Investors either take a sceptical view of the world and are prepared for the worst, or they see the risks in plain sight, which they believe are contained. The yen is a controversial trade because you give up yield to own it, yet it has been weak. The idea is that if there was a market crisis, evidence suggests it would surge, and that’s why we hold it. A byproduct of a weak yen has been a strong Japanese stockmarket, which I will investigate. Do a strong stockmarket and a weak currency cancel each other out? I will also discuss the recent move in the dollar and its impact on commodities.

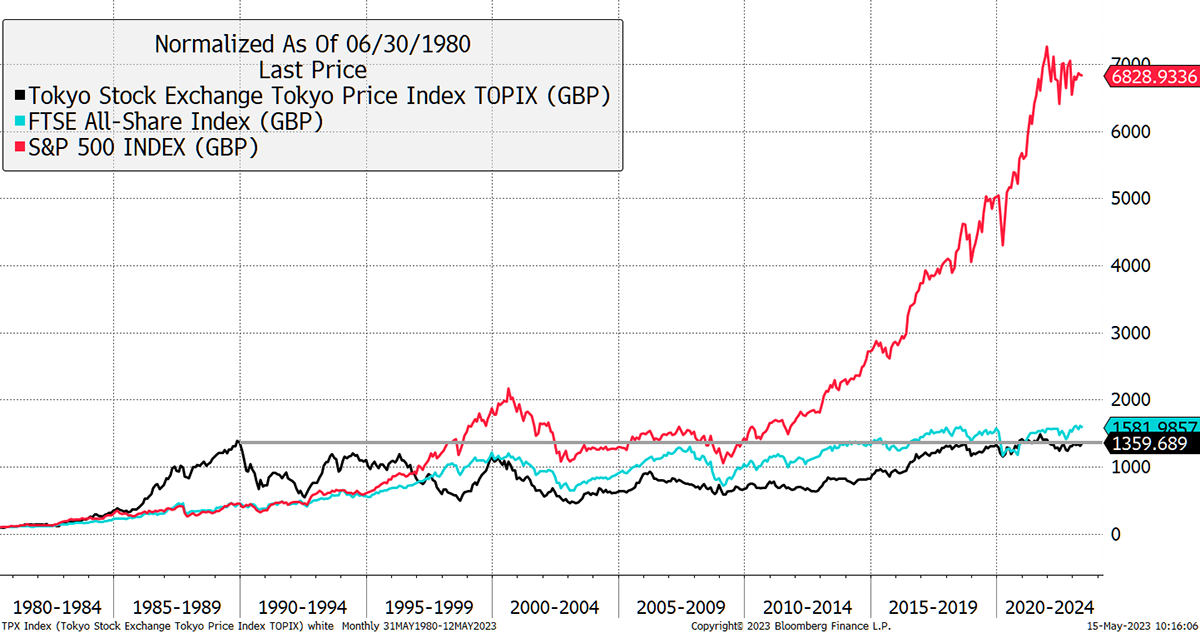

Japanese equities have done nicely this year, up 13.5% in yen, which translates into a more modest 5.3% in GBP, about the same as the world index. I’ll run through a few charts as a quick reminder of how we got here. First up shows the historical perspective going back to 1980, with US equities marching ahead over the past ten years.

