Trades in Whisky;

This year, Apple is down 12%, Google is down 6%, and Tesla 28%. Yet quietly in the background, gold has made an all-time high. The market is telling us something, just like it did in 1971, 2005, and 2018. What is so extraordinary about this new high is that it has been so quiet. For the gold bulls, that’s fabulous news because a quiet bull market is a lasting bull market.

In case you are unaware, I write about gold every month in Atlas Pulse, which, for some bizarre reason, I do for free. I hope that those interested in gold will read that and be up to speed. For the rest, I periodically cover gold in the Multi-Asset Investor when it’s important, which is now. All the issues to do with China, sanctions, money supply, investor flows, and real interest rates are in Atlas Pulse.

We have been patiently waiting for the all-time high for quite a long time. Now it has come, I want to update you on the relationships between gold, gold miners and silver. We own all three. Gold lives in Soda because it is the least volatile, most scarce and most liquid. It is a high-quality asset. Silver and the miners live in Whisky. There is nothing wrong with them; they are just more volatile and less liquid. I’ll start with the miners.

The London Gold ETF was launched in 2003. Prior to that, investors seeking gold exposure bought futures or the gold miners, which were a proxy. Until around 2003, they traded in line. Then something happened.

Gold Versus the Miners

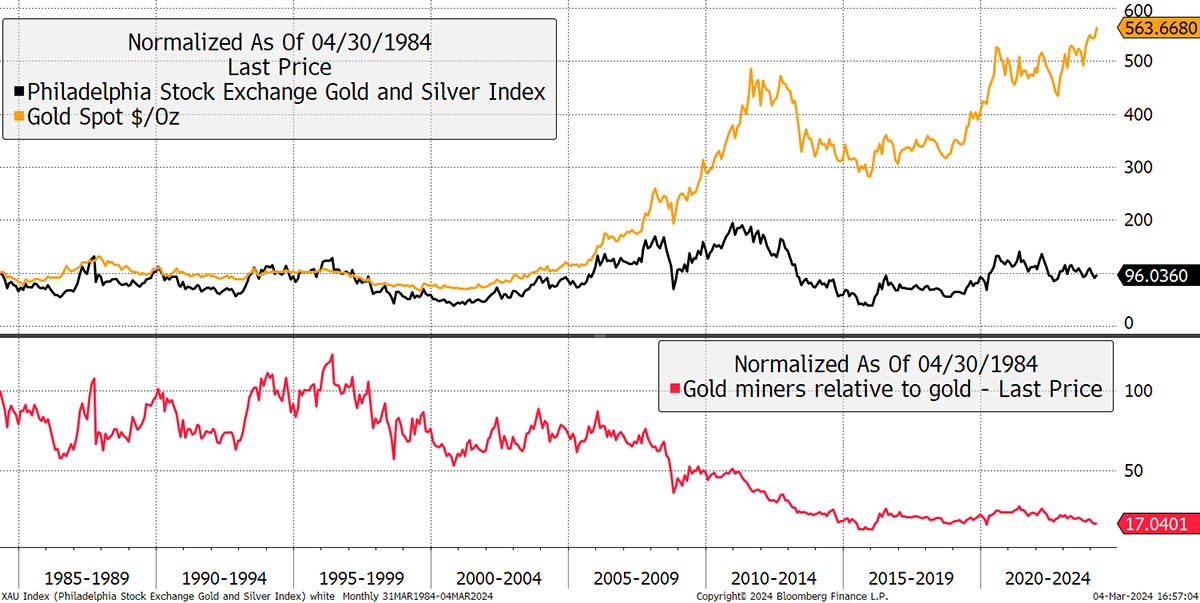

The gold miners used to trade on high valuations because they were the only way for equity investors to gain exposure to the gold price. As the ETFs grew, the miners’ premium fell, and they underperformed gold. $100 invested into gold stocks (black line) in 1985 is worth $96 today, despite gold rising to $563.

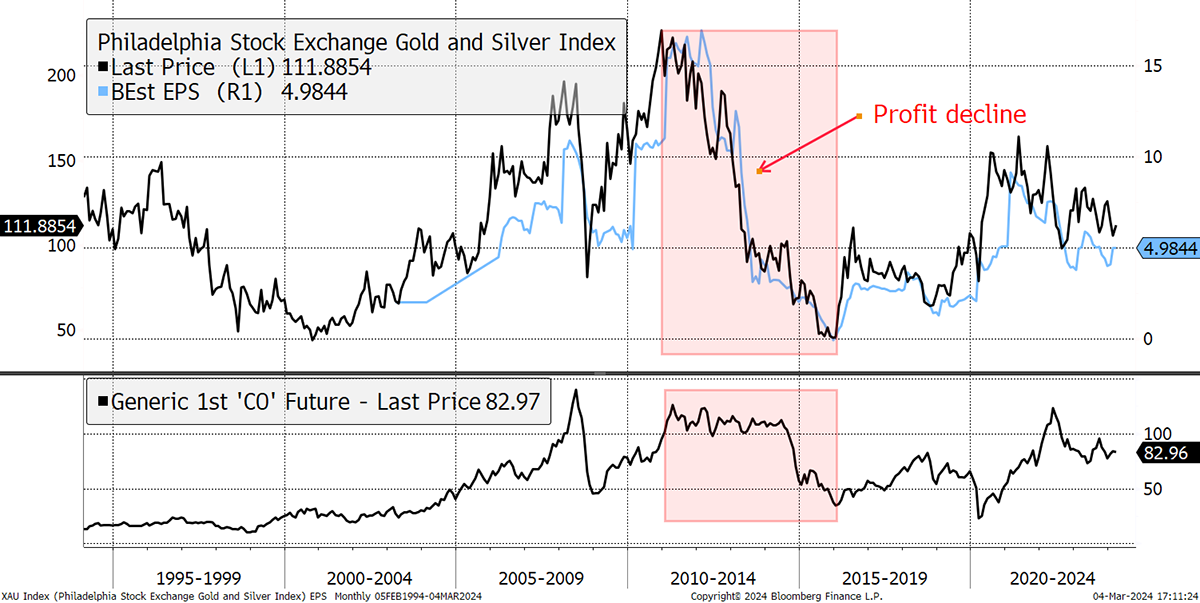

The miners have always broadly followed aggregate profits, but the rating applied has also fallen. In part, they lost their proxy premium due to the ETFs, but they also faced higher costs, primarily from higher oil prices, which is a major expense for miners.

As a result, the miners and their profits fell by 80% between 2011 and 2016, which was twice as much as the gold price. More recently, gold has made a new high, while the miners are at levels seen in the 1980s, or at roughly half of their all-time high in 2011.

Gold Miners and Profits

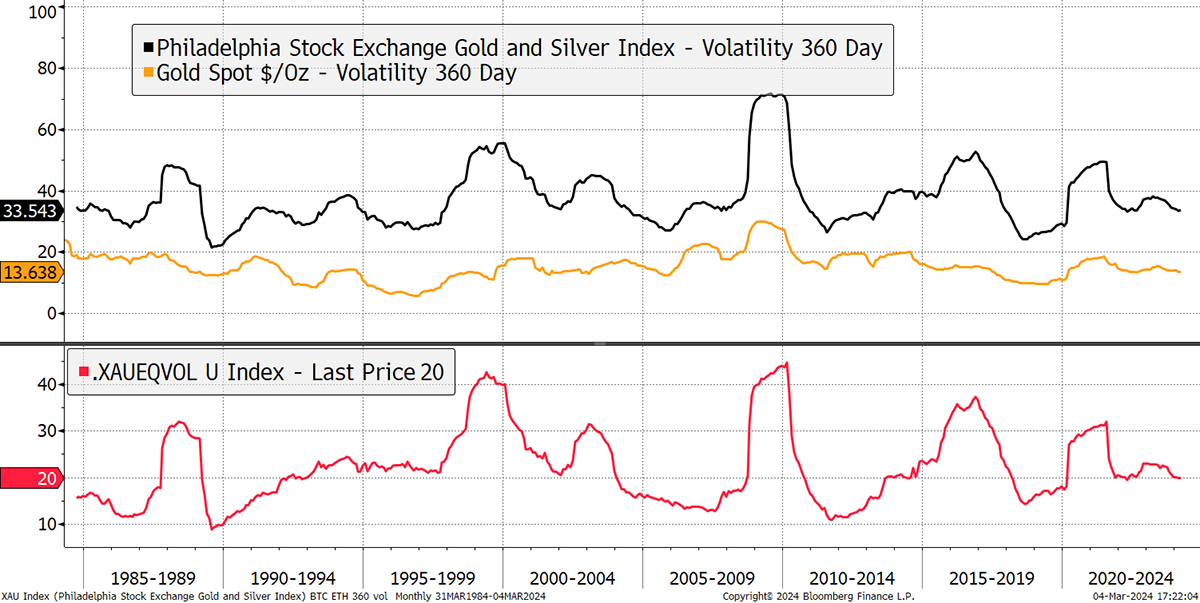

If it feels like more risk for less return, and it is. Another way to look at this is with volatility, which I show in the chart below. Gold is in gold, and the miners are in black. The red line shows the difference. The miners range between 10% and 40% more volatile than gold. That is an additional risk investors in miners haven’t been rewarded for. I might have expected that if the miners were cheaper today, they would be less risky and, therefore, less volatile. They are not, as the volatility above gold is similar to 40 years ago.

Gold and Miner Volatility

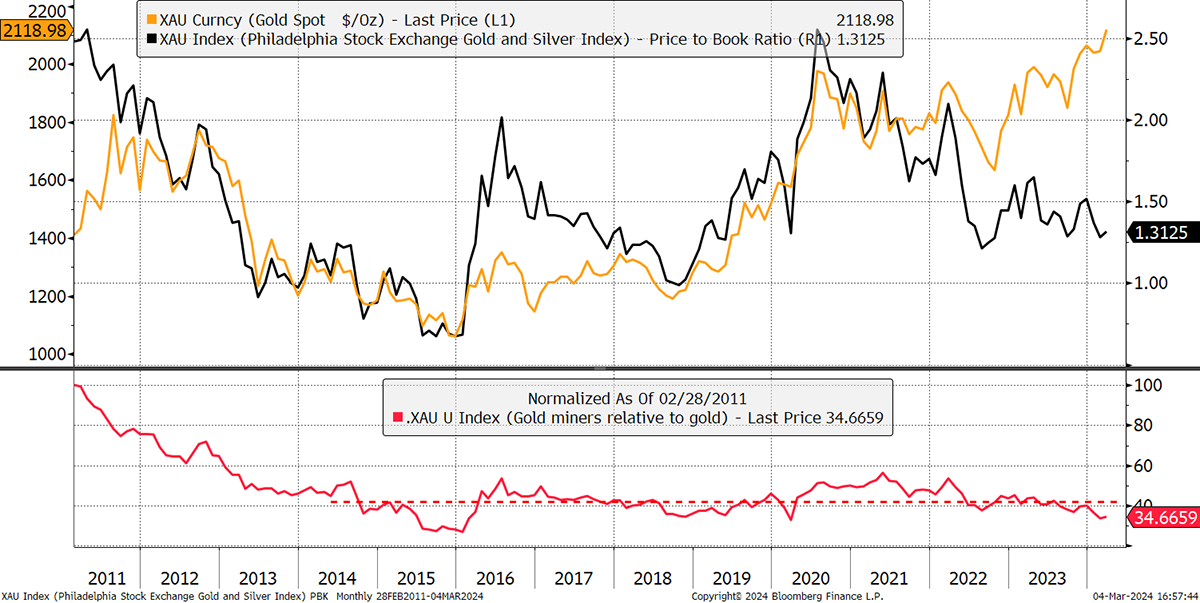

Moving to valuations, it becomes clear that the miners are cheap. While earnings are even more volatile than the shares, a more stable price-to-book ratio (PBR) has broadly followed the gold price. Investors have been willing to pay not just higher prices but higher valuations for gold miners when gold has been high and less when low. Obvious, perhaps, but this helps us to quantify it.

Gold Price and Miner Valuations

The PBR is a stable valuation measure because while the share price can swing wildly, along with earnings, the book value reflects the invested capital. That doesn’t move with market prices, and so you get a reference point from which to value the miners.

The divergence between the gold price and the PBR for the mining sector is astounding. There really are no more bulls left in the gold mining sector. Furthermore, the red line, the price relative, looks like it has been flat for ten years, but on closer inspection, it has halved since 2020/21. Can the gold miners’ PB return to 2.5x book? I bet they can, and they will. That means investing in the gold miners today will see double your money plus the gas in the gold price. Rich pickings.

Silver

Yet silver is also cheap as one ounce of gold will buy 89 ounces of silver when the 30-year average has been a lesser 68. Silver is cheap gold because gold has lagged by 50% since 2011, while the miners have lagged silver by even more.

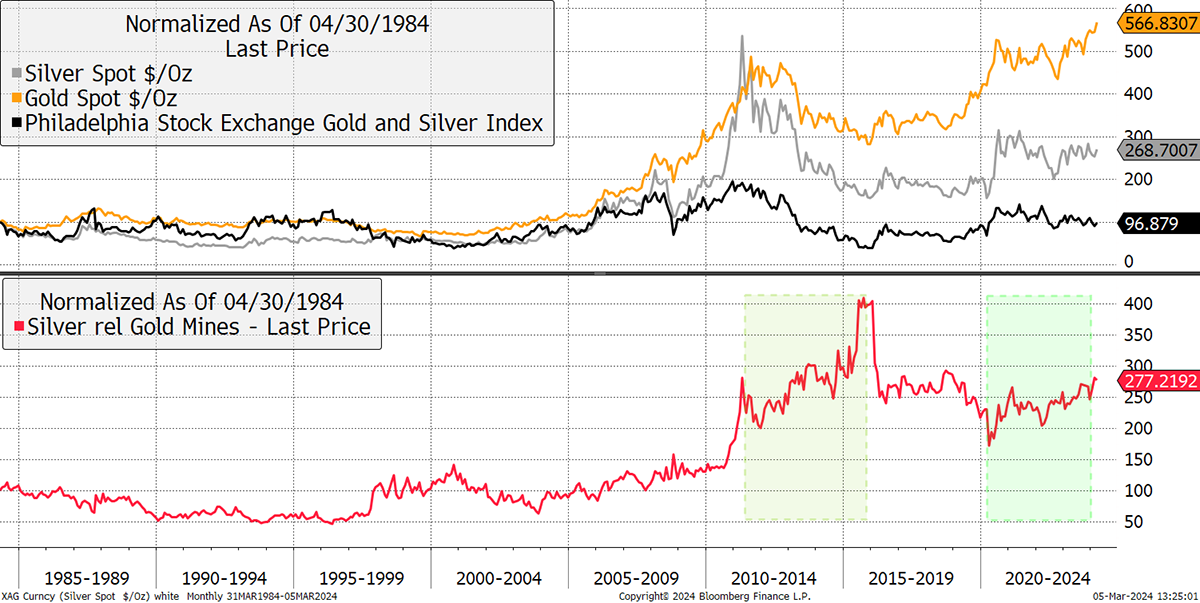

Gold, Silver and the Miners

The red line shows silver relative to the miners. Looking at the past decade, the most recent reset in precious metals, silver beat the miners during the first green box and again during the second. In contrast, the miners beat silver between 2015 and 2020, when gold was last in a bull market.

Putting this together, we can be fairly sure that if gold is going up, silver will beat gold, and the miners will beat both. Bitcoin has also surged.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd