ATOMIC 67

Traditional markets are in a state of turmoil, the dollar is at an extreme, yet crypto is starting to behave. The long-term use cases are emerging, and they will be transformational.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | BitDAQ reawakens |

| On-chain | Velocity and volatility down |

| Macro | This dollar bubble will soon break |

| Investment Flows | Stable, bullish considering the market environment |

| Cryptonomy | The Lightning Network, Bitcoin’s new narrative |

Technical

By Charlie Morris

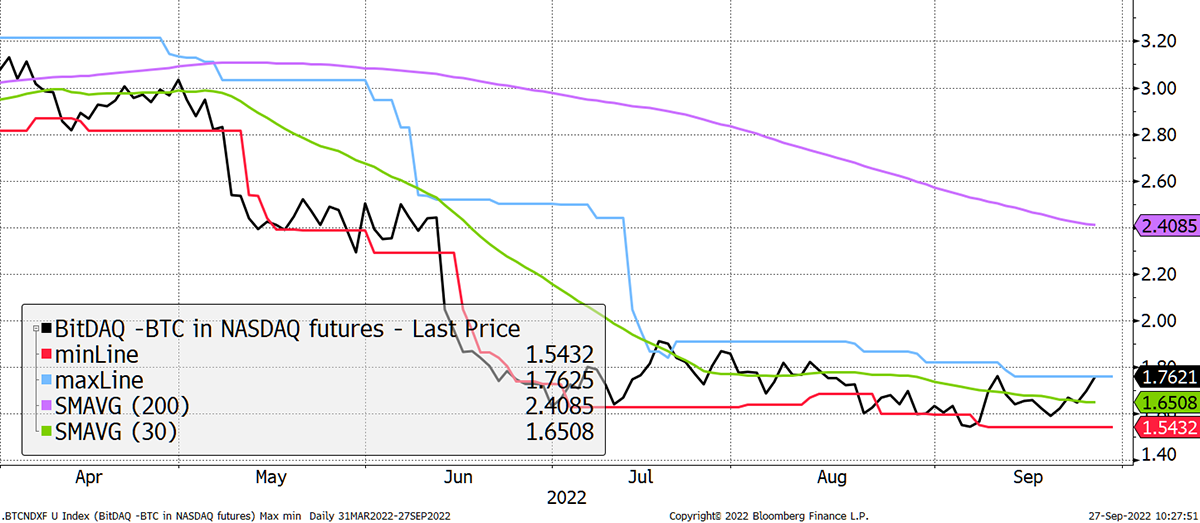

My favourite bitcoin chart is BitDAQ, which is bitcoin in NASDAQ. It has just jumped to a 2-star trend.

Bitcoin 1-star

Source: Bloomberg

It is my belief that US equities are in for a harsh winter, whereas bitcoin is looking forward to the spring. If bitcoin can outperform US equities, it will attract inflows. It’s as simple as that.

The exciting thing about this chart is the 20-day max touched this morning. We have only seen that once in six months. If it can follow through, the good times will roll.

Macro

By Charlie Morris

In a bad week for the pound, it is a good time to highlight the US dollar bubble. This is causing mayhem in markets, and the best bit is that bitcoin has already done its worst.

When the dollar turns south, which inevitably it will, bitcoin will fly again. That time is getting closer and could even be imminent. It would be the first time a sterling crisis has marked such an occasion.

I normally talk about crypto currencies, but this week, we’ll focus on fiat currencies. I’ll flick through some major currencies and show their fair value according to purchasing power parity (PPP), which is widely used to show the relative cost of living using long-term inflation differentials.

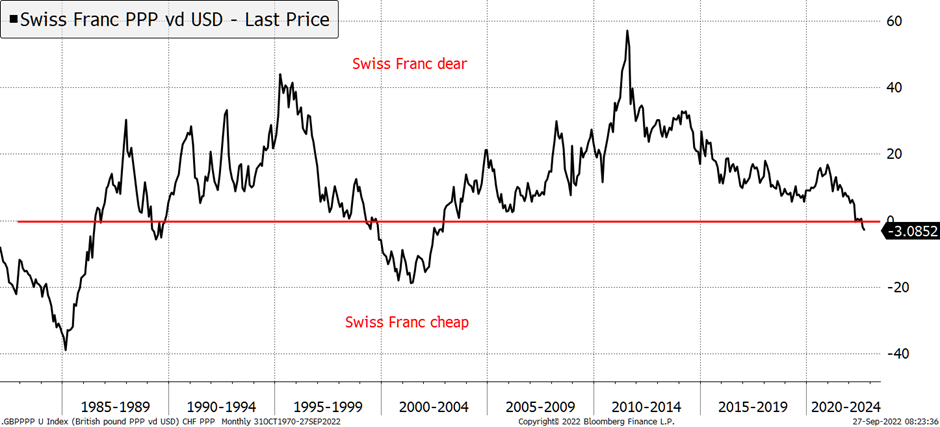

The Swiss Franc has been strong but has still fallen against the dollar since 2020. Switzerland has enjoyed lower inflation, and despite being one of the best-performing currencies on earth, it is now slightly undervalued vs USD. It deserves to be relatively strong because it is a natural home for money at times of stress.

Swiss Franc

Source: Bloomberg

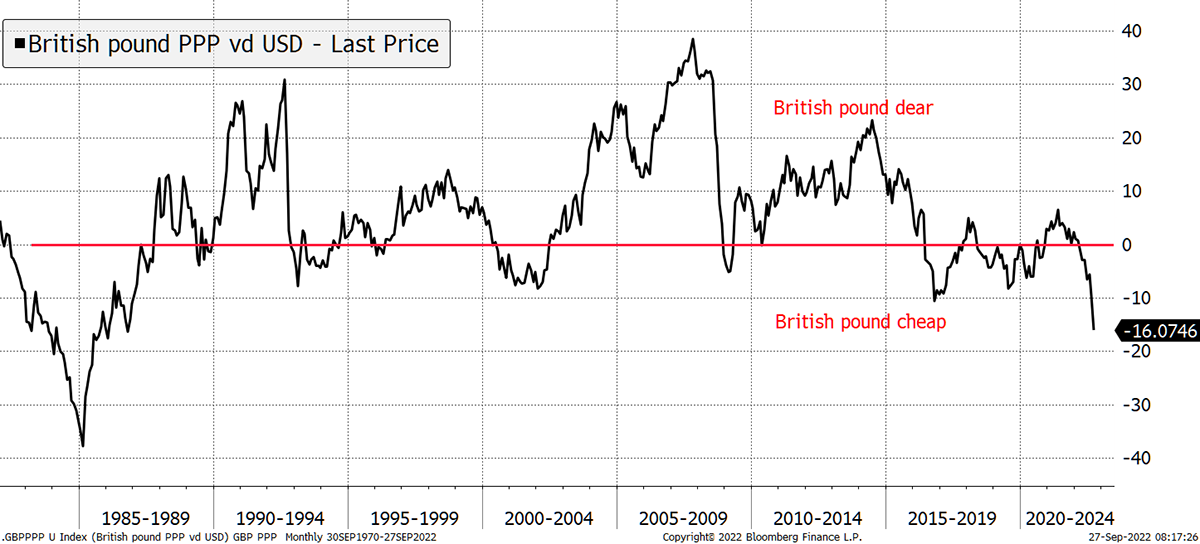

The Pound is a risk-on currency and does best in equity bull markets and vice versa. The mini budget triggered a fall on Friday, but history will soon forget that. It’s now undervalued.

British Pound

Source: Bloomberg

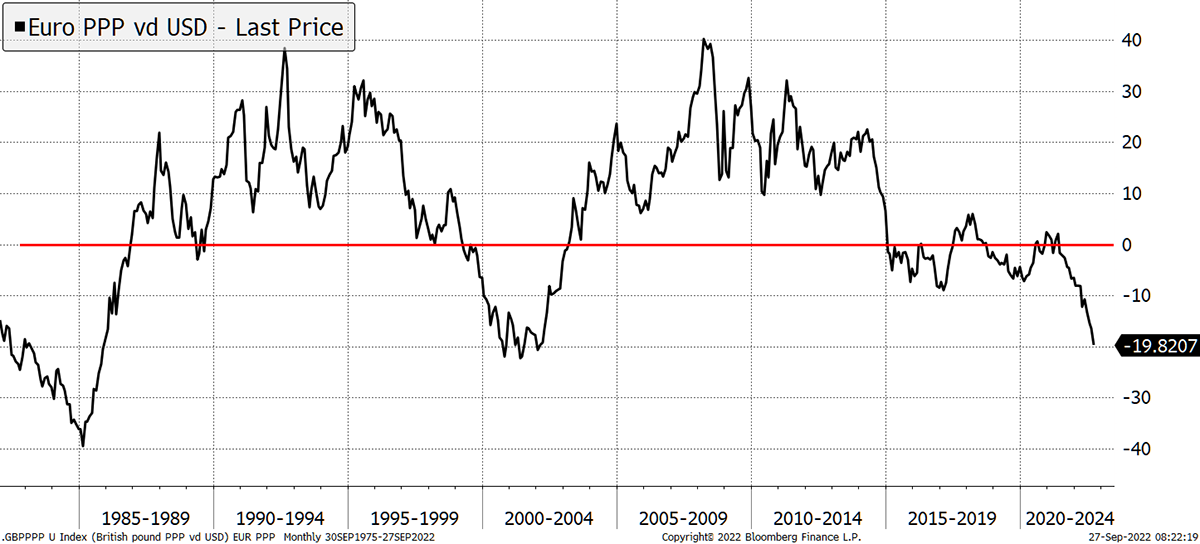

The Euro has also been weak and is undervalued. The panic around gas is overdone, and the European Union won’t break up while the political will remains. It’s now cheap.

Euro

Source: Bloomberg

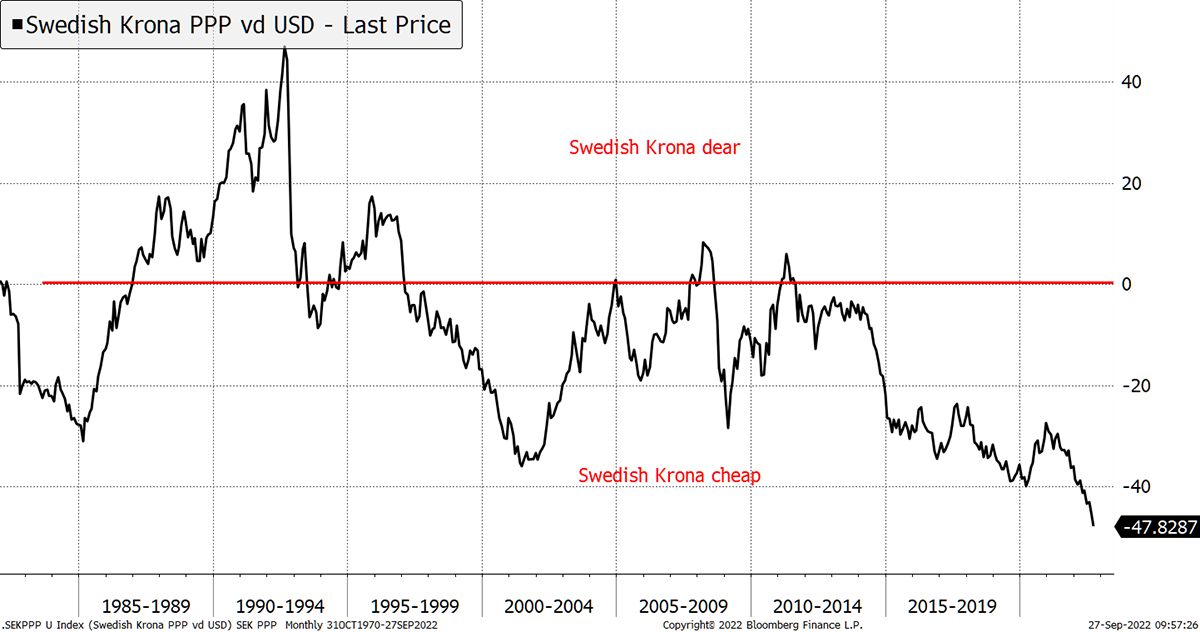

The Swedish Krona is highly correlated to the pound, which is something no one seems to talk about. Stockholm is a mini London, but more importantly, both GBP and SEK are peripheral European currencies that are inversely correlated with liquidity conditions. In any event, this currency is dirt cheap. A good holiday destination.

Swedish Krona

Source: Bloomberg

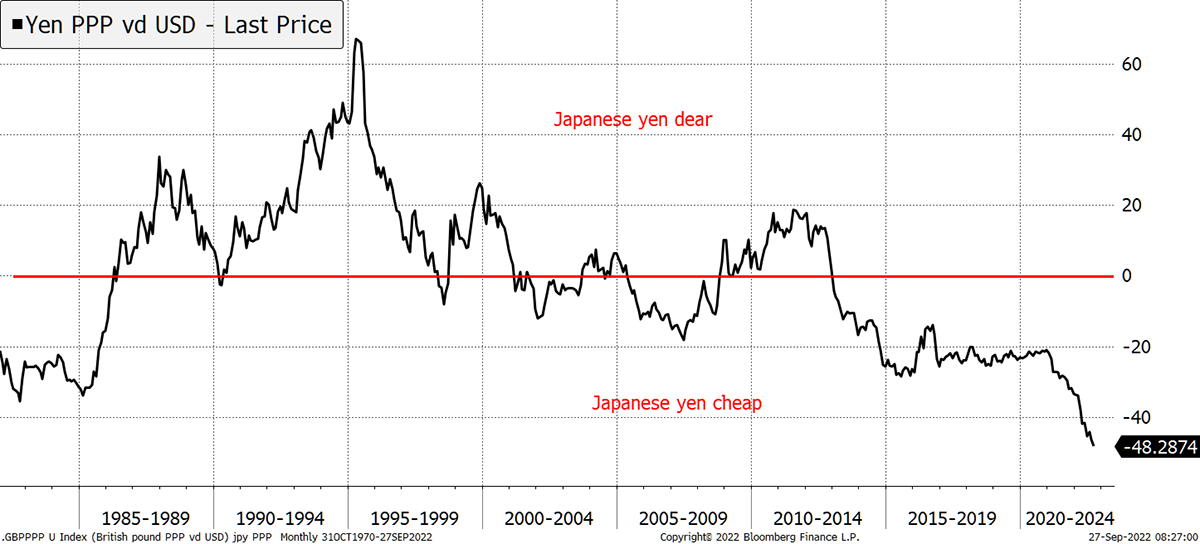

Another trip of a lifetime opportunity is Japan. Persistent low inflation has made the yen super cheap.

Japanese Yen

Source: Bloomberg

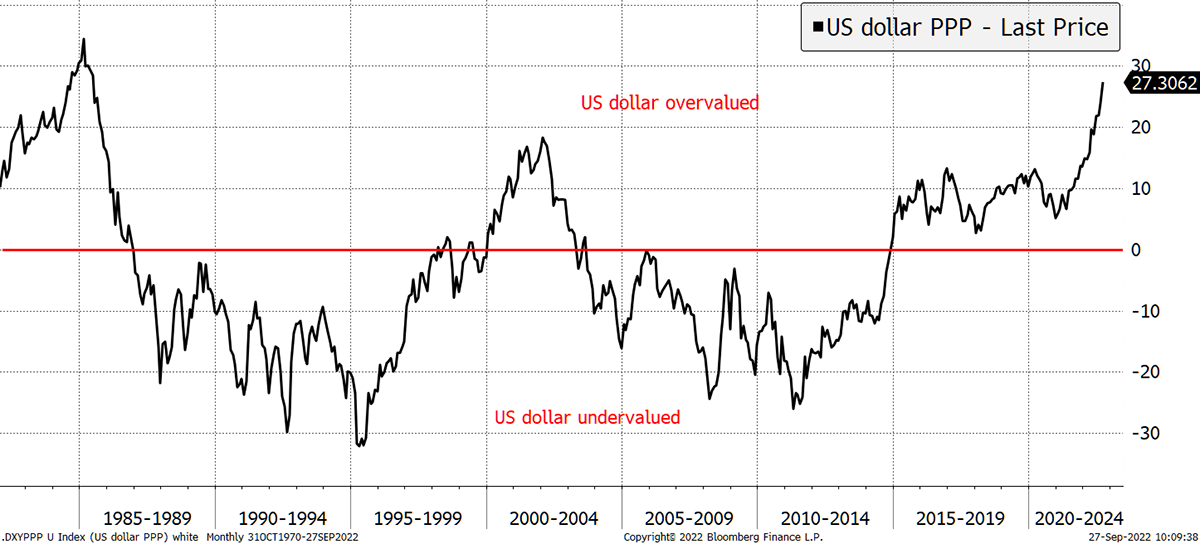

Putting it all together and weighting it, we get the dollar bubble-o-meter. The last time the dollar was this dear was in 2001. That saw US equities lag the world until 2014. The 1985 peak didn’t see them beat the world until 1996. This is a very dangerous time to be invested in US equities.

The Dollar Bubble

Source: Bloomberg

Long-term bitcoiners should be super excited about this. The dollar bubble is soon to burst.

On-Chain

By Charlie Erith

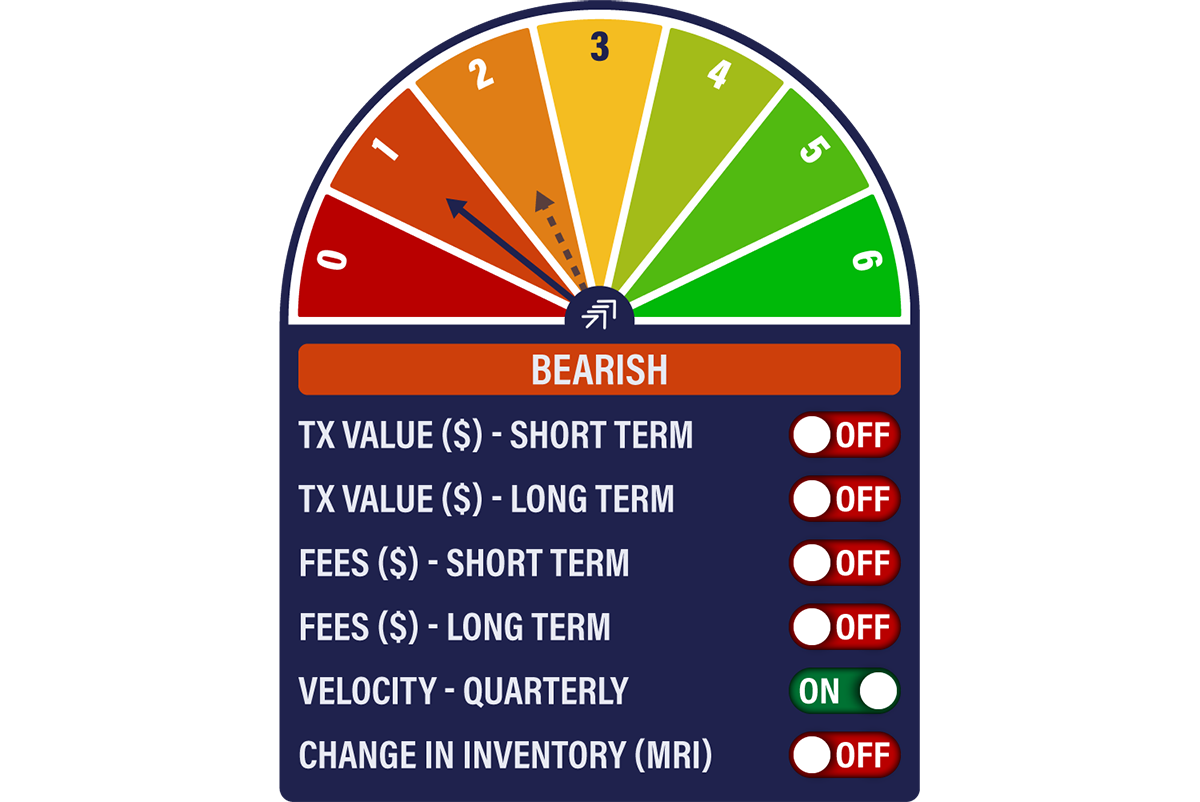

Activity on the bitcoin blockchain remains quiet and still makes no argument for an upgrade to a bullish stance. Indeed, the Network Demand Model has slipped from 2/6 to 1/6 this week, with the short-term spend indicator once again turning off.

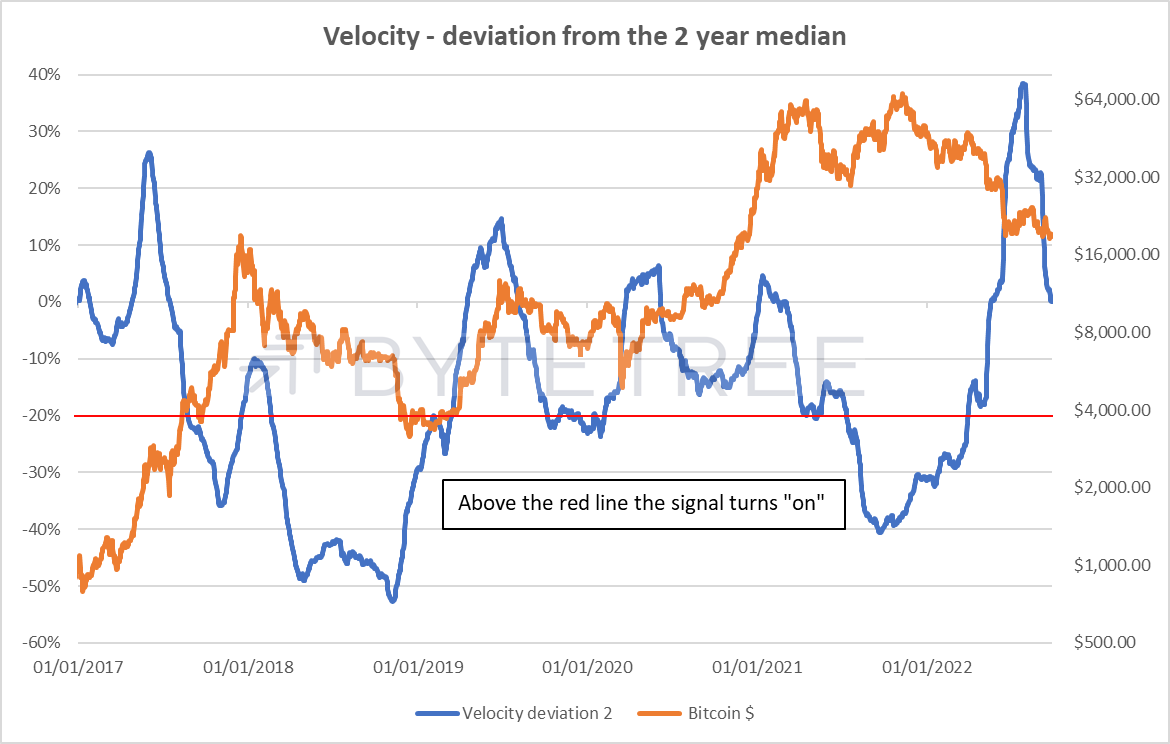

The only indicator left on is Velocity, which has been on since 30 March when the bitcoin price was US$47,000. This was around the highest price this year, so if anything, it’s a contra-indicator in the short term. But as long as we know what we’re dealing with, it’s useful.

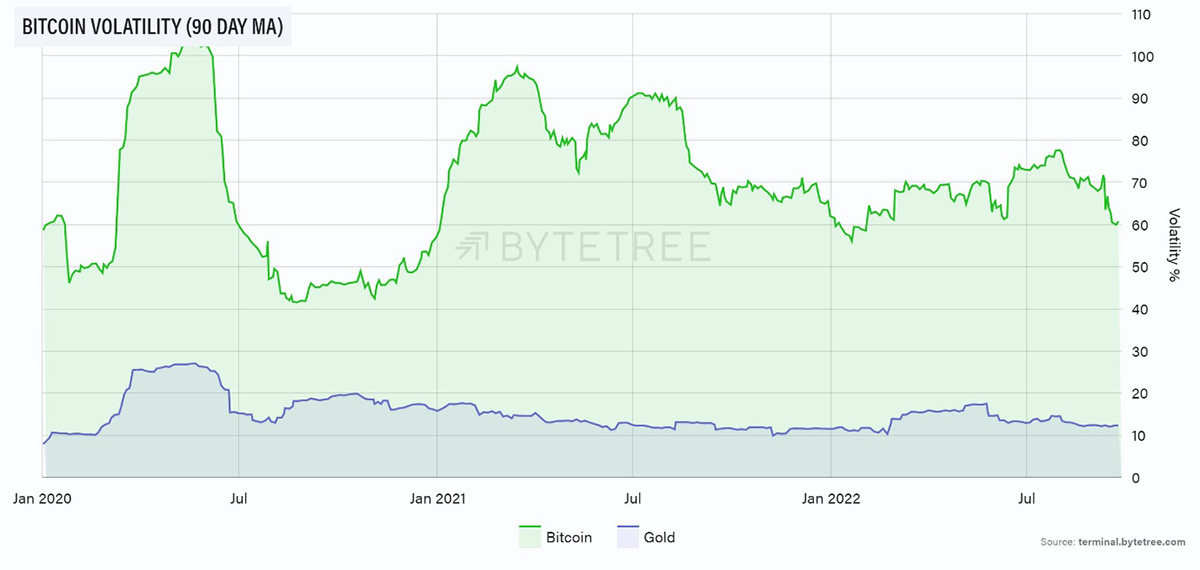

Velocity measures the number of coins that are changing hands. When it’s high, we’re seeing heavy turnover and vice versa. At the moment, the measure is coming down sharply, a sign of a more robust ownership base perhaps. Interestingly, that squares with bitcoin’s falling volatility, not something you’d expect in this period of heightened market turmoil.

Source: ByteTree

Source: ByteTree. Bitcoin (green) vs Gold (blue) volatility (%) over a 90-day moving average, since January 2020.

Institutional Flows

By Charlie Erith

Our observations from the on-chain section – bitcoin’s falling velocity and volatility – are reflected in fund flows, which are remarkably steady. In fact, both bitcoin and ethereum have seen a slight pick-up in the last couple of weeks.

Source: ByteTree. Bitcoin (BTC) held by funds over the past three months.

Source: ByteTree. Ethereum (ETH) held by funds over the past three months.

Cryptonomy

By Charlie Erith

A couple of weeks ago, we highlighted the need to keep tabs on the Lightning Network. The Lightning Network is a layer that runs on top of the Bitcoin Network, making payments supremely rapid and incredibly cheap. The simple analogy to the real world is running a bar tab. You open up a tab, buy drinks all evening without paying for them individually, and settle up when you leave. The Bitcoin Network thus becomes a settlement layer for payments - instantaneous, supremely secure, decentralised and cheap. The potential for disruption of the status quo is mind-boggling.

This Forbes article by Caitlin Long, a highly influential crypto lawyer and “dada-bank” CEO in the US (“dada” stands for dollar and digital asset bank), brought this back to top-of-mind. She draws a parallel between “Money-Over-Internet-Protocols” and the impact of “Voice-Over-Internet-Protocol” (VOIP) on traditional telephony. The latter was also initially derided in the late 1990s, but once it reached scale in 2003, it made copper-wire networks obsolete.

The importance of this technological development can’t be overstated. Crypto is going through a phase where it needs genuine use cases to justify its continued emergence. Bitcoin is no different. Thus far, it has been pitched as “digital gold”, a form of alternative currency. This is of course highly controversial from many angles. But if it has the potential to disrupt and replace incumbent payment networks, it finds itself having the most fundamentally important use case of all.

As Lyn Alden goes on to explain in her piece, this is not the end of it. We are talking about scaling solutions here, and “there is no hard limit on how big the network can get over time”. Given how technology evolves, expect further layers and use cases to appear over time.

The most intriguing possibility is that “in addition to sending value instantly and cheaply, the Lightning Network can be used to send non-monetary information”. As Alden says, use-cases could include “social media messages, video calls, file sharing, identity verification, content monetisation, social networks and other applications”. Indeed, there is a company called Impervious building a browser for exactly this purpose.

There are, as ever, many risks with this new technology, mostly centred around adoption and regulation, let alone the difficulty in imagining and predicting the future. Yet finally, a vision is coming into view of what bitcoin could become, and it’s a great deal more than digital gold. This is a technology that can be the foundation of the next phase of the internet. When seen in that light, an investment for the long-term is transformed from being purely speculative.

Summary

Uptober is days away, and use cases for the technology continue to evolve. Be ready.