Japan, the US and the UK since 1980

Source: Bloomberg

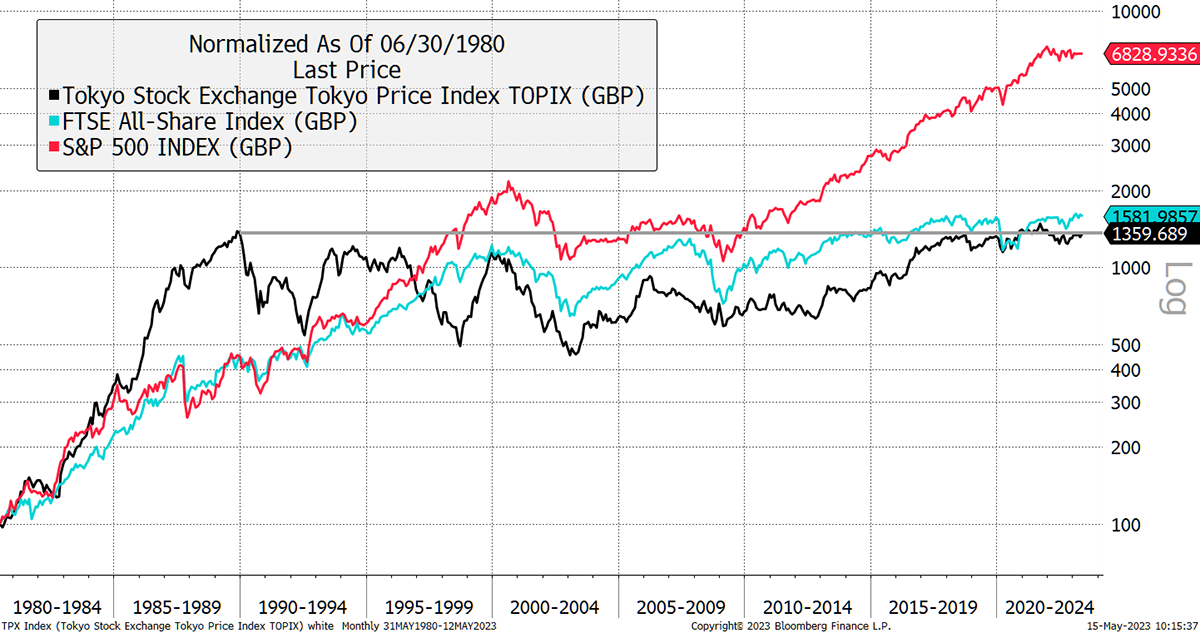

This is why they invented log charts, which tell the same story but from a very different perspective. There is a greater weight to what happened in the 1980s than recently as percentage moves are treated equally.

Japan surged in the 1980s, peaking in 1990 at levels some say was the greatest bubble ever seen. At that time, UK and US equities practically mirrored one another. Since 1990 Japanese equities have struggled to break away towards new highs, while UK and US equities have carried on, mainly US.

Japan, the US and the UK since 1980 (log)

Source: Bloomberg

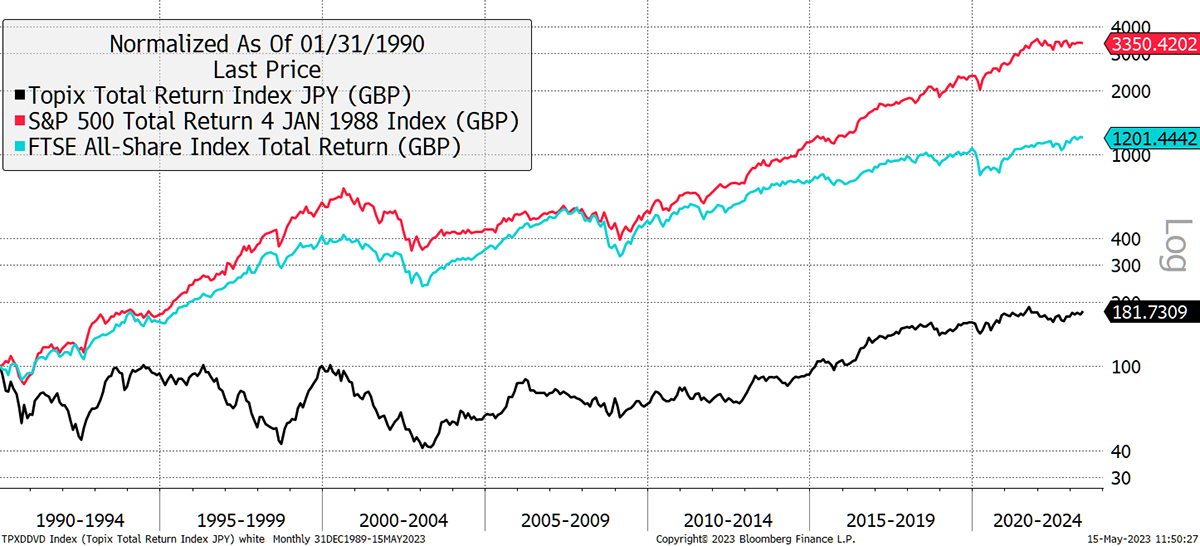

Bear in mind that these markets are being shown in GBP without dividends. When I add them back in, the UK has been much stronger as the dividends have been higher, but the US has still broken away over the past decade. What is so remarkable is how Japanese equities have made no money in 33 years, while their dividends have averaged just 1.4%. Today it is above 2%, but still below most major stockmarkets.

Japan, the US and the UK since 1980 (log total return)

Source: Bloomberg

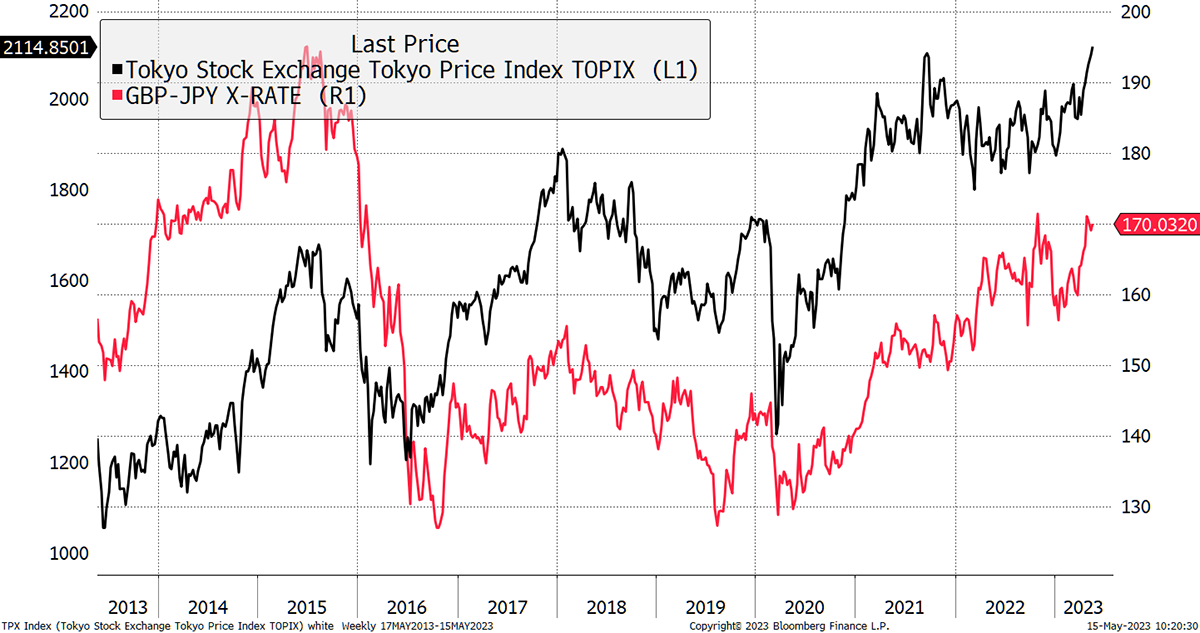

As you know, the yen has been soft, yet it has great potential should stockmarkets take a turn for the worse. It was often said that a weak yen was good for the Japanese market because it’s an export-driven market. The chart below shows the Japanese stockmarket and the currency, which have been highly correlated. When the pound (or dollar) has risen against the yen, the Japanese stockmarket has historically done well.

Japanese Stocks Like a Weak Yen

Source: Bloomberg

In truth, this idea holds true for most stockmarkets, which appear to be doing well when their currency is weak. See Argentina, Turkey etc.

The Japanese market may be rising, but if the currency is losing value, it’s potentially running to stand still. The way to see through that is with currency-adjusted price relative, which is shown below. For Japanese equities to be leading the world, this line must be rising, something it has rarely done since 1990.

I have anticipated a recovery twice in a decade, in June 2019 and August 2021. Both rallies soon fizzled out. With the 200-day moving average turning up (red line), could this be the one? If it is, it would be the first time since 1990 that Japanese equities lead the world.

Japan Relative to the World

Source: Bloomberg

A rally in Japanese equities is long overdue. The valuation measures are attractive compared to other markets, but with a rapidly ageing population, there’s not much growth to look forward to.

Should I recommend Japanese equities and fund the trade by reducing our position in yen (JT13)? The answer is absolutely, just not yet. Right now, I would prefer to hold yen, and if or when we do get the surge, we sell yen and buy (Japanese?) stocks. That would be a double whammy born out of bad news.

The Dollar Rallies

And that bad news might be coming sooner than we think as the dollar is starting to rally again, which can be painful for stockmarkets. The buoyancy we’ve had since October has coincided with a dollar fall. This is hugely important for markets.

The dollar is expensive compared to other currencies, but premium valuations are all around us, and we must live with that. The worry is the US dollar index has not made a new low for three months and has recently shown strength. That means we should be prepared for a dollar rally, which may tighten financial conditions even further.

Beware the Strong Dollar

Source: Bloomberg

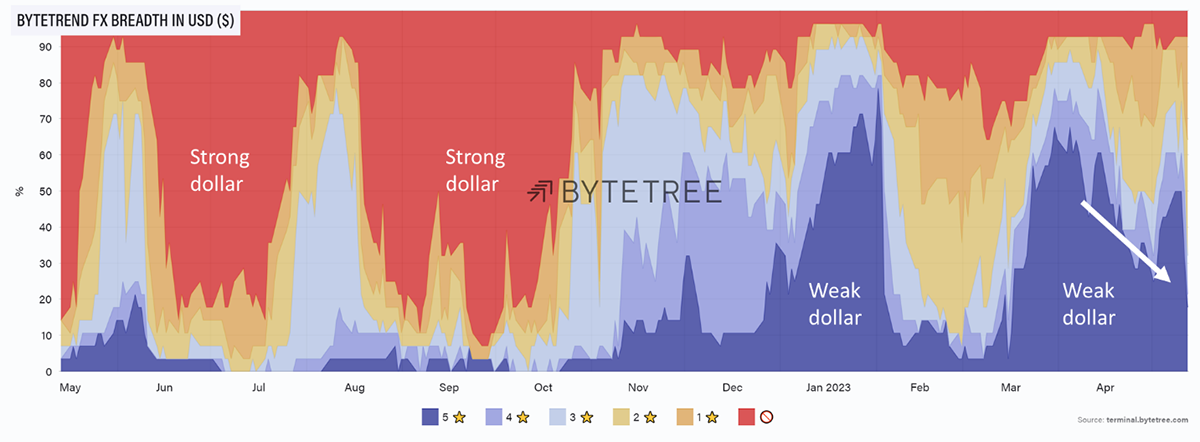

I have used the same chart style that I use for ByteTrend. In the FX section, the breadth chart combines the above chart with that of all major currencies. In January, 78% of all currencies were in a strong uptrend vs the dollar, and as of last Friday that has dropped to just 18%, shown by the arrow (not that clear). This advanced technical analysis is warning us to be ready for a dollar rally.

Fewer Strong Trends Against the Dollar

Source: ByteTree Terminal

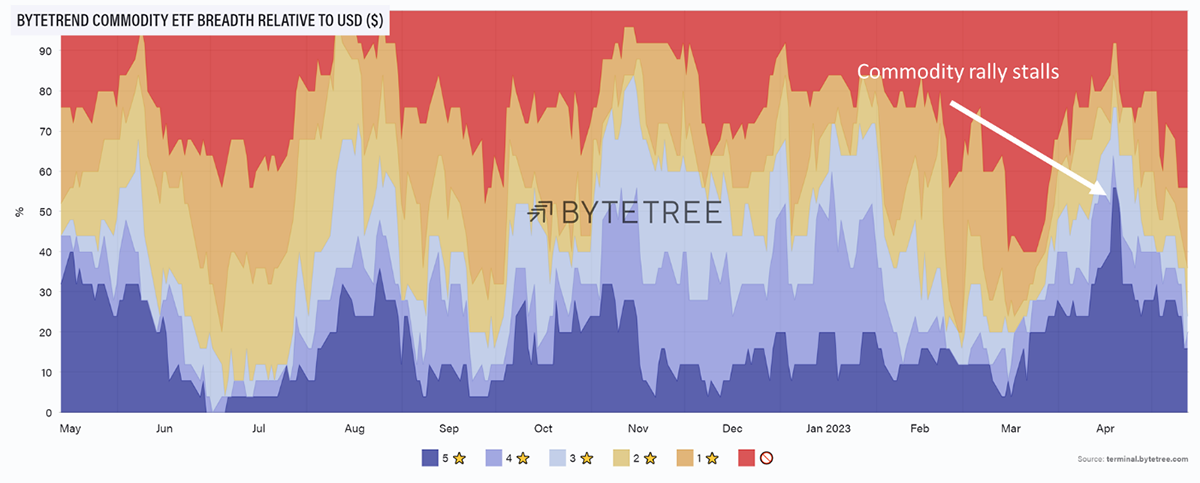

Just as fewer currencies are beating the dollar, fewer commodities are too. The spring rally was full of promise but has subsequently hit a wall. It is too early to say the bear has returned, but both copper and oil have come under pressure. Once again, the 60% of commodities in strong trends has reversed to just 20% in short order.

Commodity Breadth Dented

Source: ByteTree Terminal

If the economy is softening and the dollar is rallying, it is inevitable that commodities will come under pressure. Yet it is also inevitable that any weakness in commodity prices will prove temporary as they stand a good chance of leading the next up-cycle. To fulfil our governments’ plans, the world needs lots of copper and oil, and current prices are too low for that to be supplied.

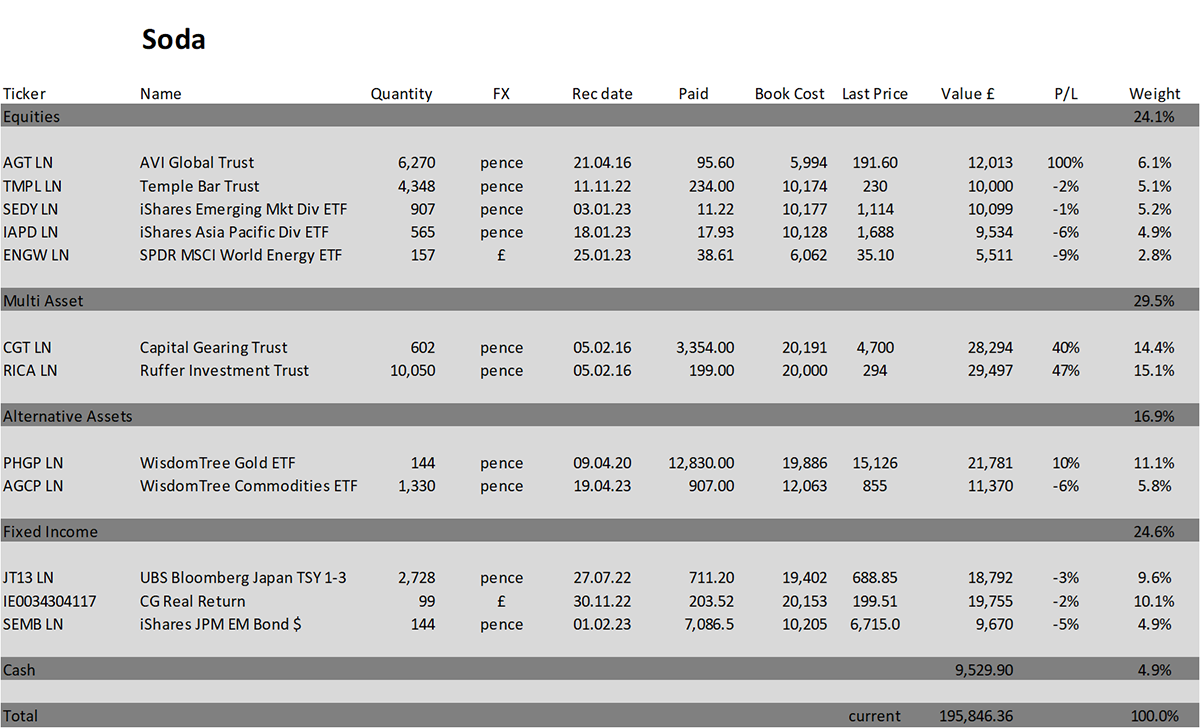

Commodity exposure in Soda comprises 11.1% gold, 5.8% commodities and 2.8% in energy stocks. Total 16.9%.

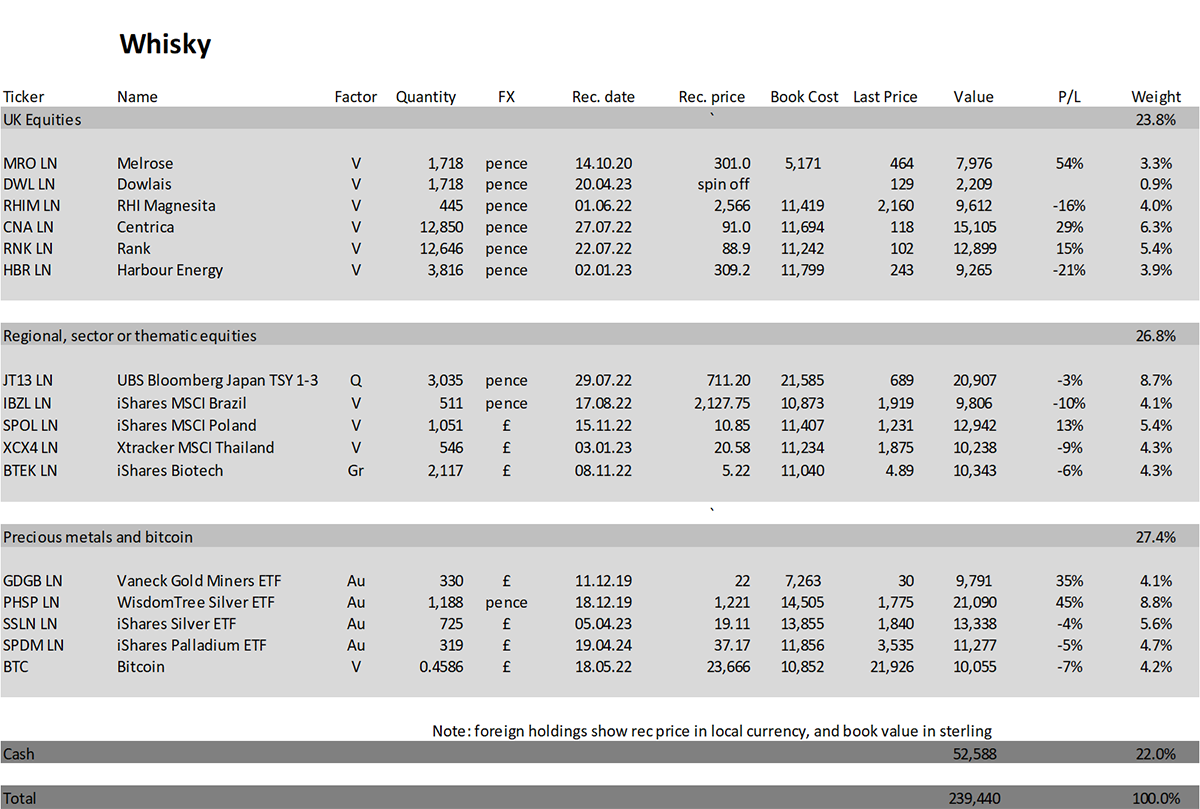

Commodity exposure in Whisky is 14.5% silver, 4.6% palladium and 4.1% gold miners. Total 23.2%. You could add some of the stocks too.

While we are discussing commodities in Whisky, it’s London Platinum Week, the largest conference on platinum, palladium and other metals. Maybe some interesting stories will emerge. I reiterate, the market is heavily short on palladium.

I am reluctant to sell commodities, but a strong dollar combined with a soft economy could put them under pressure. Having thought about this, I will take no action this week but will not hesitate to send a flash note should things turn nasty.

Action:

No action.

Postbox

I have come across predictions of a coming deflation several times over the last couple of months, based on various models (can’t remember which ones, though!). I struggle to see how such a scenario could play out but I do not wish to dismiss it just because I disagree with it (I am sure the printing machine wouldn’t take long to go to next gear). What is your view on the probability of this happening? This would likely be very bad for assets such as gold and TIPS? Thanks for your insight, as always.

It is possible, as are many different and painful scenarios. The biggest risk seems to be coming from private equity and real estate, where these “private debt markets” cause a major credit event. Basically, if the system cuts off credit, we end up with debt deflation which is financial oblivion, like in the 1930s. I think investors are relaxed, not because it’s not a real risk, along with the US debt ceiling, but because they have become used to endless bailouts.

It is so horrendous that it will never happen. Famous last words. TIPS won’t like it that much, but nor would most investments. Equities would fare worse. If this risk escalates, I will very likely reduce inflation-linked bonds, but the second the authorities print money, you’ll wish you owned them again!

It’s a scenario where cash is king, especially the yen.

Many years ago, investing in shipping containers used in international trade provided a decent yield from the rental income. Although sensitive to World trade volumes and interest rates perhaps, could this be a worthwhile option at some point in the cycle? Your thoughts are much appreciated, as always, particularly as my lack of a bearskin nevertheless does not ensure clarity of investing vision.

I don’t know about containers, but pallets are a good proxy. Brambles (BXB AU) bought Chep (global pallet business) off GKN (nowadays our own Dowlais DWL) over a decade ago. An interesting time to raise this as it just made an all-time high. Sadly, it appears to be an ex-growth business with a lack of cash flow. I haven’t followed it closely, but back in the day, it always seems to lose the pallets. I’m not sure how they solved that.

A New High

Source: Bloomberg

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 2.2% this year and is up 95.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.2% this year and up 139.4% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The worst bit is the waiting game, as markets are slow to reveal themselves and almost always end up somewhere other than where everyone thinks they will be.

It’s going to be a long summer, but at least the sun is out.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd