Trade in Whisky;

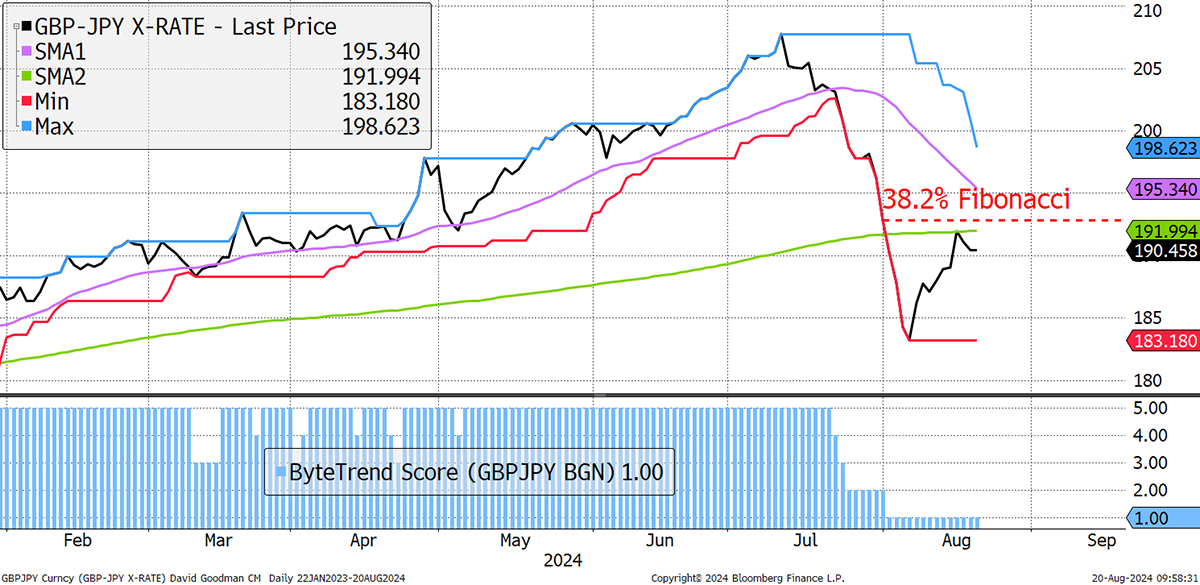

With two full weeks passing since the flash crash, we can get a sense of the new market regime. The Yen has bounced slightly, but not by enough. The technical analysts out there will say a 38.2% retracement of the prior fall is essential to demonstrate a change in trend. That would mean GBP-JPY moves above 192.50, and it hasn’t. Instead, it is below its 30- and 200-day moving averages, which need to be broken before we should assume the unwinding of the carry trade is over.

Sterling vs Yen Stalls at Resistance

This chart is an important one to follow (or USD-JPY). It doesn’t necessarily mean market mayhem because the unwinding of the yen (yen goes up) is now a known risk, which means help is at hand. We mustn’t panic until it’s time because problems could be buried for months or even years, as we don’t know how willing the authorities are to keep the market cogs fully greased.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd