ByteFolio Issue 102;

Bitcoin’s halving is just under 12 days away. It will take place on Saturday, 20 April, at 08:45 GMT. On the one hand, it is hugely exciting, but on the other, it’s not. That’s because all you see is one number in the 840,000th block changing from 6.25 to 3.125. That number is the miner’s BTC reward for each block. So, while the event is forgettable, the longer-term impact of halving the miners’ revenue (less fees) is important. The market is getting excited already.

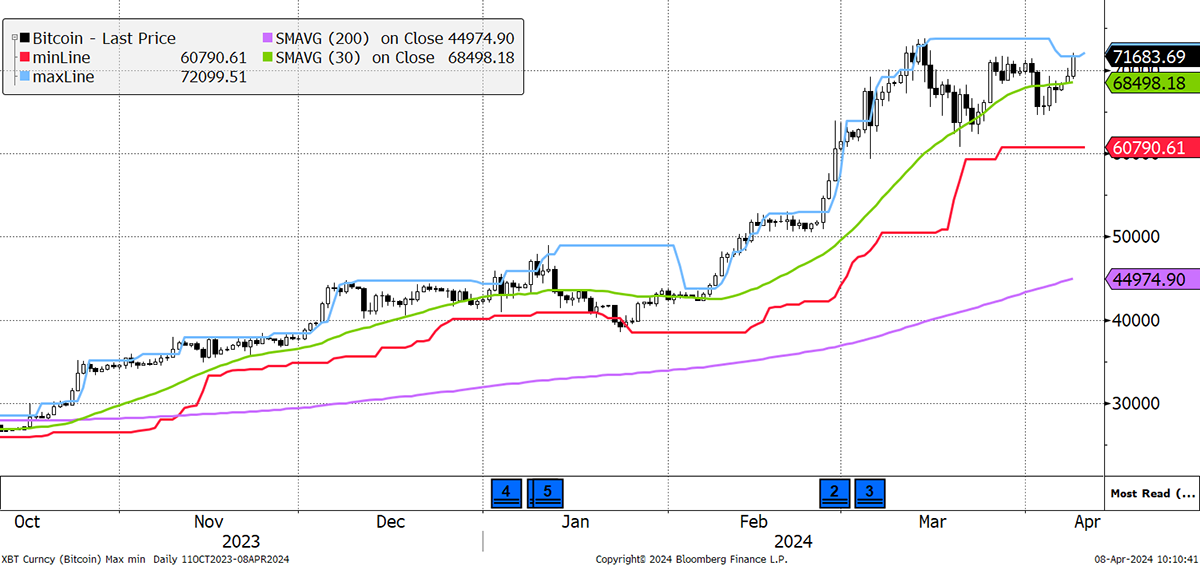

Bitcoin Strength Ahead of Halving

The miners currently earn 900 BTC per day, which at current prices means $64.5 million or $23.5 billion per year (add on another 7% or so for fees). The miners sell most of that Bitcoin, which must be funded by network inflows. This is why the ETFs are so important, as they bring capital in size.

The bullish part is that by halving the block reward, you nearly halve the miner’s revenue, which, in theory, reduces the selling pressure on the network. All things being equal, the Bitcoin price should rise.

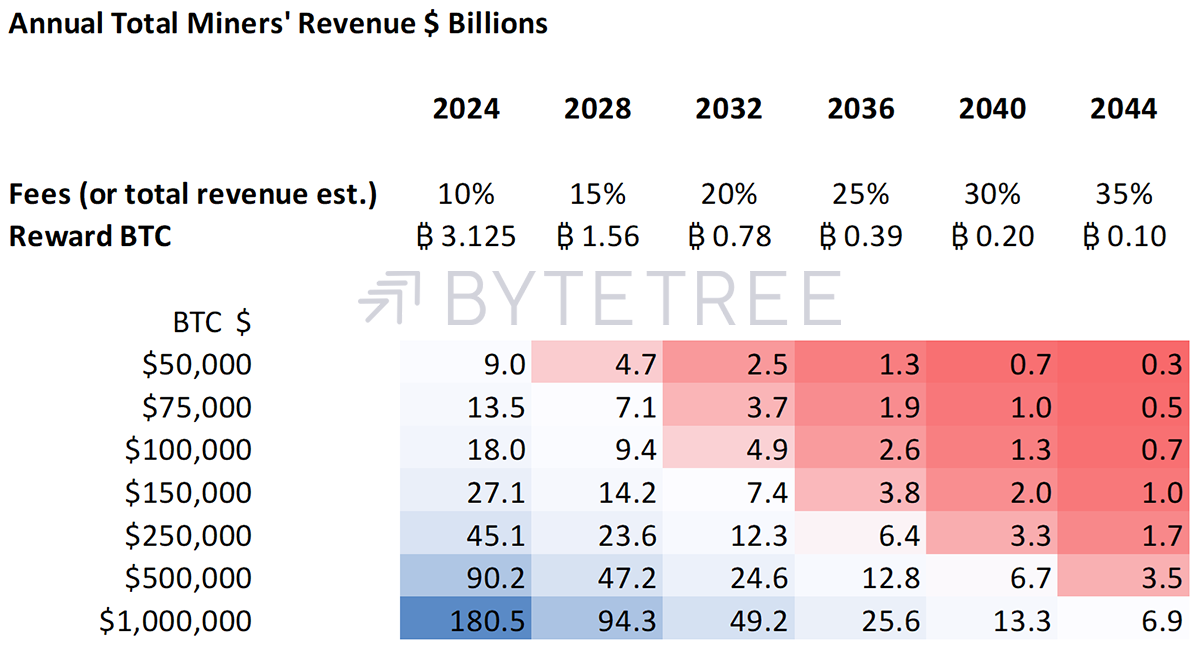

The next four-year cycle will see a block reward of 3.125 BTC, and I would make an educated guess that fees will make up 10% of the block reward, which will rise each cycle. The miners’ annual revenue is shown in billions for rising Bitcoin price scenarios over future cycles.

Annual Total Miner Revenue ($Bn) Required vs the BTC Projected Price

At the current $25 billion level for miners’ revenues, it isn’t too difficult to imagine $150,000 Bitcoin in the 2024 to 2028 cycle. It could also spike much higher in the short term, but it is harder to hold those levels unless the really big money can sustain the network. Yet by 2036, the current network funding would sustain a million-dollar Bitcoin. Of course, a million by then won’t be a million as we see it today, but it’s still presumably a decent gain.

In the early days, Bitcoin was driven by adoption, but now the network has matured, the focus is on flows, which must equal miners’ revenue. That trumps everything else.

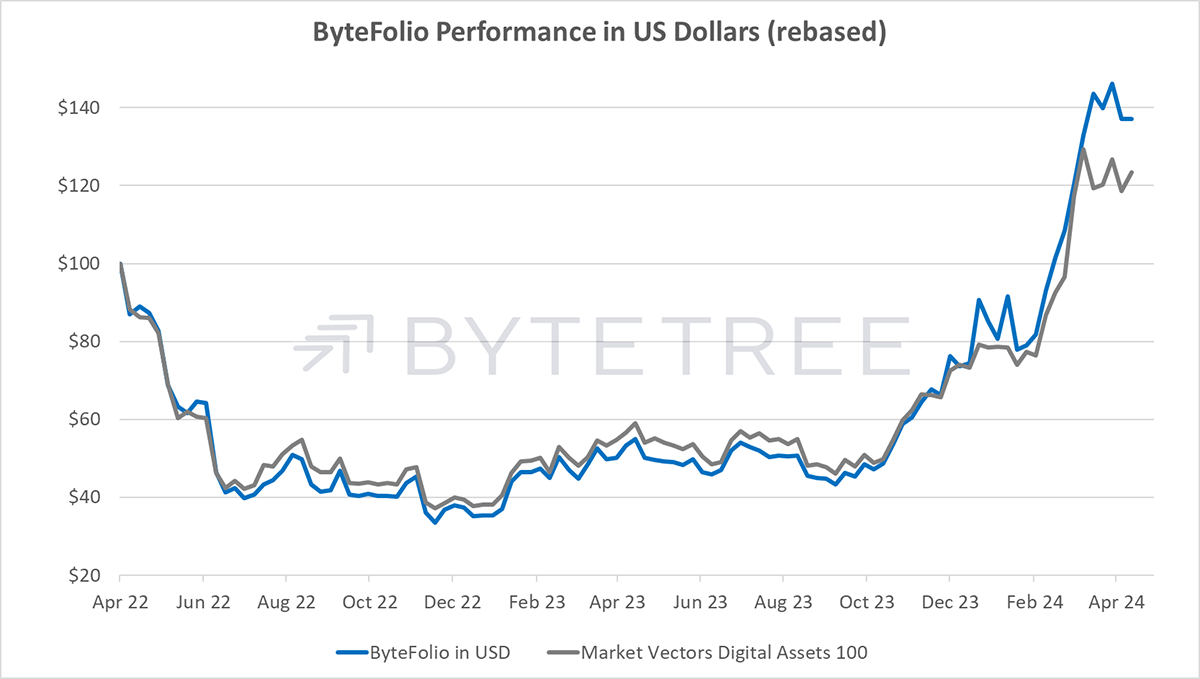

ByteFolio as at Issue 102

Miners’ revenue is where demand meets supply. It isn’t the halving that creates value; it is the network growth. You can reduce supply as much as you like, but unless demand grows, Bitcoin isn’t a sure thing. We are bullish, but it’s an important reminder at times of excessive optimism.

I will be away next week, but Ali will share some other useful insights on the upcoming halving. In the meantime, our analysts are very excited about our largest holding, so let’s dig in.