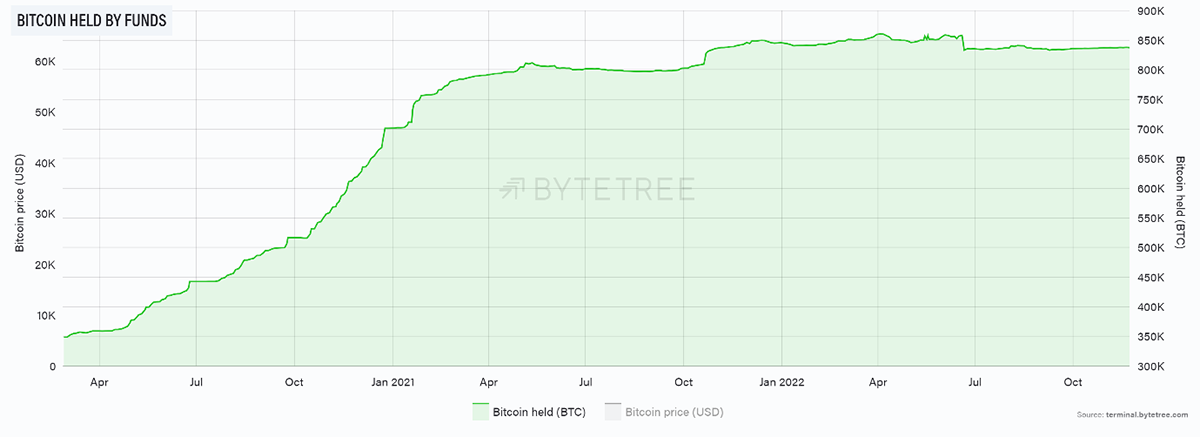

According to ByteTree data, 838,116 BTC are held by funds and ETFs, which is 4.4% of the total bitcoins mined to date. That had been growing into mid-2021 but has subsequently slowed.

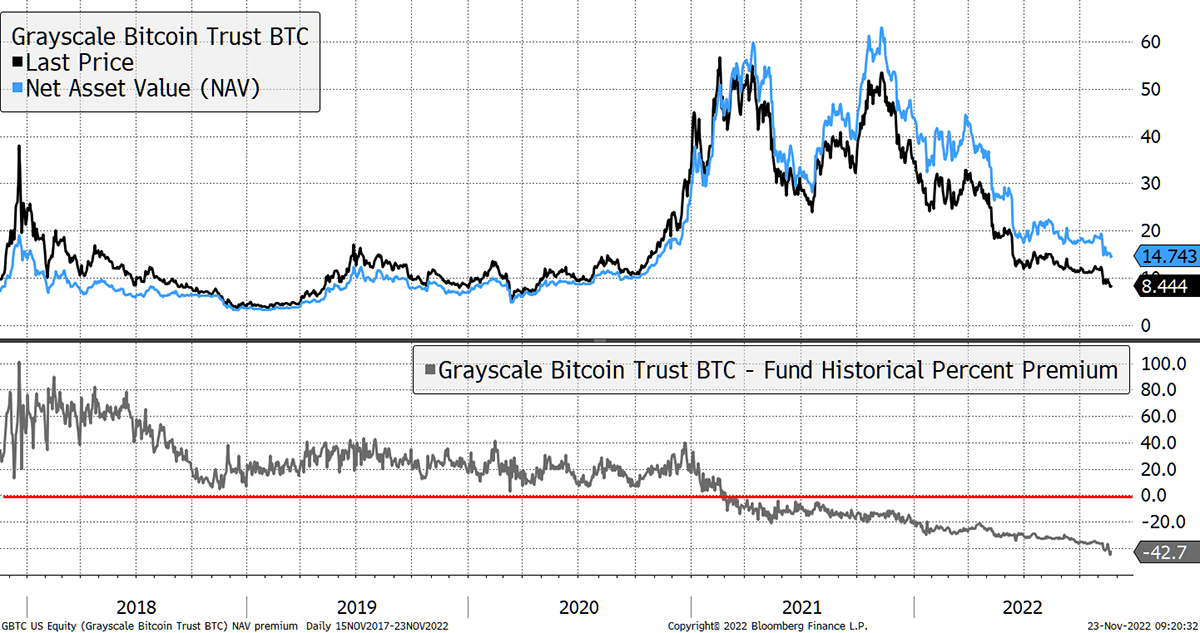

Remarkably, 77% of all bitcoin held in funds (633,394 BTC) are held in the Grayscale Bitcoin Trust (GBTC), making it the largest publicly traded bitcoin fund in the world. A few years ago, demand was so high that the shares traded at a premium to the value of their bitcoin. In early 2021, that turned into a discount, as alternative routes to the market became available at a lower cost.

The Grayscale Discount

GBTC charges 2% per annum, which is high given its economies of scale. That equates to 12,668 BTC per year (or two weeks’ mining). It is only possible to charge that much when you have a trick up your sleeve. Pre-2021, bitcoin was in high demand and bitcoin funds lacked competition. Today, there are many alternatives, and we’ll look at some below.

GBTC would have lost vast assets under management if investors were able to switch, but they can’t. They have retained their assets because their investors are stuck in a lobster pot from which they cannot escape.

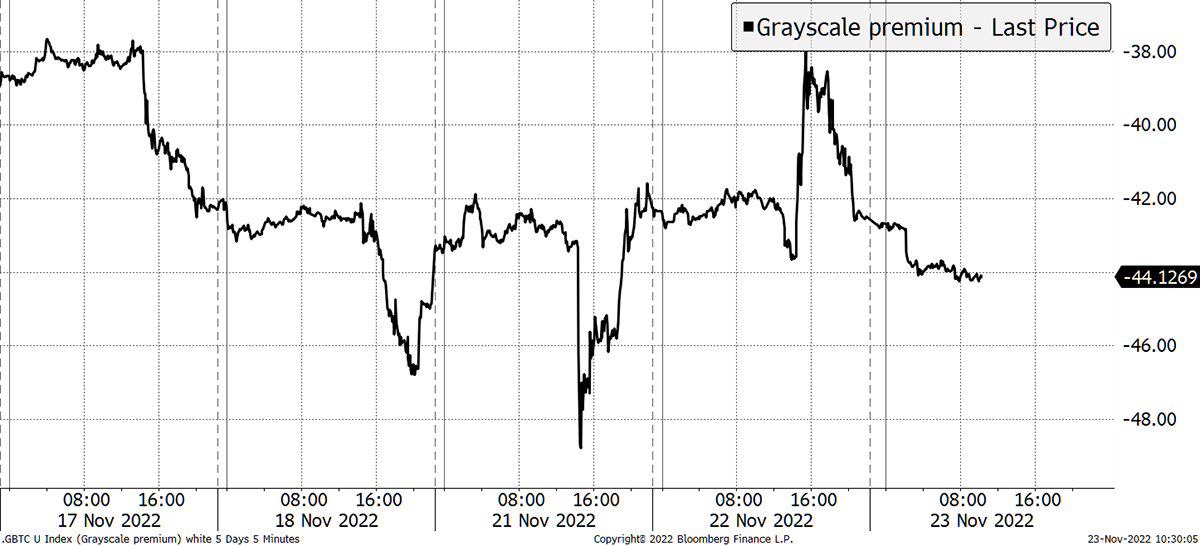

Since the investors cannot leave, the price slides instead. The discount today stands at 42.7%, which is extremely high for a fund holding a liquid asset (bitcoin). I have followed closed-ended funds for 25 years, and you only see 30% + discounts in distressed, illiquid assets such as real estate, private equity, or micro caps. Bitcoin is hugely liquid.

GBTC’s bitcoins are effectively locked up, as there is no mechanism for Grayscale to sell bitcoin and buy back their shares, which are significantly undervalued. As a result, investors suffer. Perhaps they could, but they don’t.

With the recent scandals in crypto, investors have questioned whether the coins exist. Have they been lent out and lost? They put out a statement confirming the coins were held by Coinbase. The Coinbase CEO, Brian Armstrong, verified this on Monday, which saw the intraday discount rally back from the excruciating 49%.

Another reason for the widening discount is the rise in alternatives. In Europe, we have enjoyed bitcoin and crypto ETFs since 2015. Except, of course, in the UK, where they were banned by the regulator in October 2020, when the price was around $10,000. They are still offside, and I believe they will remain so.

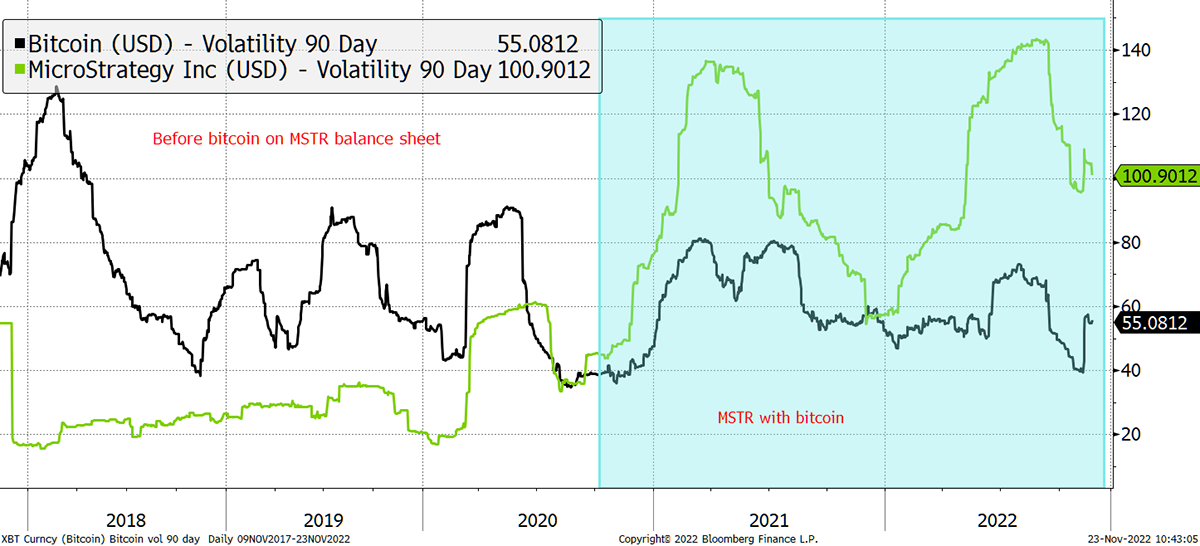

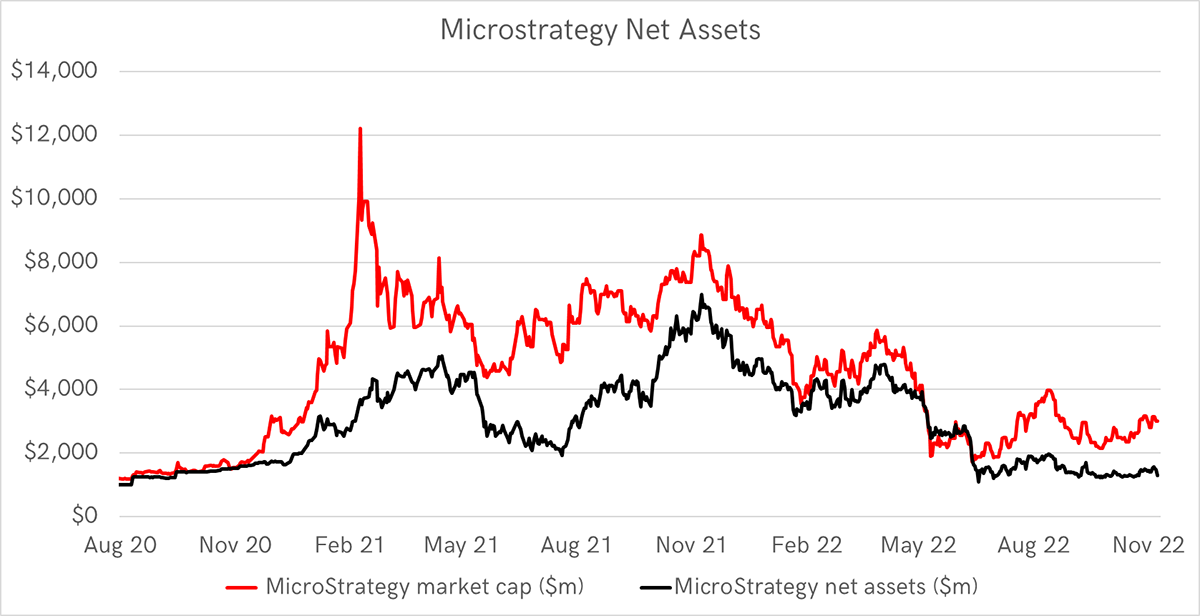

In August 2020, Michael Saylor’s MicroStrategy (MSTR) decided to go all in, and today his company holds roughly 130,000 BTC on its balance sheet. One advantage over GBTC is that there are no management fees and, more importantly, a source of income as there is a cash-generative software company in the mix. In that sense, you get paid to own bitcoin.

The trouble with MSTR is that it is funded by $2.2 billion of debt. That makes the company leveraged and therefore riskier. If MSTR was simply “bitcoin with earnings”, it would be less volatile than bitcoin. It isn’t. It is more volatile because it is “leveraged bitcoin with earnings”. You can see the transition after they announced their bitcoin holdings in August 2020.

MicroStrategy Is a Risky Option

The $2.2 billion of debt is what makes MSTR more volatile than bitcoin itself. That is because when the price of bitcoin falls, the debt remains flat while the value of the assets falls. Hence MSTR volatility peaks have coincided with bitcoin price drops.

This volatility goes beyond the rational link to the value of the assets. Investors like the leverage that MSTR shares offer. If bitcoin rose to $100,000, the debt would remain $2.2bn while the assets would balloon to $14bn. An easy win. Sadly, it’s also true in reverse.

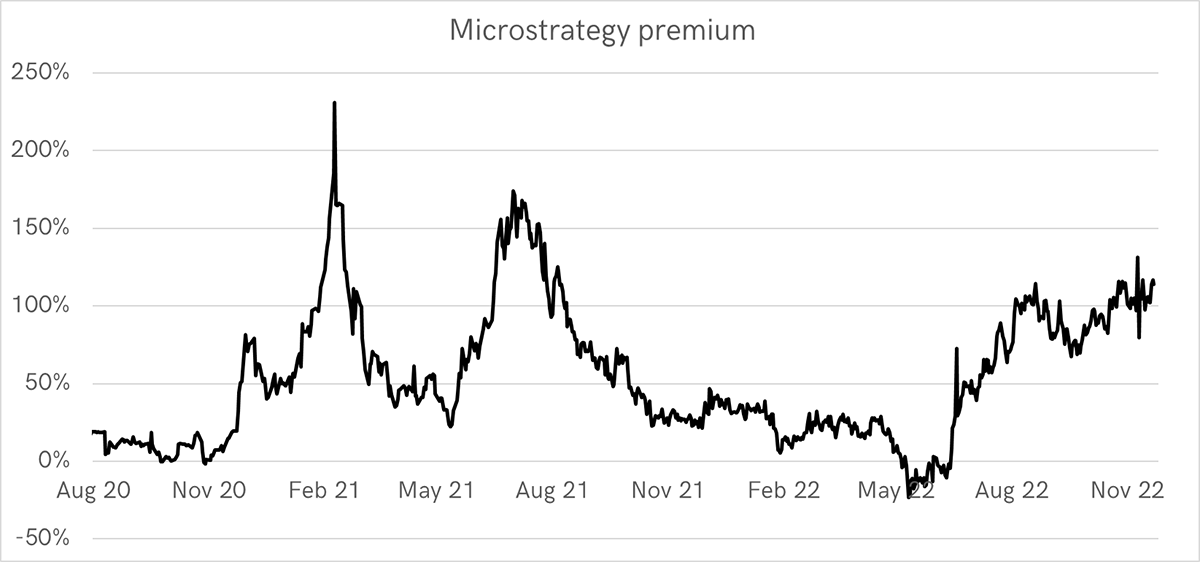

The advantages of MSTR are that as a shareholder, you get paid to own bitcoin, there are no fees, and you get upside leverage. The downside is you currently pay a premium for the privilege. Currently, the company is valued at $1.9bn yet holds (estimated) net assets of $884m. That assumes the software business is worth $1bn, which is generous given the enterprise value between 2017 and 2019 was slightly lower.

On a per share basis, it follows that the shares are worth around $78 when they trade at $167 in the market, which is a 114% premium to net asset value.

That is exactly the opposite of GBTC, which trades on a significant discount. At current prices, the rational thing to do would be to switch from MSTR to GBTC. You’ll start to pay fees, and you’ll have to believe the bitcoins exist in safe custody, but that’s not a bad bet.

Invest $100 in GBTC; you get $172 of bitcoin.

Invest $100 in MSTR; you get $46 of bitcoin.

In other words, and at current prices, you get 3.6x bang for your buck in bitcoin exposure with GBTC over MSTR. It is a shame that most investment platforms in the UK have banned GBTC but allow trading in MSTR.

ETFs

There’s a third way where you invest $100 and get $100 of bitcoin, and it’s called an ETF. As I said, there are many in Europe, but these days, you’ll also find them in Australia, Canada, Singapore, Dubai, and Brazil. Hong Kong will soon be joining the list.

These are good products that do the job as described, which is simply tracking the price of bitcoin 1:1. Fees vary, but these days you can pay very little indeed. 21Shares’ cheapest product charges just 0.21%, yet there has been little take-up.

Like the UK, the US has not yet given bitcoin ETFs the green light, hence the need for alternatives. Yet the US did allow bitcoin ETFs based on futures.

Over the past year, the ProShares Bitcoin Futures ETF (BITO) has lagged bitcoin by 1.95%, of which 0.95% can be attributed to the management fees. A year ago, I was sceptical and assumed the futures funds would lag by a much wider margin due to the roll yield. I was expecting 6% or more, so this 1.95% lag is a pleasant surprise. But it’s still a lag.

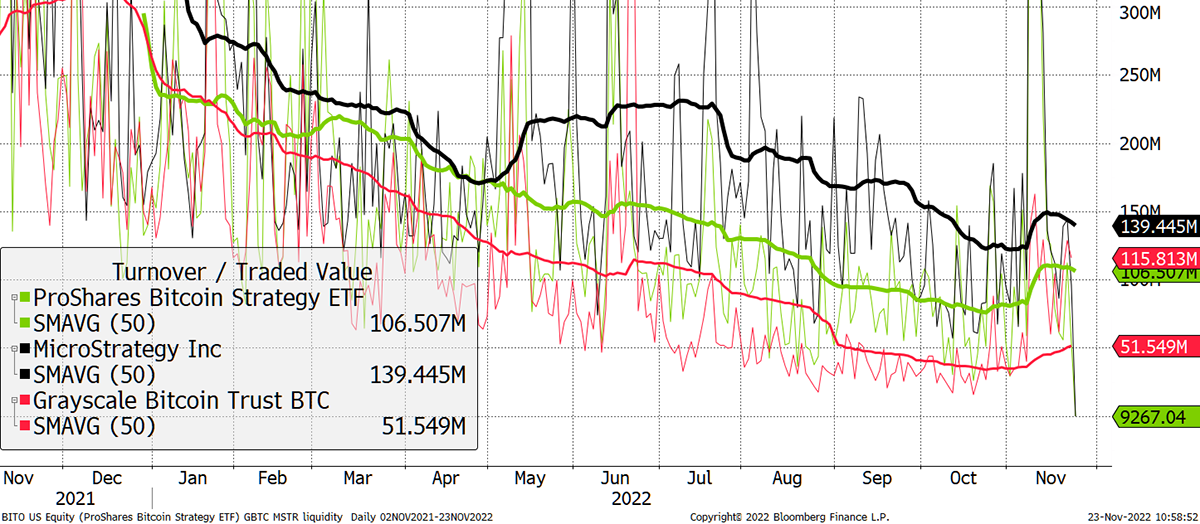

We have looked at the pros and cons of the big three alternatives to bitcoin ETFs: GBTC, MSTR and BITO. The final piece is liquidity. The market caps are $5.9bn, $1.9bn and $522m, respectively. You would think that the daily volumes would follow in order of size, but no.

Bitcoin Fund Liquidity

I have taken the daily value traded and smoothed it using a 50-day moving average. All three funds are less liquid than they were a year ago, but GBTC’s slide is the most notable.

The largest fund, GBTC, is the least liquid, trading $51m per day. BITO comes next, trading $106m per day. Finally, the most liquid vehicle is MSTR, which trades $139m per day.

MSTR’s liquidity premium explains its price premium, just as GBTC’s poor liquidity partially explains its discount. BITO has been impressive for such a small fund to maintain such high liquidity while nearly holding NAV.

Summary

It’s funny old choice bitcoin investors need to make. The link between fees, risk, volatility, value, liquidity, and ownership rights is clear. Investors have to make choices. But if Grayscale eventually do the right thing, and bitcoin goes to the moon, then GBTC is today’s best option. If only every jurisdiction would embrace bitcoin spot ETFs, investors wouldn’t have to face these difficult choices.