Compound Finance: How can Investors Capitalise on Decentralised Finance

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: COMP;

Decentralised finance represents an ecosystem of financial instruments; these instruments enable participants to actively invest their ‘dormant’ assets. Decentralised lending and borrowing are very similar to the 3000-year-old traditional credit system where collateral is required to reduce the risk of all parties involved. One cannot ignore that DeFi is very similar to the early days of lending and borrowing in the ‘real-world’, and this shows the vast potential of this sector.

Lending and borrowing digital assets through decentralised exchanges and protocols have quickly become the largest sector within the Decentralised Finance, DeFi, ecosystem. The core mechanism is similar to that of a cooperative bank, run solely by its community members. The principal digital assets used within these DeFi trades are stablecoins, which we will explore in the 2nd part to this report.

This two-part report aims to provide readers with meaningful investment guidance with regards to the DeFi space and in particular Compound.Finance and its native governance token, COMP. By the end of this report, an investor should be able to make an informed decision as to whether DeFi is an area they could enter.

The recent adoption of DeFi can be attributed to several factors. However, one cannot ignore the outsized and unsustainable gains that have been generated through yield farming* and the impact it has had on the adoption of DeFi. This part of the report will primarily focus on evaluating the DeFi sector as a whole, and the second part will analyse; Compound.Finance, their native governance token, COMP, and its role in driving the DeFi trend.

(*yield farming is the act of lending and borrowing on decentralised finance platforms with the aim of earning several APYs and tokenyields. The interest earned from yield farming tends not to be sustainable and participants will end up jumping between a variety of DeFi protocols to find the best yield. Yield farming and liquidity mining only take place in the DeFi lending and borrowing sector; however, this is an area where it has much influence.)

This yield farming surge is a major driver in the popularity of the borrowing markets within DeFi; this is because there are arbitrage opportunities with interest rates on different protocols. For example, by using a service such as DeFiRateyield farmers can quickly identify where a profit can be made. Currently, one can borrow Dai (a crypto-backed stablecoin) from Compound.Finance with an APY of approximately 4%, after which a user can lend that Dai to dYdX (a crypto exchange) for over 6%; this leaves a 2% positive carry just on the asset. However, investors must realise that protocols like Compound.Finance, AAVe and Curve (crypto money markets) all have native tokens which are distributed to lenders and borrowers as well. This is beneficial for investors as DeFi can generate lucrative APYs and valuable native tokens. For example yEarn’s (a decentralised ecosystem of aggregators that utilise lending services such as Aave, Dydx) native token, yFi, was trading at $40,000 (source: CoinGecko) on the 12th September 2020.

These opportunities are likely to become scarce as DeFi matures, this can be seen from early ‘real-world’ trading where youthful markets tend to be inefficient for a short period of time, enabling early participants to exploit inefficient spreads.

Although the first DeFi protocols were launched in November 2018 (MakerDAO), it has taken nearly two years for DeFi to take off. This is likely due to two things; firstly, the release of native protocol tokens which have been a considerable driver for adoption as they can be very lucrative. Secondly, the current trend of yield farming has drawn ample attention to the DeFi space.

What Problem does DeFi Lending and Borrowing Fix?

DeFi has the potential to fix a perceived problem some ‘old world’ investors have; ‘Bitcoin is not an asset’. In some people’s view, Bitcoin is not an asset because it does not have the facilities to generate a yield. A yield relates to whether an asset can earn its holder a cash flow.

For example, in traditional finance one can earn an interest rate on their FIAT currency in a variety of different ways; such as a saving account. In contrast, Bitcoin does not have the immediate facilities to create a cash flow just by holding it. Yields enable investors to create passive incomes without diminishing their capital. Identifying yields are also a major decision-making tool with ‘old world’ investors when working out how much a company’s shares will return in dividends.

Many investors have been hesitant towards digital assets because of this very point. However, DeFi has the potential to change this view due to protocols such as Compound.Finance. Bitcoin cannot create a yield by itself, but it can through DeFi lending and borrowing. This enables investors to generate a cash flow through similar methods to their FIAT currency.

There are two main ways to generate a Bitcoin yield; WBTC, and conversion of Bitcoin for an alternative asset. Firstly, an investor can easily ‘wrap’ their Bitcoin to create a version that is built on the Ethereum network. DeFi is typically based on the Ethereum network, meaning that tokens used here must conform to the correct Ethereum-Request-For-Comment, ERC. WBTC converts Bitcoin into an ERC-20 version, this does not change the value of your Bitcoin but instead enables investors to generate a yield on their WBTC.

Alternatively, an investor can convert his Bitcoin into a US dollar stablecoin such as USDC or DAI, this enables investors to enjoy much more lucrative returns in the DeFi space without diminishing their original investment.

The Current Trends in Decentralised Finance

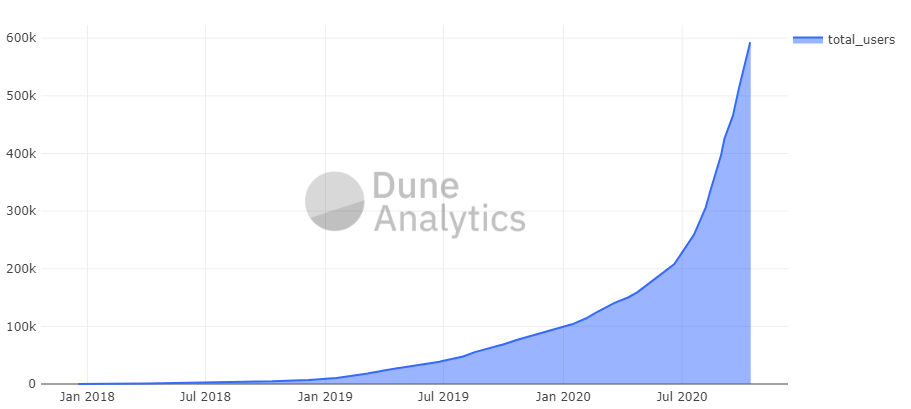

The chart above shows the total number of unique addresses using DeFi networks. The dramatic increase in users shows significant interest associated with the DeFi ecosystem. This is partly due to yield farming and ecosystem participants being incentivised by early user rewards. A good example of this is UniSwap, and their airdropped native token UNI, which drove lots of users to the protocols yield farming program as well as driving Uniswap’s DEX market dominance to around 65%.

In a recent report on the ‘Geography of Cryptocurrency’, ChainAnalysis analysed the geographical trends in different regions. This section will show how DeFi appeals to these trends and whether it generates value for the entire digital ecosystem.

From analysing ChainAnalysis’s report, we noticed that America tends to have a lower trade intensity than East Asia. Trade intensity is measured by the value of order book trades to exchange inflows; this metric represents how many times a bitcoin changes hands after being bought from an exchange. East Asia’s trade intensity is twice as much as America; his is significant because it signals that Americans are ‘opting to hold’ their crypto for longer than six months, mainly due to the tax implications.

How Does DeFi Capitalise on This Trend?

The financial instruments available on DeFi are straightforward in comparison to the traditional finance sector. The monetary system that DeFi is aiming for already exists, and therefore one could expect to see ‘real-world’ financial experts taking a more prominent stance in the sector. A proactive investor would look to enter the space early, which would enable them to benefit from early user incentives.

Participants are given the ability to borrow from a money market and benefit from an interest rate by collateralising their assets. This is significant because DeFi Lending in particular benefits users who tend to hold onto their digital assets without touching them; these are known as ‘dormant assets’. One protocol which excels at monetising ‘dormant assets’ is Compound.Finance. Please see part two of this report, which looks at COMP and Compound.Finance.

How Can an Investor Manage Their Risk?

Firstly, an investor needs to decide their risk profile, as there are a variety of different opportunities across the whole of DeFi. Riskier projects, such as Yam.Finance, can end up losing their investors’ money because of unaudited code. In contrast, safer projects such as Compound.Finance, offer a lower APY but instead have credible backers and a protocol that is much more likely to survive.

Investors must pay close attention to the digital assets that they lend and borrow, as volatile investments can cause positions to be liquidated. Stablecoins should take up a large proportion of a DeFi investors portfolio, due to the risk of liquidation being minimal. Stablecoins will be covered more in the 2nd part to this DeFi series.

DeFi Drives Gas Prices

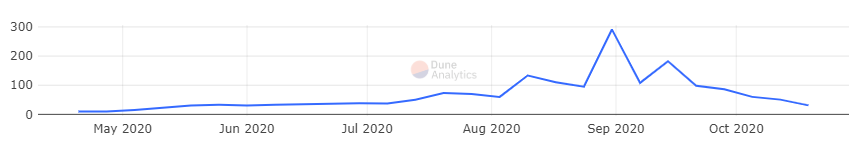

Lastly, an investor must consider Ethereum network ‘gas’ fees. As we can see from the chart above, fees can dramatically spike when there is increased network activity; this should not affect institutional investors, as they deal in large volumes. However, retail investors should consider how much of their capital will be lost to fees before they start. This is especially the case when choosing a protocol with a lower risk/return, as it may take some users over a year to cover the gas fees, assuming they are investing with small tickets.

Summary

Overall, this report aims to show investors the various opportunities that are available in the DeFi space, such as how both the lending and borrowing markets are beneficial to network participants in and out of DeFi. Furthermore, the DeFi sector can effectively appeal to different geographical trends, and this flexibility generates value for an investor. Lastly, the final section of the report offered investors with guidance to consider before starting a venture in DeFi.

To have a more granular look into DeFi, please read our second part to this DeFi series about Compound.Finance.

Comments ()