ATOMIC 90;

If you went back to April 2021, when Bitcoin was trading above $60,000, and told them what was coming, including the continued institutional absence from the space, few would guess a price above $10,000 today. Perhaps even $1,000. Yet it trades above $27,000 and is beating the stockmarket in a crisis. This remarkable asset is the real thing.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Roll Yield Spikes |

| On-chain | Sluggish, but Halving Is Close |

| Investment Flows | Soft |

| Crypto Stocks | Blockchain Equity ETFs versus MicroStrategy |

| Macro | Resilience Against Rates |

Technical

Bitcoin futures look good, especially when you compare them to the crisis in the bond market. There’s heavy overhead resistance at $30,000, which will be overcome sooner or later. More importantly, the price is above $25,000, which was the overhead resistance from May 2022 to March 2023. If we can hold that, which we probably will, Bitcoin is very much in a bull market, albeit a quiet one.

BitUSD - Bitcoin in Dollars - ByteTrend Score 5/5

Think of everything thrown at Bitcoin over the last couple of years, starting with China’s ban in April 2021. Then there were Western regulators, frauds and hype cycles. If you went back to April 2021, when Bitcoin was trading above $60,000, and told them what was coming, including the continued institutional absence from the space, few would guess a price above $10,000 today. Perhaps even $1,000. Yet it trades above $27,000 and is beating the stockmarket in a crisis. This remarkable asset is the real thing.

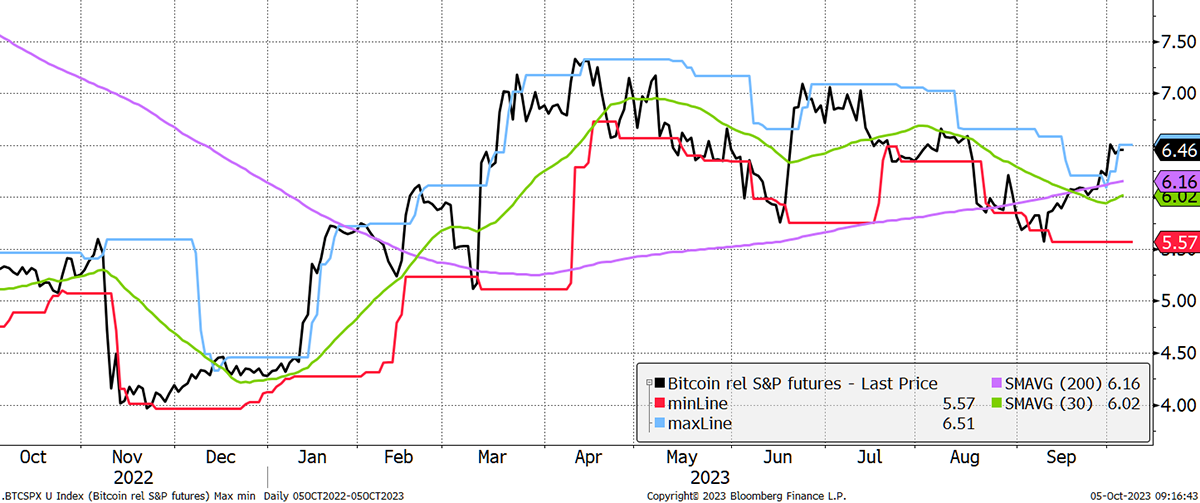

Against the S&P 500, which has held up well, Bitcoin is close to a 12-month relative high.

Bitcoin in S&P – ByteTrend Score 5/5

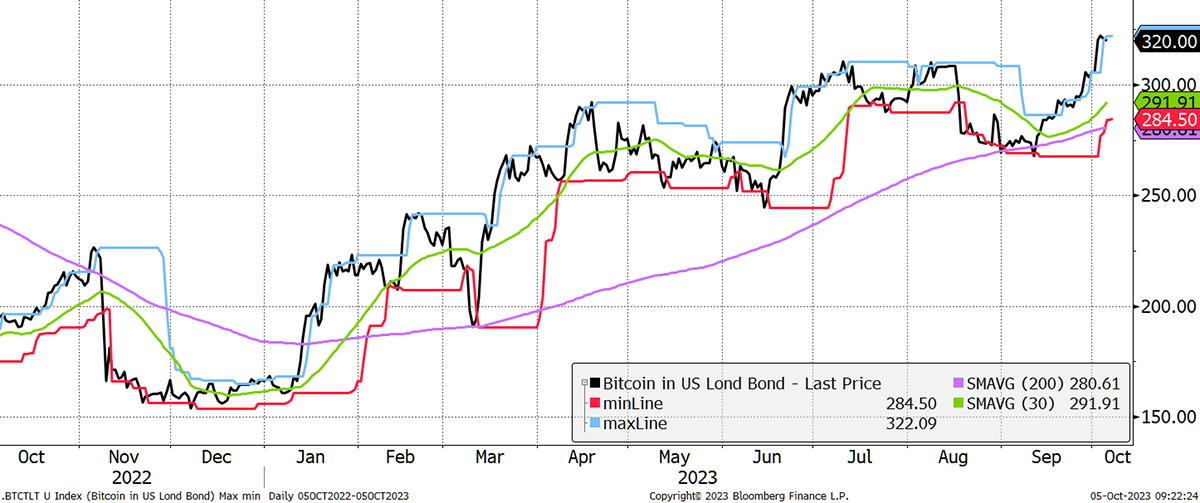

Above all, Bitcoin is the true safe haven from Uncle Sam’s bonds. In the long bond, Bitcoin is off to the races.

Bitcoin in Long Bond – ByteTrend Score 5/5

In these charts, I have used futures, mainly because they are like for like when shown against the S&P or bonds as they trade at the same times. Real Bitcoin trades 24/7, whereas Bitcoin futures are much lazier and only trade weekdays during office hours, excluding public holidays.

