Venture: Update - Middle East

The missile strikes on Iran have stirred markets with large moves in natural gas, oil, and precious metals. The dollar is also up.

For experienced investors looking for more opportunities

The missile strikes on Iran have stirred markets with large moves in natural gas, oil, and precious metals. The dollar is also up.

ByteTree Venture is an equity research service seeking deep value, momentum, or special situations around the world, run by ex-HSBC fund manager Charlie Morris.

Each company we recommend is tracked over time, and sold when appropriate.

Venture focuses on special situations and value in global equities (and occasionally commodities). Venture is far-reaching, and while most trades have been in the UK, that is simply because Britain is where the most value was initially found. There have increasingly been others in the US, Austria, Canada, China, Germany, Japan, Italy, and Denmark.

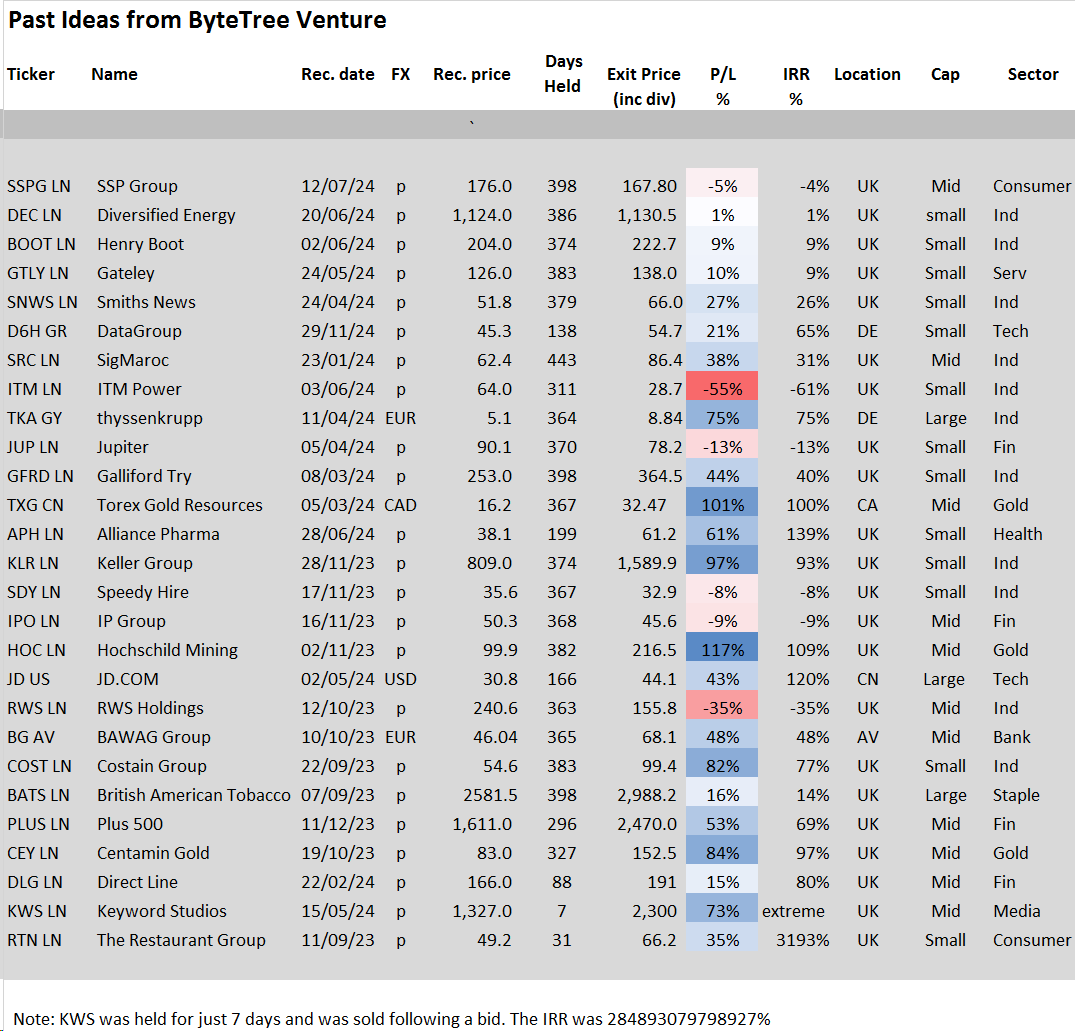

For example, here are our past (closed) recommendations:

