Four Good Times to Buy Gold in 100 Years

Disclaimer: Your capital is at risk. This is not investment advice.

The Federal Reserve raised interest rates on Wednesday by 0.25%, as did the Bank of England on Thursday. If they hadn’t, there was a real risk people might think there was an ongoing banking crisis. Imagine that!

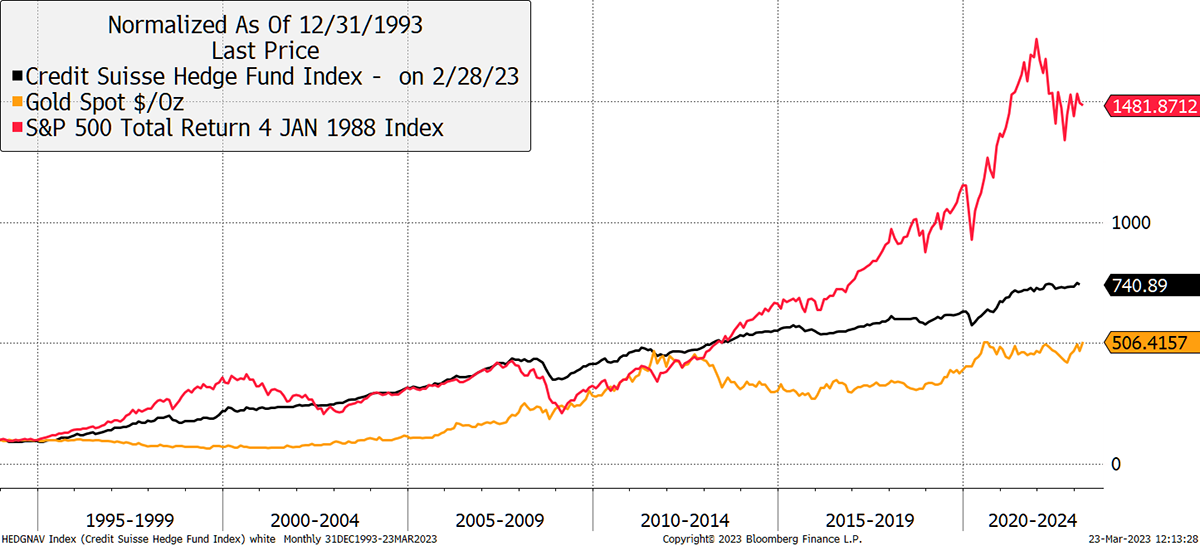

There is nothing new about bubbles and crashes, and before 2008, it was normal for well-constructed portfolios to seek diversification away from bonds and equities. At the time, the main beneficiaries were hedge funds that claimed they could make money in both rising and falling markets. 2008 provided the real-world test, and that claim proved to be optimistic.

Equities, Hedge Funds and Gold

The track record at the time showed how a typical hedge fund sailed through the dotcom crash of 2000 to 2002, having delivered the same returns as the S&P 500 without the volatility. The high fees seemed worth it because the fund managers had market-beating skills.

What is perhaps harder to see on the chart is that hedge funds collectively returned 14% per annum from 1994 until 1999, which was excellent. The next seven years, until just before the credit crisis, saw returns drop to 9%, which still wasn’t bad. Yet since 2008, the hedge fund industry has compounded at a mere 3.6%, which is the same as the long bond ETF (TLT), including last year’s bond market crash.

The bottom line is that hedge funds made high returns during the good times in the 1990s, but when the environment became tougher, they were unable to add much value because the tailwinds turned into headwinds. The investing environment matters a great deal.

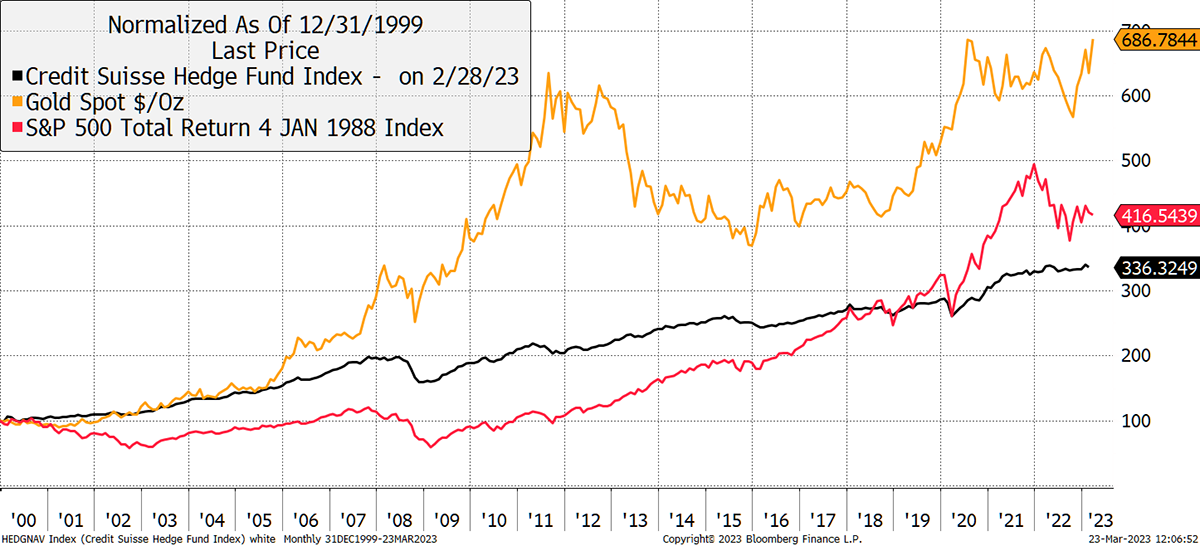

Let’s shunt that same chart forward by six years. Suddenly gold becomes the standout leader of the 21st century, in contrast to its slump in the late 1990s. Investors didn’t need to own gold in the 90s because those were the good times. The stock market was surging, and you could even get 3% more than inflation with cash sitting in the bank. Little wonder gold was irrelevant in the 1990s.

Then things changed. Having been shunned for years, gold had become dirt cheap and was soon to find its way into the spotlight. As “success” depended on ever-increasing amounts of debt, the financial system had shifted from being dynamic to dangerous. In anticipation of bad things to come, gold rallied into the financial crisis and carried on for a few years thereafter. It took a break for a few years while the hot money moved on, only to reawaken for this new era of inflation and another banking crisis (which isn’t a banking crisis, according to the Fed). Gold has responded well once again and is poised to move much higher.

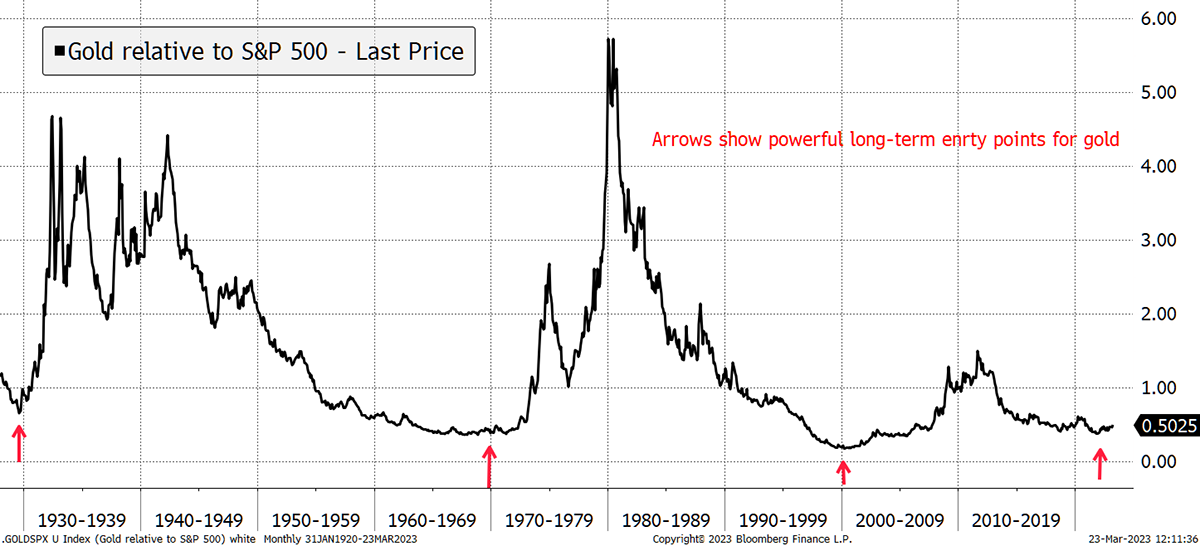

Gold Is King

Over the past 100 years, there have been four compelling times to buy gold. In 1929 it proved to be a saviour ahead of the great depression. Then in 1969, it preceded the great inflation of the 1970s. In 2000, it cemented itself as the most liquid alternative asset of the 21stcentury in anticipation of the credit crisis. And just recently, gold is signalling strength ahead of what looks to be an emerging sovereign debt crisis.

Four Times in 100 Years to Buy Gold

Central banks have been printing money for years, and ever more so since the 1998 Asian crisis. It is no coincidence that gold has appreciated ever since because it cannot be printed faster than it can be mined, which is about 2% per year.

Last year was the greatest year for gold accumulation by central banks in history, and in recent months, we have learnt how the Chinese are at the forefront of that. What choice do they have now that US treasuries have been weaponised?

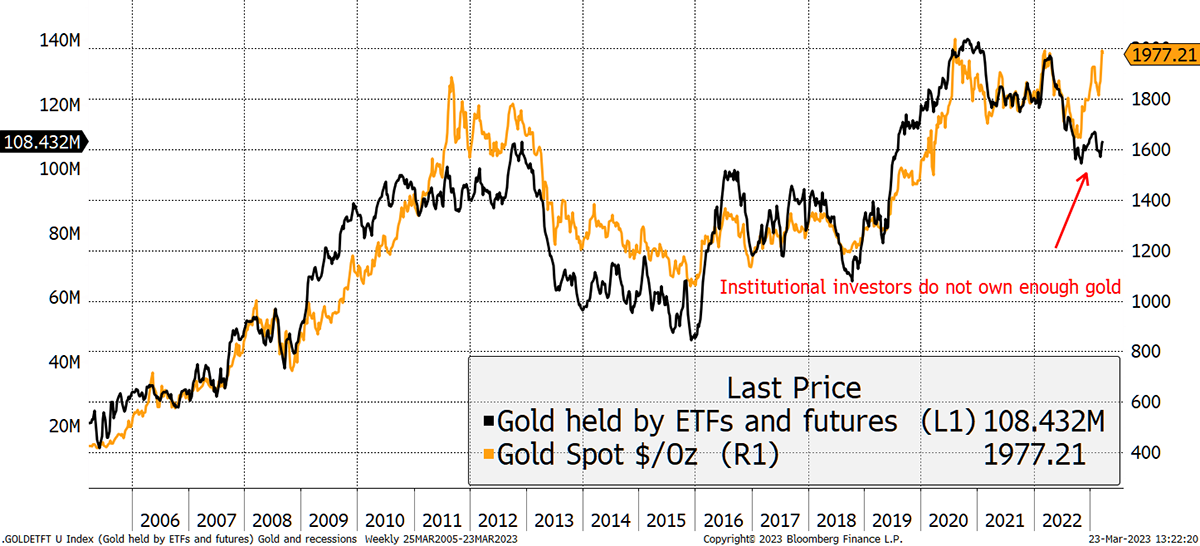

The great surprise is how those portfolio managers, who pre-2008 were so eager for diversification, have shunned gold since 2020. You might have thought it would be a good time to own a little, given the extraordinary uncertainty in the world. But no, institutional investors, who look after other peoples’ money, have become sellers. They have missed out on the recent gold rally and will have to catch up.

Institutional Investors do not Own Enough Gold

I wrote about this in the Multi-Asset Investor on Tuesday and will be writing much more on gold as it moves back into the spotlight. Few doubt the next few years will be tricky times for investors, and gold will have an important role to play in portfolios. It is going to be an interesting conversation.