ByteTree Market Health Update; Issue 25

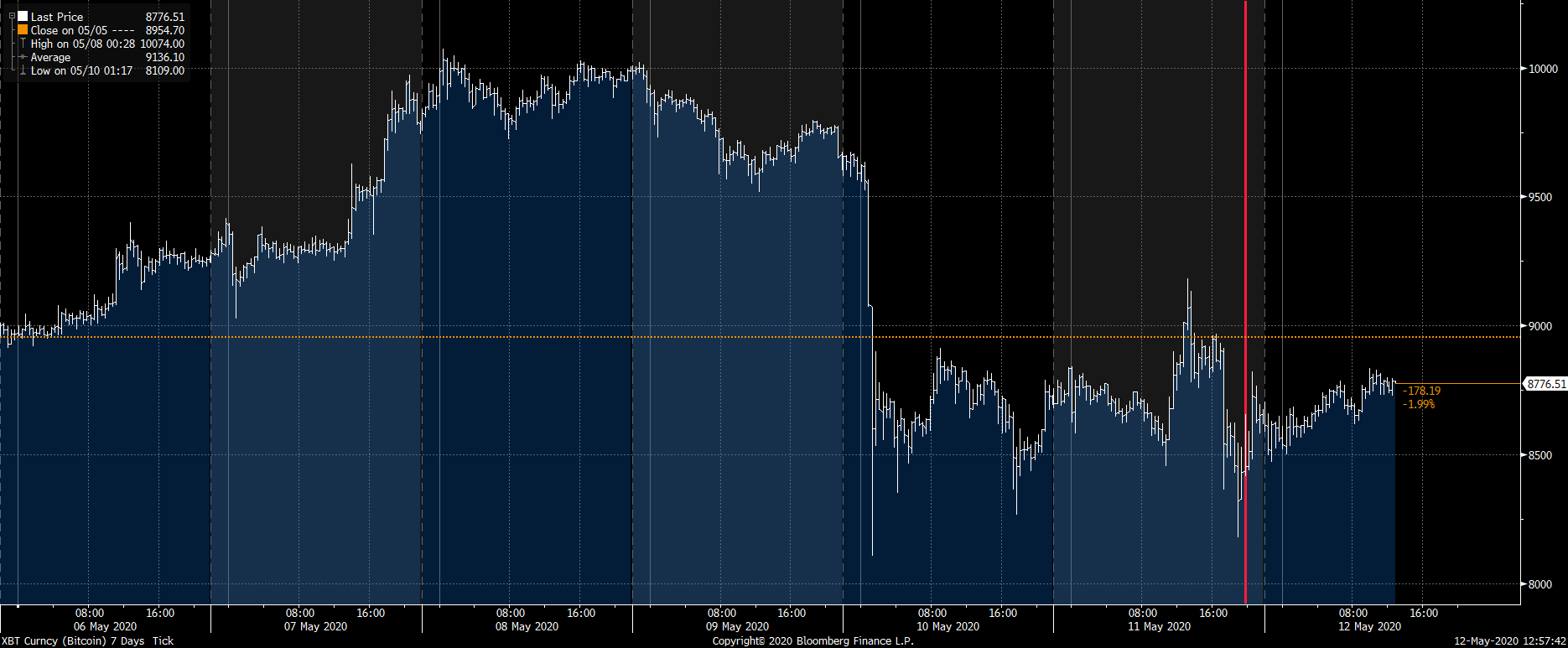

What an exciting week that was. With all the speculation of what might happen, there was a mini-crash over the weekend. But in the end, halving passed without incident. Here is the Bitcoin price over 7 days, with halving marked in red at 19:24 BST, which is UST +1.

What has changed?

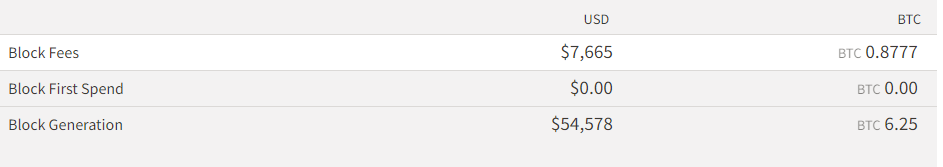

The block generation has fallen from 12.5 to 6.25 each block. Given the miners receive the generation plus the fees, the importance of fees will only rise. Fees have risen significantly in recent weeks, and we should probably get used to that because the miners need their pound of flesh.

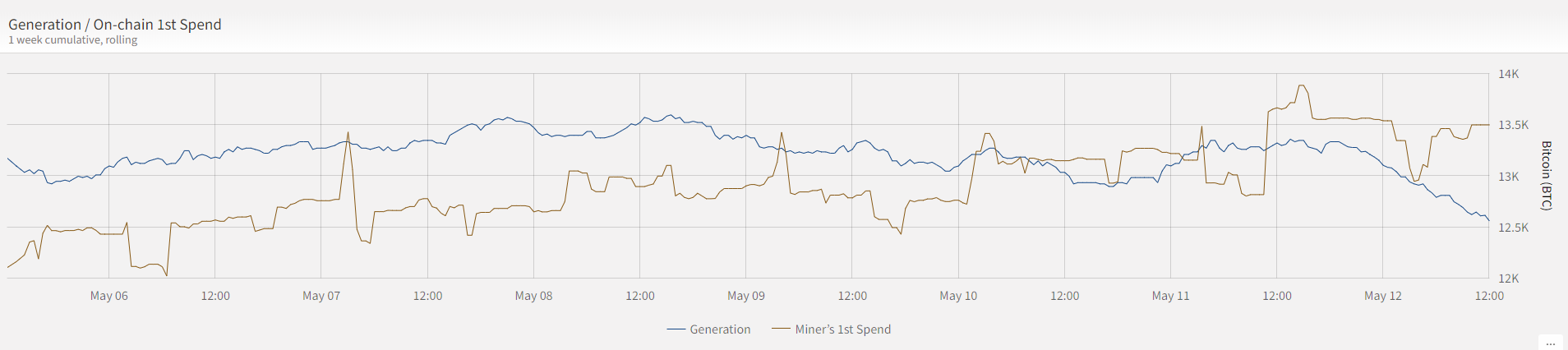

On a weekly basis, expect to see generation will fall from approximately 12,600 to 6,300 BTC. This will be visible on the blue line which will fall over the next week.

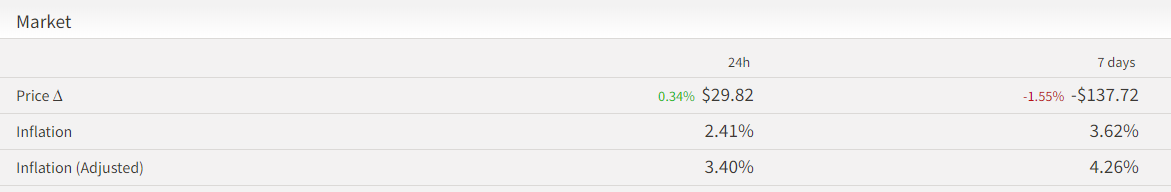

You can also expect to see the rate of inflation tend towards 2%. The past 24 hour measure is well on it’s way. Expect the 1, 5 and 12-week averages to follow suit. The bottom line is that Bitcoin’s inflation rate is now around 2%.

Will Bitcoin double?

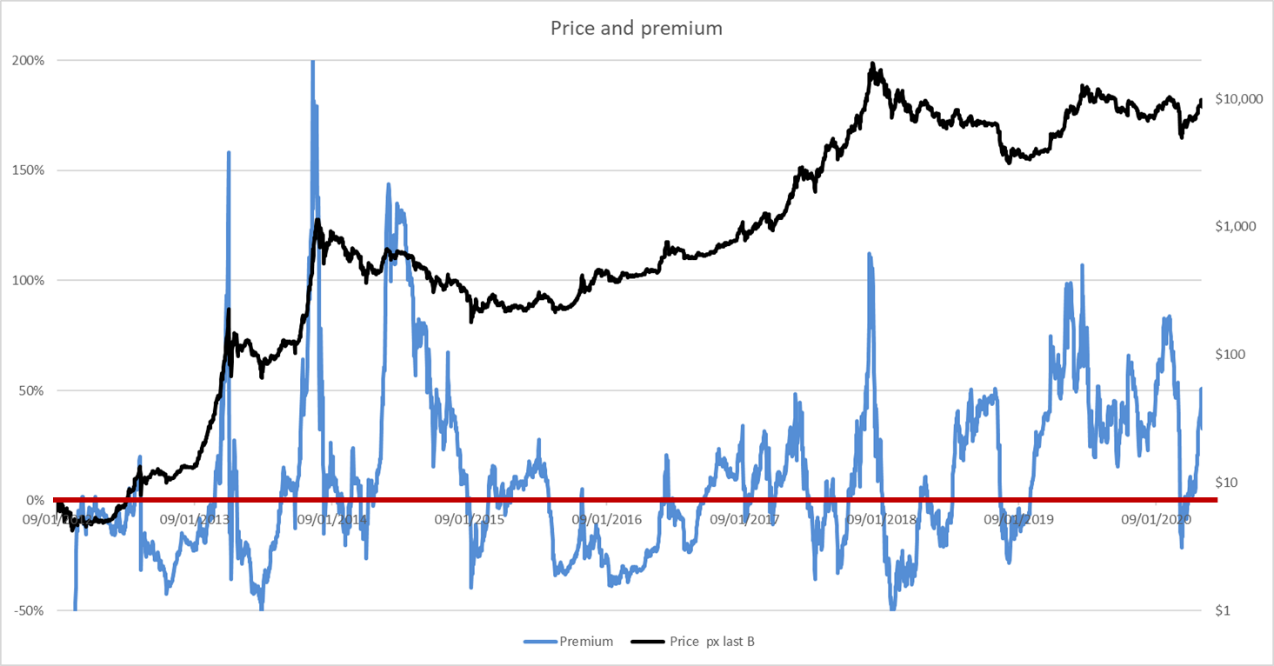

Bitcoin will double, time and again, or else I wouldn’t be here. But I remain sceptical that the price lift comes courtesy of halving. While we tend not to use valuation to trade, it is a useful measure of risk. The largest gains have tended to come from periods of low valuation, and the biggest drops occurred following periods of exuberance, of which the 2013 and 2017 peaks clearly stand out. The pre-COVID era is also notable.

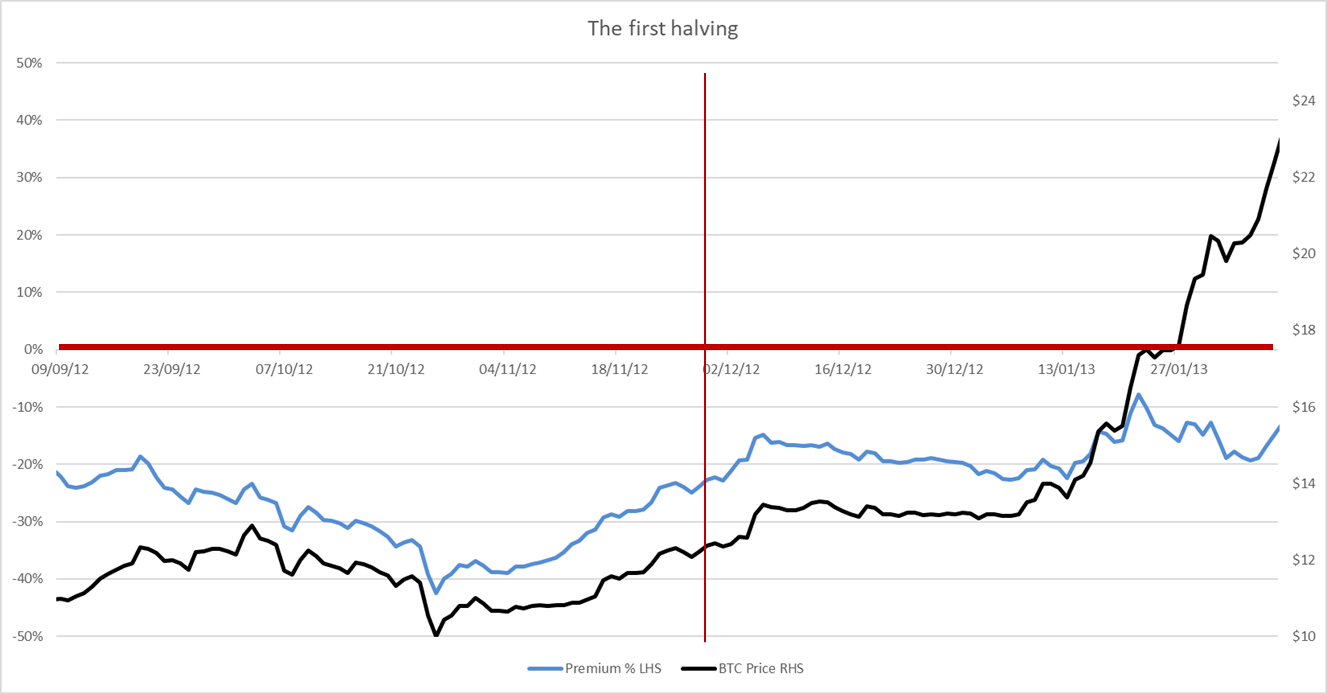

The first halving - 29 Nov 2012

I’m told there wasn’t much fanfare at the time of the first halving, and the price was trading cheaply during the run up. It was uneventful, but then prices moved towards fair value in January 2013.

The second halving - 10 July 2016

I recall this and it was a talked about event, but it passed fairly quietly as Bitcoin had few friends at the time. The price hit a 20% premium in the month before, only to fall to a 20% discount in the month after. It took around 6 months before the price took out the pre-halving high. Obviously 2017 was a vintage year, as the network grew from transacting $70 bn to $576 bn. Little wonder. Yet halving itself caused panic buying beforehand, which evaporated soon afterwards. The overall result was that Bitcoin returned to trend growth. Halving interrupted a perfectly good trend.

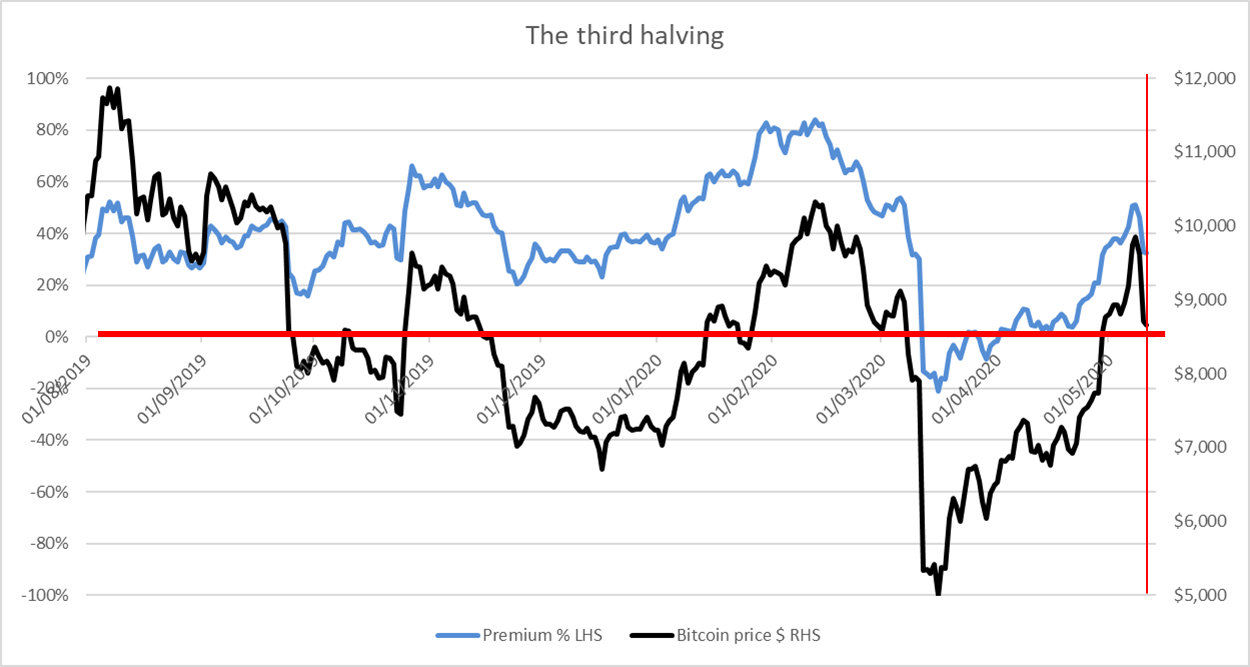

The third halving - 11 May 2020

And that brings us to yesterday. Recent events have been confused by COVID-19, but the price was at an 80% premium in February, before crashing to a 20% discount. It has since bounced to a 30% premium, or 50% before the weekend drop. Looking ahead, the risk is that the network slows, and the current premium is unjustified. Fortunately, it isn’t too large.

You can attribute Bitcoin’s rise to the network growth, which has seen the price double 18 times. If halving is true, it can only claim 2 (or perhaps now 3) of those doubles. Premiums can either indicate a growth surge is on the way, or they can reflect exuberance. In any event, the network demand model is running at 6 out of 6 which is bullish. It means there is interest and the network is growing, which is good.

Halving is an event known years in advance. That there will be less Bitcoin generated in the future is an important part of its design, but that in itself doesn’t create value. If it did, we would simply buy Litecoin instead.