Token Takeaway: KAS;

Kaspa is a next-generation Proof-of-Work (PoW) ledger that aims to solve the blockchain efficiency issues faced by Bitcoin and other prominent PoW chains. Using its innovative architecture, Kaspa offers an open-source, highly scalable layer-1 (L1) blockchain for seamless peer-to-peer transactions. This Token Takeaway will examine the fundamentals of Kaspa and its value proposition as a PoW L1 blockchain. We will also explore the future of Kaspa and how its native token, KAS, fits into all this.

Overview

Kaspa was developed by DAGLabs, a blockchain research and development company led by Yonatan Sompolinsky. Polychain Capital primarily funded the project following an initial $8m funding round as a vote of confidence. DAGLabs repaid Polychain Capital by using some of the initially mined KAS tokens. According to Kaspa Wiki, DAGLabs and Polychain Capital have both waived all Kaspa intellectual property rights, officially making Kaspa a “community-owned” project. DAGLabs initially supported Kaspa developers at half-capacity, but it later dissolved.

Kaspa went live in November 2021. It is designed to be a next-generation cryptocurrency that uses a PoW consensus, addressing nearly all the technological limitations that current PoW chains like Bitcoin face.

The consensus mechanism is the core component of all blockchains. While PoW is often criticised for its environmental impact, it offers greater security and decentralisation compared to Proof of Stake (PoS) systems. For the benefit of this report, I will briefly explain the difference between the PoW and PoS consensus mechanisms.

What Is Proof of Work (PoW)?

The PoW consensus mechanism is like a competition where computers (called "miners") race to solve a complex puzzle. The first one to solve the puzzle gets to verify and add a new block of transactions to the blockchain, and in return, the miner earns a reward. The more powerful the computer, the faster it can solve the puzzle, but it also uses a lot of electricity.

Bitcoin is the most popular and largest cryptocurrency, and it also happens to use PoW. Miners worldwide compete to solve these puzzles using high-tech computers, and the winner gets 3.125 BTC as a block reward for verifying and adding the block. The more miners there are, the more difficult it is to solve the puzzle, making the chain that much more secure.

What Is Proof of Stake (PoS)?

PoS is more like a lottery. Instead of competing with powerful computers, people (called "validators") are chosen to add new blocks based on how much crypto they are willing to "stake" or lock up as a security deposit. The more you stake, the higher your chances of being chosen. If you act honestly, you get rewarded, but if you try to cheat, you lose some or all of your stake.

Ethereum, after the ETH 2.0 upgrade, uses a PoS consensus. People who own ETH can stake it to become validators and earn more ETH as a reward for helping maintain the network. There is generally a minimum staking requirement and a cool-down period for unstaking.

Why Does Kaspa Exist?

Kaspa’s primary purpose is to address the blockchain trilemma. This term refers to the challenge of balancing between three critical aspects of blockchain technology: decentralisation, security, and scalability. The trilemma suggests that it's difficult for a blockchain to excel in all three areas simultaneously without compromising at least one.

As the first and most prominent PoW blockchain, Bitcoin laid the foundation for decentralised and secure transactions but has faced significant scalability issues. Bitcoin’s transaction throughput is limited, resulting in slower processing times and higher fees during peak demand.

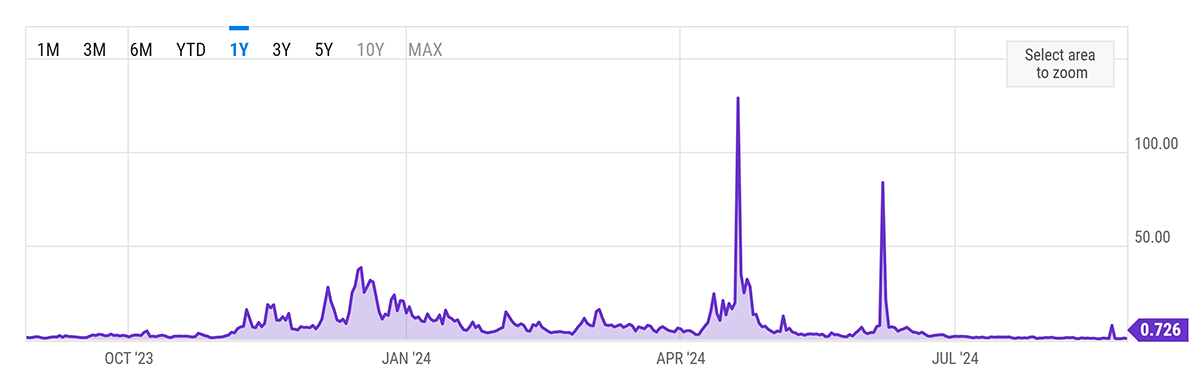

Average Bitcoin Transaction Fee

Recently, on 22 August 2024, the average transaction fee on Bitcoin spiked by nearly 940% from $0.70 to $7.60. Moreover, as illustrated in the above chart, there have been numerous instances over the past year where the average fee on Bitcoin has spiked significantly, almost to a point where it’s unfeasible to use Bitcoin for small-value transactions.

Kaspa was created to overcome these limitations by introducing an innovative PoW ledger that maintains decentralisation and security while significantly enhancing scalability. Through its unique architecture, Kaspa enables faster transaction processing and greater efficiency, offering a balanced solution to the blockchain trilemma.

Kaspa doesn’t aim to outshine or replace Bitcoin—that would be impossible. Bitcoin's true value lies not in its technology but in its vast and established network, which includes thousands of developers, miners, significant institutional interest, and tens of millions of token holders. Building a network of that calibre requires a lot more than better technical features, not to mention that Bitcoin has a first-mover advantage and a certain reputation in the industry. Instead, Kaspa presents itself as an alternative for users. As Bitcoin increasingly evolves into a store of value, especially with the rise of Bitcoin ETFs, Kaspa and its native token, KAS, can serve as a solution for peer-to-peer transactions. Ultimately, the core principles of both projects are quite similar.