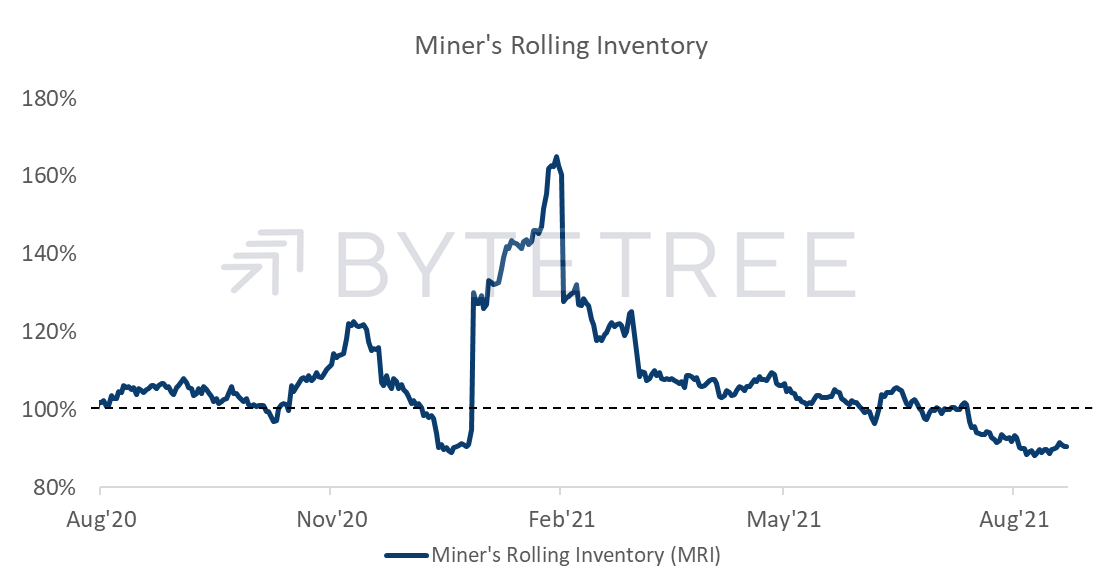

Miners themselves continue to stockpile bitcoin. MRI shows the percentage of newly minted coins that are “spent” into the market for the first time.

This perhaps indicates the financial strength of the mining community, although with “difficulty” likely to continue to adjust higher as capacity comes back online (next adjustment is currently due 25 August), it will be interesting to see at what point they start realising profits.