ATOMIC 37

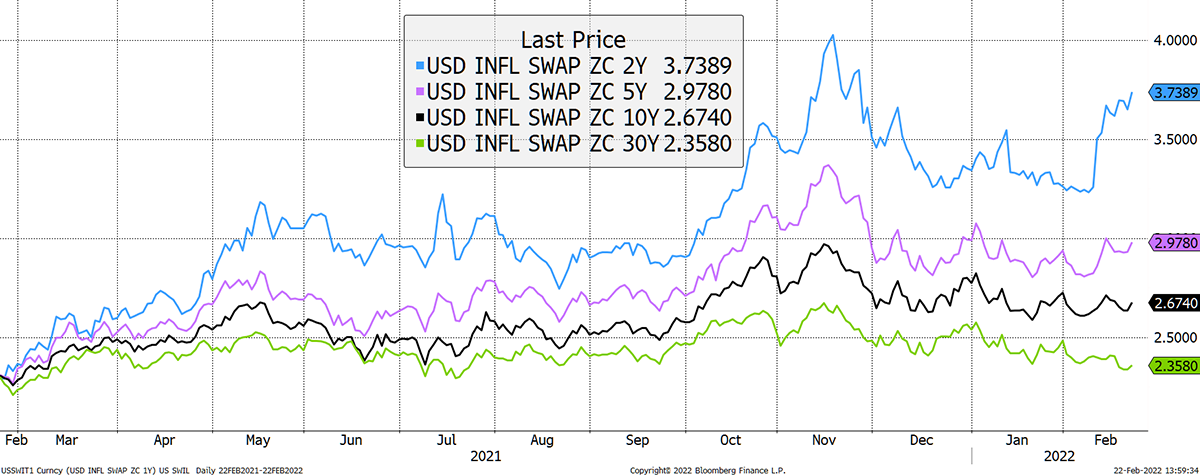

Usually, we see a deflation shock in risk-off conditions, but not this time. In recent days, inflation expectations have risen while financial markets come under pressure. Outside of Turkey, we haven’t seen this sort of thing since the 1970s.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Bear test |

| On-chain | Falling transactions |

| Investment Flows | Still encouraging for bitcoin |

| Macro | War |

| Crypto | Conflict and opportunities |

Technical

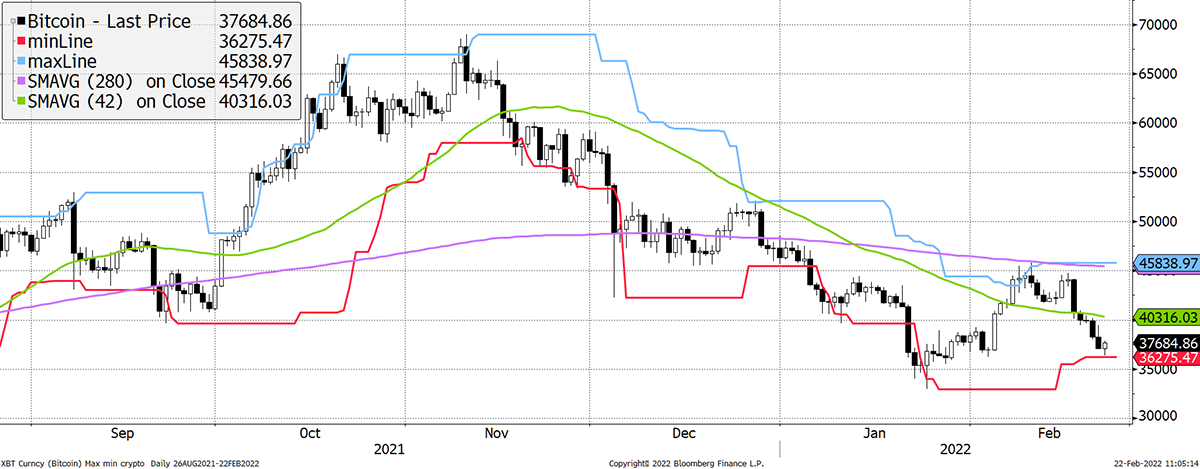

The ByteTrend star count in the top 15 has dropped from 24 stars last week to 13, which is a bit like saying crypto is flying on 17% of full power. Now that the 280-day moving average (equivalent to 200 days in the non-crypto space) is downward sloping and recently acted as resistance, this looks increasingly like a bear market. Yet somehow, it is proving to be resilient.

Source: Bloomberg. Bitcoin with 20-day max and min lines, 42-day and 280-day moving averages past six months.

Last week, the price rallied back to the max line, and things were looking good. The weakening trend has won the day and price has drifted back to the min line. If it closes below, the BTC ByteTrend score will return to zero.

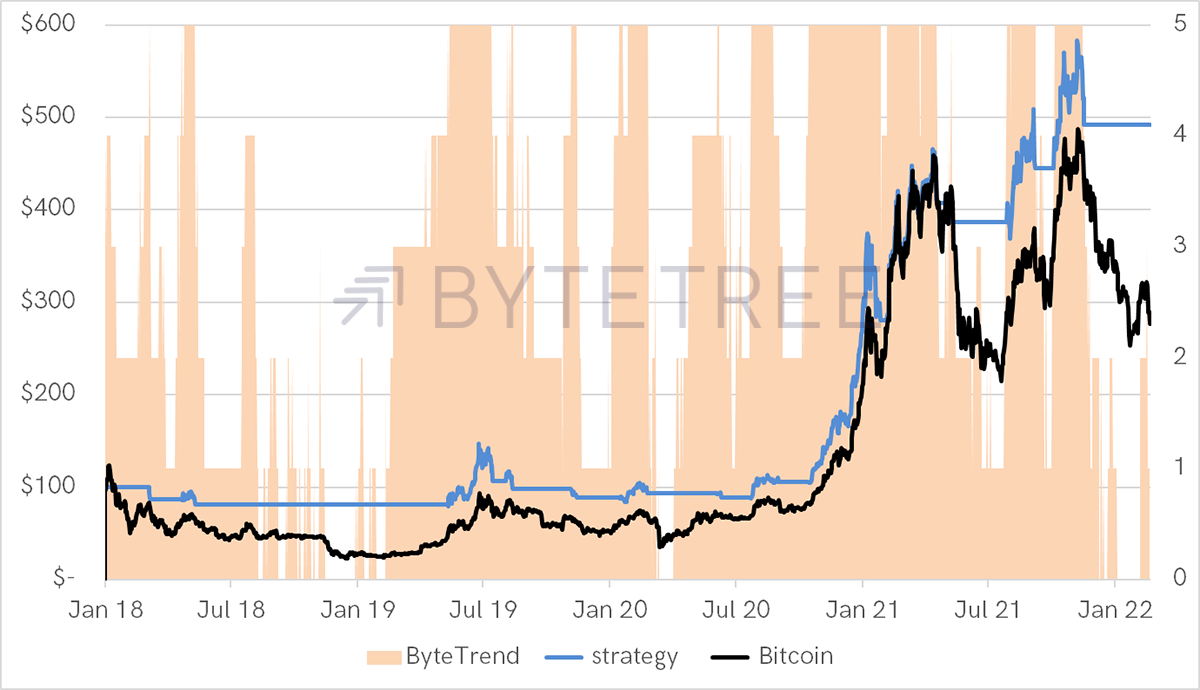

One simple technique is to buy bitcoin when the score touches 5 and sell when it goes to 3 or below. It is a reminder of the power of trend following as a concept. The rate of compounding exceeds that of buy and hold because you preserve capital during the bad times.

The power of trend following - buy 5, sell 3

Source: ByteTree. ByteTrend trend-following strategy as described since 1 Jan 2018.

With trend-following, many struggle with the fact that buying at the lowest price is not important. What really matters is avoiding the loss of capital. If you can do that and participate in these high probability rallies, the long-term results will be spectacular. All you need to do is to stick to the rules and follow them. Surprisingly few manage this!

Be sure that this sort of “fat tails” approach to a trend-following strategy wouldn’t be as effective in calm assets such as bonds or blue-chip equities. It would almost certainly underperform buy-and-hold.

It works best in cyclical assets, and in this regard, crypto was made for trend-following strategies. Keep an eye on the site improvements here, which are coming thick and fast. I’ll be increasing my coverage and, sooner or later, we will have a model portfolio.

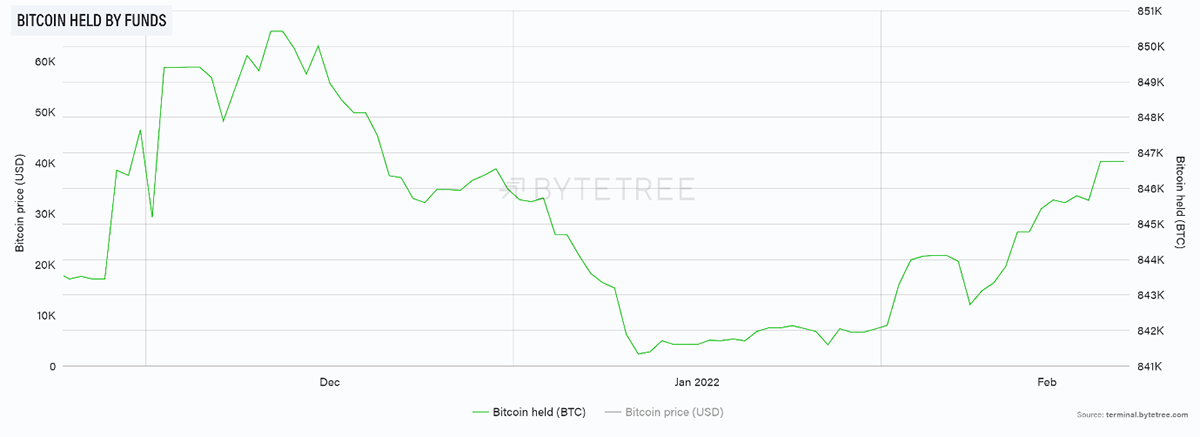

Investment flows

Funds are leaving ETH, which is sad to see, but if you told me money was going into gold and silver, then this should come as little surprise.

Financial markets cannot remain in risk-on mode as Russia invades her neighbours. It is frankly a remarkable feat that the bitcoin funds are seeing inflows at all. This would have been unthinkable back in 2018 (the last tail end of the bull).

Source: ByteTree. Bitcoin held by funds over the past three months.

On-chain

There is no change in on-chain activity, which has remained soft with the transaction count falling. The good news is that it isn’t collapsing as it did in 2018, which yet again highlights the current boost to bitcoin’s credibility.

Source: ByteTree. Bitcoin transaction count over the past year.

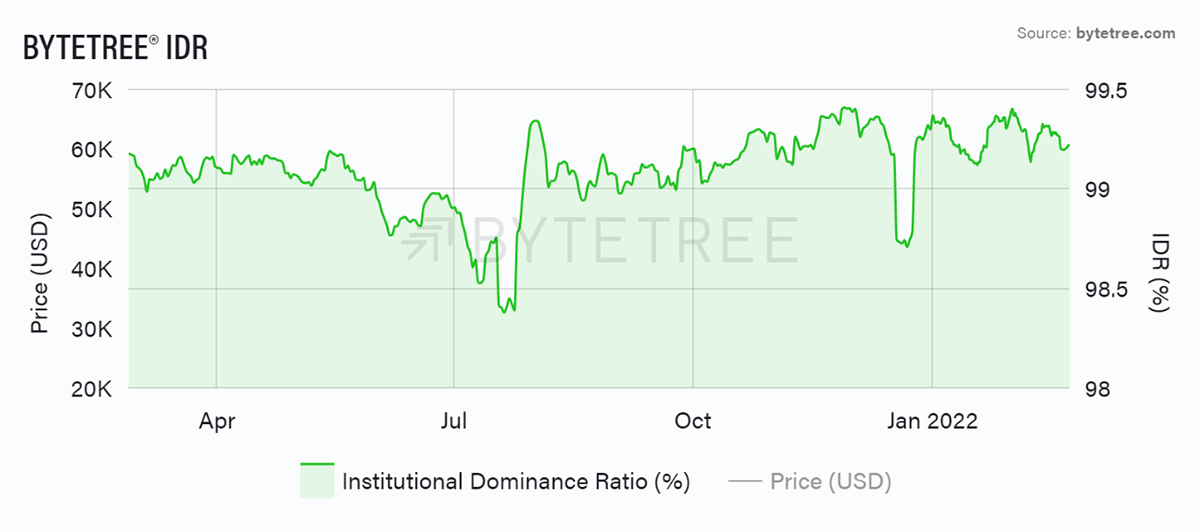

The institutional dominance ratio (IDR) remains firm, which tells us that the institutional bid is very much alive. It is hard to assume the worst while this remains buoyant.

Source: ByteTree. Institutional Dominance Ratio (IDR) over the past year.

Bringing this back to price, Russia has invaded Ukraine, and the NASDAQ is lower than it was in January. In contrast, bitcoin is higher. That is resilience for sure.

Macro

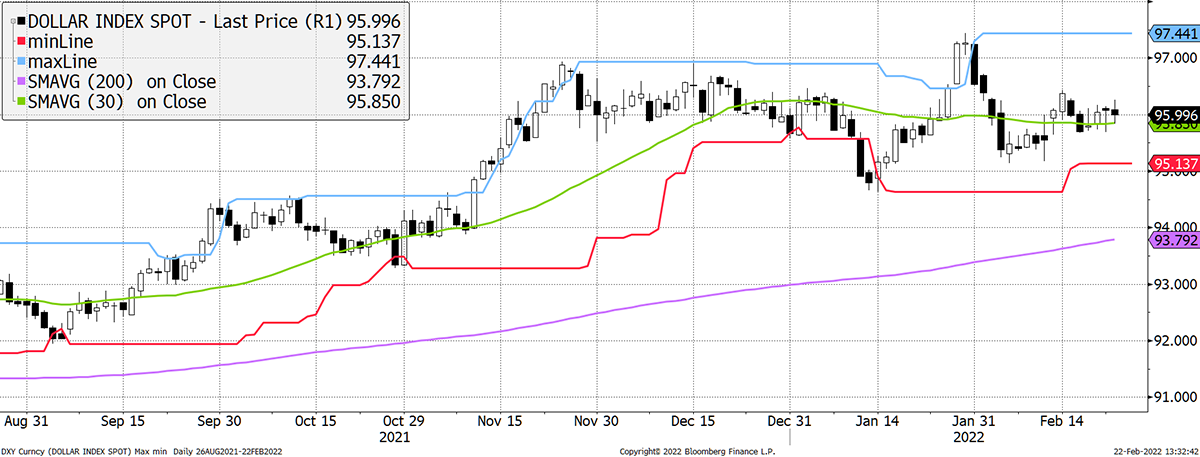

Normally in risk-off, we have become used to a flight to the dollar. Not this time as it has stood still. Outside of the Russian Ruble, foreign exchange has been relatively calm.

Dollar holds steady

Source: Bloomberg. US dollar Index past six months.

We also tend to see a deflation shock, but not this time. In recent days, inflation expectations have risen while financial markets come under pressure. Outside of Turkey, we haven’t seen this sort of thing since the 1970s.

Inflation rises in risk-off

Source: Bloomberg. US inflation expectations past year.

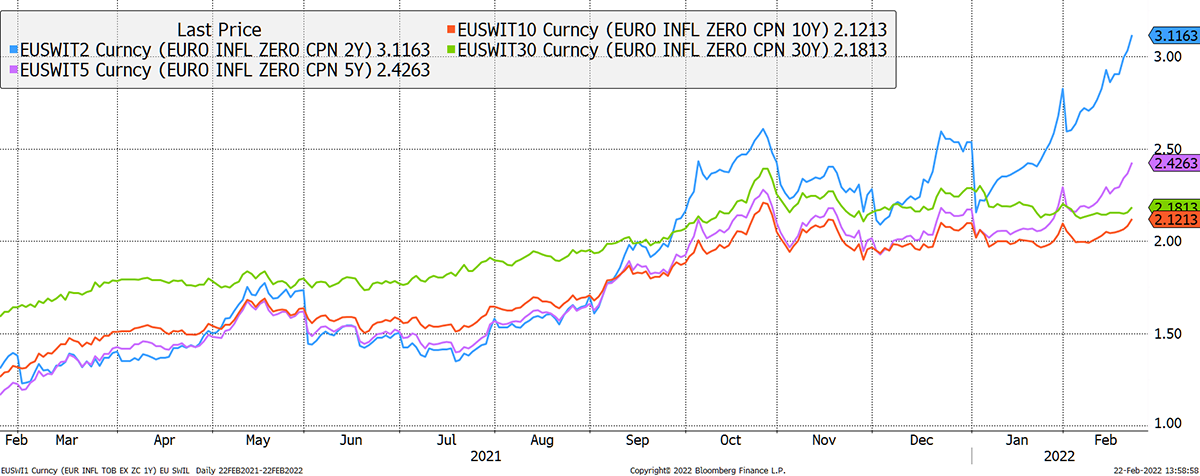

While US inflation expectations have risen slightly, European expectations are now catching up quickly. One issue for Europe is the high cost of energy as it has embraced a green future. Lovely stuff, but with that, Europe has become heavily dependent on Russia.

Eurozone inflation accelerates

Source Bloomberg EU inflation expectations past year

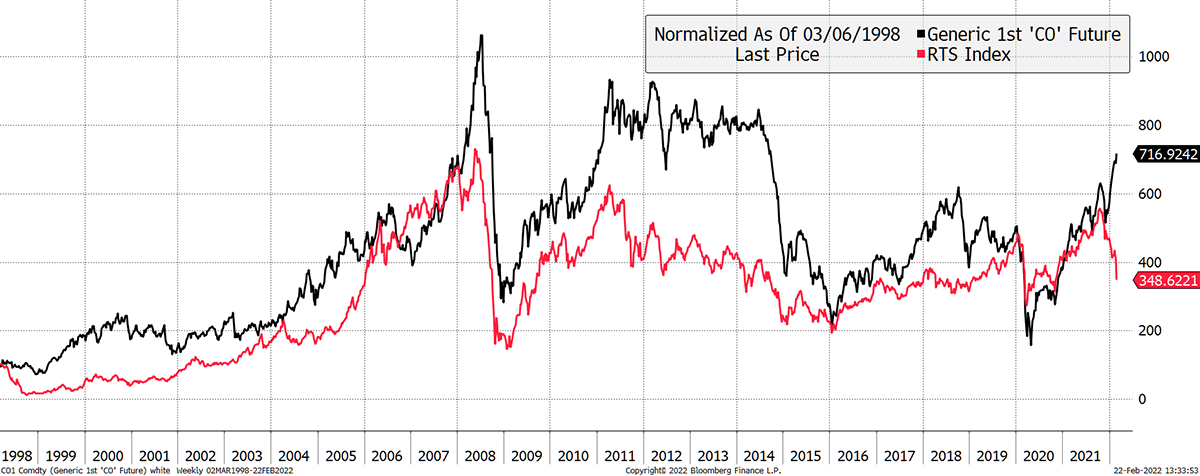

As a bonus, I’ll show one of my favourite relationships – the link between Russian stocks and the oil price. The two series are highly correlated, in a mean reverting relationship. It is rare to see oil so strong while Russian stocks are so weak.

Oil up, Russia down

Source: Bloomberg. Russia stock market $ and Brent Crude oil since 1998.

While not exactly relevant to crypto, this relationship shows the power of an important cyclical relationship. Russian stocks are below their 2008 levels when they cost over 30 barrels. In 1998, they cost less than 5 barrels, just ahead of a gargantuan bull market in oil. Today they cost 12 barrels, and oil is firm.

Russian stocks for 12 barrels of oil

Source: Bloomberg. Russia stock market measured in barrels of oil since 1998.

If oil rises, Russian stocks could do very well. If it falls, they could be resilient. Russian stocks are cheap for political reasons. The value is undisputed.

Cryptonomy

Tension rises in eastern Europe as the conflict between Russia and Ukraine intensifies. Both countries have also recently taken a similar approach to legalise crypto. Last week, the Ukrainian government passed amendments to the law that will launch a legal market for virtual assets. In an official statement, the Deputy Prime Minister – Minister of Digital Transformation, Mykhailo Fedorov said:

“The new law is an additional opportunity for business development in our country. Foreign and Ukrainian crypto companies will be able to operate legally, while Ukrainians will have convenient and secure access to the global market for virtual assets. Market participants will receive legal protection and the opportunity to make decisions based on open consultations with government agencies. There will appear a transparent mechanism for investing in a new asset class.”

Meanwhile in Russia, internal conflict has risen between the country’s Finance Ministry and Central Bank. Initially, it was thought that the two parties had reached a consensus over the crypto bill earlier in the year, now that seems to be far from the truth. In a statement released yesterday, the Finance Ministry said they had submitted a proposal for Bitcoin regulation last week. While the Finance Ministry went public, the Central Bank, on the other hand, has reportedly leaked a document with a draft bill to ban cryptocurrencies. President Vladimir Putin has called on both parties to settle their differences.

On the other side of the pond, the cryptocurrency lending platform BlockFi is fined $100m by the SEC over an illegal high-interest yield product. Following this, US customers will no longer be able to open any new interest-yielding accounts, while clients outside of the US remain unaffected. BlockFi has taken the fine in stride and started the SEC registration process for a new crypto interest-bearing security.

A recent report from Chainalysis reveals that crypto-based crime hit a new all-time high last year, with $14bn transferred to illicit addresses and scams attributed as the largest portion of the crimes. The report also points out that as crypto adoption soars, the illicit transaction volume will increase. Total transaction volume for crypto increased by 567% on 2020 figures, while illicit transaction volume was up by just 79%.

Finally, for some good news with two gigantic businesses eyeing up the Metaverse as the next market opportunity. JPMorgan took the leap into the Metaverse with a virtual lounge in Decentraland. The bank has stated that they see a market opportunity of $1 trillion in yearly revenue and are exploring options. They are not alone as Disney has called the Metaverse the next great storytelling frontier, with Senior Vice President Mike White at the helm of the new project. With the company’s 100 years’ worth of experience leading the storytelling business, we could argue it was only a matter of time.

Summary

On so many measures, bitcoin is doing well. The four-year cycle, which hasn’t gone away, sees the halving years and the years that follow to be the best. The one after is the worst, which is where we are on the road map.

The fact that the price remains so resilient is a huge sign of progress. The longer we see bitcoin hold $30k in 2022, the more the institutional investors will allocate.