Vision

To deliver actionable, high-quality, contemporary investment guidance at an affordable price.

Mission

We offer high-quality investment advice, services, and products across various asset classes to help investors achieve better outcomes by applying sound financial principles.

What We Do

ByteTree Research offers investment research as a subscription.

There are so many ideas and opinions out there. At ByteTree, we provide you with answers through high-conviction calls, tracked in a model portfolio for maximum transparency.

We cover a vast range of investment areas. See our Products section below for full details.

For a monthly fee, you can sign up to receive our work, which will arrive by email and be posted on the website, giving you access to actionable, accountable, professional investment research to help you invest better.

The research is led by Charlie Morris, our CIO and founder, who spent over a decade as a multi-asset fund manager at HSBC before going independent. A team of analysts across the different research services supports him.

Investing is a highly personal endeavour, and across our range of services, we offer something for everyone: from global multi-asset portfolios to trend-following, quality investing, and digital assets.

So pick what's right for you, and take the first step to a better investing journey.

Products

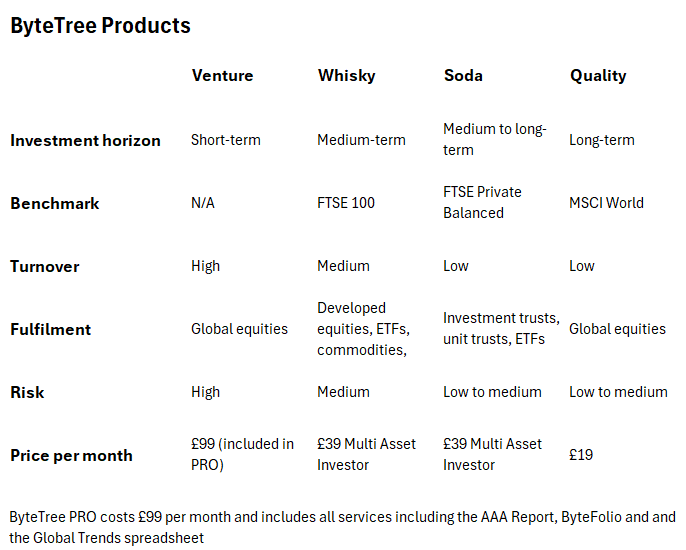

Investors are offered different choices by risk and return:

- Soda Portfolio is a medium-risk, long-term, low-turnover portfolio that invests in diversified large-cap stocks, funds, exchange-traded funds (ETFs), and investment trusts.

- Whisky Portfolio, a medium- to high-risk, tactical, actively traded portfolio, investing in mid to large cap stocks in developed markets, investment trusts, global ETFs and bitcoin.

- Venture Portfolio, high-risk, tipsheet investing in global small, mid and large cap stocks in developed and emerging markets. It could also cover other asset classes.

- Quality Portfolio, medium-risk, for long-term investors, recommending 20-30 of the world's best companies, with deep dives, active model portfolio management, and market/performance updates.

- ByteTree Global Trends, a global market intelligence platform, our home for trend following and momentum investing, offering free and paid insights on the most powerful trends in financial markets.

- Adaptive Allocation Report, medium-risk, tactical, actively traded portfolio investing in global ETFs based on their trend strength.

- ByteFolio is an ultra-high-risk, tactical, actively traded portfolio investing in crypto tokens.

- ByteTree created the BOLD Index, which blends Bitcoin and Gold on a risk-weighted basis. The 21Shares BOLD ETP (BOLD) is listed across Europe.

- ByteTree is also developing ByteTrend.io, a trend-following system that serves as a radar across financial markets, providing investors with a sense of where risks and opportunities lie.

Q4 Report, 2025

You can view our latest performance and thoughts here:

History

Charlie Morris and Mark Griffiths started ByteTree Group, the parent company of ByteTree, in 2013 as a research project to analyse the Bitcoin blockchain. Charlie was a multi-asset fund manager at HSBC Global Asset Management, and Mark was an experienced, award-winning full-stack developer. Their work clearly demonstrated that Bitcoin was real, something many had doubted in the early days, and ByteTree’s on-chain data became known as the most accurate in the industry.

Development continued across other blockchains, with the intention of building a fully functional crypto data platform. However, it became clear that it was out of our reach, as processing live data from multiple blockchains was a serious technical challenge that exceeded our funding and capabilities. Competition exploded, and we moved into new areas. In 2019, Laura Johansson joined to drive the company’s marketing initiatives and manage content.

In 2020, we created the BOLD Index, which blends Bitcoin with Gold. It had become evident to us that these assets were a natural fit as Bitcoin performs best in the good times and gold in the bad.

In June 2021, ByteTree launched investment research, starting with Atlas Pulse on gold and ATOMIC on Bitcoin, followed by ByteFolio, a service that aims to identify the leading crypto token projects.

Then, in August 2022, Robin Griffiths and Rashpal Sohan brought the celebrated Adaptive Asset Allocation newsletter onto the platform.

Shortly after, in October 2022, Charlie Morris commenced publication of The Multi-Asset Investor, a continuation of the widely followed Fleet Street Newsletter, of which he had been an editor since 2016.

Then, in September 2023, Charlie launched Venture, and in 2025, Global Trends, and ByteTree Quality, supported by a new team member, Kit Winder CFA.

On the data side, Mark developed numerous tools designed to help investors on their way. There was the gold valuation model, fund flow information for gold and Bitcoin (boldetf.com), and later, ByteTrend.io, a trend-following system that identifies winners and losers in traditional ETFs, FX, commodities and crypto.

Is ByteTree For You?

ByteTree is here to help you manage your investments through research, tools, and products.

There is plenty to choose from, and we deliver something for everyone.

To read what our clients think, please have a look at the feedback on Trustpilot.

The best way forward is to get to know us by signing up to our free mailing list and following our free market and investment commentary.

You can also have a look at our YouTube channel, full of expert interviews, or our Twitter or LinkedIn accounts.

To find out more about the investment philosophy and track record of our flagship investing strategy, The Multi Asset Investor, click below.