I have long been a fan of investment trusts (ITs) for long-term investors. They are ideal, as they provide the fund manager with a fixed pool of capital, freeing them of distractions from the daily buying and selling of fund units, which is seen in unit trusts and other open-ended funds.

A fixed pool of capital can also deliver higher performance, as was demonstrated in 2008. However, this is hard to demonstrate due to the few comparable funds available these days. I attended a presentation in 2009 that showed how investors panic selling unit trusts at the bottom of the market a few months earlier had negatively impacted the performance of investors who remained.

This was caused by the seller forcing the manager to raise cash at precisely the wrong time. The actions of the seller had caused prices to be lower than they ever needed to be, and when the market bounced, those assets were gone, and the fund never fully recovered.

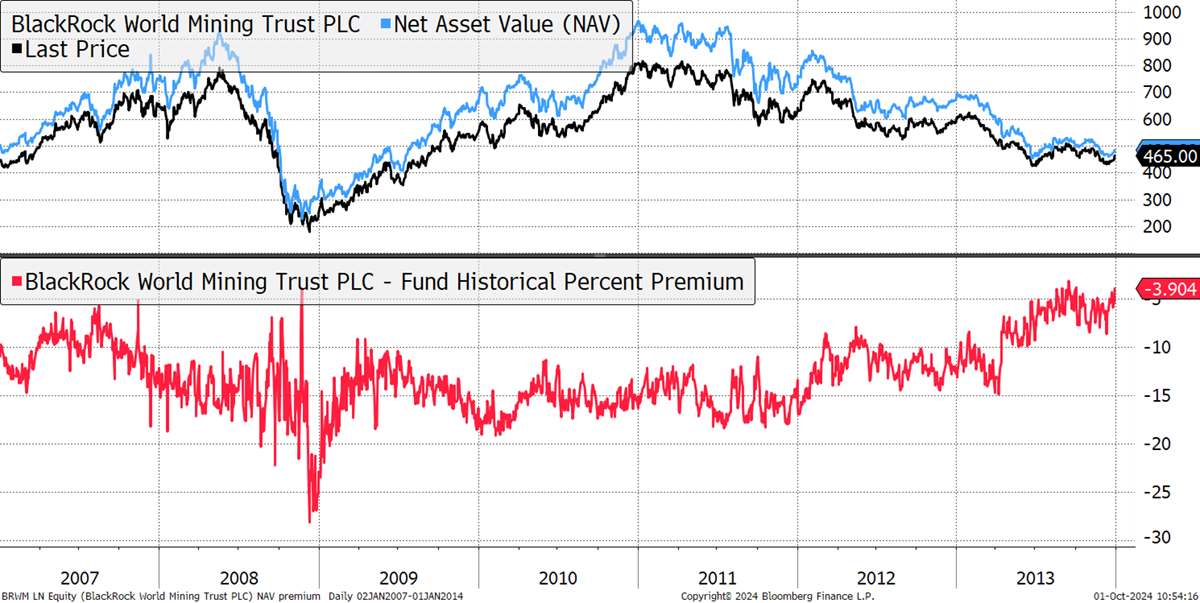

The IT managers had no such problem because their portfolios fell, and investors who wanted out could sell their shares for 28% less than what they were worth. Investors who hung on were soon back at or close to par (no discount). The seller had no impact on the long-term holders.

BlackRock World Mining in the Financial Crisis

ITs, or more generally closed-ended funds, can also hold less liquid assets, such as smaller companies, and infrequently traded assets, such as property, infrastructure, diamonds, songs and art. They can also use modest levels of gearing to increase returns.

Yet highly liquid assets, such as large-cap stocks, don’t need such a structure. If you are holding blue-chip stocks, the ETF is a masterstroke in financial technology. Buy and sell, in huge sizes, at the touch of a button. The ETFs have even created liquidity pools that didn’t previously exist. For example, corporate bonds held in an ETF are more liquid than those that are not. The same would hold true for gold mining shares and such like. The basket of stocks held in, say, GDX, becomes heavily traded in its own right.

The success of the ETF has no doubt negatively impacted the unit trust, but also the IT as big liquid stocks no longer need them. And when you look at the leader tables in ITs, there’s an increasingly eclectic bunch of funds, dominated by less liquid assets.

Top 10 UK Investment Trusts by Size

| 1. | Scottish Mortgage Investment Trust PLC |

| 2. | Pershing Square Holdings Ltd |

| 3. | F&C Investment Trust PLC |

| 4. | Polar Capital Technology Trust PLC |

| 5. | Alliance Trust PLC |

| 6. | Greencoat UK Wind PLC |

| 7. | JPMorgan Global Growth & Income PLC |

| 8. | HICL Infrastructure PLC |

| 9. | Renewables Infrastructure Group Ltd |

| 10. | Monks Investment Trust PLC |

Source: Bloomberg

In all cases, there is expertise behind each name, but that is no guarantee that good results will follow. In recent years, renewables have been popular. There was the green mission, which helped, but more importantly, the yield was attractive in a zero-interest rate world. Now that “risk-free” gilts pay a good yield, these funds have dropped to discounts. If rates returned to zero, unlikely but worth asking, might these discounts close? That’s possible but doubtful because the enthusiasm has gone. Discounts can close, but it will take a mixture of good results and patience.

I like the way the IT universe reflects our times, either what is relevant today, or has recently been. It is forever changing as new funds come from popular investment areas, while the funds that leave are either acquired or wound up. It is a never-ending period of creative destruction. The IT sector has narrowly beaten the stockmarket over 30 years, with ITs returning 6.9% as opposed to 6.7% p.a. for the UK stockmarket. It’s not huge, but it is a win. But I would add that discounts are currently wide and, therefore, cheap for new investors, which has weighed on returns.

Since selling Pershing Square (PSH), I do not hold an investment trust in the top 10. The Soda Portfolio has embraced eight other trusts, which make up 55.4% of the portfolio. That is on the high side because discounts are generally wide.

I recently listened to an excellent interview by the renowned financial journalist Jonathan Davis with Sachin Saggar, the alternative investments analyst at Stifel. It was an interesting discussion on the sector, and it is worth a listen. They touch on some of the structural issues behind the discounts and are encouraged that discounts will narrow in good time. One issue was the double counting of costs the ITs had to publish. That put off wealth managers, who had to disclose costs to their clients. Fewer buyers meant wider discounts, and so this became a negative feedback loop. Although the ruling is a temporary fix, it demonstrates a willingness by the regulator and the government to support the sector where we have several holdings.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd