ByteTree Market Health Update; Issue 27

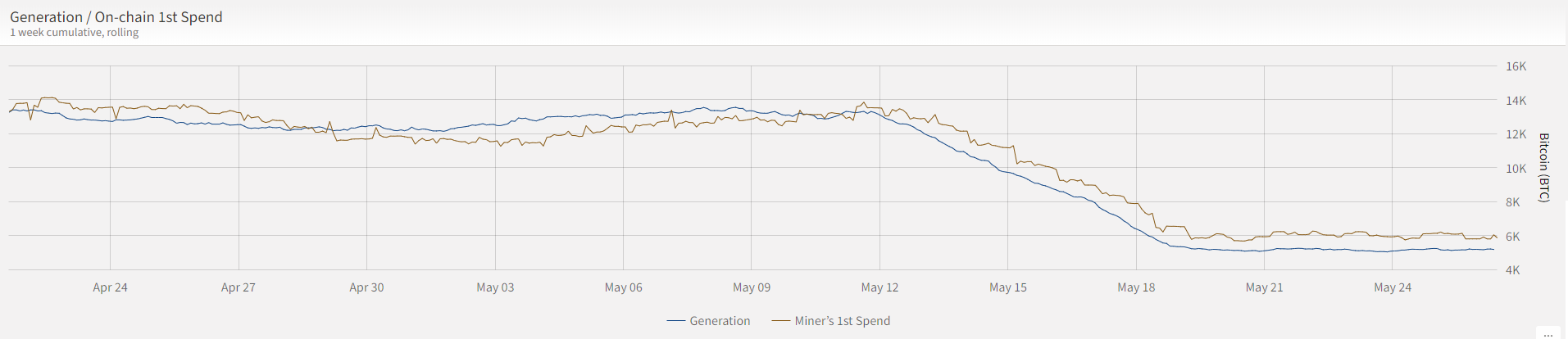

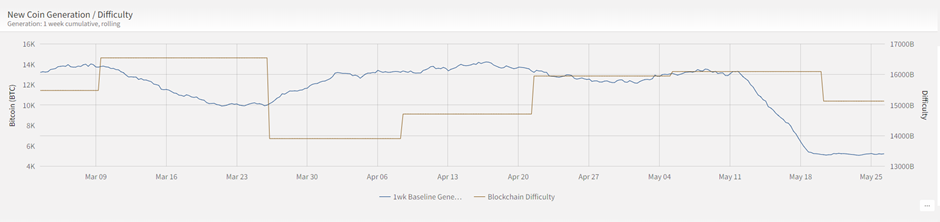

Halving was two weeks ago and things are settling down, but things have changed. The miners are supposed to be generating 6,300 Bitcoins per week but are only managing 5,100. The expectation was that the block reward would fall by 50%, but it has actually fallen by 60%.

That means there aren’t enough blocks coming through, something the networks adjusts via a downward adjustment on difficulty (computer processing power required to mine). The latest adjustment hasn’t gone far enough, and so we can expect to see a further fall again next week.

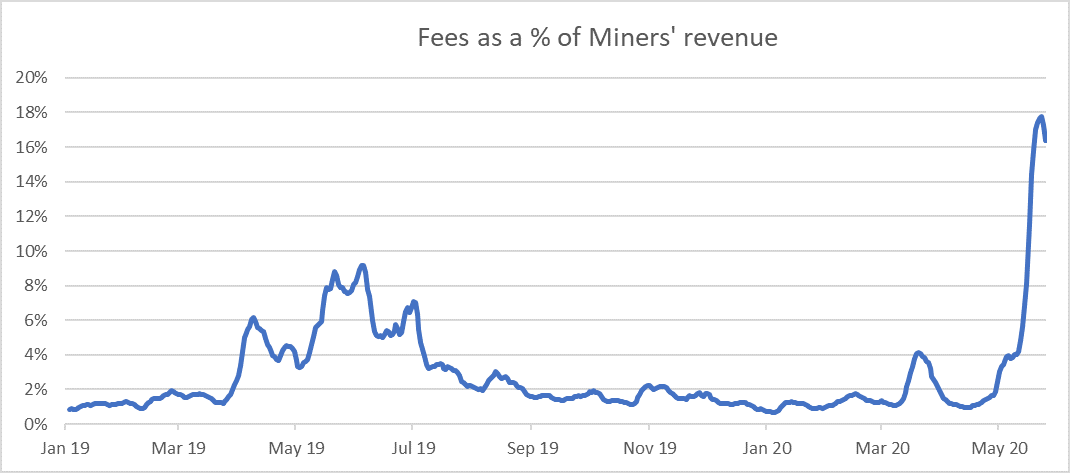

A 60% loss of revenue is a huge blow, but they have made up some of it with higher transaction fees. I have mentioned this in recent weeks, as the fees rose from $1 million per week to over $10m. They have now started to cool. This chart shows the fees as a percentage of miners’ revenue. It was negligible several years ago but is now substantial. Recall that in the distant future, the miners will only receive fees, and so this will one day go to 100%.

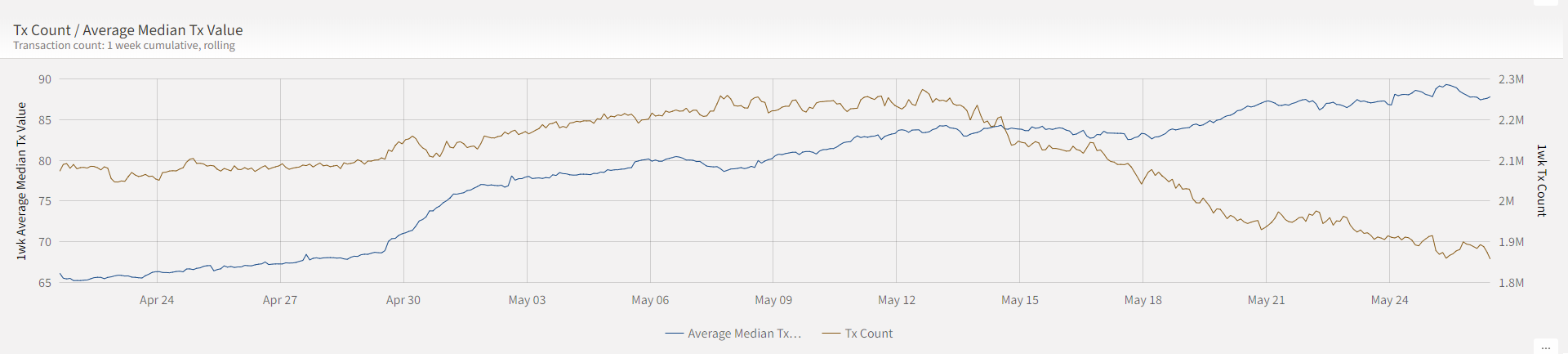

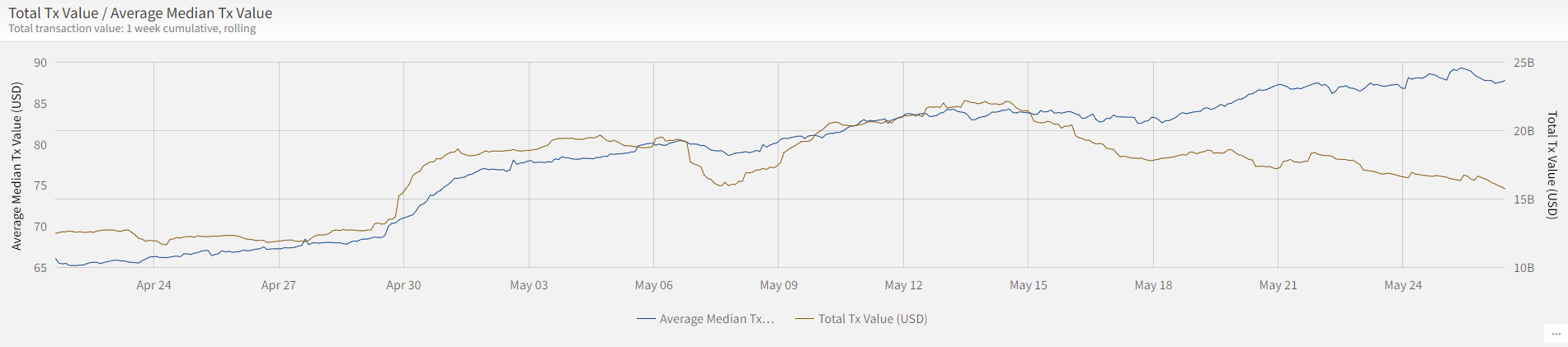

More immediately, the number of transactions have fallen while the median transaction size has risen. A direct consequence of higher fees is that you shut out small transactions, which is now happening. Some years ago, I remember people talking about using Bitcoin for micropayments. No chance of that now. Halving has seen the number of transaction fall from 2.3 million / week to 1.9 million/ week.

Larger transactions, but fewer of them, has seen some the total dollar value fall by 15% over the past week.

The ByteTree Demand indicators have fallen from 6 out of 6 to 5 out of 6. The fall in transaction value has knocked out one of our signals. MRI remains healthy, but velocity is starting to fall. As you know, I believe it is important to look at Bitcoin compared to similar assets, in this case high beta or risky equities. The punch up through the grey line is not happening quite yet.

Halving was a technical event, which leads to changes on the blockchain. Given the widely known nature of the changes, there is no reason for it to impact price. But many people think differently, and that is the risk. If the halving buyers caused the price to rise to a premium, their exit will see that reverse.