Yesterday, I was in London at an investment conference, where 19 people pitched investment ideas. They were all seasoned professional investors, and most were mid and small caps, with a strong sense of value.

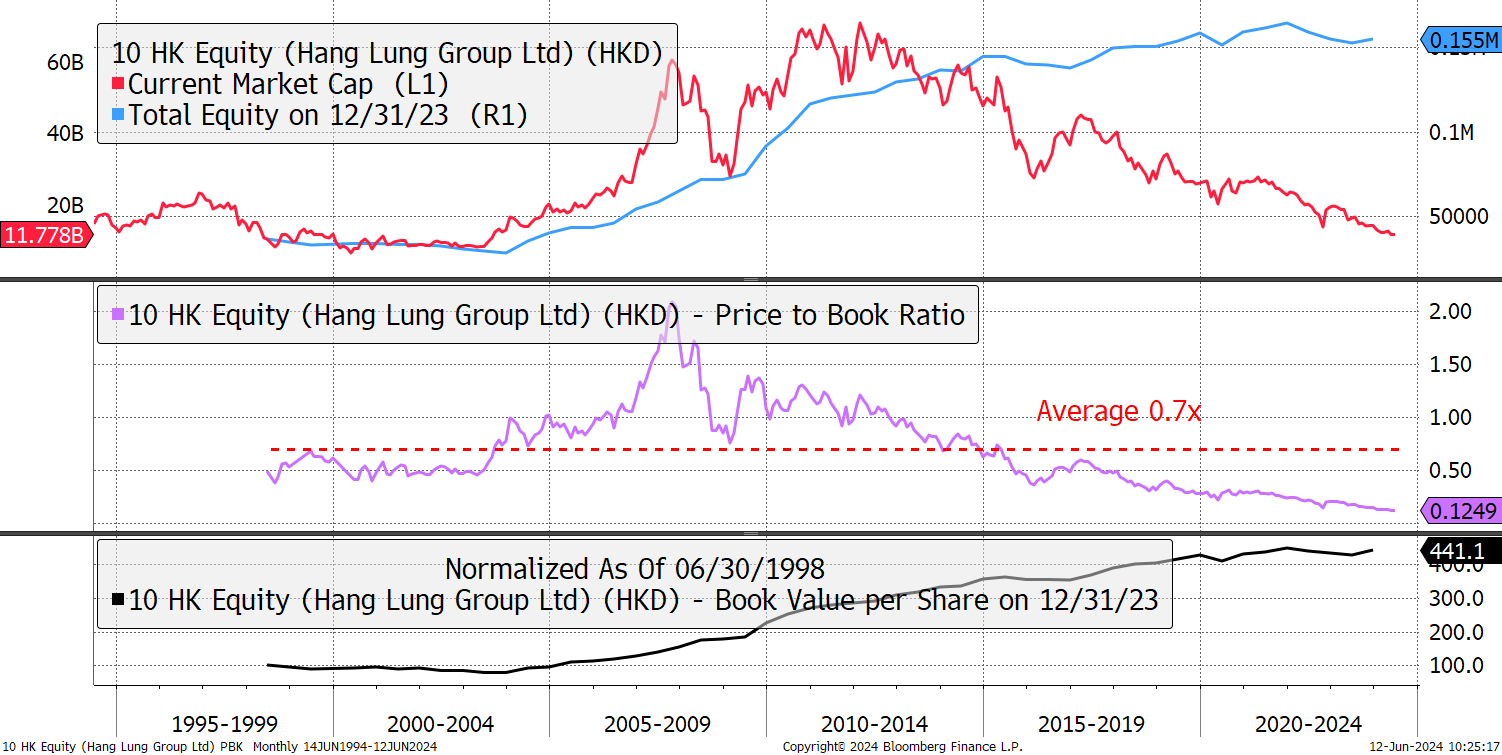

One large cap that came up was Hang Lung Group (10 HK), a Hong Kong based property company, that trades at 12% of book value. According to the accounts, the company is valued at HK$ 11.8 billion (US$ 1.5 billion) with net assets (total equity) of HK$155 billion (US$ 20 billion). Having historically traded at 0.7x book value, it appears to be cheap.

Hang Lung Trades Cheaply

The company owns offices and shopping malls across Hong Kong and China. It is a high end, and impressive portfolio, and the landlord to Louis Vuitton. The dividend yield is 10% and according to Bloomberg, the company’s balance sheet isn’t stretched.

Then comes the shareholder structure which is complicated, with links to another company called, Hang Lung Properties (101 HK). It also appears to be cheap but this time, the stress is starting to appear on its balance sheet, which is unsurprising given the severity of the property crash. Still the level of gearing is 23%, which isn’t particularly high for a property company. Assuming the accounts are what they seem, how can value opportunities like this exist?

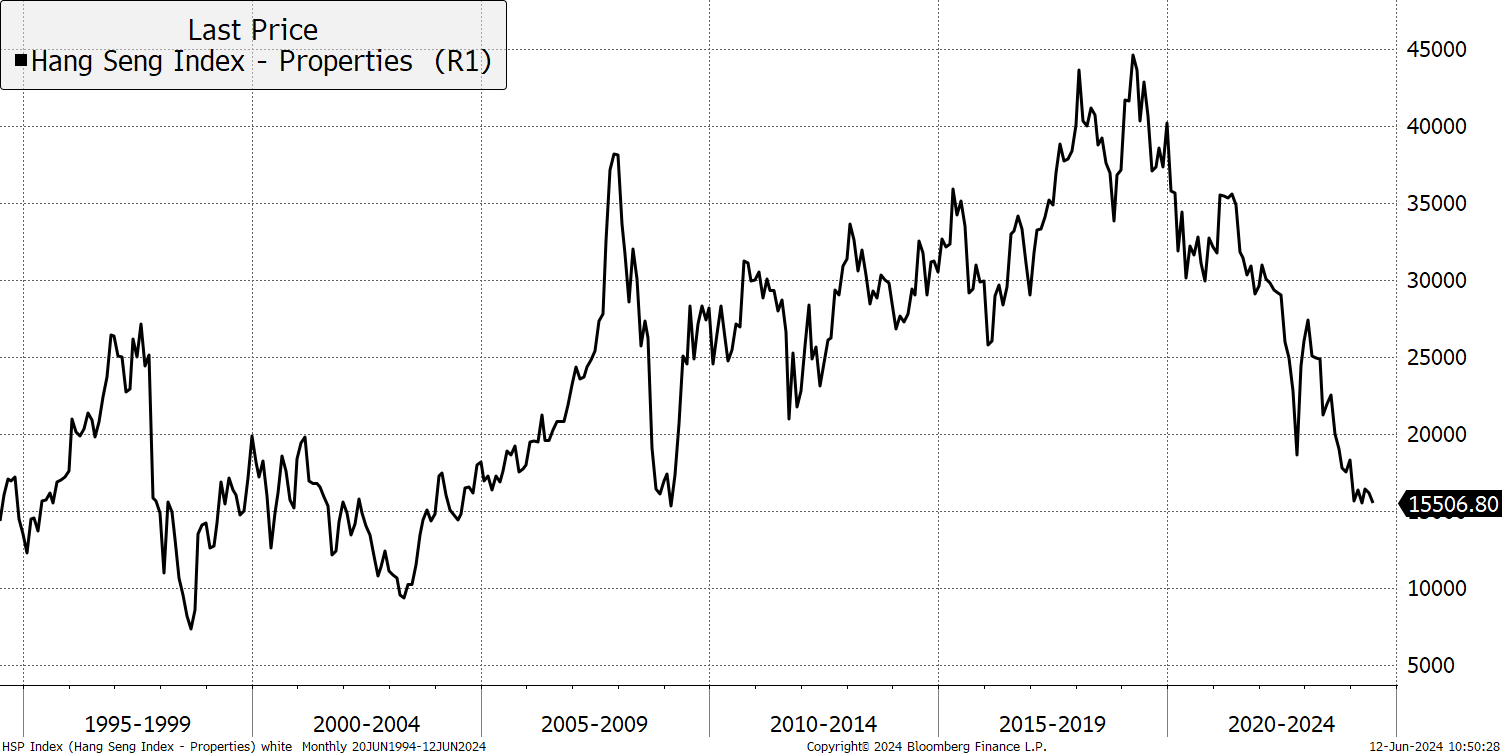

I don’t think it’s yet time to buy Hong Kong Property shares, but sooner or later, it will be. I would like to see the sector stabilise first, and for that to happen, we need to see investors return.

Hang Seng Property Index

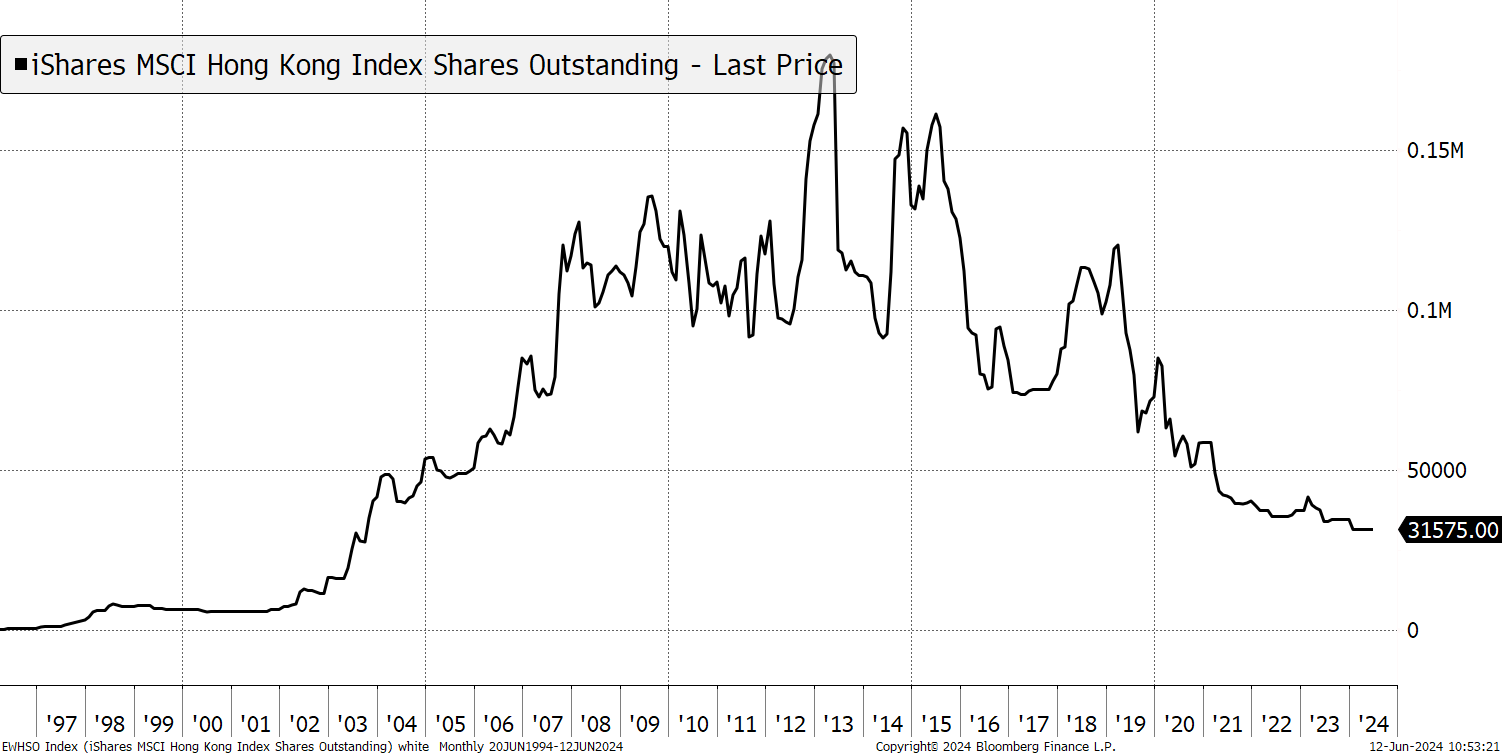

I highlight this because it gives us a taste of what is to come. There is huge value in Hong Kong and China, and sooner or later, it will be realised. Yet investors are oblivious. This is the US listed Hong Kong ETF (EWH) which has seen an 82% reduction in the number of shares since 2013, as investors have fled. EWH holds just US$0.5 bn of assets.

Hong Kong ETF has shrunk by 82%

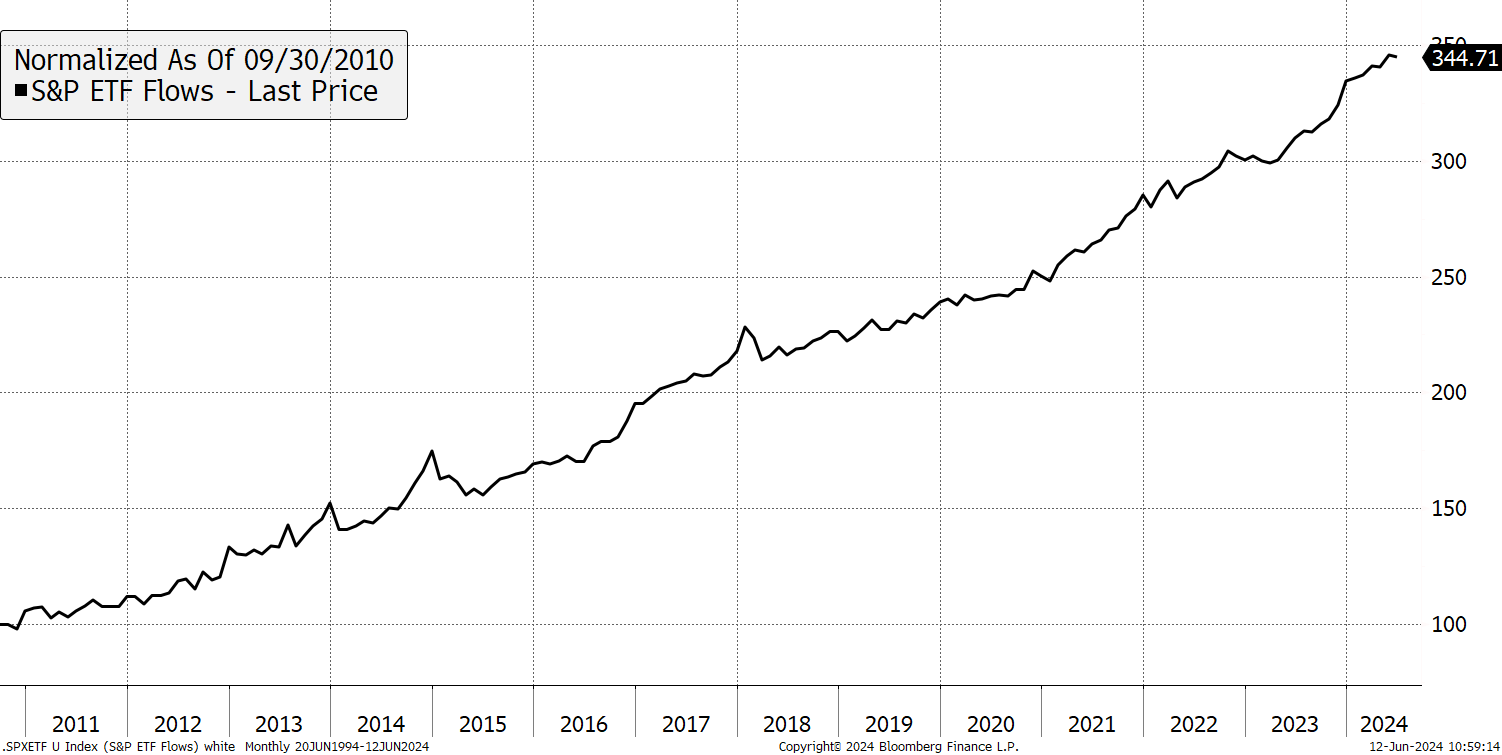

What about the Hong Kong ETFs in Europe? There aren’t any. EWH is the only Hong Kong ETF in the world, that is listed outside of Hong Kong. Contrast that with the flows into the S&P 500 index, which are 3.5x what they were in 2011. The top four US ETFs now hold nearly $2 trillion, which is more than the entire value of the HK stockmarket (US$ 1.5 trillion). That would be further boosted if you include additional S&P index funds and ETFs around the world.

US ETF Flows Keep Growing

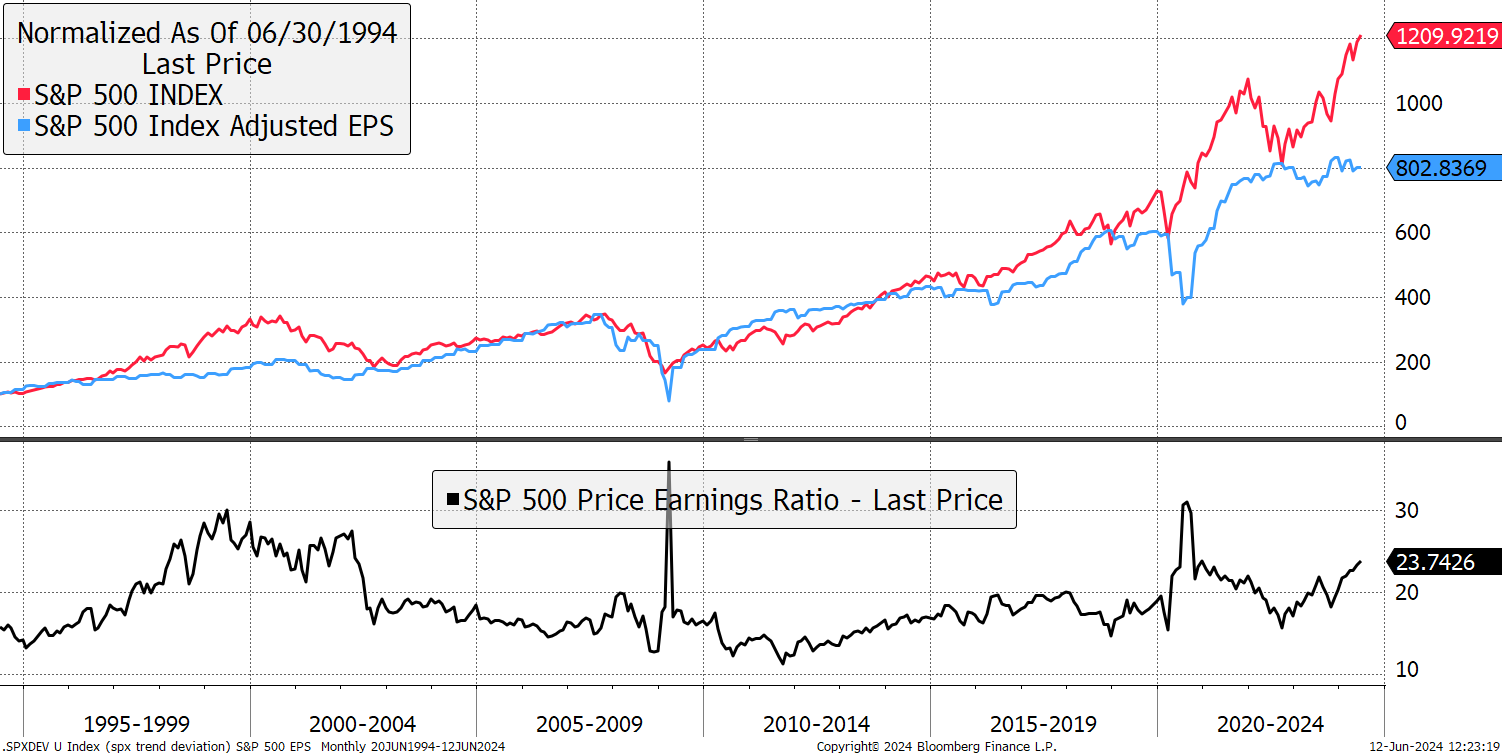

It is an extraordinary situation where global investors fuel US large caps, at seemingly any price, while ignoring the value on offer around the world. Sooner or later, something will break this extraordinary situation, and it won’t be pretty. I suspect the catalyst would be something like a truce in Ukraine. We live in hope.

Bubble

There were many other ideas at the conference:

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd