In this piece, I will update performance data for the Soda (balanced) and Whisky Portfolios (large-cap equity), which were launched on 29 January 2016, to include Q2 2024. These portfolios sit in The Multi-Asset Investor, and with 8.5 years of performance, the records are starting to stand out.

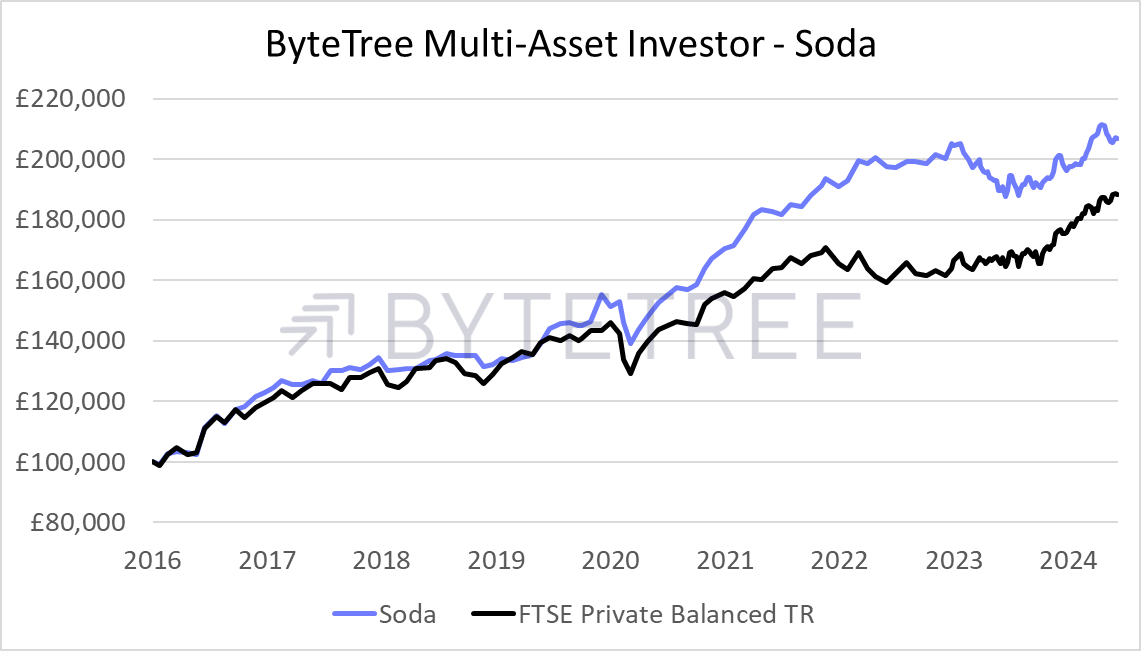

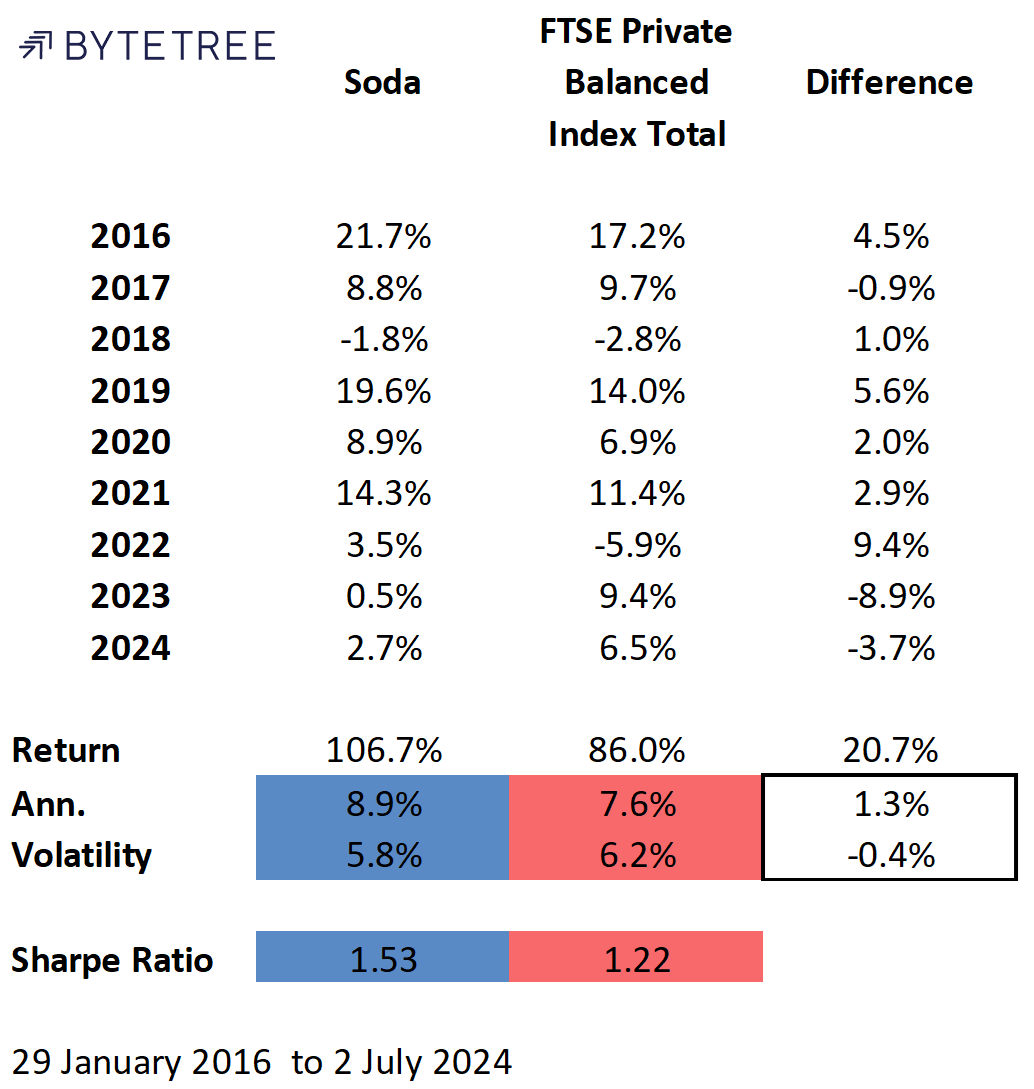

The Soda Portfolio had a good pandemic, proving resilient during the March 2020 crash and again in the 2022 bond bear market. But since then, it has been a little slower in the recovery, particularly in 2023 - a period of notable sterling strength that dampened returns on overseas assets and gold.

More importantly, the FTSE Private Balanced Index, used for comparison, holds 46.9% in global equities (of which 70% is in the USA) and 14.4% in UK equities, with the rest in cash, bonds and alternatives, and nothing in emerging markets. That means that a significant part of their return comes from US equities, which have been strong, boosted by the largest stocks, especially technology. The Soda Portfolio has been light on US equities, preferring value opportunities elsewhere. I always opt for resilience over risk, especially so in the Soda Portfolio. Over the long term, this has a habit of working very well indeed.

Soda

Comparing Soda to the market portfolio over the years, it has done slightly better most of the time, but recently, it has taken a different path. The outsized strong year of 2022, when Soda rose while the market fell, was reversed in 2023. Yet Soda still rose, just as it has this year. Soda is a conservative portfolio and, as a result, is more resilient during periods of market weakness. Note also that the volatility of Soda has been slightly lower than the market despite being more concentrated. The overall result has not only delivered higher returns to our clients but also higher risk-adjusted returns, as shown by the Sharpe Ratio.

Soda vs FTSE Private Balanced Index

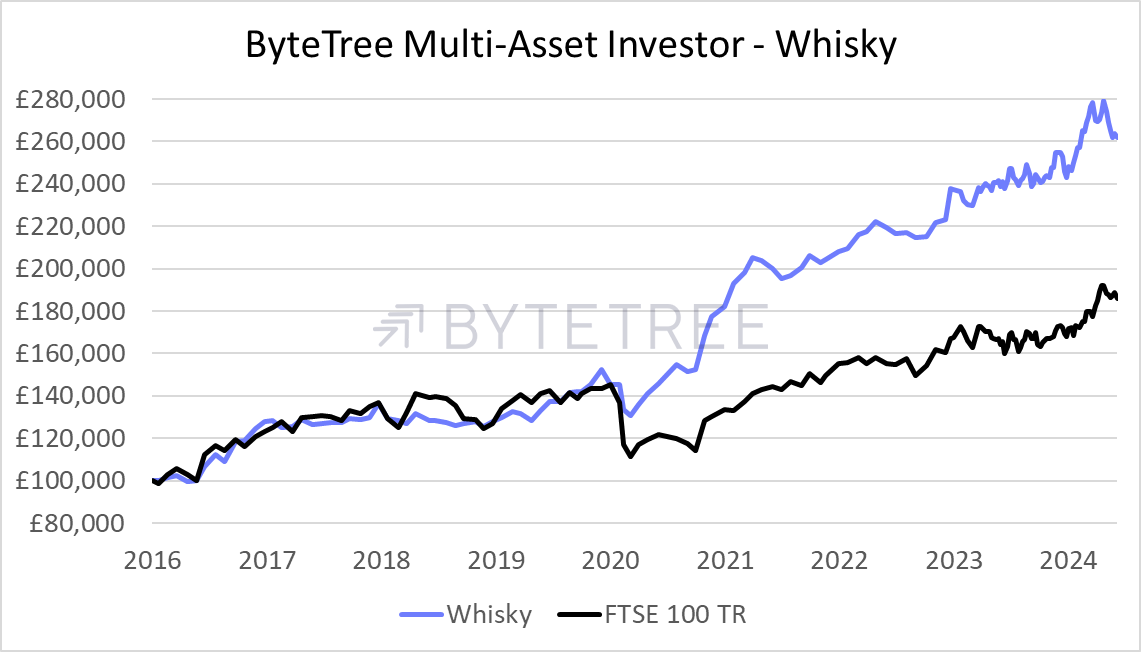

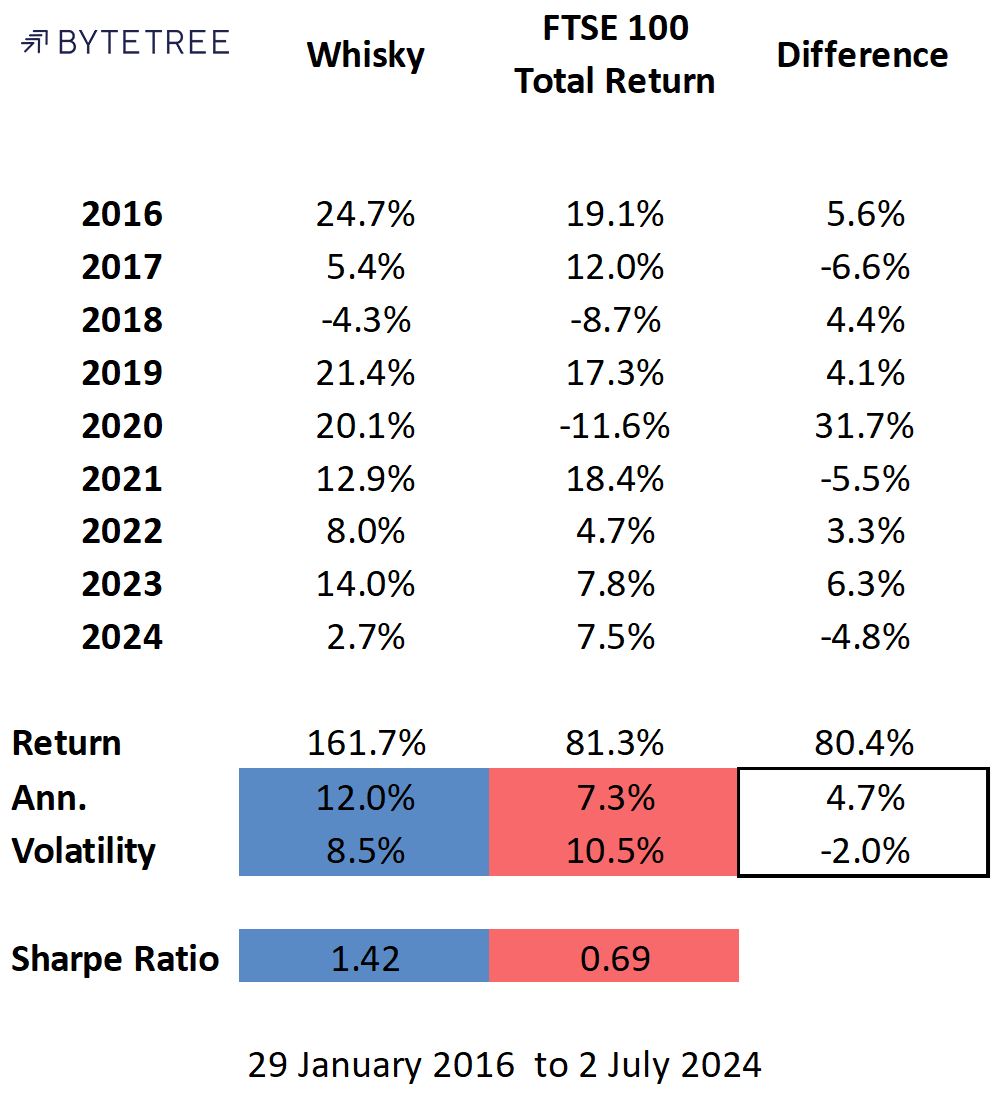

The Whisky Portfolio has continued to perform well, despite a setback in Q2 following a surge in Q1. Once again, it had a good pandemic, and thereafter was able to deploy cash into low prices. Yet finally the FTSE 100 has perked up and made a new all-time high. We wish it well, but would have preferred to own a couple of UK banks, which have flown.

Whisky

In recent years, UK equities have been out of favour. With underwhelming liquidity, the possibilities were shrinking and that persuaded me to look further afield. The result has been an increasingly international portfolio. While value dominates the portfolio, there’s an increasing representation from growth, especially in the emerging markets. Around 25% is in precious metals and Bitcoin, 19% in emerging markets and most of the rest in single stocks with a strong income stream.

2024 has slipped slightly further behind, although the last week has seen Whisky jump to 5%, thus halving the gap. I have little doubt that when the great rotation out of big tech begins, the Whisky Portfolio will spring to life. Since 2016, it has done twice as well as the market with 2% less volatility, leading to materially higher risk-adjusted returns.

Whisky vs FTSE 100

A Week (or two) at ByteTree

Without a roundup last week, I’ll do the double. In The Multi-Asset Investor this week, I wrote about Central Asia, touching on Georgia and Uzbekistan. We bought a bank. Last week, I looked at small caps and how they have been overlooked in this “passive bubble”. That is, the market now has $13 trillion in ETFs and even more in other trackers. This has happened at the expense of active managers who pick stocks. Passive funds have huge positions in the biggest stocks. In contrast, active funds tend to do the opposite and have higher allocations to smaller stocks. What happens if investors en masse pull money from active and hand it to passive? You get a passive bubble, which means the little guys that got left behind and are too cheap.

At ByteTree, we hunt down those cheap stocks. The mid to large stocks find their way into Whisky, while the mid to small stocks end up in Venture.

In Venture, I added a cheap stock that covers the food travel business. It’s a big market and they are taking it by storm. I also sold Direct Line (DLG) as the review following the rejected bid attempt was underwhelming. Take profits and lock in an 80% IRR.

BOLD was rebalanced last week by selling some gold and adding Bitcoin in the recent setback. This is why it does so well; when Bitcoin turns up again, which it surely will, it’ll be fully loaded into the rally.

Finally, in crypto, we have been quiet, but there is some flow data on Solana (SOL) ETFs, which is worth a look.

Have a great weekend,

Charlie Morris

Founder, ByteTree