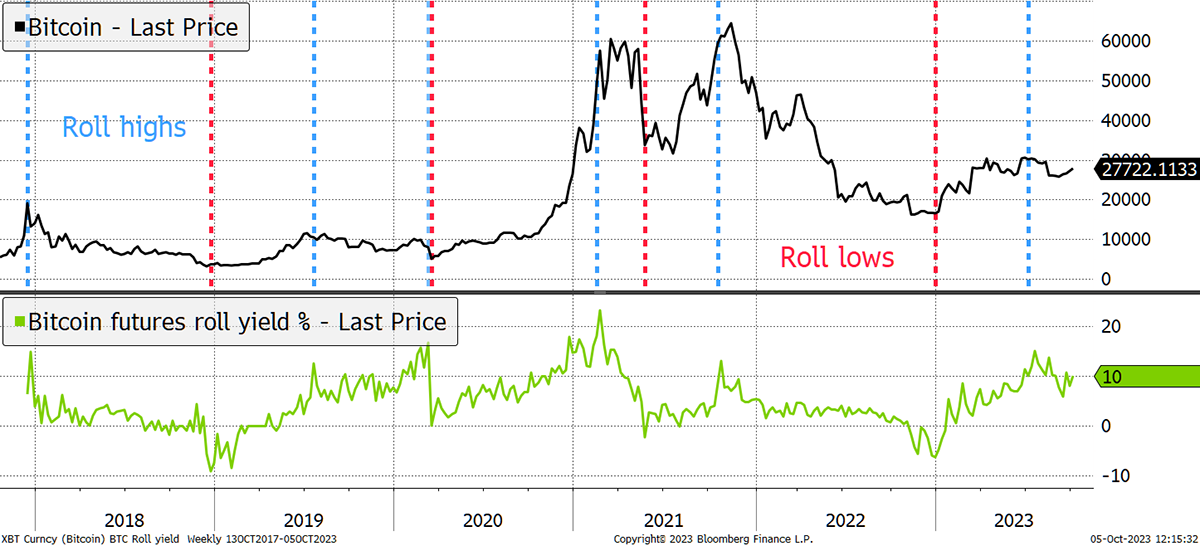

While a Bitcoin future will do what it says on the tin, the mark to market can vary wildly. That is down to the “roll yield”, which is familiar to commodity investors. The closer a futures contract gets to expiry, the less this matters. But the whole point of futures is that you can fix a price far into the future. If the prices are off, for various market factors that boil down to mismatched supply and demand, then the contracts will only disappoint.

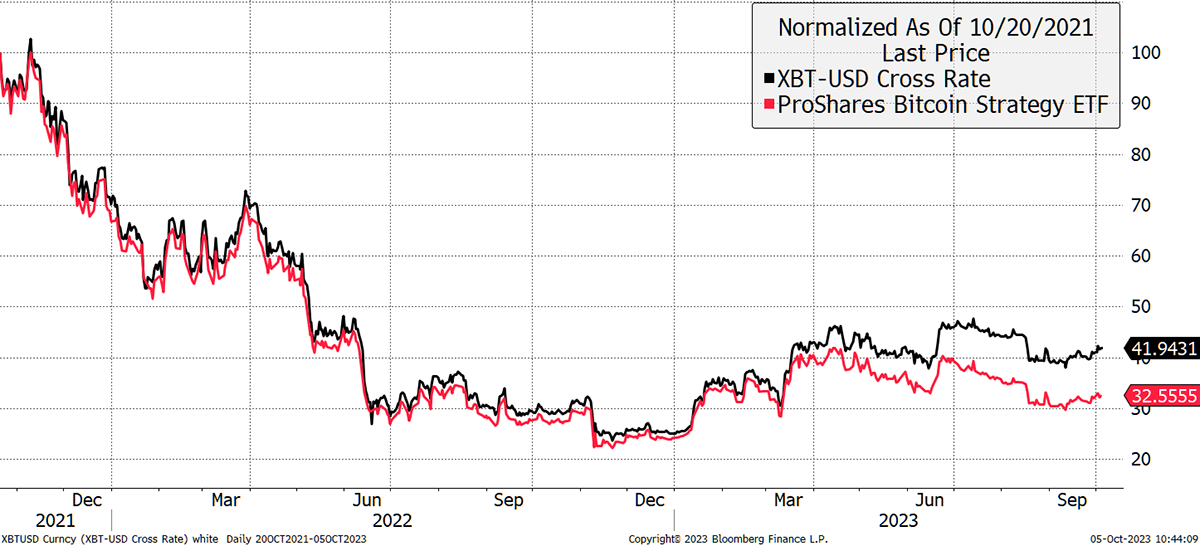

The ProShares Bitcoin Futures ETF (BITO) launched nearly two years ago. I predicted it would lag Bitcoin by 5% to 8% per year back then. They proved me wrong until earlier this year, but look now. BITO has lagged Bitcoin by 9.5% since launch, caused by the high roll yield. When the BITO buys new contracts, they have to overpay and, therefore, deliver lower returns. A Bitcoin spot ETF, that owns real Bitcoin, would only lag by fees.

Bitcoin Futures Sink the ETFs

To think the SEC allows futures ETFs and “protects investors” from spot ETFs is really something. Regulators are supposed to be a force for good, but I have my doubts about their motives. You wouldn’t build the system this way if you were starting from scratch.

I show the roll yield on the futures below in green with Bitcoin above. The roll measures the 3rd month of the futures contract against the 2nd. The difference between them is around 0.8%, which amounts to 10% per year. I have marked the roll highs in blue and lows in red. This is a slight concern because the highs are often aligned with Bitcoin price peaks. It’s not always that way, and 10% is hardly a concern, but something to be aware of. A spike in roll could mark a peak in price.

Bitcoin Roll Impact on Price

Notice how the roll yield was low last year, which enabled BITO to match Bitcoin. This year, it has remained high, and some of that will be due to interest rates. The SEC should take note.

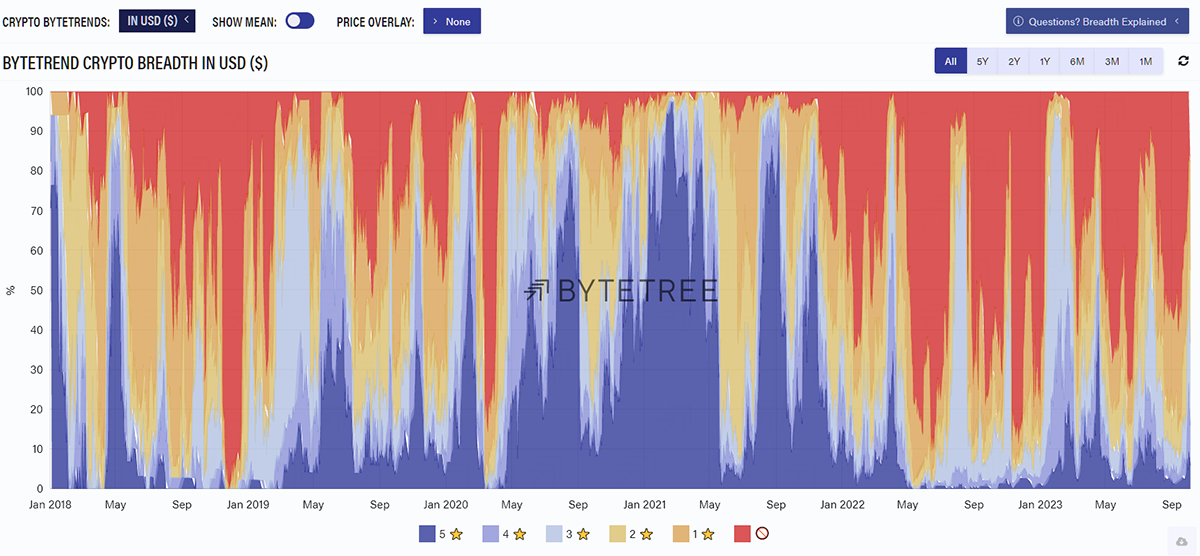

Yet, on another completely different technical note, a bullish sign comes from the tokens, which are springing back to life. “Bitcoin is not crypto”, but regardless, our crypto breadth chart is showing strength. The dark blue is rising, which means we have a growing number of uptrends among the top 100 tokens. Moreover, the red skies are retreating, with each low less violent than before. That tells us the good times are coming.

On-chain

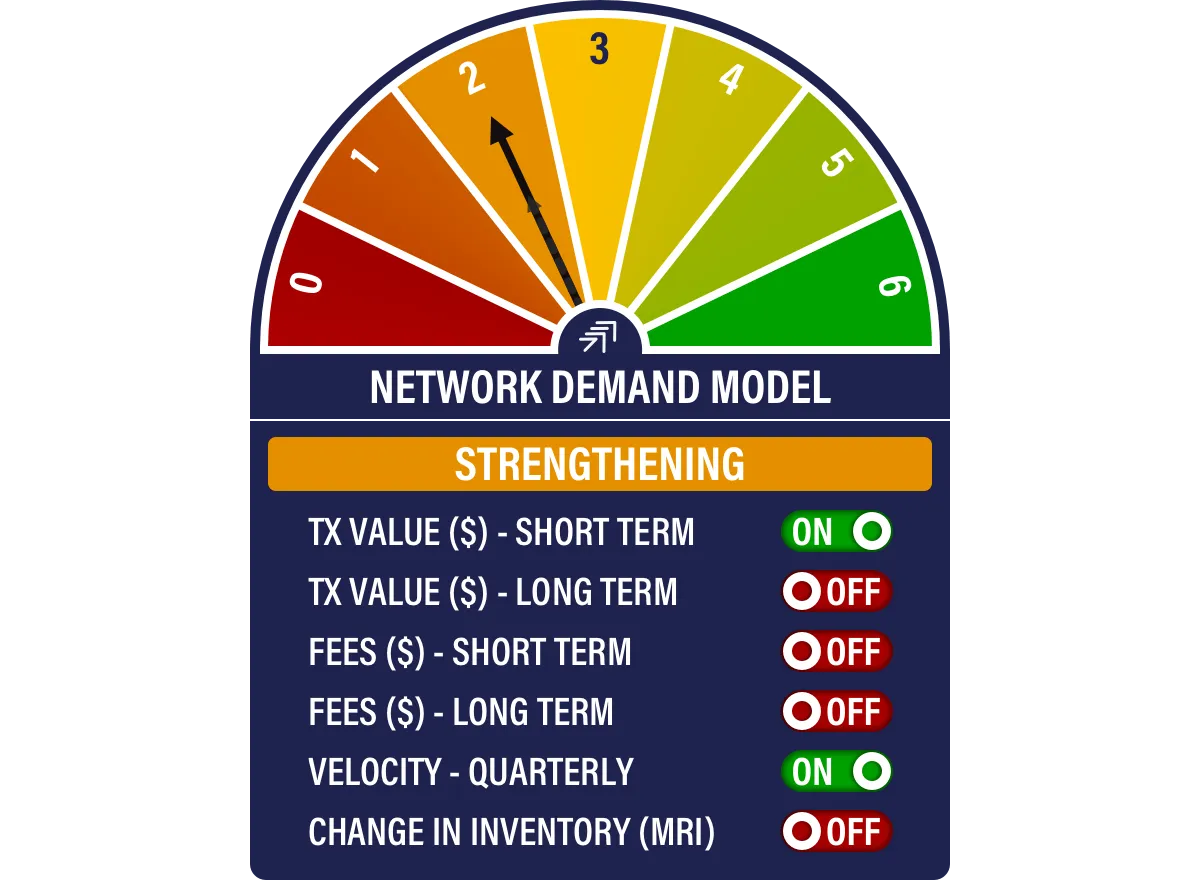

The Network Demand Model is on 2/6 again, which doesn’t sound like fun, but I drag out the old excuses. 0/6 is something to worry about, but 2/6 could be a mere rest.

