Trade in Whisky;

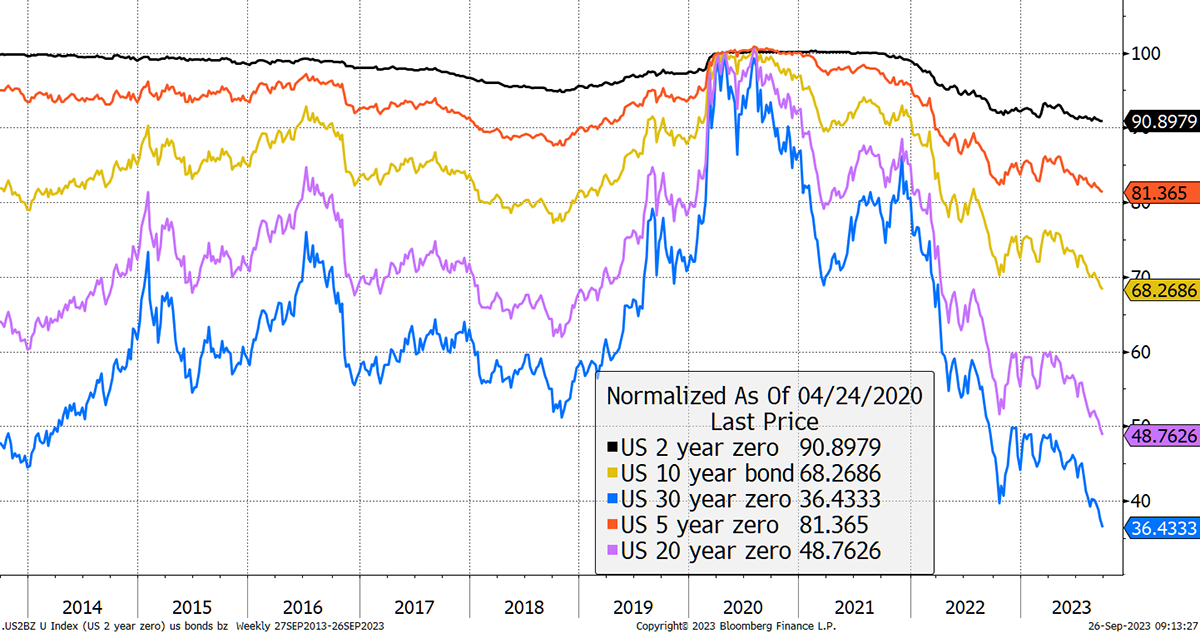

The price of US treasuries is falling again and rapidly. I show the short-dated to long-dated bonds rebased to $100 on their highest day in April 2020. The 30-year bond is now down 64%, while the 2-year bond is down 9%. For a developed market, this sort of behaviour is highly unusual but logical when you hike interest rates so rapidly from a low base.

US Treasuries Are Still Falling

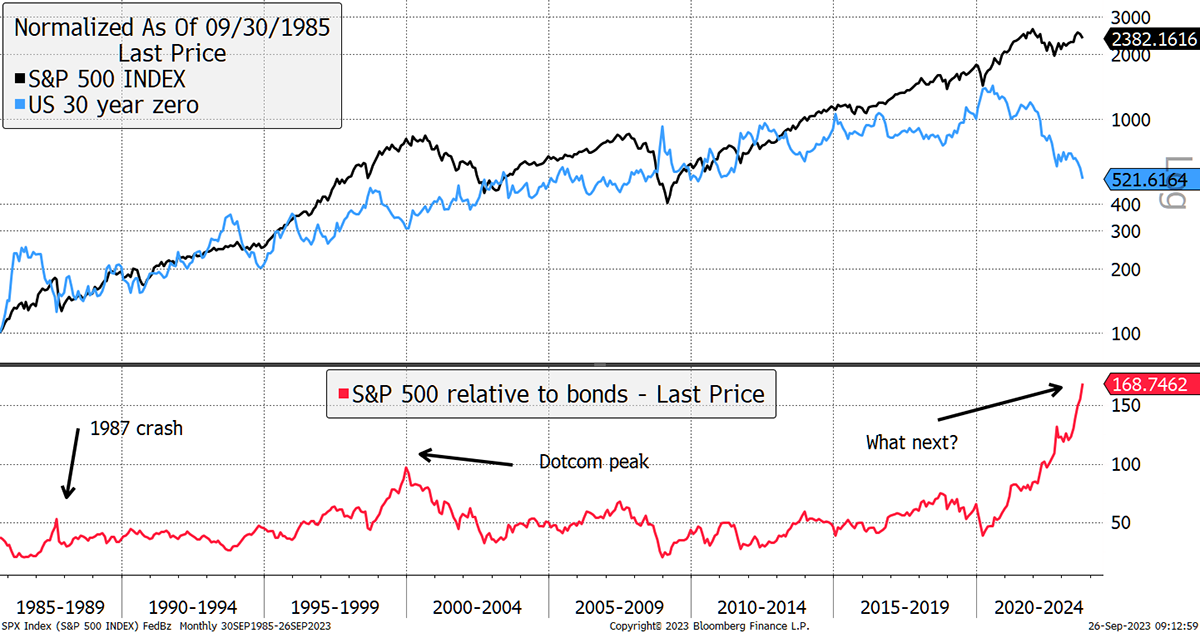

To remind you of the great stretch between bonds and equities, it’s getting ridiculous. Equities haven’t made a new high above the 2021 high, but bonds have crumbled, making their divergence extreme. I started highlighting this chart when the red line crossed above 100. It’s now 168, which is going some. Previous high divergences in 1987 and 2000 proved to be prescient. Is this time different? I very much doubt it.

The Great Stretch Between Equities and Bonds

The assumption by the markets was this divergence didn’t matter because the Fed would cut rates when they smelt a recession, but this idea keeps being pushed forward. The market doesn’t expect cuts until well into next year. Ironically, the problem for markets (not the economy) has been a lack of recession that was widely predicted last year.

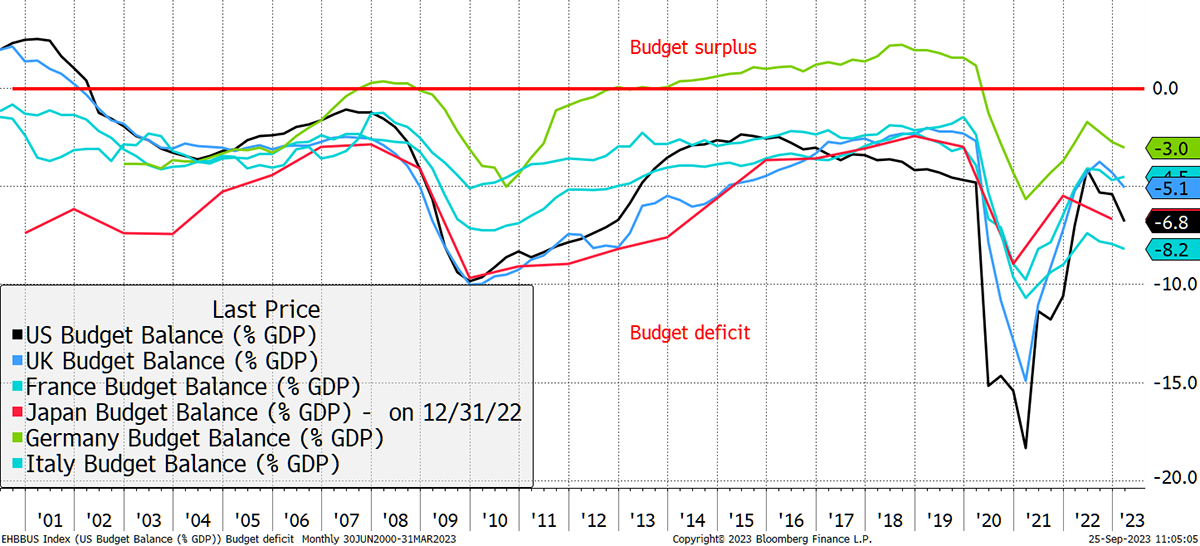

An impending recession ought to encourage investors to buy bonds. They are doing that, but not nearly enough, because it could be that there are simply far too many bonds being issued. We currently have a fiscal deficit similar to levels seen during recessions, when the tax receipts shrink. Governments are spending too much money, in part due to costly programmes but also due to the exploding cost of servicing debt.

Government Deficits Are the New Normal

US debt crossed $33 trillion a week ago and has grown by $100 billion since. This money is supporting the economy and therefore delaying the recession. On the one hand, we have huge monetary tightening, and on the other, massive fiscal stimulus. Little wonder the markets seem to be confused.

To buy bonds, we need to be sure yields will fall or at least remain stable. For that, we need more demand for bonds than supply. Perhaps the old rules no longer apply, and Western governments can no longer borrow as much as they like.

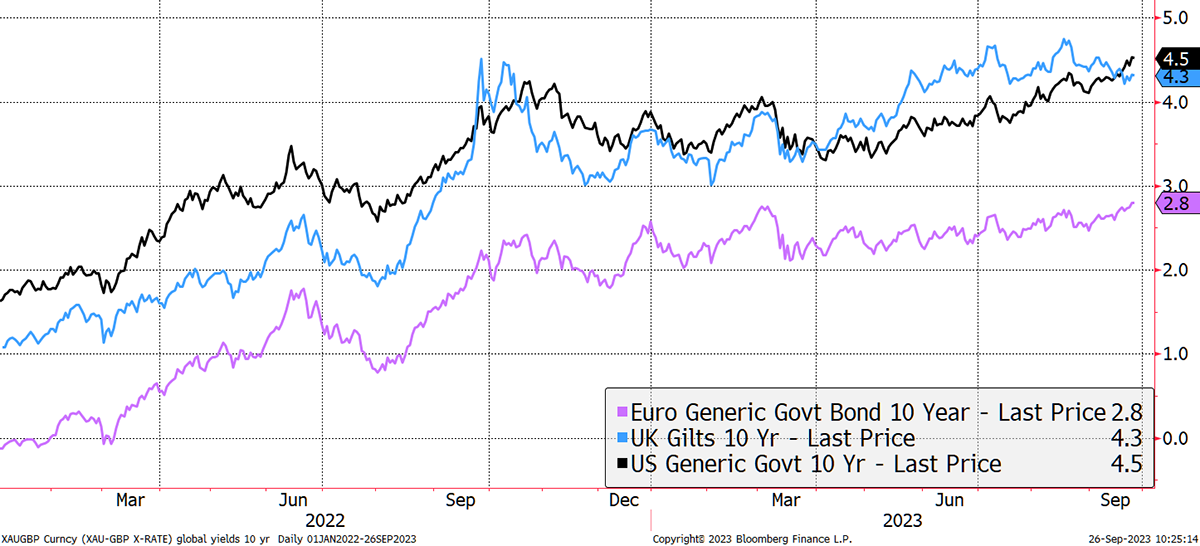

Finally, on this point, the yields are still rising in the US and Europe. It is hopeful to think UK gilts can fall in the face of that. Gilt yields were the highest following the Truss/Kwarteng budget a year ago. Now, the US yields have caught up, and I would think European yields are in a very bad place given interest rates are 4%, which is much higher than the 10-year bund yield at 2.8%. If European yields matched US or UK levels, which historically they should, the 10-year would lose 15% of its value, and the 30-year bond nearly 40% from here.

10-year Yield in Major Western Economies

We know things are starting to bite because the dollar is rising again. Stress is on the up, and we are in the correction season.

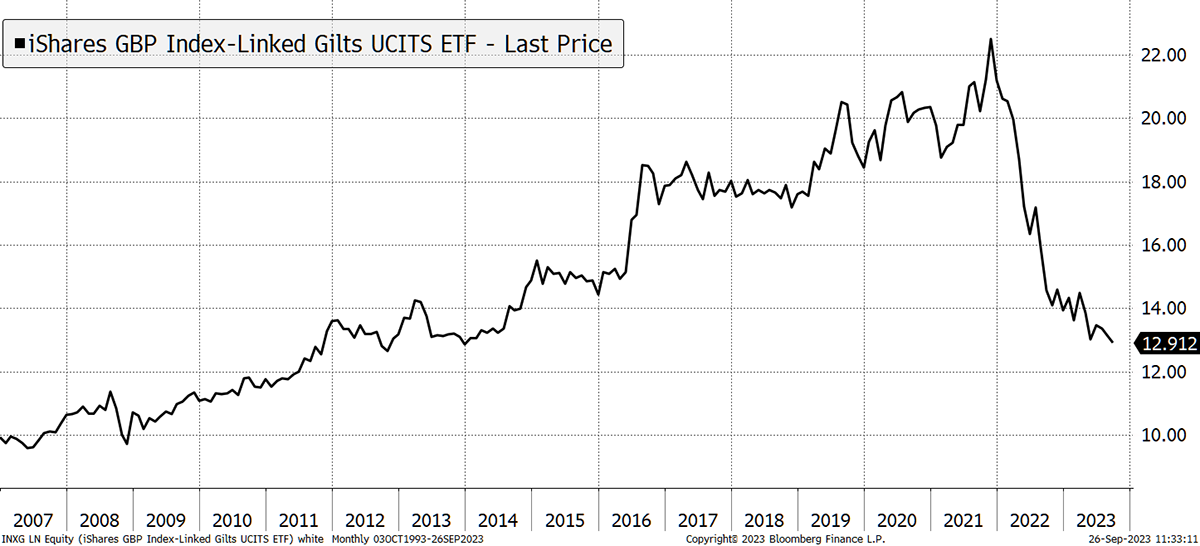

This year, I have been highly focused on survival but have not been able to let go of the problems in the bond market. The bonds I like are index-linked bonds, which lock in real returns. These offer excellent value, but I can’t rule out another chapter in this bond crisis. A couple of weeks ago, things were looking up. Now they aren’t, and we still have to wait.

Index-Linked Gilts Offer Good Value, but Prices are Still Falling

The portfolios remain defensive.

Trade in Whisky

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd