ByteFolio Issue 120;

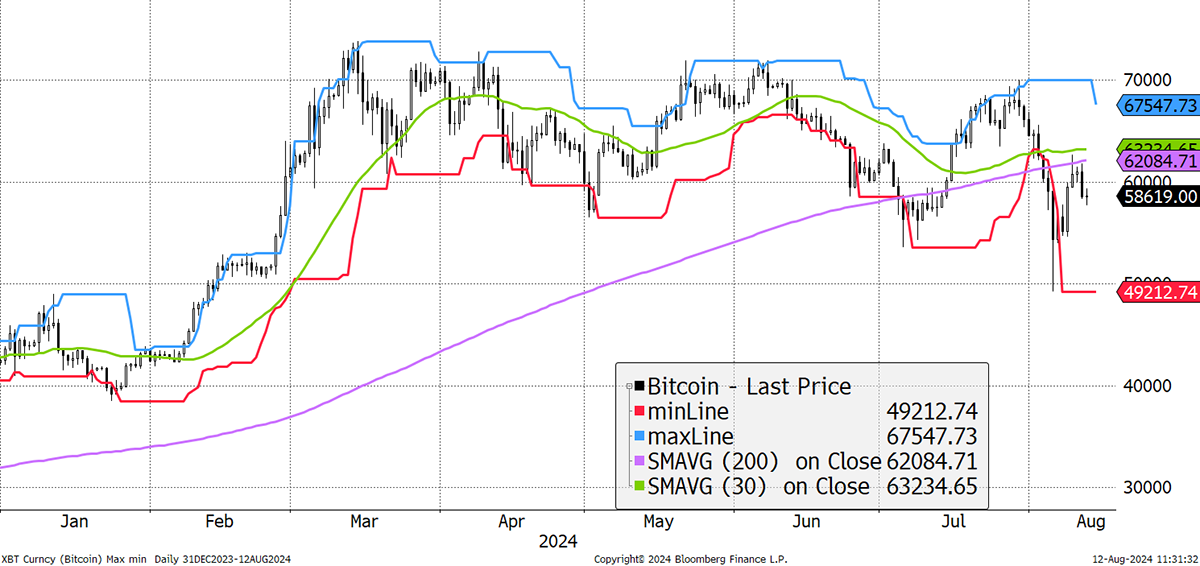

After last week’s carnage, it’s a good time to interpret the Bitcoin chart closely to see what it is telling us. The 200-day moving average is strong, which is positive. The 30-day MA is rolling over, which reflects last week’s crash, yet the price is below both MAs, which isn’t great, but that can change quickly. The 20-day max and min lines are important because they capture the pattern of lower highs and lows, which has been ongoing since March. The crash didn’t disappoint and made yet another new low last week.

Bitcoin ByteTrend Score 2/5

To break this down cycle, Bitcoin needs to make a new high above $70,000; otherwise, the downtrend will persist. It also needs to touch the blue max line first. The monthly cycles have always seen a strong move in October, following a weak August and September. There are no guarantees, but we could be on track for that.

The recent shakeout in crypto has been even more brutal in altcoins, as demonstrated by the 3-year low in Ethereum vs Bitcoin.

ETH in BTC

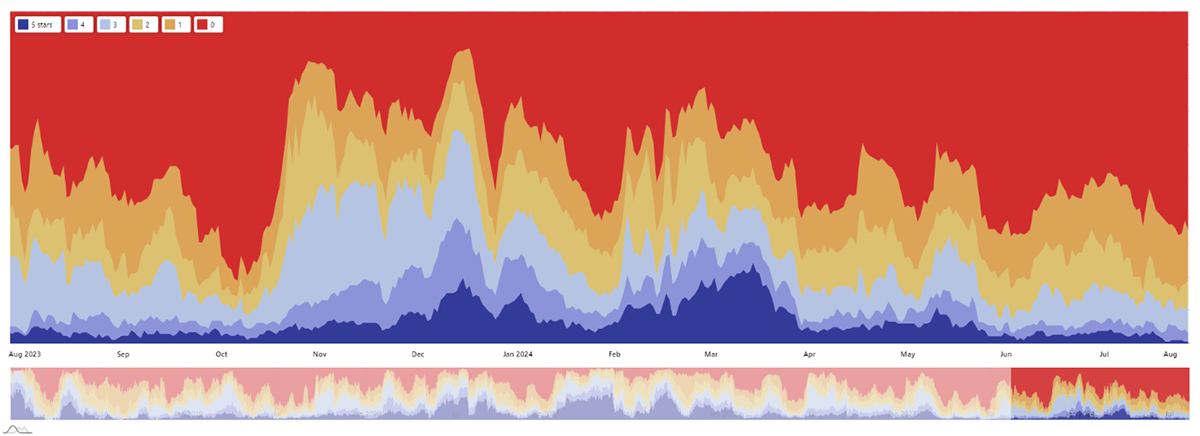

This is being repeated across the board, with just one token, Helium (HNT), displaying a 5-star trend in Bitcoin and a 3-star trend in US dollars. Breadth is currently terrible.

Crypto Breadth in BTC

The bottom line is that the economy is slowing down, and sooner or later, that could mean lower rates. That could go both ways. Crypto surely likes easy money, which lower rates will deliver, but if the economy is slowing, that may not be enough. What crypto really likes is red-hot monetary conditions, and it seems we are going the other way.