Venture was launched when I saw the UK discount as an opportunity. It came about following issues such as Brexit and the short-lived Liz Truss premiership, which kept international investors away. It wasn’t going to last forever, but it resulted in many world-class companies trading at absurdly low valuations, making it a rich picking ground.

I have selected opportunities in software, construction, pharmaceuticals, banking, broking, mining, media and airport caterers. To find great value in markets, you need to be flexible.

To me, financial markets are all about data and trends. I have spent decades refining my stock selection process, which is both quantitative and qualitative. That means I use data to identify good opportunities and then do detailed research into the company thereafter. I am looking for unusual relationships, such as valuations out of kilter with the past, or a discount to a vibrant sector of the market, or maybe simply “too damn cheap”.

These screens were built for selecting large-cap stocks and are used in the Whisky Portfolio, which is the core equity strategy in The Multi-Asset Investor. One day, I had a eureka moment to apply it to mid- and small-caps, and got some spectacular results.

Screening is a powerful tool and a key part of the process. Rather than study 3,000 companies, which would require a small army of analysts, I use computers and data. They have never selected a stock for me, nor will they. Instead, they are a huge time-saving device that helps me identify potential opportunities.

An example might be that oil is strong, or Greece is recovering from a slump. By screening data, attractive potential outliers are identified before the recovery story has even evolved.

As you saw above, this proceess has led to some excellent returns for early clients. The team at ByteTree has since grown, and I am now supported by Kit Winder CFA, but the process is identical, and we are able to uncover even more opportunities every week.

Boosted now by the trend following insights of ByteTree Global Trends, we are able to identify which stocks are working, in what sectors, and where, at record pace. There’s always value on offer somewhere.

What's more, the 21st century has enabled the private investor to become ever more empowered. Today’s investment platforms give you access to a wide range of securities around the world at low cost. We intend to takee advantage of that power, helping you invest in the best opportunities around the world.

Venture is best suited for confident and experienced investors, and is exclusive to ByteTree Pro clients, helping them identify profitable opportunities in global stock markets.

They have been generous with their praise on Trustpilot, for which we are exceptionally grateful.

ByteTree Pro includes Venture, along with access to everything we currently offer, from The Multi Asset Investor, to Quality and Global Trends.

We think it puts you in the best possible position to manage your wealth for the long term, covering portfolio management, the best companies in the world, and value opportunities, while keeping on top of the trends.

Our track record is strong, our process is robust, and the opportunities are wide-ranging.

Become a ByteTree Pro client today

ByteTree Research was founded by Charlie Morris, an experienced fund manager since 1997. At HSBC Global Asset Management in London, where he worked for 17 years, he managed $3 billion of institutional and private wealth. His funds invested in equities and bonds alongside alternative assets such as gold, commodities, real estate, credit, private equity, and hedge funds.

SolGold is in discussions about a takeover by Jiangxi Copper. It held a Court Meeting and a General Meeting on

This is a cyclical industrial recovery, and today’s company is well placed to benefit. What’s more, it trades on a rock-bottom valuation.

Chemicals are rallying as part of the global recovery in cyclical stocks. We researched the opportunities and have found another gem.

We’ve found one that is undervalued, ridding itself of underperforming brands, and repairing its balance sheet.

After a few brutal days in precious metals, I wanted to highlight some key charts before we get into some portfolio updates. Let’s start with the gold price.

Issue 105; This week’s Global Trends report saw the greatest strength in Brazil, Canada, Mexico, South Korea, and Hong