ByteFolio Update 56 | ByteTree's Crypto Leaders

Second-tier coins and tokens continue to trade very poorly. While BTC has had a great run this year, boosted by its macro identification as a form of “hard” money, the market is clearly unhappy with the rest of the sector. We cannot deny that crypto remains a highly speculative asset. Indeed, the recent increases in fees in the Bitcoin and Ethereum networks are, in large part, the consequence of the latest meme crazes.

It probably goes without saying, but because crypto is speculative, its price patterns are supremely important. Constant price erosion will gradually take traders out of the game. That is why we constructed ByteTrend, not just as a way to generate ideas but also to act as a risk tool. And the risk tool says to stay on the sideline, as far as altcoins are concerned.

There are a couple of possible reasons why this might be the case at the moment. First, the US regulatory situation continues to be deeply unhelpful. Movement between crypto and fiat has become ever harder, and where it is possible, the anonymity that used to exist has now largely disappeared because of the AML/KYC requirements. This reduces the incentive to get involved.

Second, the increase in interest rates has entirely changed the risk profile of investing in speculative assets. Why invest in something that is almost totally unproven when you can get 5% in the bank? Crypto projects, for the most part, need the oxygen of fiat money to pay developers and grow ecosystems. If that funding is seen as drying up, no wonder investors are quietly tip-toeing away. In all new technology markets, there is eventually a “show me the money” moment.

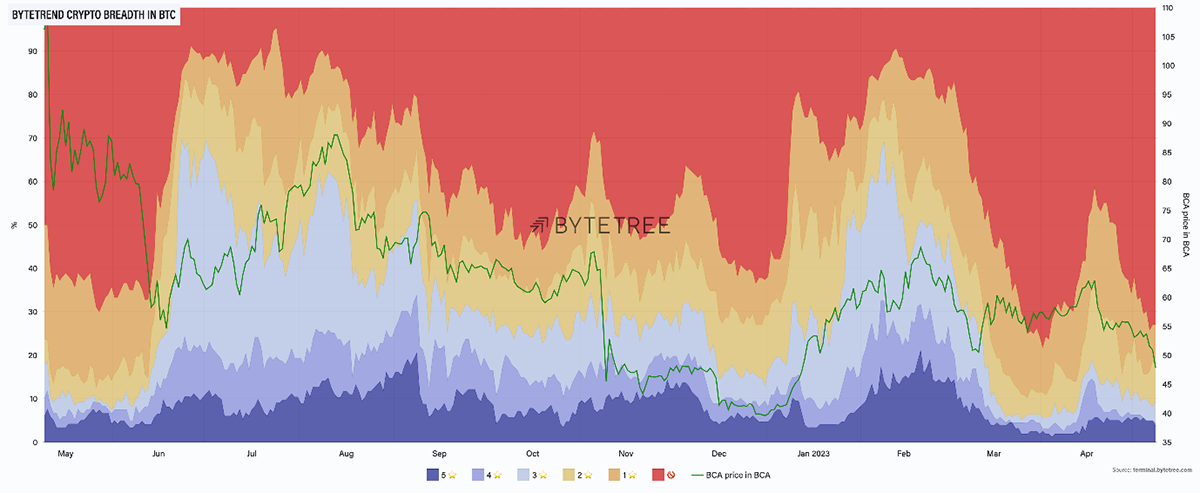

The following chart illustrates the altcoin weakness. The red sky shows how strong BTC has been against the ByteTree Crypto Average price (BCA). The green line shows how the BCA has been rolling over.