ATOMIC 88;

It’s going to get ugly out there, but there is no evidence that Bitcoin is the problem. It trades at fair value, halving is just eight months away, and if the Fed balls this up, which they will, they’ll print their way out of trouble. What matters is that if the financial markets fall, Bitcoin is no worse. If that happens, perceptions will change for the better in the next cycle.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Under pressure |

| On-chain | Stable |

| Investment Flows | The Reawakening |

| Crypto Stocks | PayPal launches a stablecoin |

| Macro | China crisis |

Technical

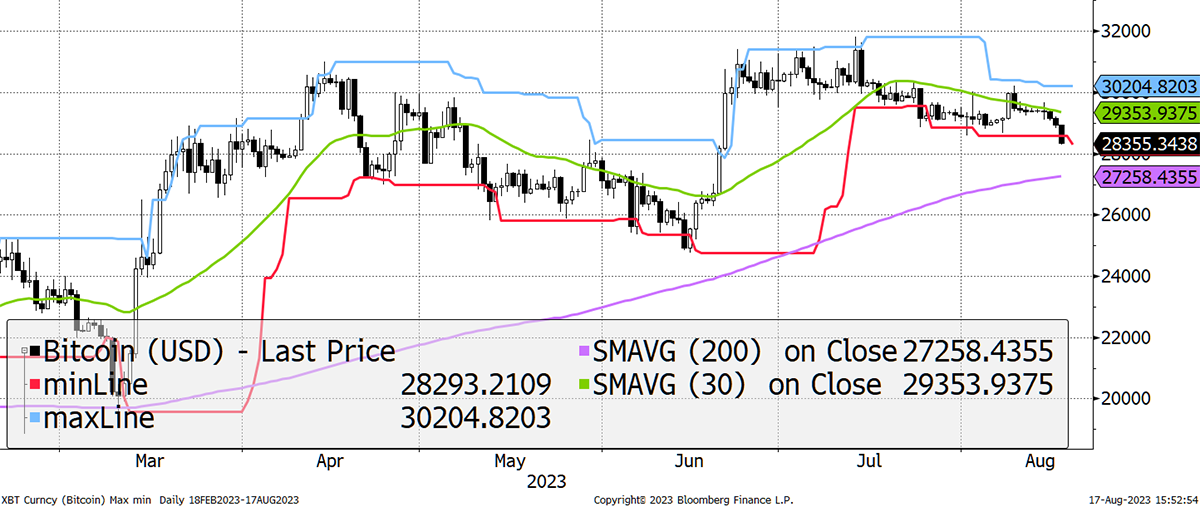

The charts are cooling off, and this feels like the year that the Fed doesn’t come to the rescue… that is, until they ball things up. Bitcoin in USD is now 2 of 5 on ByteTrend, with the only positive being the rising 200-day moving average, with the price above.

BitUSD - Bitcoin in Dollars - ByteTrend Score 2 of 5

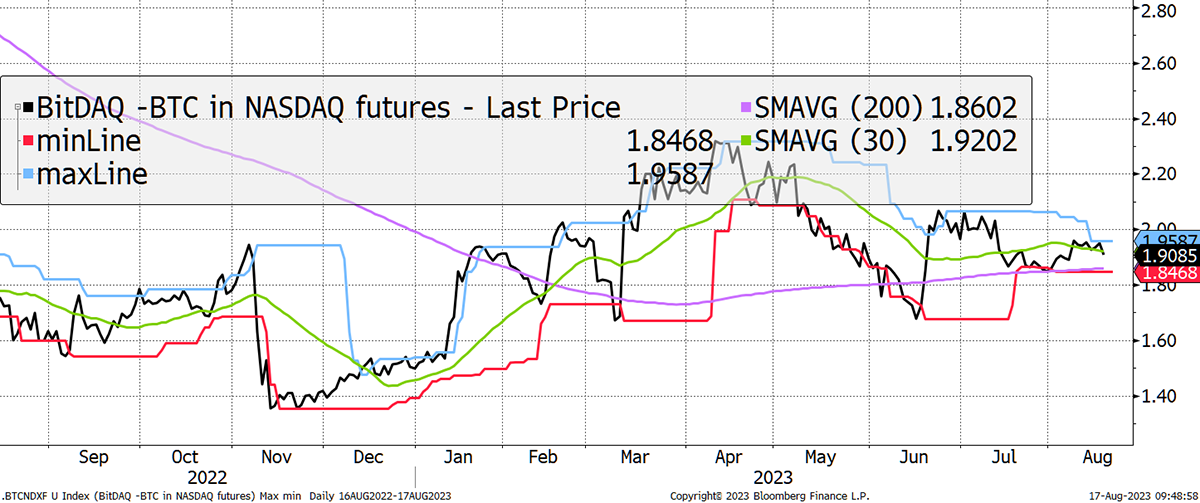

It’s a slightly better picture against the technology sector because, unlike the dollar, tech is sliding too, albeit early days. The 200-day moving average is still positive (slope), which reminds us that Bitcoin may be no worse than tech should financial markets slide. It remains my longer-term view that Bitcoin will leave the Nasdaq for dust over the next decade.

BitDAQ – Bitcoin in Nasdaq - ByteTrend Score 2 of 5

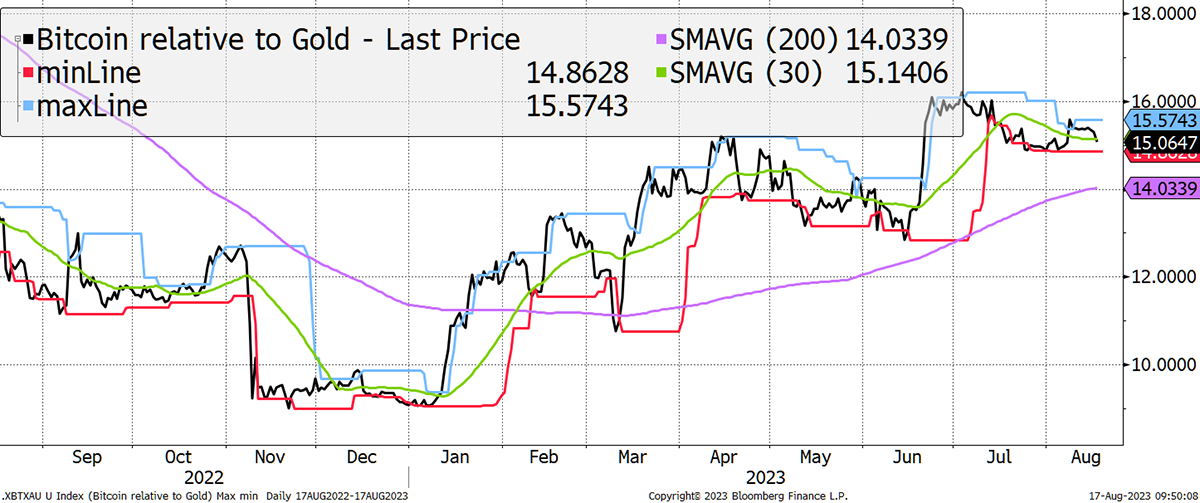

Versus gold, Bitcoin is strong as gold feels the full force of rising bond yields. Bitcoin should be more resilient under current conditions because it responds positively to higher rates and inflation. The uptrend in gold looks good, but if the going gets tough, gold will likely prove to be more resilient. Not only is it defensive in equity bear markets, but the upward pressure on rates will inevitably cool, paving the way for a gold relief rally.

BitGold – Bitcoin in Gold- ByteTrend Score 3 of 5

According to the MicroStrategy Premium, which is over 60%, sentiment is bullish. Too bullish, perhaps, but Saylor will keep issuing new shares and buying BTC, so long as that remains. The message from the market is that Bitcoin is not currently a contrarian trade.

This is also confirmed by Grayscale, where the discount has narrowed from 50% to 25%. Still a discount, but the point here is that the market has shortened the odds that the US ETF will get regulatory approval. And they should.

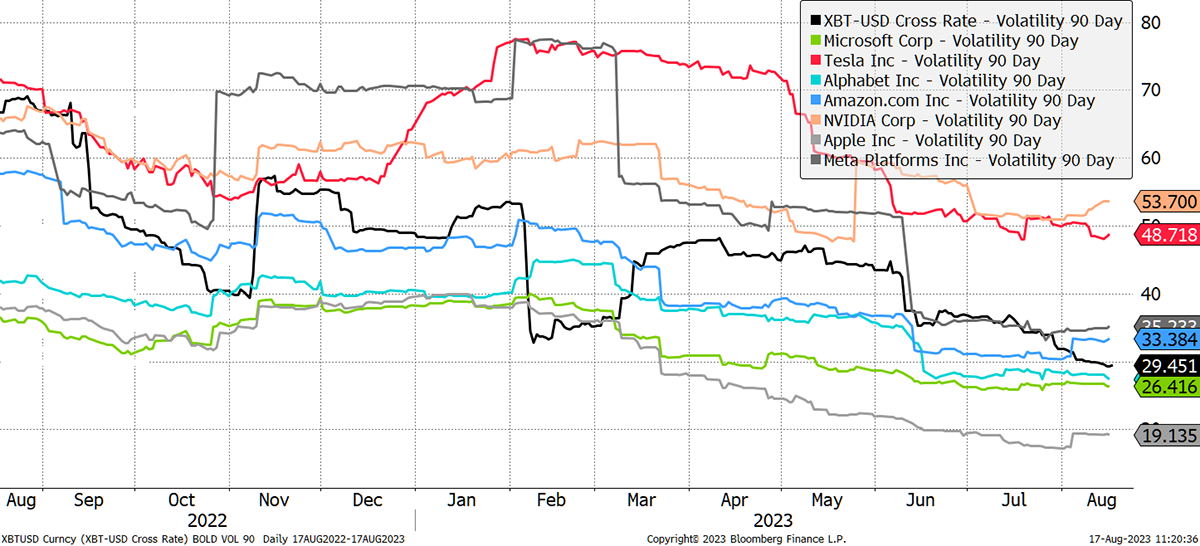

They say Bitcoin is volatile. I show the Magnificent 7, the Top 7, the tech bubble or however you describe these madly overhyped stocks. Bitcoin is marginally more volatile than Google and Microsoft, generally considered to be high-quality equities. Yet it is less volatile than Tesla, Amazon, Nvidia, and Meta. Does this surprise you?

The Big 7 and Bitcoin Volatility – Past Year

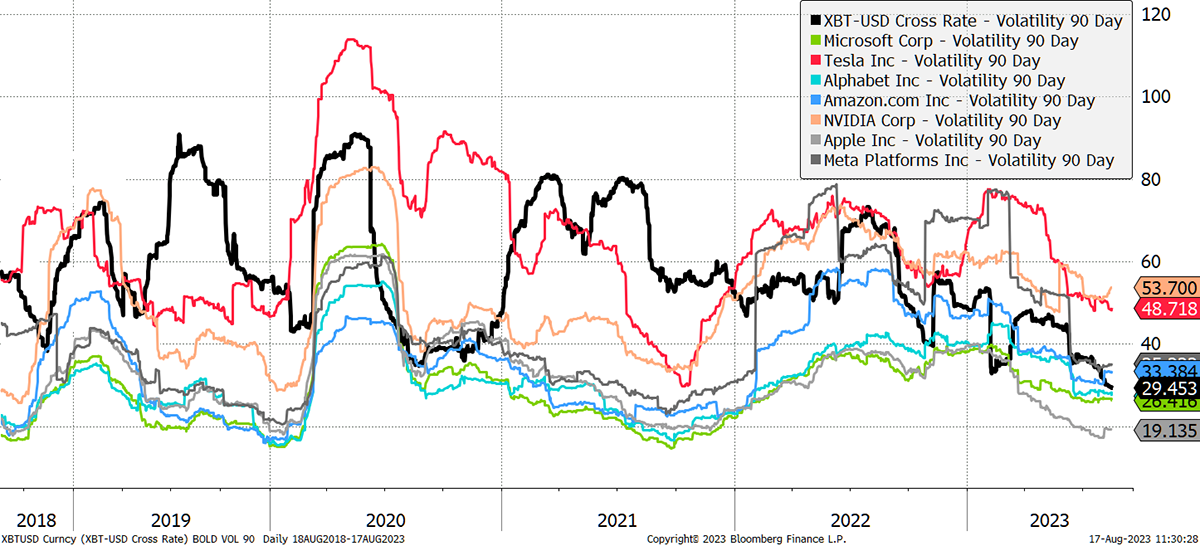

A coincidence, and temporary, I hear the cynics say. I believe it is structural, as the volatility has been falling since 2020 (and 2010). Furthermore, the devastating 2022 Bitcoin bear market saw volatility broadly in line with 4 of the Top 7 stocks. That is not something to fear.

The Big 7 and Bitcoin Volatility – Past Five Years

The regulators and the traditional investment community have got Bitcoin completely wrong. It is not ultra-high risk, but at most, medium-high risk and on its way to medium. Could the forthcoming mayhem be a period where Bitcoin makes its name? I certainly hope so. When it does, expect several hundred billion dollars to be invested in a Bitcoin ETF near you.

On-chain

Short-term network activity has declined and is OFF in the model, but there is no cause for alarm following the surge early this year. This valuation model looks at the total dollar equivalent transactions over the network and is aligned with a fair value of $29,535, which is close to the current price. That said, the network has tailed off for the time being, and I would not expect further progress in the near term.

Bitcoin Fair Value

The fees have also turned OFF, which can be explained by the unwinding of the ordinal bubble from earlier this year. This caused a transaction spike which has eased back but has settled at a higher level than at the start of the year.

The fees hit $100 million per week, which has never been sustained in the past as the cost per transaction becomes unpalatable and unrealistic. This has proved true once again. It should not be a long-term obstacle to Bitcoin’s growth because Layer-2 solutions will enable much more network capacity.

The miners earned $303 million from transaction fees last year and another $8.1 billion from the block reward (mining new BTC). Although down from the 2022 peak, it is comfortably ahead of the peak of the 2017 era, which provides further evidence that the underlying Bitcoin ecosystem continues to grow. Better still, it just turned up on a YoY basis.

With the miners receiving $8.4 billion over the past year, the same amount must have flowed into the network. That’s because the buyers and sellers must always match.

Investment Flows

Last month, I reported some modest progress on the Bitcoin ETF flows as 25k BTC were added. This month, there’s a 3k BTC outflow, which is no cause for alarm. I see this stability to be bullish. Institutional investors can’t sell what they don’t own.

While we are on flows, spare a thought for Gold ETF flows, where 17 million ounces have left the vaults since April 2022, which is 16% of the total. To put it another way, that’s $20 billion. Peak assets coincided with a real interest rate (10-year) of -1%. The outflows began when this real rate crossed above 0% in 2022. Notice how real rates haven’t impacted Bitcoin, which tends to like rate hikes because it is a growth asset.

Since the ETFs haven’t done much for the flows, we still need to pay those miners. Fortunately, Block (SQ), run by Jack Dorsey, is proving to be a major source of Bitcoin demand. Their Bitcoin sales grew over the quarter to $2.3 billion. These companies offering a compliant way to buy Bitcoin are making headway and helping to underpin the Bitcoin price.

As I have said before, Gold has a value buyer as when the price drops, the central banks, and others, step in. Bitcoin never used to have this, as the market was dominated by momentum traders, but a value buyer seems to be emerging. The tell is the falling volatility, which goes hand in hand with less risk and improved asset quality. The services offered by companies such as Square are instrumental in this role.

The more, the merrier, and we can now add PayPal to the list.

Crypto Stocks

PayPal has launched a stablecoin (PYUSD), which will be another credible addition to the list of grownups in the crypto space. It is built on Ethereum and will enable:

- Transfer PayPal USD between PayPal and compatible external wallets

- Send person-to-person payments using PYUSD

- Fund purchases with PayPal USD by selecting it at checkout

- Convert any of PayPal's supported cryptocurrencies to and from PayPal USD

Basically, PayPal wants to stay relevant and recognises the importance of digital cash. They know that shuffling around bank deposits won’t cut it in a digital age. The stablecoin is literally electronic cash, as it is totally within your control. In contrast, digital deposits held in a bank can be “Nigel Faraged”. Not only that, but digital deposits lack the speed and programmable capabilities inherent in stablecoins.

I show the stablecoins on this excellent dashboard created by 21Shares. The biggest outflows came from Circle (USDC in blue), and the regulators sunk their teeth in. USDC aside, the market has been quite stable. Tether (USDT in green) remains the beast.

It will be interesting to see how PYPL progresses. They have a vastly superior marketing machine to any of the existing stablecoin issuers. I suspect they introduce new customers and take share from USDC, who are the other squeaky clean, regulated coin.

Macro

Last month the dollar was falling, but sometimes things change quickly. DXY scored 0 out of 5, and as of today scores 4 out of 5. This is spooking the financial markets because a dollar rally is never much fun for investors.

Dollar Strengthens

Putting things into context, the rising bond yield (falling price shown in red) is pulling prices down.

Bonds Discover Gravity

But the real problem is that it could get much worse. We either have a recession, in which case the bond yield stabilises because rates start to fall. Or we don’t, and the yield curve normalises. That means the 10-year yield at 4.4% rises to 5.5% or higher, which is where cash rates are.

Will Bond Yields Melt Up?

Does anyone remember what happened in October 1987? The stockmarket crashed, caused by a preceding melt-up in bond yields.

The 1987 Crash

But the Fed have the ability to stop this carnage, but their credibility is on the line. And credibility is their most valuable asset. Although BOLD (Bitcoin & Gold) has the closest fit with the world money supply, Bitcoin is clearly close behind. The availability of money is contracting, and things could turn nasty.

Shrinking Money Supply

Summary

It’s going to get ugly out there, but there is no evidence that Bitcoin is the problem. It trades at fair value, halving is just eight months away, and if the Fed balls this up, which they will, they’ll print their way out of trouble. What matters is that if the financial markets fall, Bitcoin is no worse. If that happens, perceptions will change for the better in the next cycle.

All paths lead to Bitcoin (and Gold).

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.