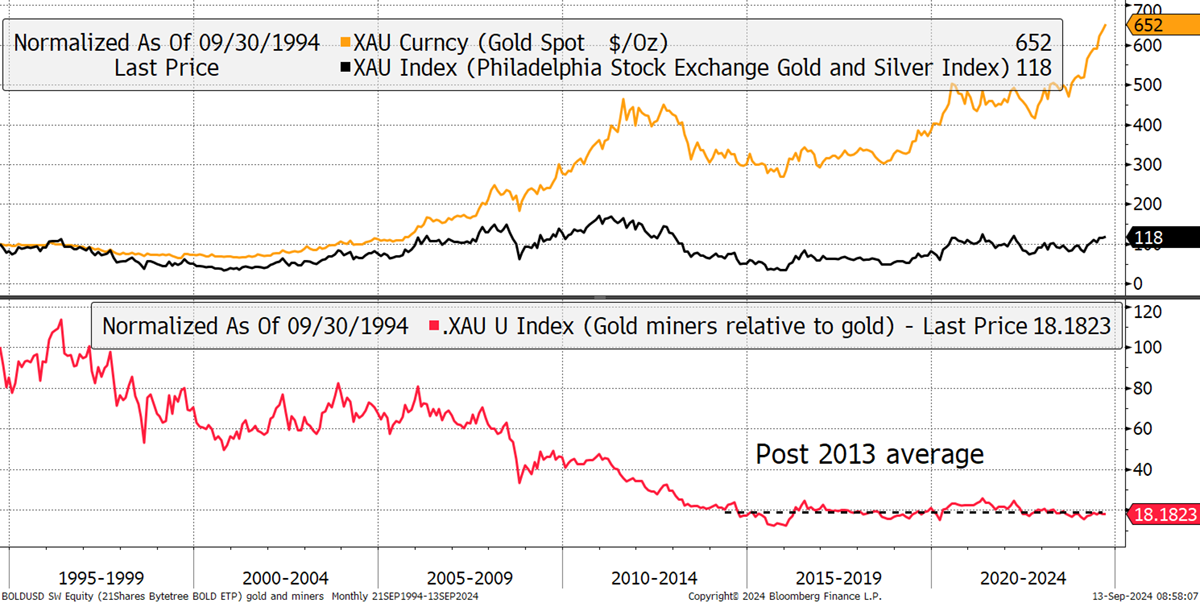

$100 invested in gold in 1994 is today worth $652, a $552 profit. Yet that same $100 invested into the gold miners is worth a mere $118. Many have pondered over this disappointing situation, wondering what the mining industry has been doing during this great bull market in gold.

Gold and the Gold Miners – Past 30 Years

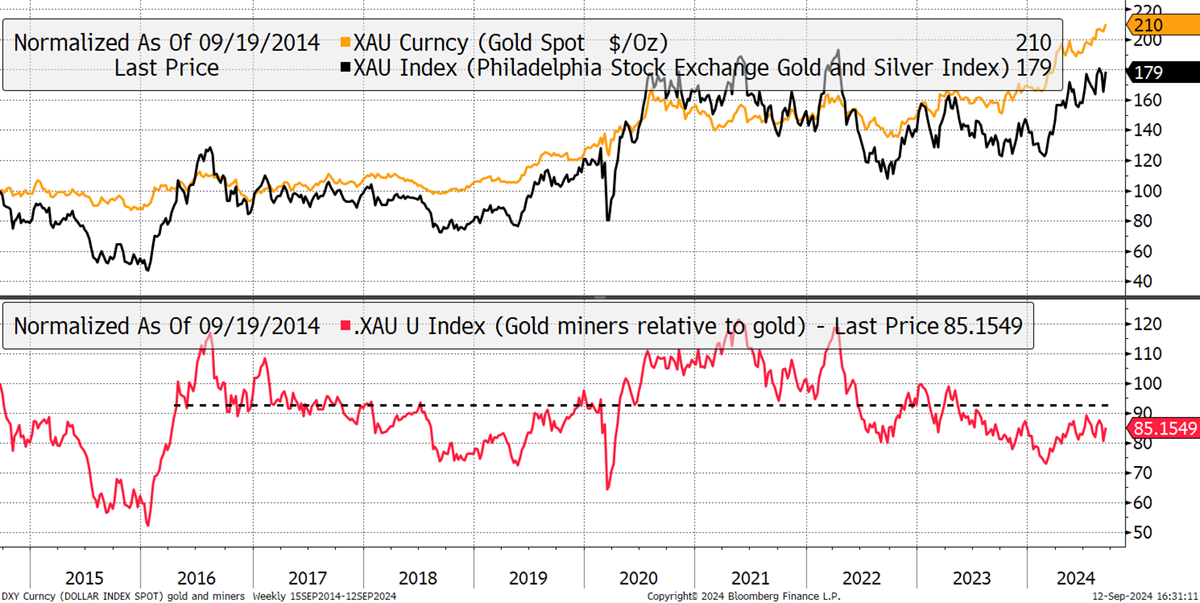

The miners have lagged gold since 1996, but since the major low point in 2015, they have been stable. I can demonstrate that by zooming in below. Unsurprisingly, the miners run harder on the gold rallies and vice versa on the falls. But despite the gold price at all-time highs ($2,550), the miners are still trading cheaply on this basis when you might reasonably expect them to have got in front of the gold price, as they did in 2016 ($1,247 av.), 2020 ($1,773 av.), and 2022 ($1,804 av.).

Gold and the Gold Miners – Past 10 Years

I have little doubt they will get ahead of the gold price, but stockmarkets don’t always do what you expect. The case for the gold miners to surge is strong, but gold is an ultra-high-quality asset. It is timeless, globally recognised, pristine collateral, and provides stability during uncertain times. Gold stocks, on the other hand, are businesses that are much less liquid, and far from being pristine collateral. They are generally considered to be risky. As the economy flirts with recession, it is of little surprise that the market backs gold, rewarding the miners only slightly.

The miners are supposed to beat gold during bull markets because they have operational leverage. That means if mining $100 of gold costs $50, when the gold price doubles, their profits treble from $50 to $150. That’s the theory, but in recent years, the miners’ costs have risen alongside the gold price, preventing margins from rising.

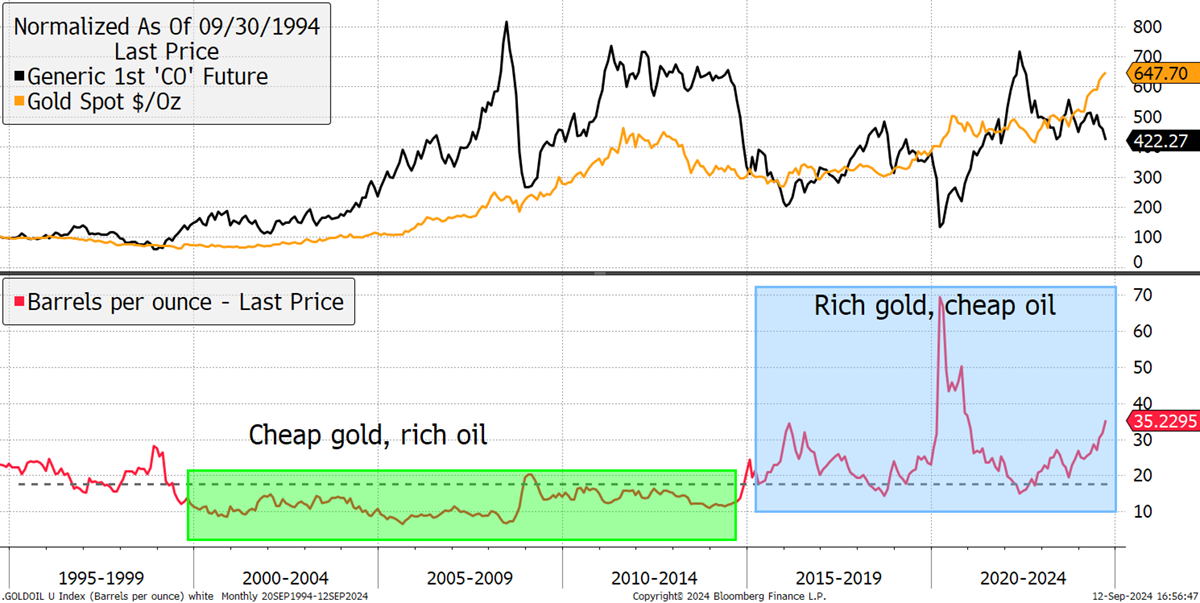

The miners’ largest cost, generally estimated to be around a third, is energy. Gold mines are energy-intensive and often far away from the grid, meaning they consume large quantities of diesel. If the price of gold is low and the oil price is high, that is bad news for the miners, as was the case between 2000 and 2015 when the gold miners were derated. But, since the oil break in 2014, courtesy of the US shale production, gold mining has become a more profitable activity.

Gold and Oil

Until a few months ago, gold and oil had the same 30-year return. Recently, gold has made an all-time high above $2,500, while oil has broken back below $80. While our oil stocks are now on the back foot, the gold stocks are in a prime position to perform. This situation of rich gold combined with cheap oil means the gold miners’ profitability will thrive. Better yet, this is happening while the miners remain cheap versus gold, making them even more attractive.