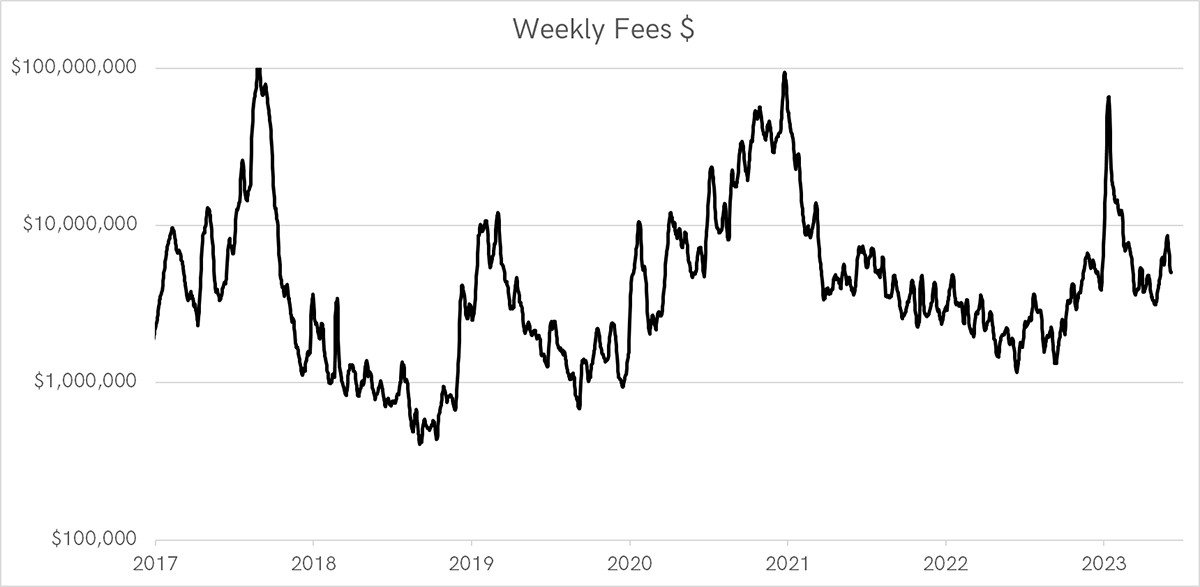

Both fee conditions remain OFF, and the excuse is once again the ordinal boom earlier this year, which has distorted the data. I think we can still ignore this.

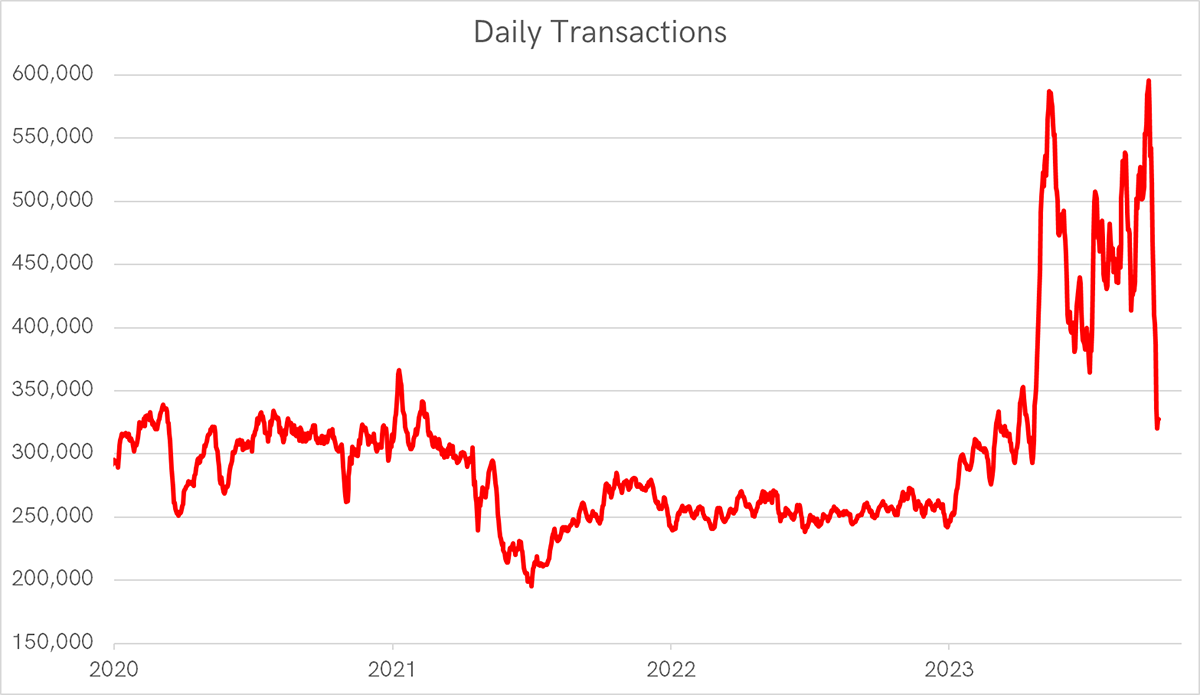

The thing that concerns me more is the transactions. That’s one hell of a drop in recent days, and it will impact fees if it is sustained. Ordinals again?

There are pros and cons out there, but inevitably, Bitcoin trading volumes are thin in this environment and so we have to take that into consideration. One bigger thing we cannot ignore is having, due on 25th April 2024. As I write, block number 810,737 was just mined. The next halving will be the fourth, and that happens every 210,000 blocks, which is 29,263 blocks away. A block is mined every 10 minutes, on average, then that’s 203 days away.

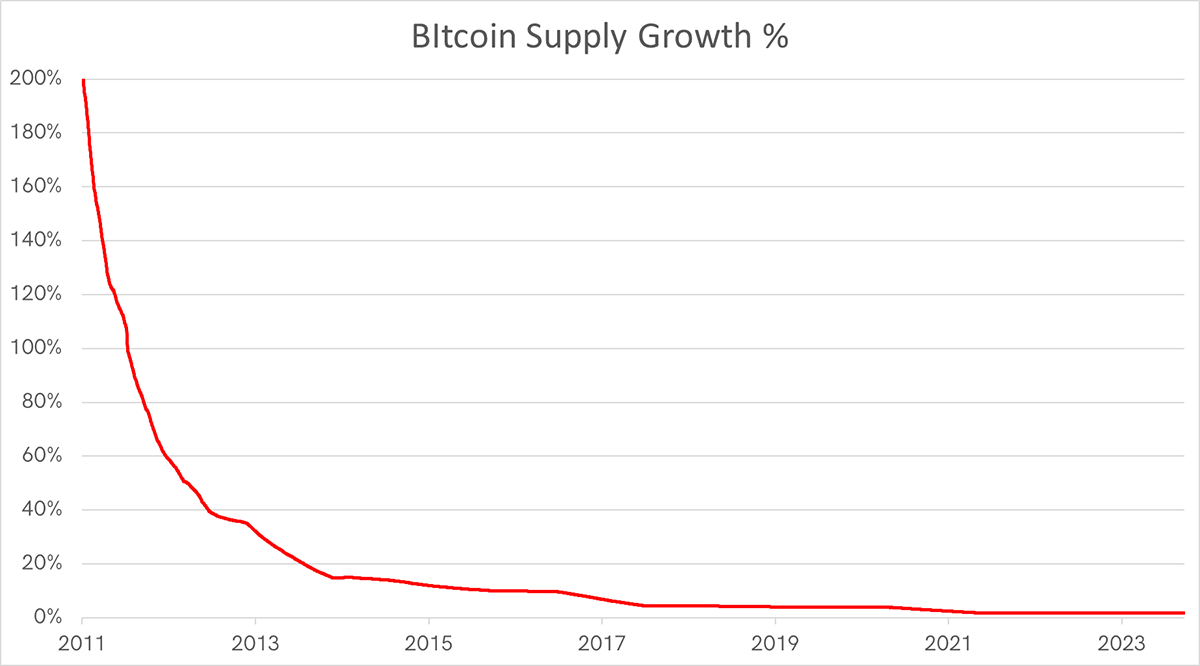

Bitcoin’s new supply growth rate was exponential when it began, but as we grind towards the 21 million end game, that rate has fallen to just 1.8% per year. Post-April, that halves to 0.9%. Bitcoin will become increasingly rare, and that will be supportive for price.

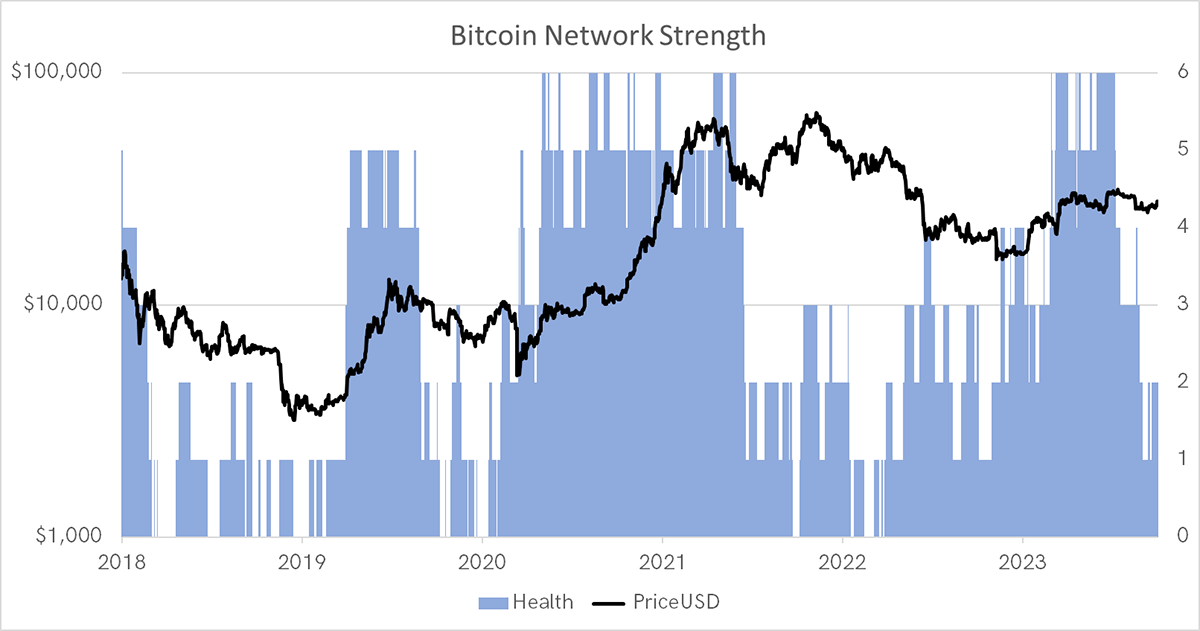

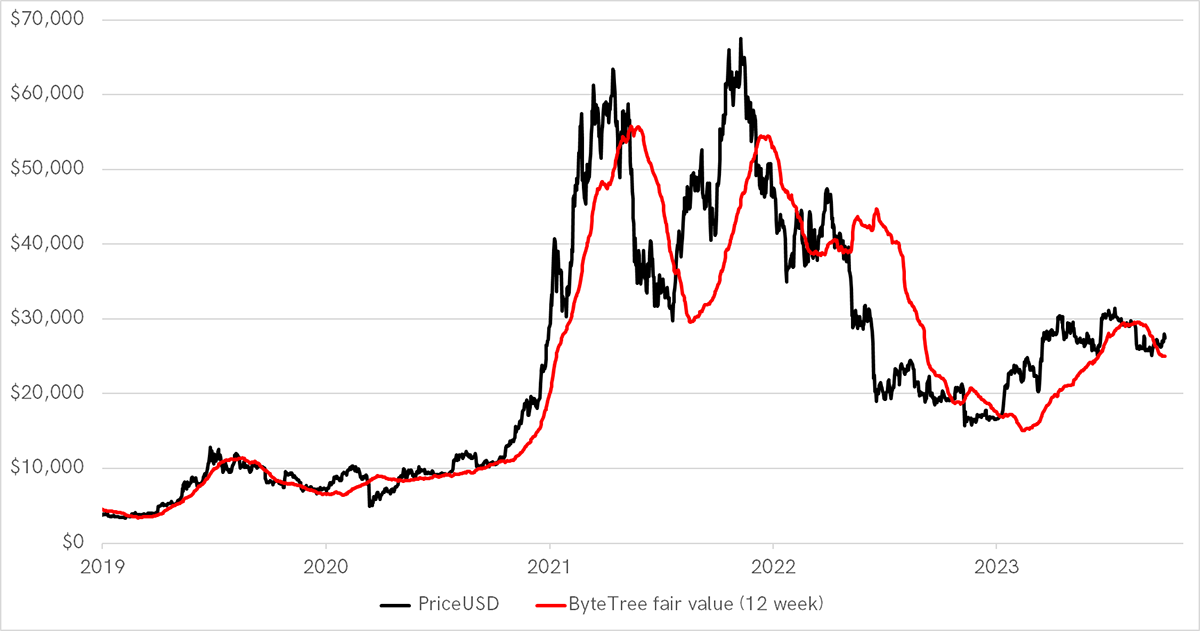

In any event, it all comes down to demand against a fixed supply. Bitcoin’s demand is summarized by its network activity, or dollar-equivalent value transferring over the blockchain. That currently implies a fair value above $25,000. That has fallen since last month but appears to be settling down. This simple idea helps us to understand how powerful a wave of institutional investors would be for Bitcoin. Regulators, spot Bitcoin ETFs in the US please, and stop banning them in the UK.

Bitcoin Fair Value

Investment Flows

The flows aren’t awful but have eased back over the past month. A bear signal would be much worse than this. On balance, it’s stable.

Crypto Stocks

I was asked to cover the Bitcoin alternatives. Many people fear buying Bitcoin via exchanges, which is why we need the ETFs. I don’t blame them, not because of the exchange, but dealing with your bank. I reiterate: widely accessible Bitcoin ETFs are a must.

There are crypto equity ETFs to consider: VanEck Digital Transformation (DAPP) and the Invesco CoinShares Global Blockchain (BCHN).

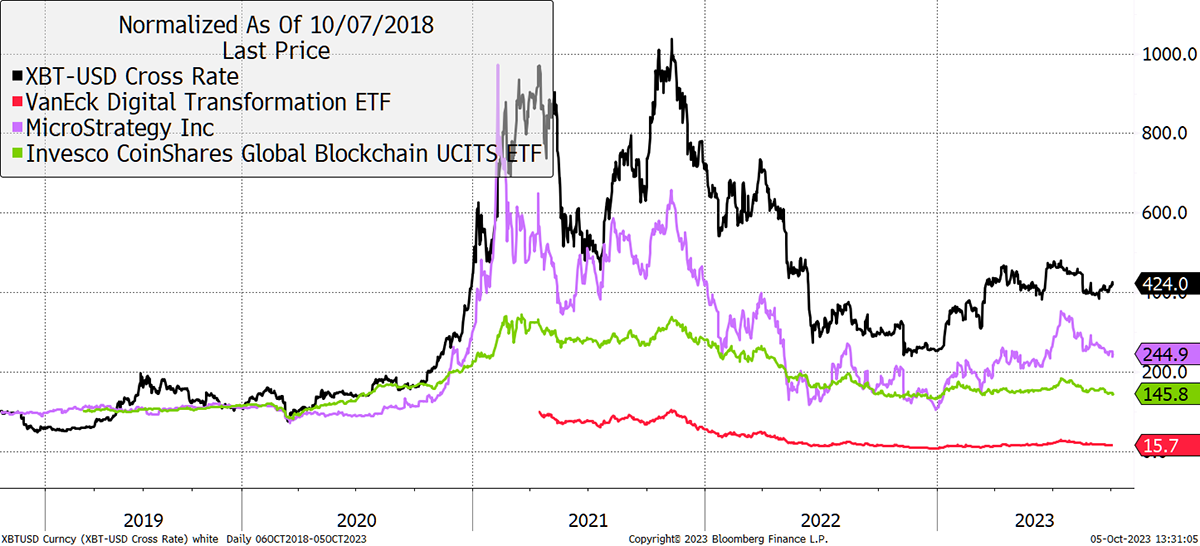

DAPP is straight in there with top holdings of Coinbase, MicroStrategy, Block and Bitcoin miners. BCHN, on the other hand, is more cautious, holding companies involved in the wider tech ecosystem. The top holdings are SBI, Monex, Samsung, Taiwan Semi-Conductor and CME. MicroStrategy and Coinbase are 6th and 7th, but it’s more of a crypto-focused tech fund than pure crypto. As a result, DAPP has volatility of 85% over the past year compared to Bitcoin of 40% and BCHN of 35%. BCHN is much less volatile, but none of them have matched Bitcoin.

Crypto Stocks vs Bitcoin

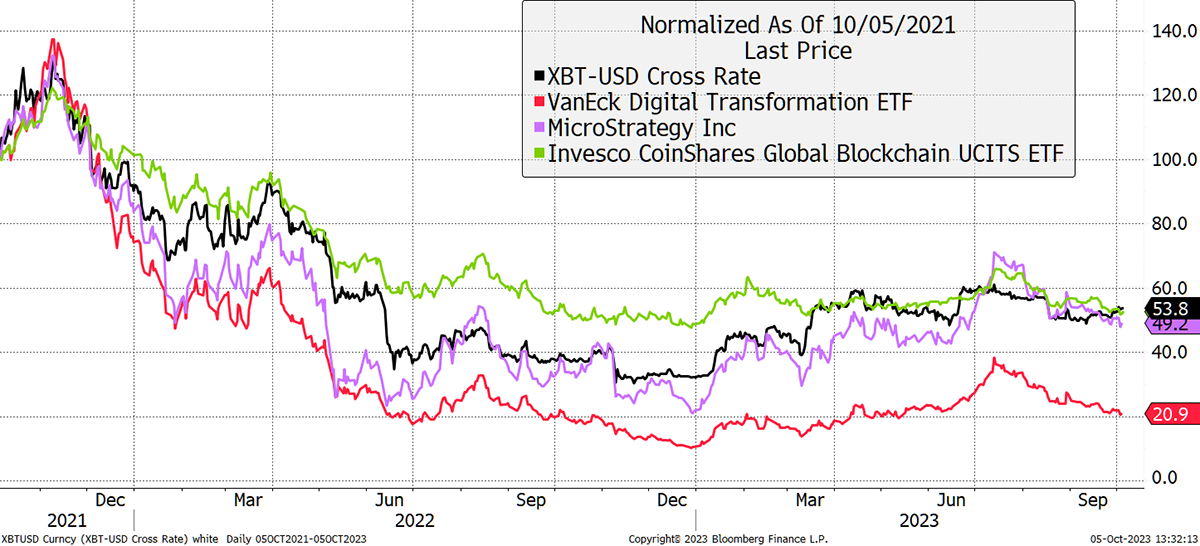

Since DAPP was launched in late 2021, that same exercise shows how it lags. BCHN has been a good match. But it has been a macro-dominated environment, and a surprising number of assets have performed in groups.

Since DAPP Launch

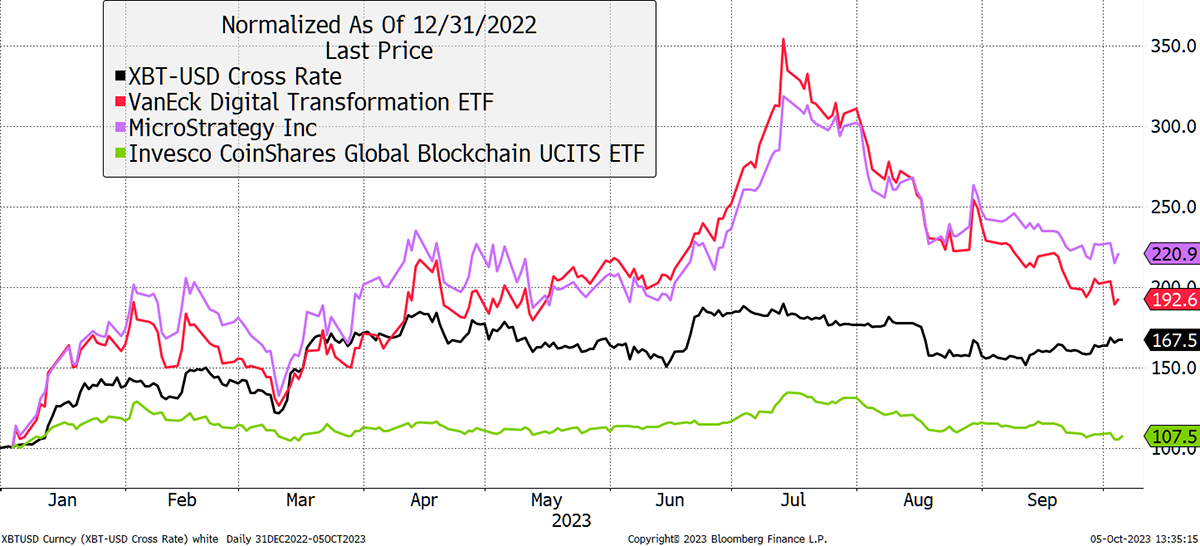

Finally, I show this year, which has been a bullish environment. Both DAPP and MSTR have beaten Bitcoin, with BCH lagging, as it is less risky.

2023

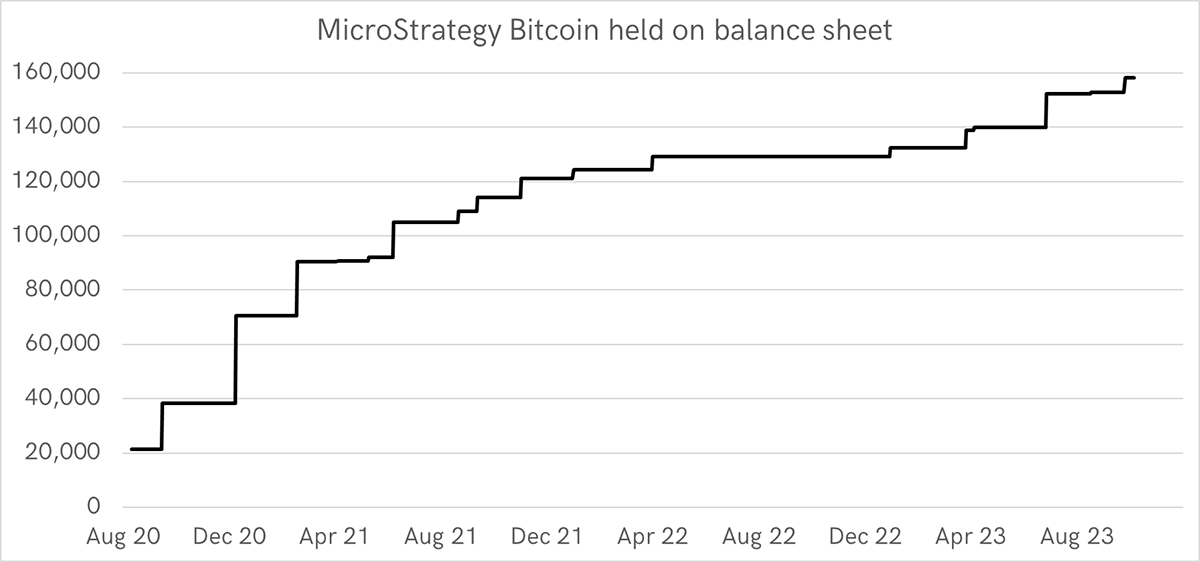

You basically want BCHN in the bad times and DAPP in the good. But the third way, assuming you can’t buy an ETF, is MicroStrategy (MSTR). Michael Saylor, the CEO, announced holding Bitcoin in August 2020, and the shares surged. Today he owns 158,245 BTC, worth $4,38 billion, which is 0.8% of all outstanding BTC. Saylor can’t stop himself.

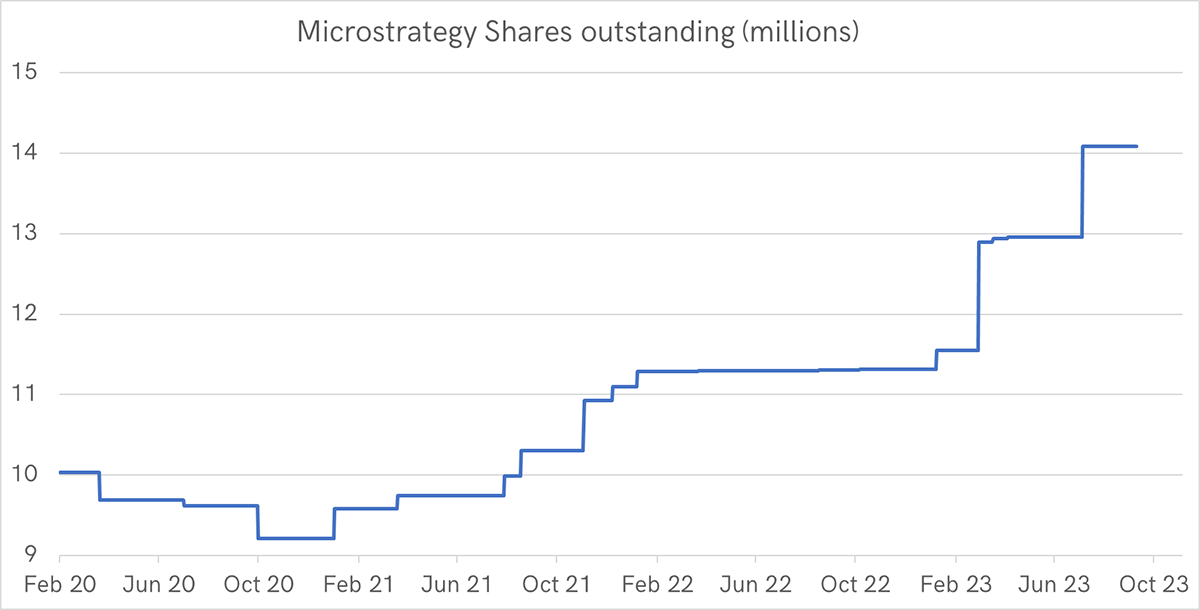

He started off by spending his $500 million cash pile. He then issued $2.2 billion of debt and bought more BTC. Now, he issues new shares to raise capital to keep on going.

This is the chart that Saylor watches. So long as MSTR trades at a premium to net asset value, he’ll print MSTR shares and buy BTC. As an investor in MSTR, you need to take the opposite view and buy when it’s at a discount. Currently, MSTR trades at a 40% premium. That’s fine, provided it stays there, but premiums rise and fall.

As an investor, you benefit from leverage (because of the debt) when the Bitcoin price is rising, but if it’s falling, you’ll do worse. The bottom line is that if you want to own Bitcoin, your best bet is to buy Bitcoin via an exchange or an ETF. Only consider equity alternatives if you can’t do that. DAPP holds some MSTR, but MSTR is a purer play and should be a closer match over time. But they are both equities first, and the MSTR premium or the DAPP valuations will rise and fall with the stockmarket.

Macro

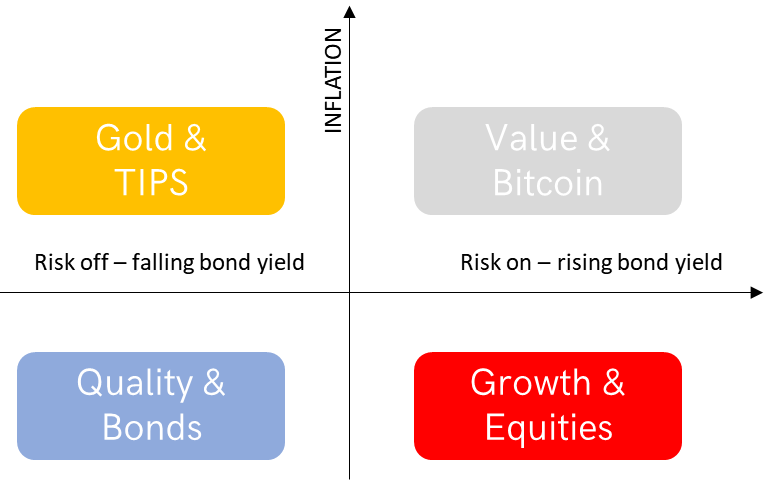

I won’t say much on macro because, with bond markets under pressure, it’s front-page news. I will simply remind you that Bitcoin sits in the top right of the ByteTree Money Map. It does well in risk-ON conditions when the bond yield is rising. Over 90% of Bitcoin’s historical gains have occurred when bond yields and inflation have been flat or rising.

Other assets that live in the top right box are commodities, banks and heavy industry. Bitcoin is a digital commodity with limited supply. It is also a digital bank and a financial store of energy. It makes sense to live where it does.

Summary

The world is crumbling, and it is a good time to be cautious. Much can go wrong, and it probably will. What is interesting for me is how Bitcoin is now unlikely to be at the centre of the storm, despite the carnage in financial markets, because the bad news is behind us.

Halving is soon within sight, and Bitcoin is becoming increasingly scarce.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.