Token Takeaway: HNT;

Helium is a global wireless infrastructure ecosystem powered by blockchain technology with a real-world use case. It enables users to deploy Hotspot devices and provides data coverage for low-power Internet of Things (IoT) devices. As fascinating as it sounds, there is a lot of controversy around Helium, with some even questioning its legitimacy. This Token Takeaway will critically explore the fundamentals of Helium and analyse the value proposition of its native token, HNT.

Overview

Helium was first introduced in 2013 by Amir Haleem, Sean Carey and the Founder of P2P music/file-sharing platform Napster, Shawn Fanning. The mission was to create a peer-to-peer decentralised wireless network that can support the growing IoT industry. Helium embarked on its journey with a $2.8m seed funding round spearheaded by investors such as SVA, Slow Ventures and Shawn Fanning. Since then, Helium has held numerous funding rounds and ICOs, bringing its total capital raised to just under $365m. Tiger Global Management, Pantera Capital, and Google Venture were among the other backers.

In 2019, Helium unveiled its flagship offering, the Helium Hotspot, enabling users to establish these Hotspots using the Helium LongFi protocol. This allowed them to extend long-range data coverage to IoT devices such as doorbell cameras, activity tracking rings and wristbands, and smart devices like locks, lights, fans, and TVs. In return for establishing these Hotspots, users earn HNT rewards.

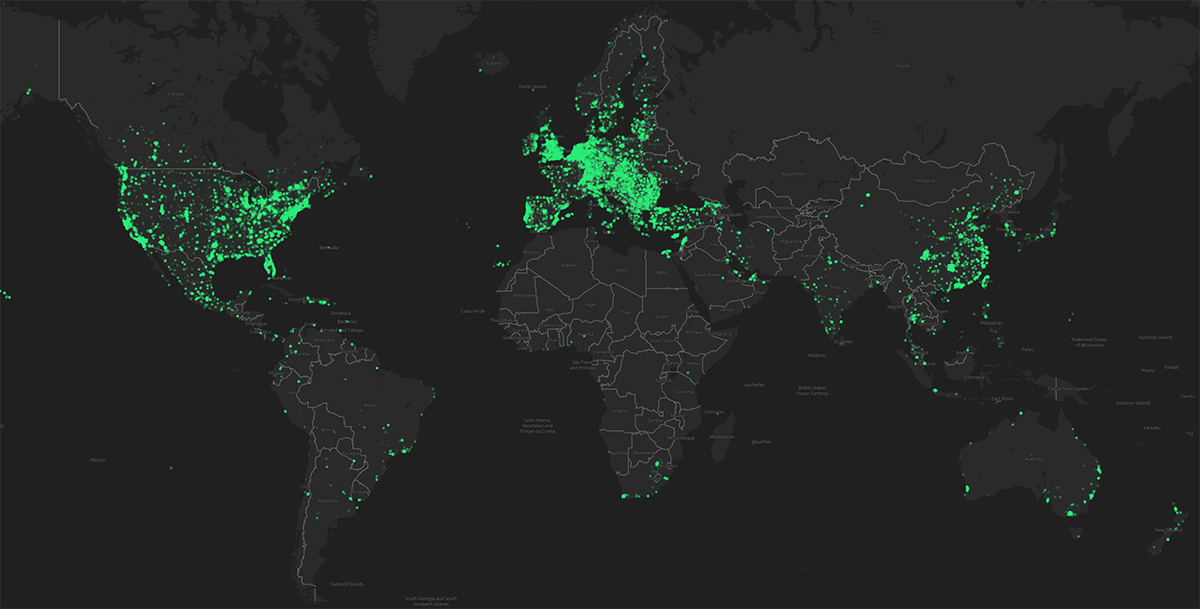

With lucrative incentives for providing data coverage through a Hotspot, Helium experienced rapid adoption. Currently, there are around 400k active Helium Hotspots across thousands of cities over six continents, with the highest coverage in Europe, North America, and East Asia.

Helium Hotspots

Recently, Helium has made significant changes within its ecosystem, transitioning its primary focus from offering coverage for IoT devices to providing 5G data services. Indeed, Helium is evolving into a decentralised telecommunications protocol, offering 5G data connectivity through Helium Mobile. This strategic shift represents a critical juncture in Helium's evolution, particularly considering the underutilisation of its previous IoT data coverage. Let’s explore what’s going on under Helium’s hood.

Helium Hotspots: Growth or Decline?

In 2021, Helium experienced remarkable growth in the number of Hotspots, soaring from 14k to over 450k, marking an impressive 3114% increase within a single year. At its peak in Q1 2023, Helium boasted nearly 1 million Hotspots within its network. However, the current count has dwindled to less than 400k, representing an almost 60% decline. While Helium deactivated some Hotspots due to misconduct and network corruption, the majority appear to have been voluntarily taken offline due to exceedingly low rewards.

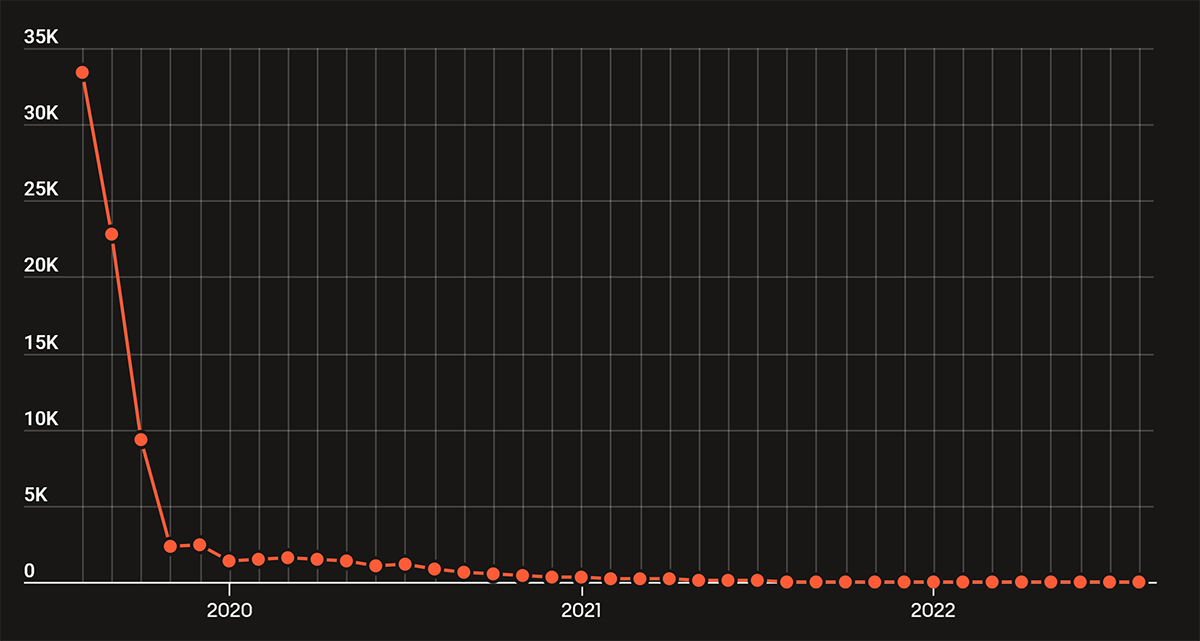

Average Monthly Earnings Per Helium Hotspot

The above chart illustrates a significant decline in the average monthly earnings for Helium Hotspots. Some operators of Helium Hotspots, also known as HNT miners, have voiced concerns that despite a notable decrease in the number of active Hotspots, the rewards have not only failed to increase but have actually dropped further. There have been claims of earnings dropping as low as 20 cents per day. At this point, it’s important to highlight that the rewards are not paid in dollars but as token incentives.

Initially, the allure of Helium Hotspots was built on the promise of potentially earning hundreds of dollars daily by simply running the Hotspot. The process seemed straightforward:

- Purchase the Hotspot from Helium.

- Pay associated fees.

- Watch the money effortlessly roll in.

Despite the high initial investment, the potential return on investment (ROI) was deemed highly attractive. Success stories of individuals amassing substantial HNT rewards and even kids turning their HNT mining endeavours into multi-million-dollar IoT infrastructure businesses fuelled a sense of fear of missing out (FOMO) in the industry, prompting widespread participation in what was perceived as a once-in-a-lifetime opportunity.

Initially, Helium and its partner RAK Wireless generated significant revenue as the sole sellers of the Hotspot, with each unit costing around $500. In addition, setting up a Hotspot (or node) required an onboarding and a location assertion fee, which were paid as Data Credits (DC) tokens. This setup created the impression of extensive economic activity on the platform. Coupled with the altcoin season at that time, the HNT price quickly rose to over $52 per token, bringing its market cap to well over $5bn. In reality, only a fraction of this activity was actually attributed to genuine network usage.

So, who actually uses the data coverage provided by this extensive network of Hotspots? In reality, very few. The Data Credits (DC) utilised for genuine network usage amounted to less than $2k per month between August and October 2022. Helium excelled in marketing its product and attracting Hotspot operators (essentially, Helium's cash cows), leading miners to believe their service was in high demand. According to Forbes, the primary beneficiaries were Helium executives and their associates. While this topic lies beyond the scope of this article, I highly recommend that you read the Forbes article for more information.

When the market entered crypto winter in 2022, and the hype around Helium started to die down, the HNT price went into a free-fall and declined by as much as 98% from its high. Still, to this day, the DC burned for using IoT coverage is not even worth $100 a day, as shown below.

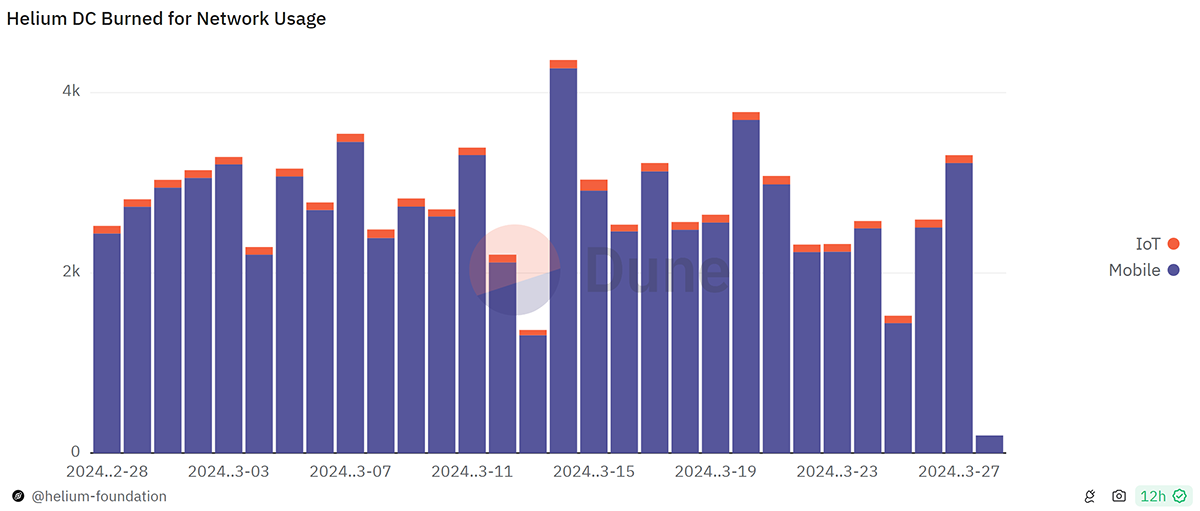

Helium DC Burned for Network Usage

In the last 24 hours, $12753 worth of DC has been burned (expended), of which $87 was for IoT data, and $3220 was for Mobile (Helium’s new 5G data coverage service). This brings the total revenue generated from network usage to just over $3307. Based on this revenue, HNT’s fully diluted $1.5bn market cap appears inflated. Although its market cap has also priced in its growth outlook, which seems promising with Helium Mobile and its 5G data service, the investors seem to be over-optimistic.