ATOMIC 39

It is bullish that bitcoin is proving to be so resilient. Bitcoin can no longer be considered a low quality, highly speculative asset. It has been in a strong uptrend versus ARKK (the non-profitable tech stock EFT), which is unquestionably a low-quality speculative asset.

BYTETREE ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Respect |

| On-chain | Stable |

| Investment Flows | Fund holdings all-time high |

| Macro | Resilience in risk-off |

| Crypto | European crypto regulation |

Last week, ATOMIC upgraded bitcoin to a bull market. So far, that looks questionable, but I’m standing by it.

Technical

The ByteTrend star count for the top 15 has eased back from 46 stars last week to 30 stars this week.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions. This will be available in a historical chart in due course.

Bitcoin now scores 3/5, which will do under the difficult circumstances that markets find themselves in. With the war in Ukraine, the dollar shooting higher and the VIX poised to surge, times could be better. The bullish case is that despite all of this, bitcoin is $38k and not $10k.

Bitcoin 3/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 42-day and 280-day moving averages past six months.

It is bullish that bitcoin is proving to be so resilient. Bitcoin can no longer be considered a low quality, highly speculative asset. It has been in a strong uptrend versus ARKK (the non-profitable tech stock EFT), which is unquestionably a low-quality speculative asset.

Bitcoin 5/5 versus ARKK

Source: Bloomberg. Bitcoin measured in NASDAQ with 20-day max and min lines, 30-day and 200-day moving averages past year.

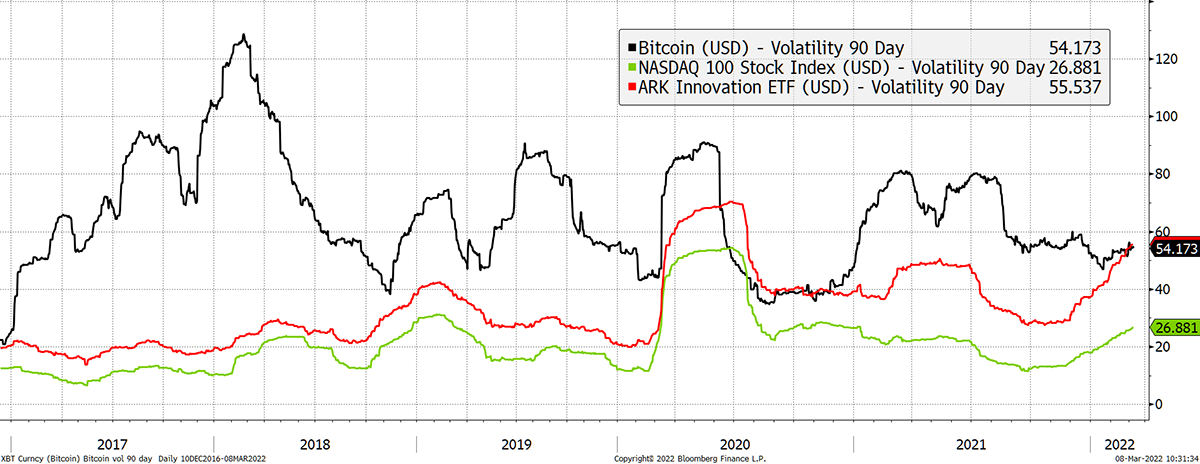

If still unconvinced, then look at 90-day volatility. Bitcoin volatility is stable, while ARKK, which is diversified across 38 companies, is now slightly more volatile. The NASDAQ is also rising, but it could be a while before this takes over as well.

Volatility takeover

Source: Bloomberg. As described since 2017.

Investment flows

Never before in history have so many bitcoins been held by the funds. It is a very simple equation. If the funds buy more BTC than has been mined, then the likelihood is that the price will rise. The funds are not the only source of demand but are likely to be the most significant variable source. And, of course, it is measurable.

Fund holdings all time high

Source: ByteTree. Bitcoin held by funds over the past six months.

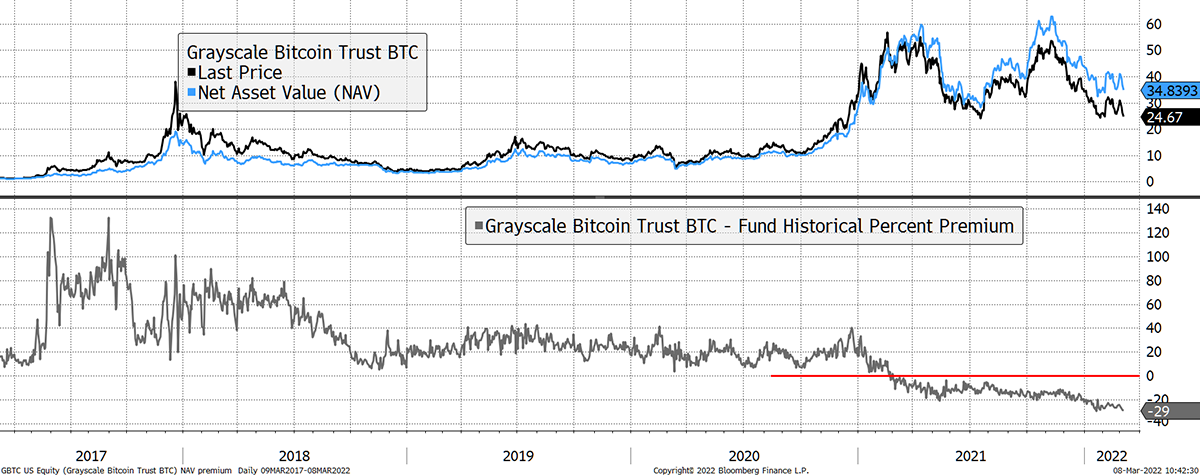

It would be nice to see the Grayscale Bitcoin Trust (GBTC) discount to net asset value narrow, but it doesn’t. I suspect this is somewhat structural as it is an expensive product (2% per annum) with many disappointed shareholders. I suspect there’s a lack of demand because it’s a lobster pot. You can put money in, but then try to get out.

I know there is demand in the US because Canada’s Purpose takes in so much money from investors. Even the Proshares US futures fund (BITO) is proving popular. GBTC just isn’t.

Grayscale lacks demand

Source: Bloomberg. As described since 2017.

Still, no matter how bad GBTC is, you would assume a narrower discount if Wall Street was chomping at the bit.

On-chain

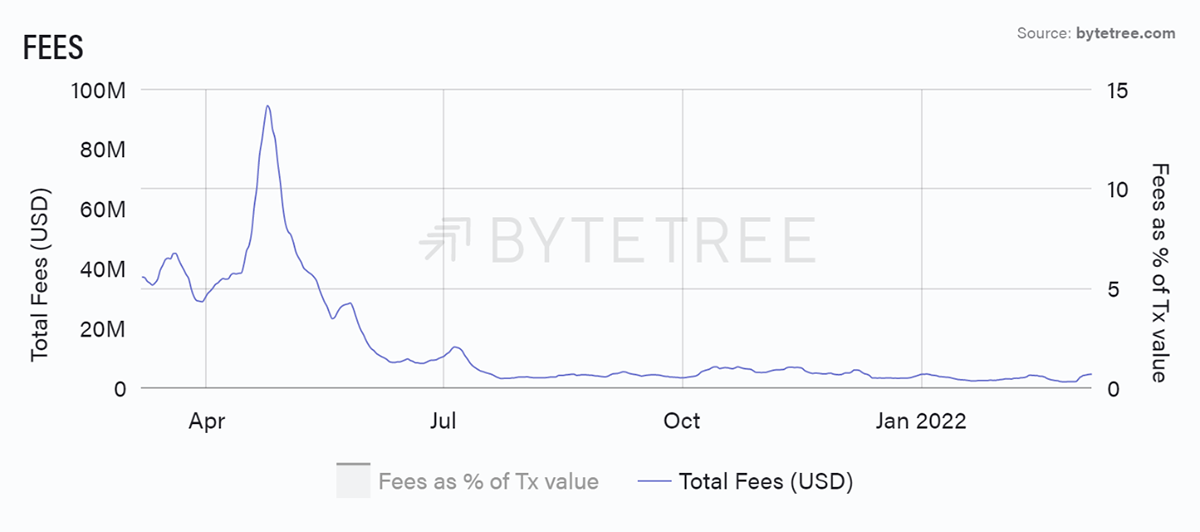

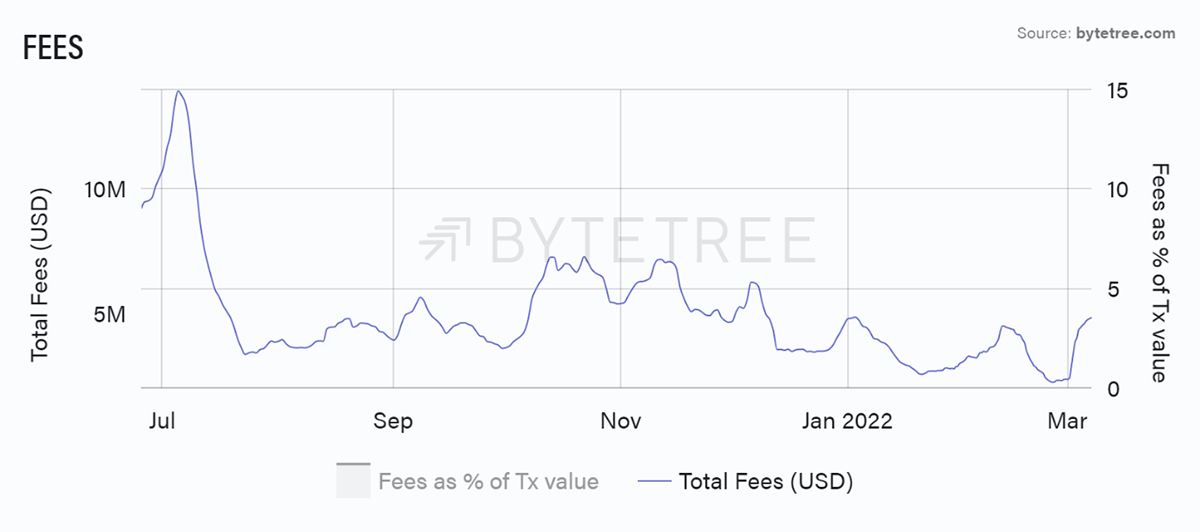

The fees have collapsed since April 2021 but have remained stable since August. This was linked to the China ban/regulations, which has been well covered.

Source: ByteTree. Bitcoin total fees (USD) over the past year.

It would be problematic if bitcoin usage was falling from here, but it isn’t. The network is hardly thriving, but stability is a good thing in such a harsh investment environment.

Source: ByteTree. Bitcoin total fees (USD) since July 2021.

Macro

Last week I said the dollar had disappointed and that was a good reason for bitcoin strength. How wrong I was as the DXY blasted higher on Friday, just as the stockmarket started to tank. The dollar is still the global safe haven, along with gold, which I’ll be covering tomorrow.

Dollar barely moves

Source: Bloomberg. US dollar Index year.

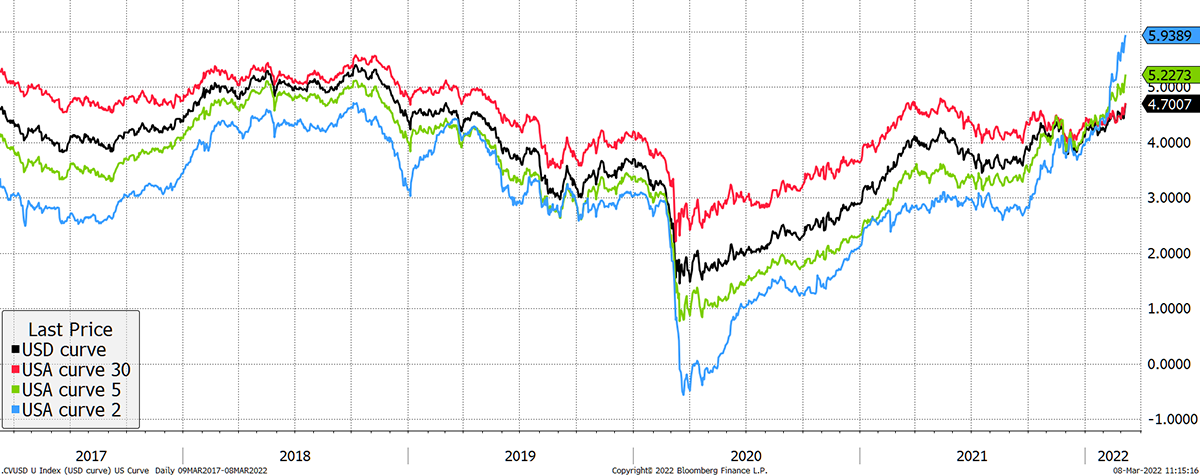

The dollar rally is unhelpful, and we rarely see risk-on asset prices respond well when this happens, but it’s possible. Moreover, I have long been saying that bitcoin likes the bond yield to rise (generally a risk-on signal) alongside rising expectations.

I have described these conditions of risk-on inflation as a “rising curve”. The last time they got going was in 2020, which saw the price of bitcoin rise from around $5,000 to $64,0000 in April. When the investors are buying under the right macro conditions, great things can happen. Those conditions are back.

Source: Bloomberg. US inflation expectations plus bond yields as described since 2017.

Cryptonomy

Fantom (FTM), currently scoring a 1 on ByteTrend, saw a steep decline in price following the news of influential crypto developers Andre Cronje and Anton Nell officially quitting their jobs. Nell, who served as the senior solutions architect for the Fantom Foundation, announced their departure, adding that “there are around ~25 apps and services that we are terminating on 03 April 2022”. Fearing a rug pull due to the badly worded statement, Yearn.finance (invented by Cronje) and other tokens included in the 25 saw a significant price drop. It later emerged that the termination related to the front-end websites, while the projects themselves will continue unaffected.

The European Parliament’s Economics Committee has announced that they will put a comprehensive crypto regulation bill to a vote on 14 March. The bill was originally scheduled for a vote on 28 February but was delayed after they decided to rework some text that could be wrongly interpreted as a ban of proof-of-work blockchains like Bitcoin due to concerns around environmental impact. The proposed bill takes a generally positive approach to crypto, with one of the primary goals to “ensuring that the EU financial services regulatory framework is innovation-friendly and does not pose obstacles to the application of new technologies.

However, CoinDesk highlighted a draft report that proposes to expand a “travel rule” to every digital asset transaction. Banks and payment companies are required to keep information on every transaction that exceeds EUR 1000, while the bill recommends no threshold for crypto transactions. The argumentthat followed was that “there are clear indications that crypto-asset activities associated with criminal activities and terrorism financing are often transfers of small value” and therefore pose a significant security risk. Should the draft bill come to pass, it would require exchanges and wallet providers to “obtain the name of the sender and the recipient, the sender's home address, passport number and the wallet address of both the sender and recipient” for every crypto transaction.

This sounds like bad news for crypto-exchange FTX, who recently announced an expansion into Europe after receiving approval from the financial regulator in Cyprus. Last week, FTX also made waves following the launch of its philanthropic Future Fund under the FTX Foundation, which is largely funded by billionaire CEO Sam Bankman-Fried. The fund aims to distribute between $100 million to $1 billion within this year to support projects in ten categories, including AI, Economic Growth and Space Governance. Their website currently lists 36 project ideas, and while smaller ambitious projects are urged to apply, the fund is specifically targeting massively scalable projects.

Finally, Terra saw an all-time high in dollar termswith $23.5bn total value locked after the price of its native token LUNA climbed 38.8% over the past week. Terra (LUNA), which has held a 5/5 score on ByteTrend since 28 February, will be featured in this week’s Token Takeaway.

Summary

If there is any truth in the inflation narrative around bitcoin, great things should happen. My only doubt here is that we have to wait for risk-on market conditions to return. That might involve a ceasefire or a Russian regime change, so don’t hold your breath.

But just as investors questioned gold in 2021 when inflation rose but the price wouldn’t budge, maybe we see that in reverse. In which case, bitcoin trades a range for months to come. But that’s bullish because it makes the next surge all the more likely, and you have to be in it to win it.

I stand by my bullish call.