ByteFolio Issue 124;

It has been a rough week for markets and Bitcoin too. But the problem is across markets and not Bitcoin or crypto specific. The market liquidity is running dry and needs a boost for things to improve. Rate cuts are on the way, but they may indeed imply that the monetary system has become too tight and needs to ease.

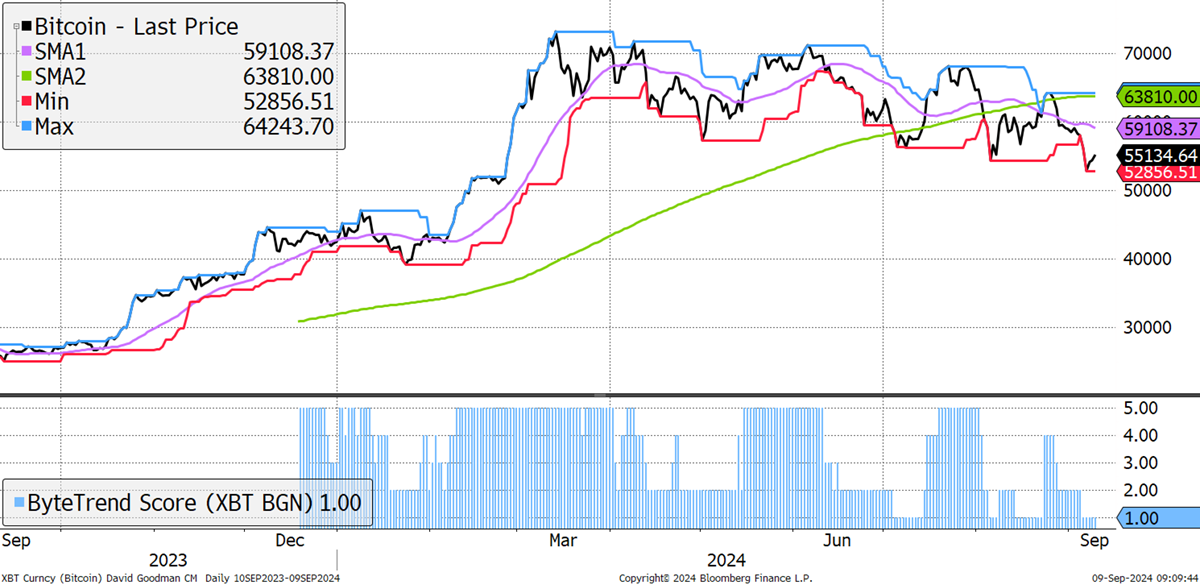

Bitcoin ByteTend Score 1 of 5

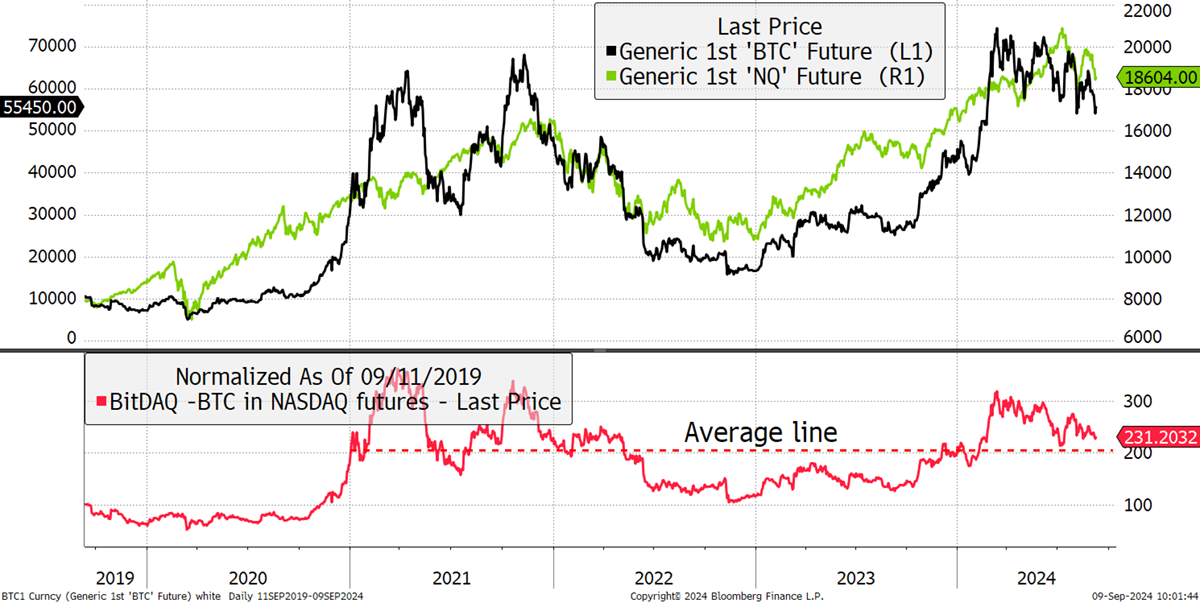

Bitcoin has never been a safe haven and has always led markets both on the way up and on the way down. Yet each bear market has been less distressing than its predecessor. Looking at Bitcoin (black) against the NASDAQ (green), they remain correlated, and so Bitcoin’s weakness comes as no surprise in the face of a falling stockmarket.

BitDAQ – Bitcoin and NASDAQ

BitDAQ (red) is still above the post-2020 average. It has generally traded around the NASDAQ, and now that significant volume lives on the New York Stock Exchange, this link makes sense. That said, the hope is always that when the NASDAQ finally throws in the towel, Bitcoin will detach itself and continue the bull market where tech left off. That remains plausible and likely if mainstream investors view tech as ex-growth and Bitcoin and crypto as plausible. I see this as inevitable, but then again, I have held this view since 2013.

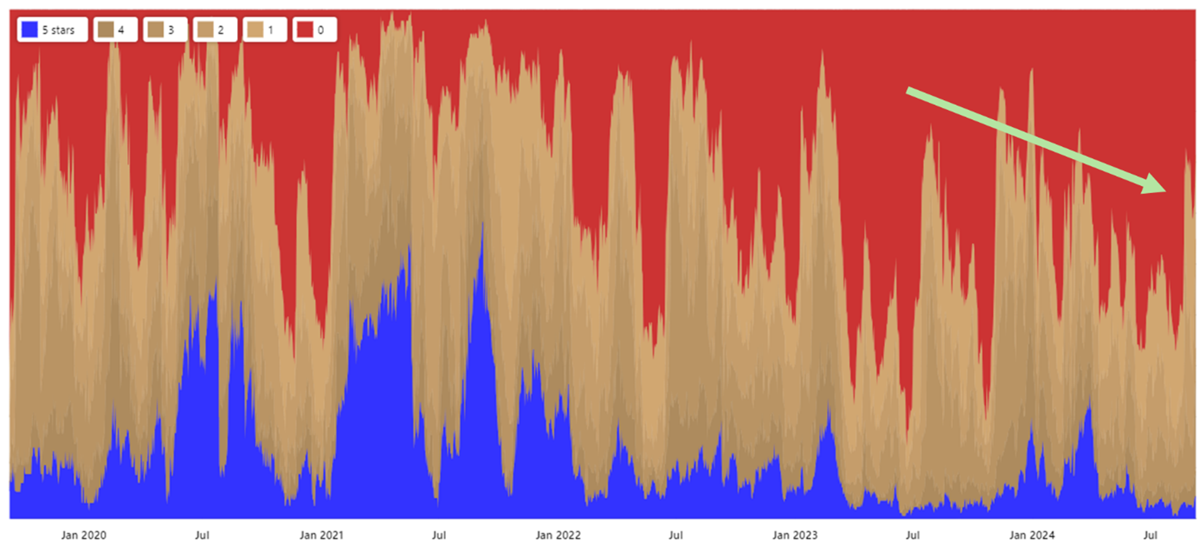

There is some good news on the altcoin front. While there are still very few tokens beating Bitcoin (blue), making conditions for crypto investors impossible, there are no more downtrends (red). This is good news because it suggests things aren’t getting any worse. That could well mean that things will only get better.

Few Tokens Are Beating Bitcoin but There Is Stability

The ByteTree fair value for Bitcoin is $61,477, against the current market price of $55,235.