ATOMIC 50

We are in year three of epoch 4, and previously that was horrible. Today, bitcoin takes it in its stride.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Not enough stars |

| On-chain | Average block time is slowing- is this a risk? |

| Investment Flows | Stable |

| Macro | Decoupling a must |

| Crypto | Middle Ground |

Technical

By Charlie Morris

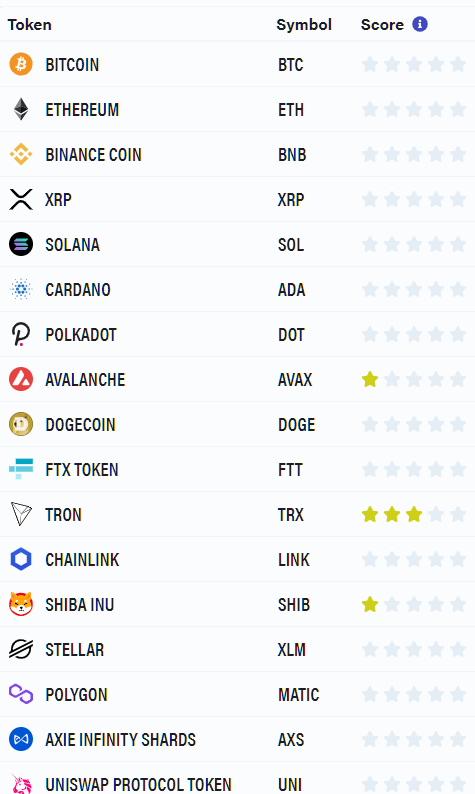

At least it is easy for me to do the ByteTrend star count. Well done TRON (TRX).

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

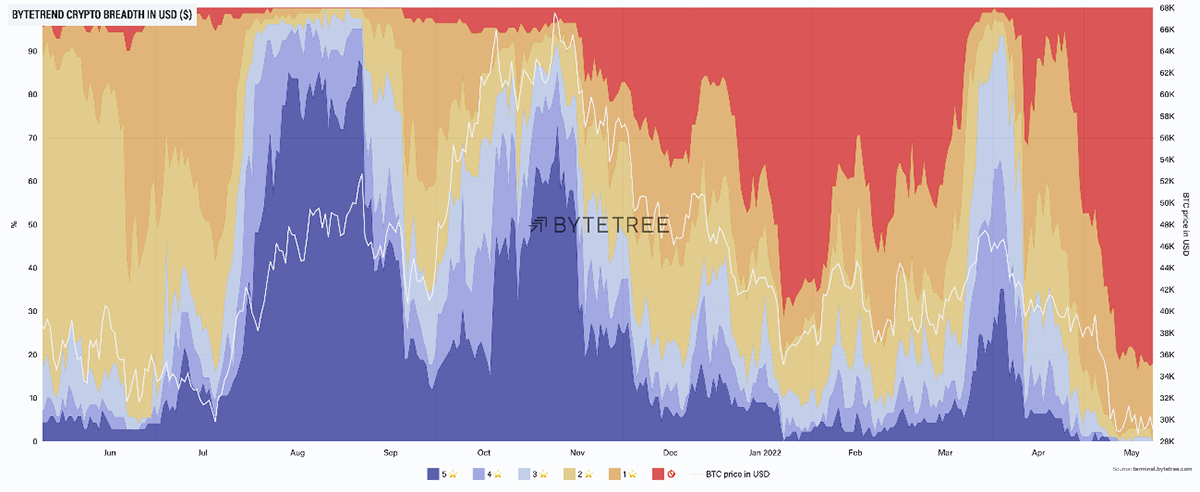

Crypto Breadth

Our new breadth charts are nearly ready for daily updates on the site, with a few final tweaks. This will be a powerful tool when things get going again. The red skies have dropped to 20%, which means 80% of tokens have a score of 0/5.

Source: ByteTree

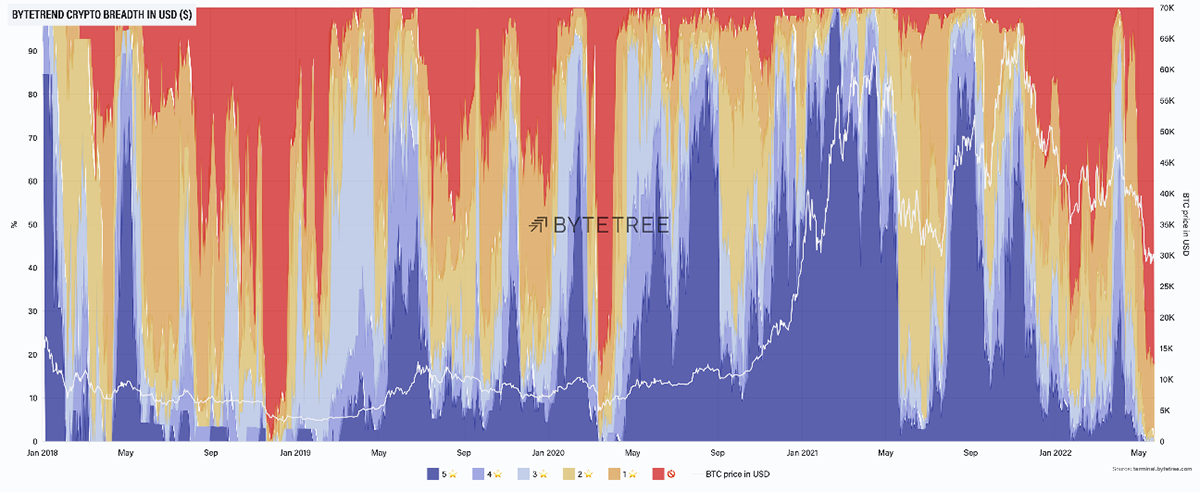

Back in 2018, during the last trainwreck, things were worse as it was momentarily 100% 0/5. Things improved, and they will again.

Source: ByteTree

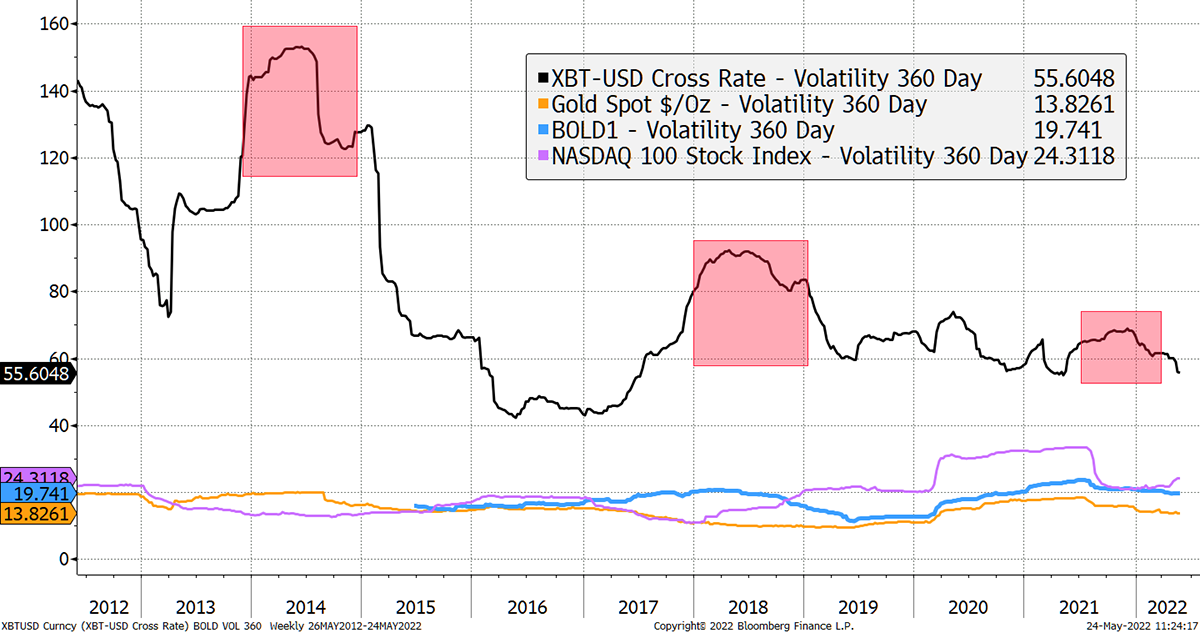

Not only that, but back in the 2014 and 2018 bears, bitcoin volatility was way higher than it is today. We are in year three of epoch 4, and previously that was horrible. Today, bitcoin takes it in its stride.

Bitcoin volatility cools

Source: Bloomberg

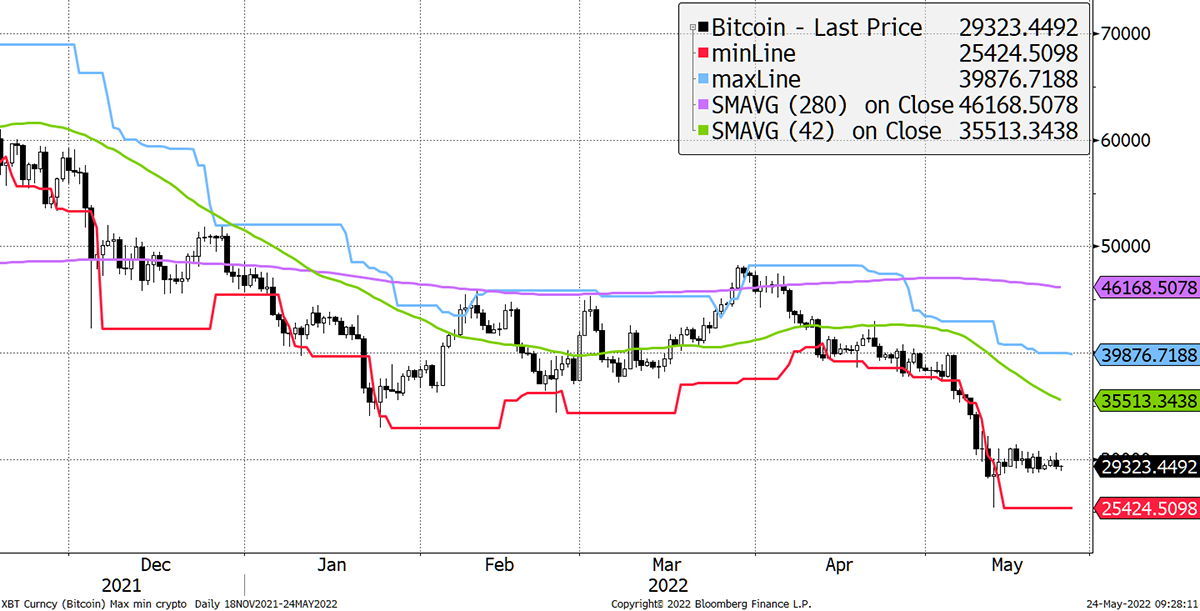

The current bitcoin price is still soft but hasn’t moved since the Terra USD blow up. I sense a degree of resilience.

Bitcoin 0/5

Source: Bloomberg

We all know how quickly things can change, and on balance, I would prefer to remain long than on the sidelines.

On-chain

By Charlie Erith

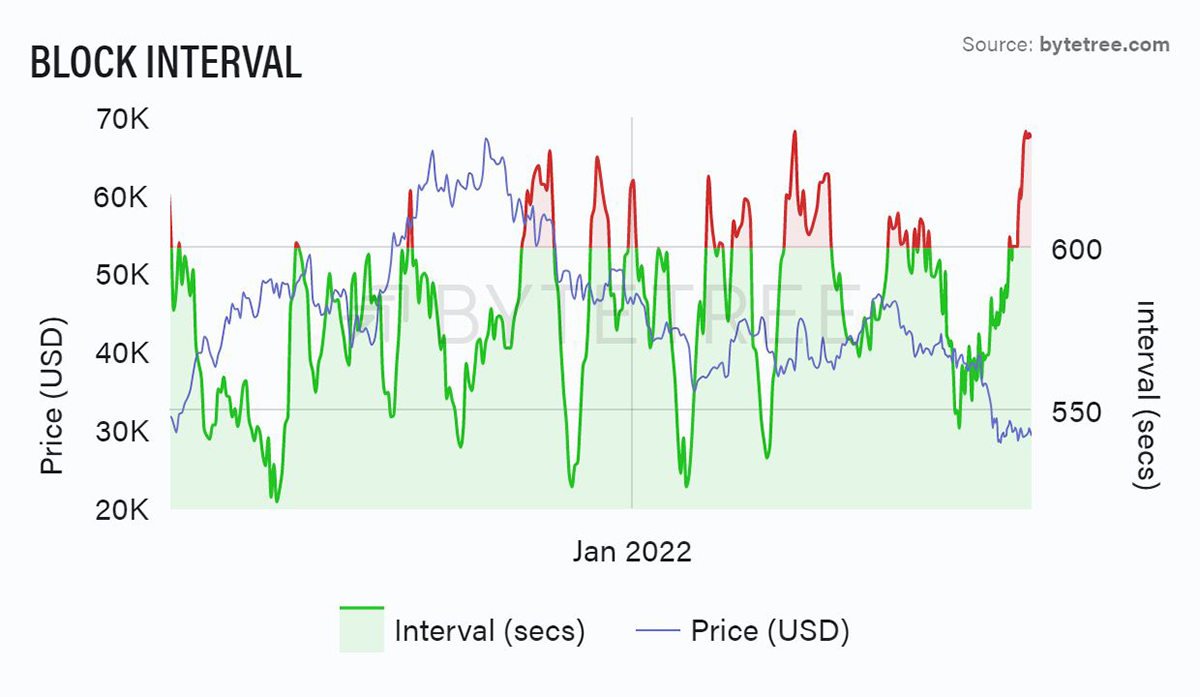

Note how the block interval has recently increased, as shown below.

Source: ByteTree. Bitcoin block interval and price since July 2021.

The block interval is the time it takes the miners to process a single block. The aim is to process one block every 600 seconds, and the code adjusts every 2,016 blocks (approximately every fortnight). When there is too much computing power in the network, the interval drops, and the difficulty adjusts higher.

When the block interval increases, it tells us that miners are downing tools and leaving the network. For whatever reason, the rewards aren’t sufficient. Either bitcoin prices and fees are too low, or input costs (energy mainly) are too high. When those factors reverse, they turn the machines back on.

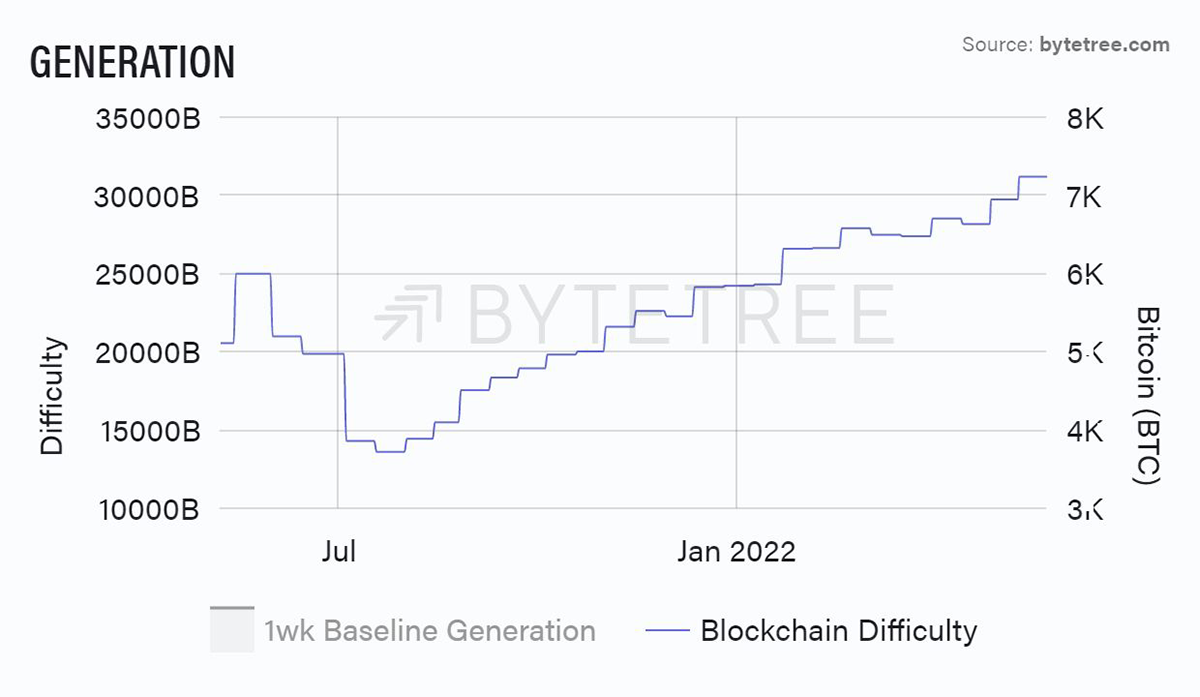

The departure of the Chinese miners in May 2021 resulted in a major collapse in the block interval. In response to this, mining “difficulty” adjusted sharply downwards but has been rising steadily ever since and, as shown below, is materially higher than in May last year.

Source: ByteTree. Bitcoin blockchain difficulty over the past year.

This has happened regardless of the price move, which over the period peaked into the year-end before declining ever since. In other words, the structural underpinning for the bitcoin network – the miners - is extremely sound. Somewhat amazingly, there have been reports that, despite being banned, Chinese mining has resurfaced and still accounts for 22%of the total bitcoin mining market. Talk about an antifragile system.

The key point to take from this is even if we see difficulty adjusting downwards, it is coming from a very strong position. The Bitcoin Network looks incredibly robust at this point.

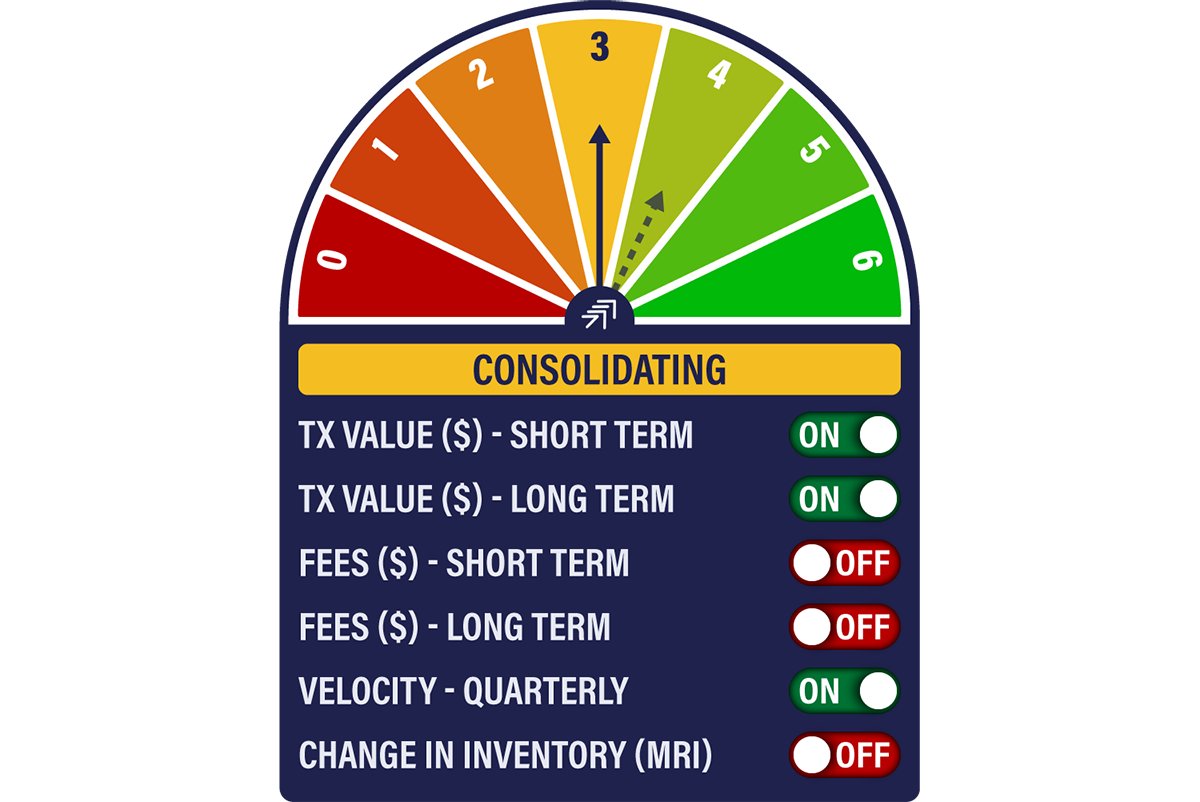

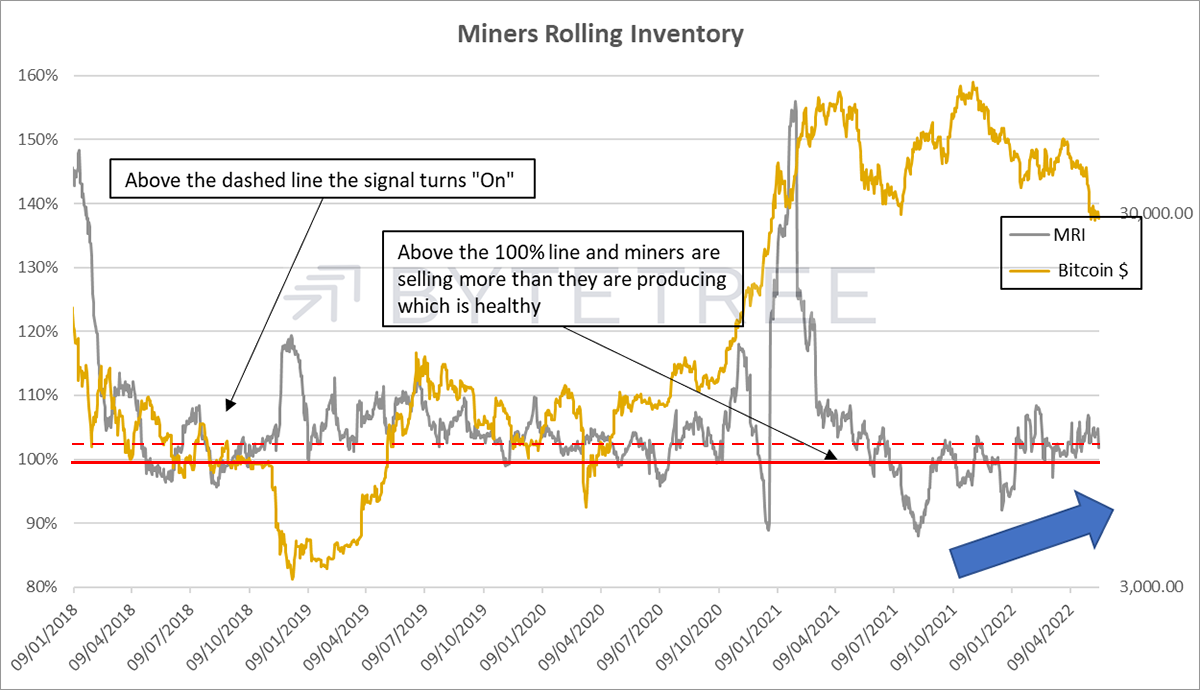

Network Demand Model

The Network Demand Model has slipped to 3/6 from 4/6, with the MRI signal (Miner’s Rolling Inventory) turning off. As on-chain activity has fallen since last week’s frenzy, fees have also fallen. We were anticipating an uptick from the fee signals, but we’ll have to wait for now. The model is telling us to be patient for the time being, but the general direction of travel is constructive. For instance, even though MRI is off, it remains above 100%, so more coins are being sold into the market than minted, which is perfectly healthy.

Source: ByteTree

Investment Flows

By Charlie Erith

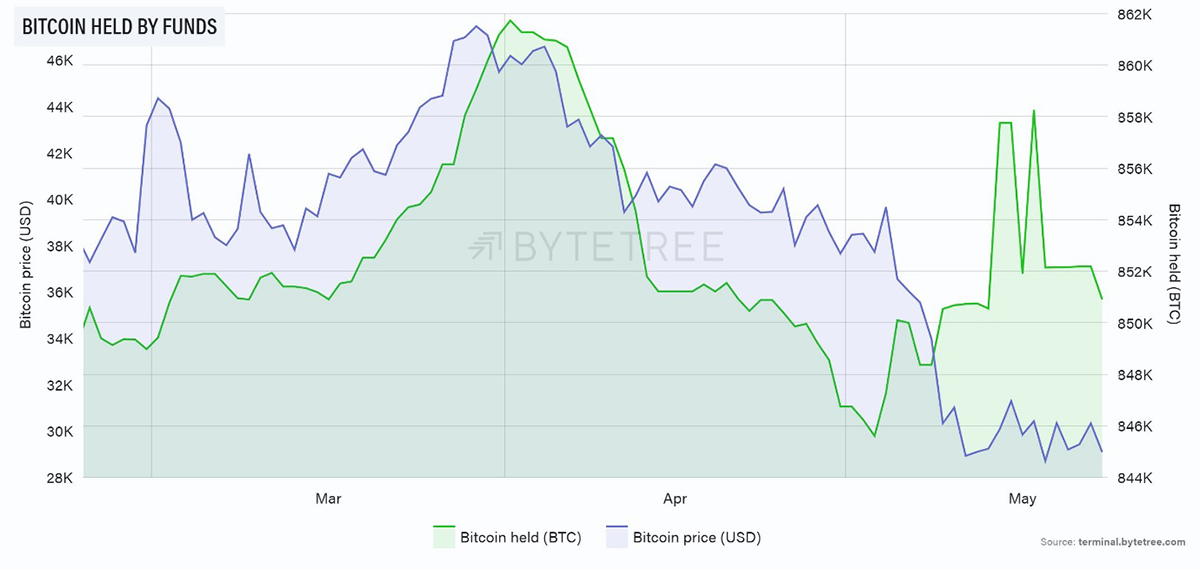

Not much movement in the bitcoin fund holdings this week. We saw an unexpected spike in the latest sell-off, since when holdings have drifted fractionally. What is good to note is that the recent price move has not engendered any panic. Fund holdings are some way higher than the lows at the start of May.

Source: ByteTree. Bitcoin held by funds (green) and price (blue) over the past three months.

Quite clearly, the market sees no possibility of reform of the Grayscale Bitcoin Trust (GBTC). It now trades at an astonishing 37.1% discount to NAV.

Source: ByteTree. The Grayscale Bitcoin Trust (GBTC) premium/discount history.

Macro

By Charlie Morris

We are in the everything bubble, and that is hard to shake off. Bitcoin, which we believe is roughly at fair value, needs to decouple, and this sits at the heart of the bull case.

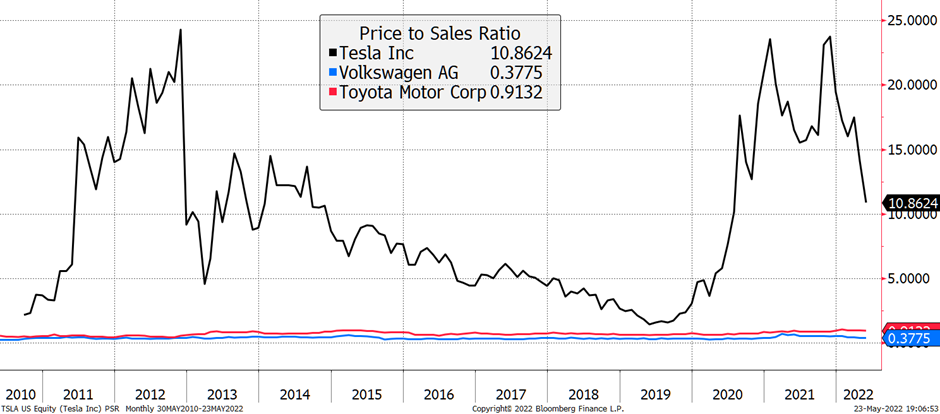

The bubble is not over. Tesla (TSLA) is a car company, yet still trades on 10x sales. Car companies are happier under 1x. Some believe it is a data company, so that’s all well and good then!

A car company or a data company?

Source: Bloomberg

The point is that although many non-profit tech stocks have already de-rated. If things get worse, the pain will spread to the large caps, and not just in tech.

I have long believed that one day, bitcoin would decouple and start to trade as a liquid alternative asset. We know volatility is falling, but few realise how liquidity is rising. Charlie Erith will cover this tomorrow in an important piece.

I won’t spoil the punchline but have a think about the daily liquidity of gold, silver and bitcoin. Can you rank them? The answer will appear on these pages tomorrow.

Dollar exhausted?

Source: Bloomberg

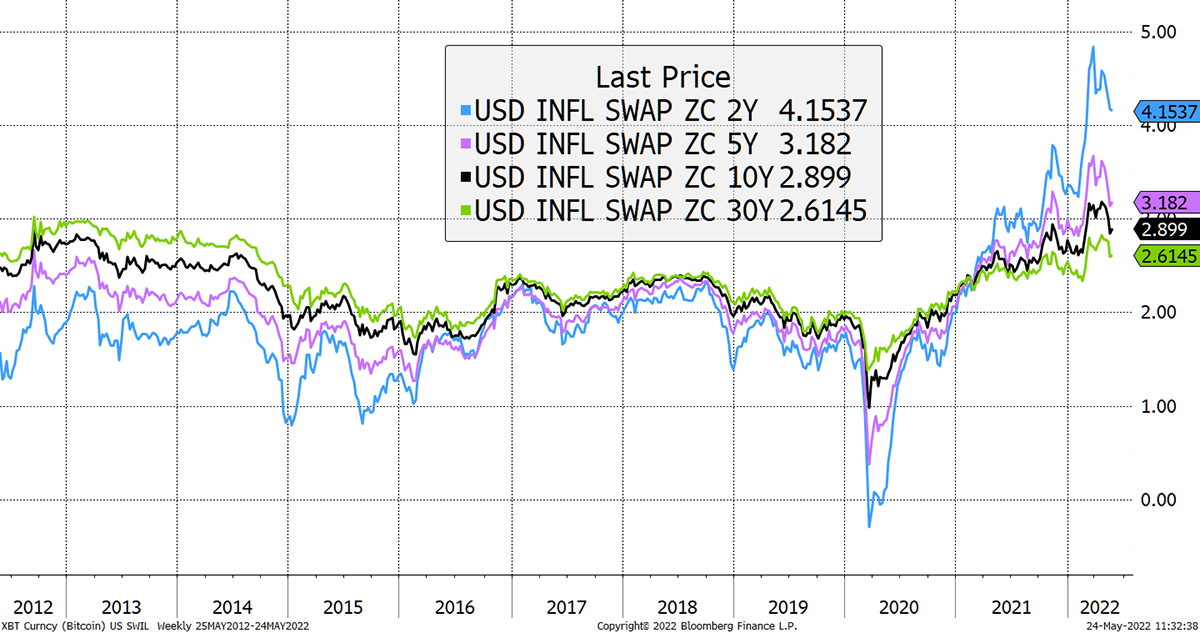

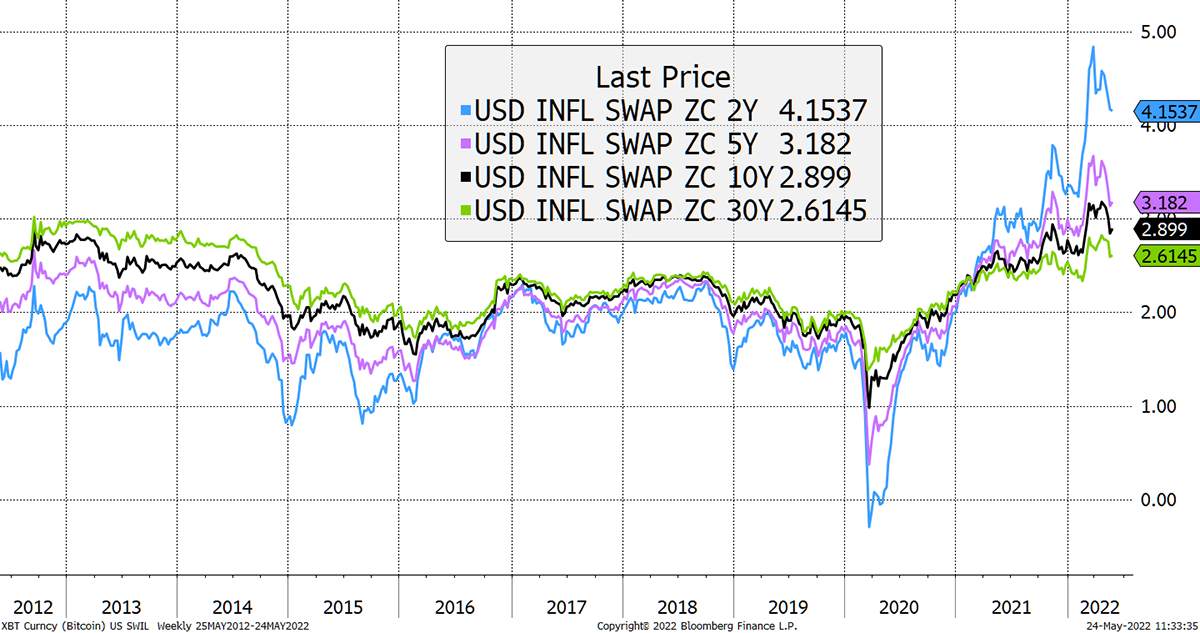

Inflation is easing off but remains elevated. Financial asset prices may be collapsing, but commodities are proving resilient. These are different times, and I tend to think of bitcoin as a digital commodity. Limited supply, variable demand. It is certainly a better fit than a currency.

The VIX trends higher

Source: Bloomberg

Cryptonomy: Middle Ground

By Laura Johansson

On Sunday, Christine Lagarde, the President of the European Central Bank (ECB), was interviewed on a Dutch talk show called “College Tour”. Cryptocurrency was one of the topics that came up during the interview, and Lagarde was asked about her opinion on them, to which she responded:

“My very humble assessment is that it is worth nothing. It is based on nothing. There is no underlying asset to act as an anchor of safety.”

Unsurprisingly, the criticism stems from the risk that comes in the form of market volatility. In her mind, too many young people are investing in crypto assets with their eyes closed, looking to make a quick profit, only to fall foul of the market swings.

“What worries me about crypto is that people who don’t realize they can lose everything are investing in it. I worry about people who assume [crypto investments] will pay off, who don't know the risks, who will lose everything and will be very disappointed. That’s why I think it should be regulated.”

But when directly asked whether she would discourage people from investing in crypto, Lagarde didn’t give a definitive answer. Instead, she turned the conversation to Central Bank Digital Currencies (CBDC), stating that when the digital Euro is released, which is vastly different from other cryptos, she will personally guarantee it because the ECB will be behind it.

And Lagarde is right. CBDCs are different from other cryptos. As Charlie highlighted in our CBDC article series last year, they are essentially FIAT disguised as crypto. They may be built on blockchain technology, but at the very core, they are still FIAT currencies that will inflate away over time. But that is perhaps the necessary middle ground between the old world and the new.

I disagree with Lagarde’s stance on cryptos, but it is encouraging to see crypto taking a prominent place in world economies. It opens up the discussion around the crypto regulatory environment and brings new innovation to the space. CBDCs are here to stay, and so is crypto.

You can watch the full interview here - the cryptocurrency discussion starts around 12:10.

Summary

Even if bitcoin breaks, it will be nothing like 2014 or 2018. Rightly or wrongly, I believe it will hold and go on to do great things. There are so many doubters that it is impossible not to be bullish. When they finally all agree with us, I’ll be cashing in.