Strengthening the Foundations

This week, I take profits from biotech and Japanese banks, and shift into two of the world’s greatest companies.

A diversified portfolio service that blends traditional bonds and equities with alternative assets such as gold, commodities, and digital assets

This week, I take profits from biotech and Japanese banks, and shift into two of the world’s greatest companies.

Led by ex-HSBC fund manager Charlie Morris, The Multi-Asset Investor is a weekly investment research newsletter delivering two portfolios to clients: Whisky (medium-high risk) and Soda (medium risk).

We recommend, you invest.

Each new addition to the portfolios is communicated with a full investment case, and instructions on position sizing. Positions are tracked, reported on, and sold when appropriate, with every decision and update shared in real time.

In tough markets, The Multi-Asset Investor has delivered highly impressive risk-adjusted returns for our clients.

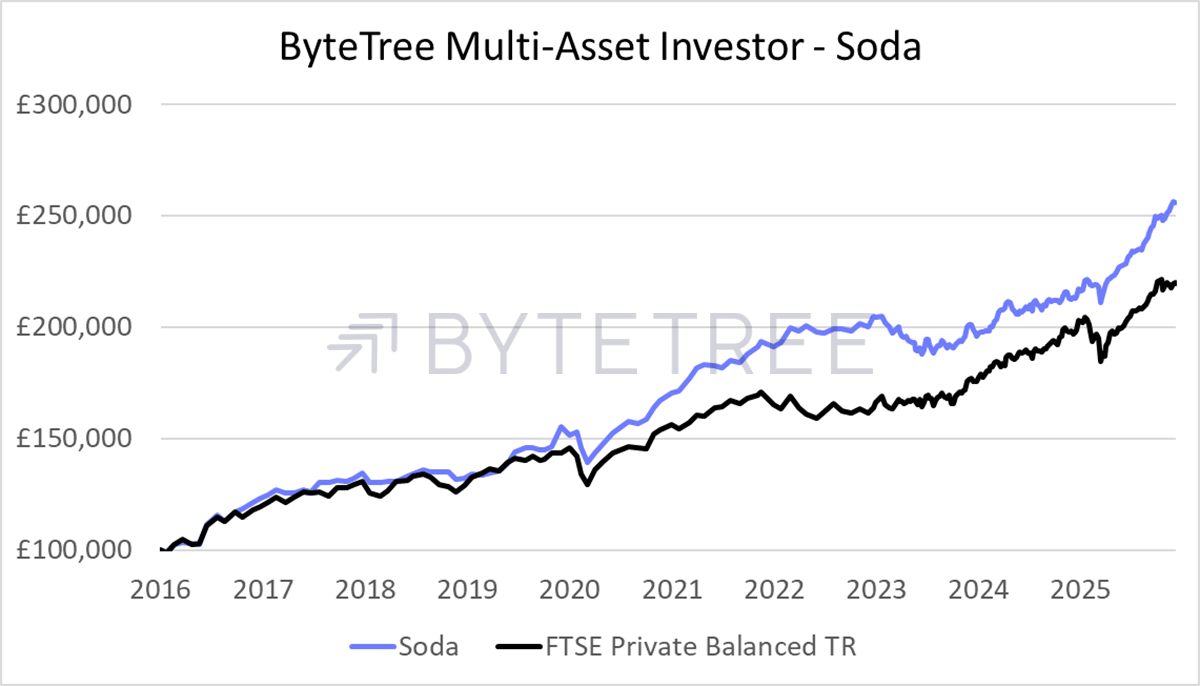

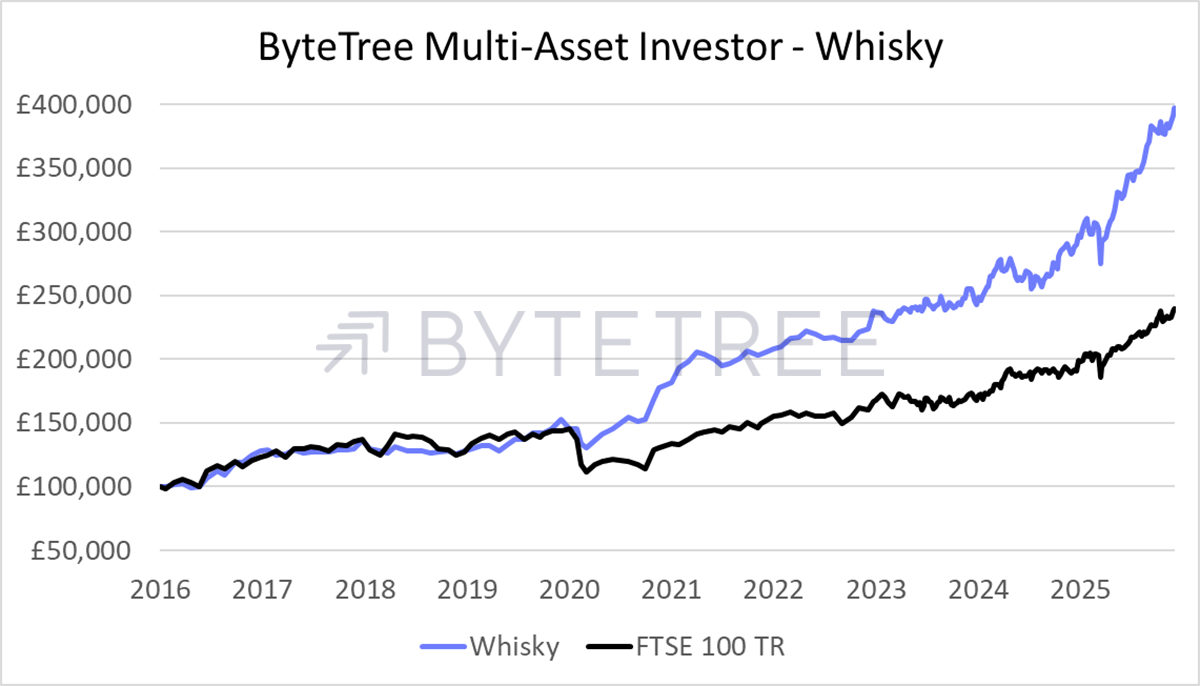

Total gross returns, from inception, 29 January 2016, to 31 December 2025:

Whisky and Soda bring Charlie's best ideas into an investable portfolio, based on sound financial principles:

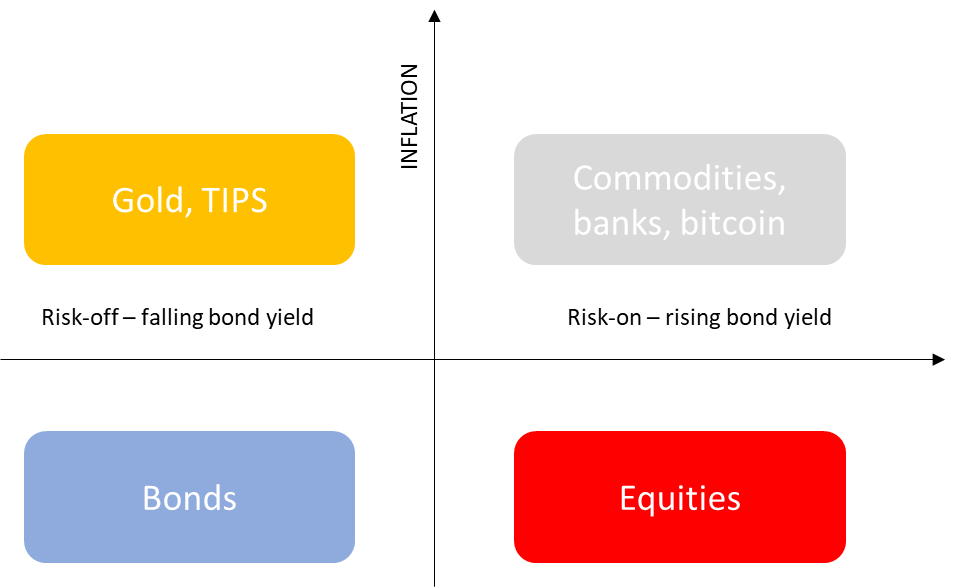

The strategy is backed by a repeatable process, called the Money Map. This is a framework we use to identify key areas in which to focus, and more importantly, the areas to avoid. Above all, this is how we diversify a portfolio by having exposure to each quadrant, whatever the weather, because macroeconomic environments can change quickly.

Following the Money Map is a core part of our discipline, and has helped the Whisky portfolio to deliver positive returns in 9/10 years, falling by -4.3% once, and delivering a +20.1% return in 2020 while the FTSE fell by -11.6%. Wealth preservation is at the heart of what we do.

Soda has low turnover, a long time horizon, and invests in collective investment schemes like funds, ETFs, and investment trusts, making it highly stable, falling just -1.8% in its only down year. It is the core of the strategy, Whisky is the growth on top.

The portfolios are designed to be easily replicated for investors managing their own money. Every Tuesday, research is shared, via email and on our website, that explains the most important developments in global markets, and shares new additions or sales in the model portfolios.

Charlie explains his decisions, good and bad, in language that is easy to understand and entertaining. The Tuesday letters also answer client questions, as well as detailing current performance.

You can view our latest results and commentary here:

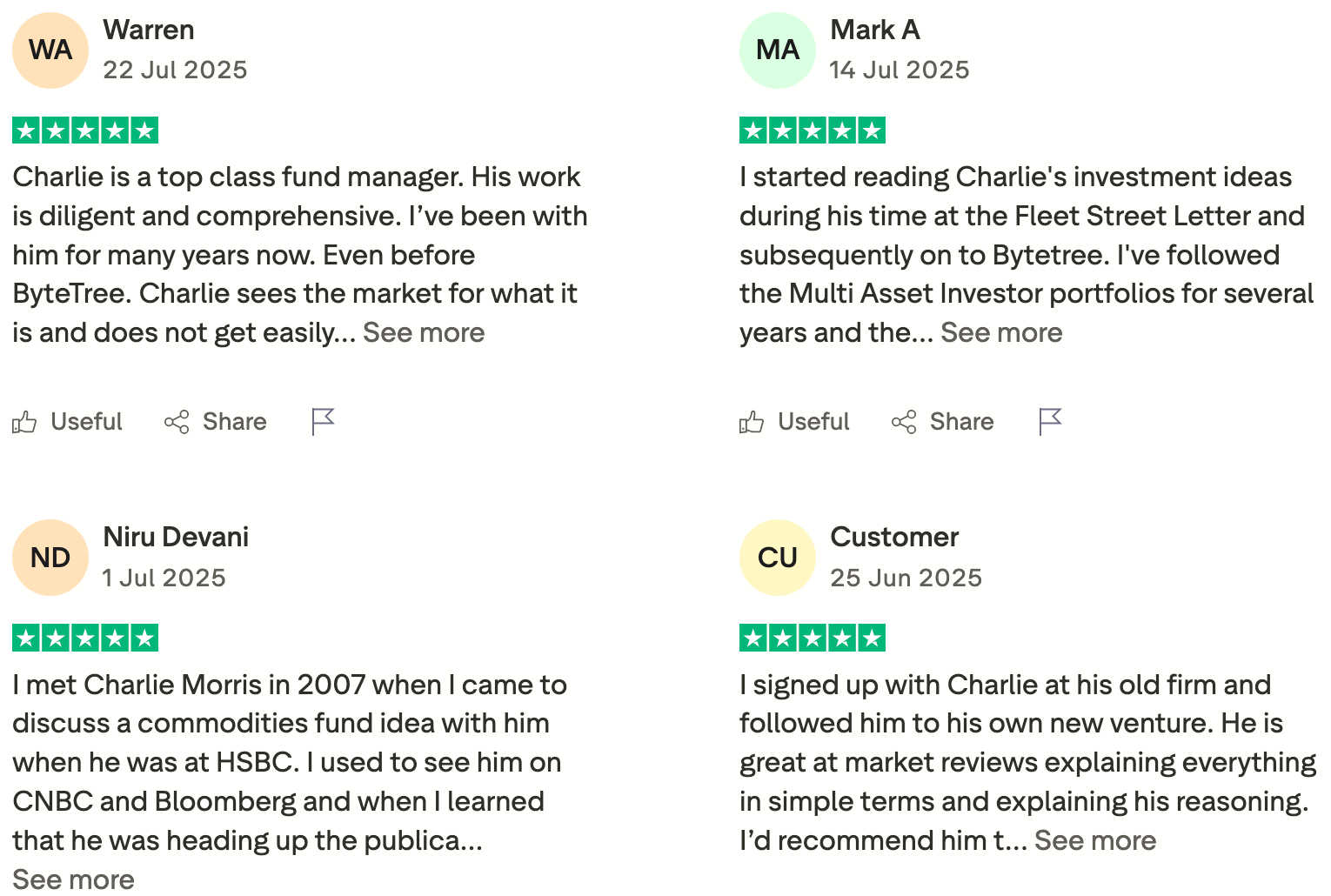

We exist to make your investing life easier, and are very grateful for the feedback of our existing clients on Trustpilot, as well as the trust they show by investing with us.

With a ten-year track record, and a robust, repeatable process, The Multi Asset Investor is designed for investors who want to invest better...

For those who aren't satisfied with handing over control of their future to someone else...

For people like you, who want to understand and enjoy the investing process, and the results it can bring.

For full access to The Multi Asset Investor, including all research, new recommendations, and both model portfolios...

Join us, by becoming a client today.

The Multi-Asset Investor offers a free research tier packed with insights on markets and investing.

Charlie Morris is the Editor of The Multi-Asset Investor. Prior to this, he was the Editor of the Fleet Street Letter, a market newsletter for private investors published by Southbank Investment Research with a wide readership. He is also the Chairman and Chief Investment Officer of ByteTree, which he founded in 2014 as a platform to deliver independent, robust and thought-provoking market analysis.

Charlie has 25 years of fund management experience and is a pioneer of multi-asset investing. At HSBC Global Asset Management, he launched the Absolute Return Service in 2002, which grew to over $3 billion. Much of that success came from moving away from the crowd and embracing a wider range of asset classes that traditional investors were not familiar with at the time.

Subsequently, Charlie managed the Total Return Fund at Atlantic House Fund Management until June 2020, at which point it was ranked number 1 out of 48 funds in the Trustnet Target Absolute Return Sector. He sits on the investment committee for the Society of Technical Analysis and on the Board of Halkin Services, a renowned investment think tank. He has regularly been featured in leading news publications and has given numerous presentations to investment bodies and Universities. Charlie's pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Prior to a career in finance, Charlie served as an officer in the Grenadier Guards, British Army, having graduated from the Royal Academy Sandhurst in 1994.

A shareholder vote is near for one of our long-term holdings. Advice is laid out below.

Listed private equity companies have come under pressure. The sector touts a good story, and forecasts a strong IPO market in 2026, yet the businesses behind them, which hold large stakes in private companies, are not yet celebrating.

These past few days in precious metals remind us how quickly things can change, and why diversification is so important in portfolio management.

Ten years ago today, shortly after I left a 17-year stint at HSBC Global Asset Management, I took over the

Trade in Whisky; Before I get to today’s trade, I want to comment on Japan. Although just a blip