Compound Finance: Decentralised Finance Lending and Borrowing

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: COMP;

In part 1, I explained how DeFi could help Bitcoin generate yield for its holders, whilst also appealing to the geographical trends of the digital asset ecosystem. The report then looked into providing guidance that investors should bear in mind before starting a venture in the DeFi space. In this report, we will move onto looking at the DeFi space from a more granular level.

Firstly, we will focus on a particular protocol; Compound.Finance, their native governance token COMP, and its role in driving the DeFi trend. Compound.Finance was initially released in 2018; however, it has recently gained a lot of traction because of the lucrative returns of COMP. This coupled with its protocols V2 upgrade, which supports lending and borrowing market for five additional digital assets, quickly cemented Compound.Finance as a sector leader.

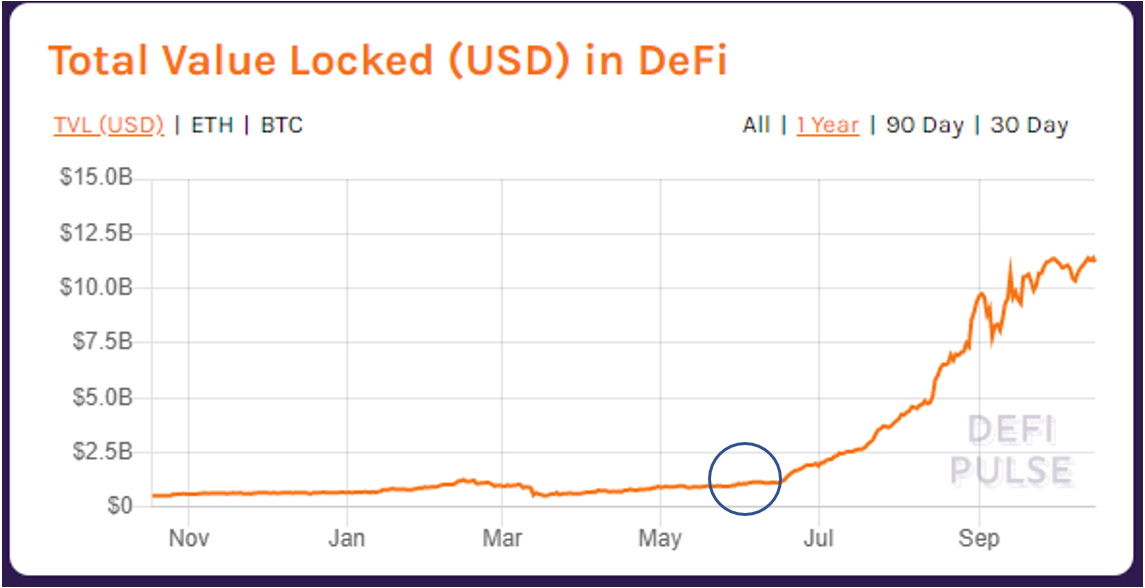

The chart above shows the total $value currently locked in the DeFi ecosystem; the blue circle indicates the release date of the Compound.Finance V2 upgrade. This steep rise in AUM is partly due to rising demand for stablecoin markets, of which Compound.Finance has the largest.

Compound.Finance: Stablecoins and DeFi

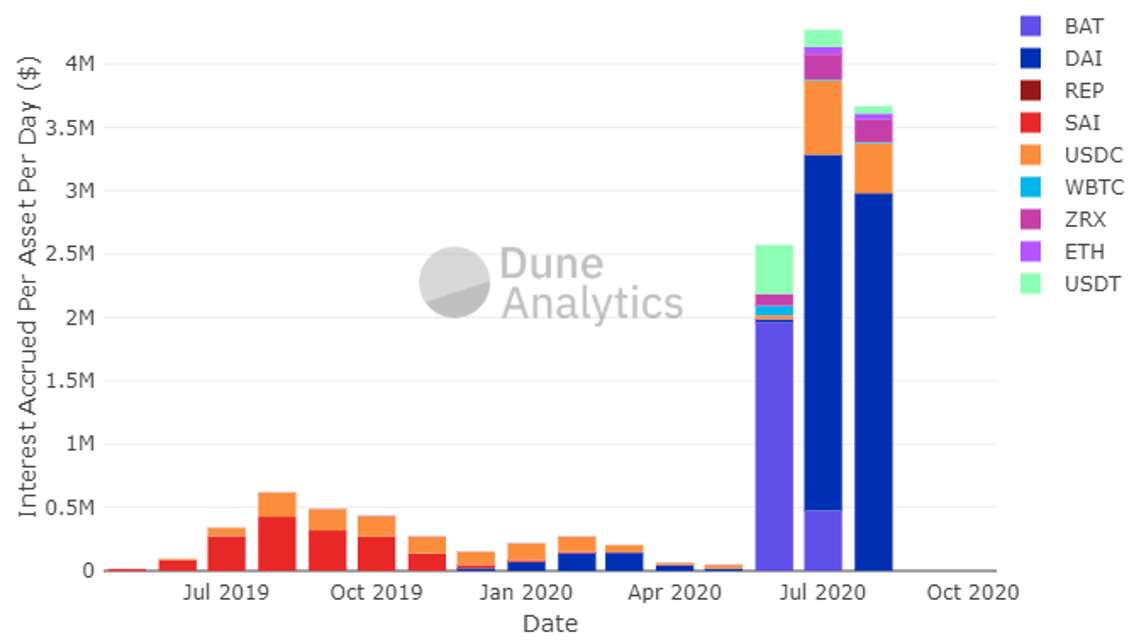

The chart above shows the interest accrued by each market on Compound.Finance, as we can see holders of non-pegged assets, such as Ethereum and Bitcoin, do not benefit from the lucrative returns of stablecoin markets, comparing the Compound.Finance interest rate of Dai (3%), an unbacked US dollar stablecoin, and Ethereum (0.2%) show that difference.

Stablecoins are significant to the DeFi ecosystem because of increased supply signals network retention, which means that users are opting to stay in the ecosystem. DeFi can help these retained users put their stablecoins to work and earn a return for doing so. As we mentioned in the first part of this report, tax implications are most likely the culprit for this shift in popularity for stablecoins.

DAI Dominates the DeFi Boom

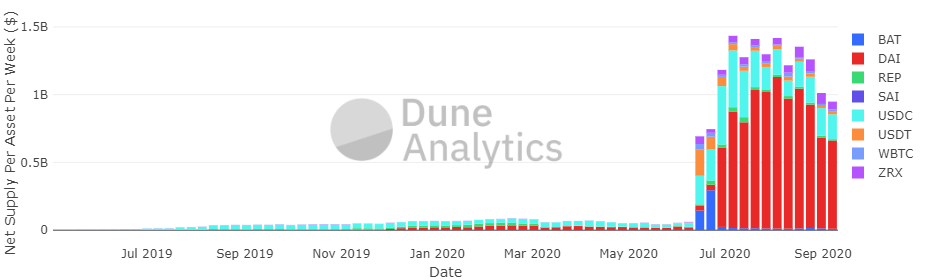

The chart above shows the $net supply of each asset market on Compound.Finance; as we can see, the main markets are USDT, Dai, and USDC, which are all stablecoins. This generates value because it appeals to the behavioural trends exhibited by users of the current digital asset ecosystem. Investors should realise that demand for a digital asset will drive the APY of that market up. With that logic, we can deduce that the market with the most demand is Dai.

East Asia Stablecoin Trends

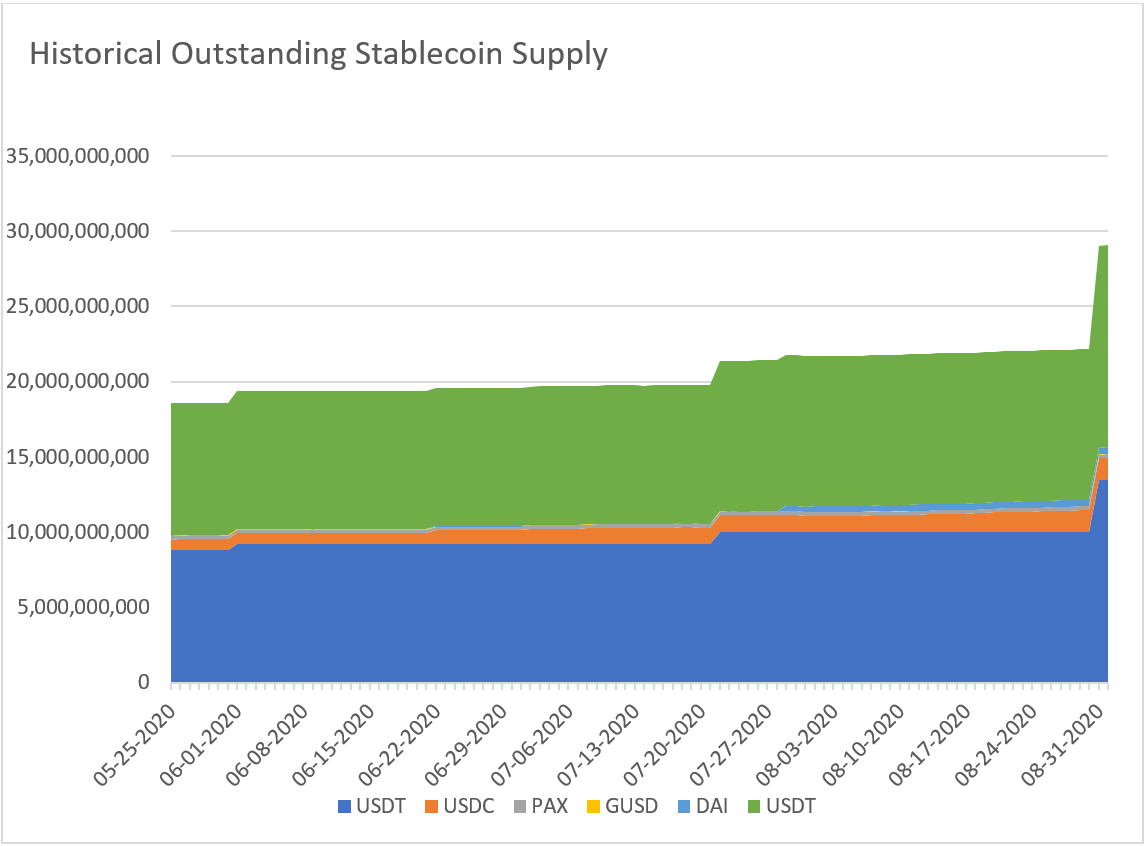

The table above shows the steady rise in the supply of stablecoins, symbolising that they have experienced a wider scale adoption. The Chinese government passed a bill in 2017, which banned digital asset to yuan transfers (more information). Although this did not stop everyone from performing these trades, it does deter many users from converting their digital assets to FIAT, thereby increasing the demand for digital stablecoins.

According to a report from Chainanalysis, stablecoins account for 33% of all transactions in East Asia, of which 97% are Tether, USDT. This provides an opportunity for DeFi lending protocols to appeal to the East Asian market. Compound.Finance has recently upgraded its USDT interest rate model, which promotes long-term incentives for users who lend their USDT to the protocol. Not only does this provides value for the East Asia sector but also for the growing stablecoin market, which has a sector market cap of over $25bn according to CryptoSlate.

East Asia provides an opportunity for Compound.Finance to grow into the biggest regional market, since Compound.Finance’s largest money markets are for stablecoins (total AUM of approximately $1.5bn). At ByteTree, we expect to see a continued positive trend for stablecoin adoption, and along with a continued rise in total AUM of Compound.Finance’s stablecoin markets.

Overall, investors who allocate large amounts of their capital to stablecoin should consider an investment in DeFi. As mentioned above, the best APYs are for stablecoins, and the demand for them is growing. Therefore, DeFi presents stablecoin holders with the opportunity to generate a yield on their stablecoins.

So I Have to Sell My Bitcoin for an APY?

Although there are a variety of ways to generate a yield within the DeFi space, stablecoins tend to present investors with the best yields and security. However, we acknowledge that not all market participants wish to sell their beloved assets, such as Bitcoin. Here is where tokenisation can help. Since DeFi is built on the Ethereum Network, holders must tokenise their original asset for an ERC-20. When looking at Bitcoin, market participants can exchange their Bitcoin for wrapped Bitcoin, also known as WBTC. WBTC, like most other ERC-20, can be used to generate yields for token holders on DeFi lending and borrowing markets.

Please refer to the first part of this report for more detail on how to generate a Bitcoin yield, found here.

How Does Compound.Finance Generate Value for Investors

Compound.Finance is a DeFi protocol that enables participants to lend and borrow digital assets from on-platform money markets. It is a low risk/return platform that offers users security and usability in return for users locking their assets as collateral. Compound.Finance like Bitcoin has a ‘first-movers’ advantage when it comes to their respective sector of the ecosystem. It is widely regarded as one of the best DeFi lending and borrowing platforms with a good reputation, credible team, and an investor base that have helped to drive value.

Compound.Finance was founded by Robert Leshner, who is a vocal and well regarded digital asset specialist, and Geoffrey Hayes, who is the maintainer of Exthereum, a new Ethereum network. Furthermore, it is backed by world-class investors such as Coinbase, BainCapital, a16z, and others. Coinbase is one of the largest centralised exchanges, and this investor alone is beneficial as they have deep pockets.

The COMP Token

COMP is the native governance token of Compound.Finance. It was released on 16th June 2020 and has seen a prominent uptake by the market. The price peaked a week later at $336 and is now around $100, valuing the total network at $376M. COMP is built on top of the Ethereum network as an ERC-20 token, and ownership enables holders to vote or delegate on protocol proposals. These proposals tend to focus on upgrading the features of each digital asset market, such as adding new lending and borrowing markets.

The two main areas that generate value for COMP are its supply mechanism and governance rights, which both stem from ownership of COMP tokens. However, there are a variety of short-term influences that provide COMP with unsustainable value, which investors must identify to make an informed investment decision.

COMP’s Supply Mechanism

The current DeFi craze generates short-term value for COMP by pumping capital into the protocol so that users can benefit from the early incentives. These early incentives are a result of the supply mechanism of COMP; a fixed new supply of COMP is released every day, around 3,000 tokens.

Suppose we assume that the protocol will continue to grow at its current rate. In that case, COMP’s fixed supply adds short-term value for early adopters since the tokens are distributed between fewer market participants. Market liquidity determines the distribution of COMP tokens, and currently, the largest distribution of COMP goes to the Dai market.

COMP’s supply mechanism works proactively to protect the interest of token HODLers if its value stagnates. COMP tokens are capped at a supply of 10 million. Only 309,553 COMP tokens have been released (as of 8th September). Similarly to Bitcoin, both digital assets are a store of value, courtesy of their deflationary supply function.

An investor can capitalise on the COMP’s supply mechanism by becoming an early adopter. This would generate value for investors who are a part of the concentrated supply of COMP. The longer the lifespan of the Compound.Finance protocol, the more diminished the returns from COMP’s distribution.

COMP Governance

Token holders having a say in the future direction and development of a protocol is a key feature of a Decentralised Autonomous Organisation (DAO). Without community support, a DAO cannot succeed. Within a DAO, the type of stakeholder is not important; anyone with COMP tokens can vote and voice their opinion. Value is undoubtedly generated when protocol users know that they can participate in the future direction of a protocol. The transparency associated with DAOs helps with risk management and overall governance.

COMP Supply

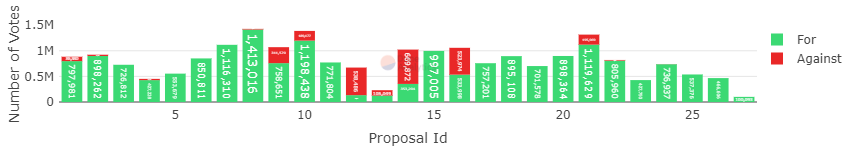

The COMP governance initiative is very successful, with only 310,048 COMP tokens being released to the community through rewards. It is positive to see nearly 1.5 million COMP tokens being delegated to Compound.Finance proposals. The other tokens are delegated from pre-sale investors and backers; however, this still shows a high rate of token-holder engagement.

Governance Lies in the Hands of the Owners

| ENTITY NAME | NUMBER OF VOTES | VOTE WEIGHT | PROPOSALS |

|---|---|---|---|

| A16z | $ 345,000.00 | 3.45% | 1 |

| Polychain Capital | $ 325,700.00 | 3.26% | 10 |

| Gauntlet | $ 125,000.00 | 1.25% | 18 |

| Paradigm | $ 111,000.00 | 1.10% | 5 |

| Robert Leshner | $ 100,000.00 | 1.50% | 13 |

| Geoffrey Hayes | $ 100,000.00 | 1.00% | 12 |

| Dharma | $ 100,000.00 | 1.00% | 19 |

| blck | $ 100,000.00 | 1.00% | 25 |

| Set Pause Guardian to Community Multi-Sig | $ 86,000.00 | 0.86% | 0 |

| ParaFi Capital | $ 65,000.00 | 0.65% | 15 |

| InstaDApp | $ 50,000.00 | 0.50% | 20 |

| Argent | $ 50,000.00 | 0.50% | 13 |

| Dragonfly Capital | $ 31,000.00 | 0.30% | 4 |

| IDEO Capital | $ 28,000.00 | 0.28% | 15 |

| Kyber Network | $ 25,000.00 | 0.25% | 10 |

Source: Compound.Finance. Voting weight per entity.

The table above shows the top 15 entities involved in the COMP governance procedure; they hold 16.5% of the entire networks voting weight. A number of the top address are investors and the creators behind Compound.Finance; also classified as ‘delegates’. A delegate can essentially represent parts of the COMP community, much like a constituent MP.

COMP token holders have the opportunity to delegate their votes (based on the number of COMP tokens they have) to entities they agree with; for example, Robert Leshner is currently a delegate for 39 other COMP holders.

Currently, COMP distribution is focused towards the investors and backers. There are positives if we consider the current state of the DeFi sector; the majority of users are not concerned with the longevity of the protocol, but the yield it can generate.

At the moment, the only major parties interested in the longevity of the protocol are the investors and backers. Therefore, it would be beneficial to let them have a larger say in COMP governance proposals. However, one cannot ignore the fact that currently the governance of COMP seems to be reasonably centralised. This will need to be fixed in the future as more participants will want to have a say.

Investors must consider this issue with COMP’s governance because if it carries on, the value of the token will be worthless to investors who are not in the top 15 entities. This will leave the protocol in the hands of controlling parties, which completely defeats the nature of a DAO as sovereignty will only be reserved for a few.

The Future of Compound.Finance and COMP

Another positive point of enabling COMP token holders to have sovereignty over the protocol governance arises when looking at the potential proposals that could be passed. Compound.Finance has reserves which are filled with fees taken from each market’s ‘reserve factor’. The community decides the reserve factor; for example, proposal 9, which was created on 25th June 2020, agreed that the reserve factor of Compound USDT, or cUSDT, would be 20%. This means 20% of fees from that market are put into the asset reserve pool.

The COMP token holders control these reserve pools, and their sole purpose is for protocol insurance should anything go wrong. Insurance creates a layer of security, which in turn generates value for COMP.

Allowing COMP holders to have complete control over reserves was intentional by the creators, as it encourages active governance participation, as well as the potential to create a proposal. This could incentivise an engaged community by distributing reserves back to token holders.

Growing Insurance

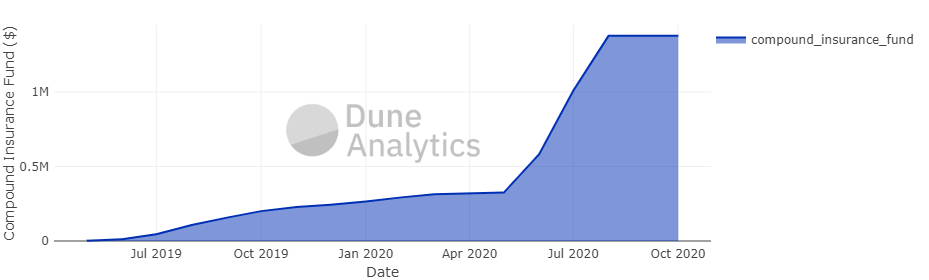

The graph above shows a dramatic increase in the holdings of the protocol’s insurance fund, and this is due to a large amount of short-term capital being driven into the protocol from yield farming; the current value of Compound.Finance’s insurance fund is $1.4M.

When looking at Compound.Finance’s largest borrowing market compound Dai, we can assume the added value that a proposal like this could generate. The total amount of Dai borrowed amounts is $945M (as of 1st September 2020), with a reserve factor of 5%. The reserve factor, as mentioned above, is decided by the community and is a value taken with market fees. This leaves $680k of Dai in the markets reserves. If a proposal was passed stating that 0.1% of the current Dai reserves should be distributed back to the participants, then we could see value generation for investors.

The potential for COMP to pass a proposal to begin a ‘Burn’ initiative is also easy to do. A ‘burn’ initiative, akin to a traditional finance share buy-back, has profound effects on the value of a token, which is achieved through periodically reducing the supply. To find out more about the positives a ‘burn’ initiative can have for a digital asset, please look out for our value report on Binance’s native token, BNB, which will be uploaded soon.

Although potential is a known driver for value, this governance proposal may never actualise if COMP’s current distribution of voting rights continues on the same path.

As an Investor, Have I Missed My Opportunity?

The best time to have invested in Compound.Finance and COMP would have been ahead of its V2 protocol upgrade launch in May 2019. However, if you are a retail investor, then the lower ‘gas’ fees at the moment certainly provide an opportunity to invest in yield farming, or simply lending and borrowing. As an institutional investor coming into the DeFi space after the yield farming craze has subsided is positive, due to the protocol now providing the potential for longer-term returns, instead of just volatility and hype.

At ByteTree, we believe that the yield farming craze will stagnate due to its unsustainability; however, this is not the end for DeFi lending and borrowing. It is easy to forget that lending and borrowing has been an influential part of ‘old-world’ finance for decades. The only feature that differentiates DeFi from its traditional finance counterpart is its decentralised nature and native token opportunities.

Summary

Compound.Finance and COMP present investors with a secure and established platform. A low-risk profile would suit this protocol very well; however, there are definite issues with the COMP DAO which an investor must consider before allocating capital to the initiative. But above all, we celebrate the continued evolution within crypto, where the only way is up.

Glossary

Aggregator – A system that combines digital asset price with feeds into one initiative, guaranteeing liquidity and constant ability to trade.

Annualised Percentage Yield (APY) – a representation of a compounding interest rate.

Assets Under Management (AUM) – the total market value of the investments that a person or entity manages on behalf of its clients.

Decentralised App (dApp) – An open source protocol which runs on a decentralised peer-to-peer network.

Decentralised Autonomous Organisation (DAO) – A protocol that has decentralised governance, and therefore is entirely controlled by the community how to follow the same rules to achieve a common goal.

Decentralised Finance (DeFi) – an ecosystem that is built on public blockchains. DeFi acts as a platform for alternatives to the traditional centralised financial services found today.

DEX – an abbreviation of a Decentralised Exchange.

Dormant Asset – An asset which tends to be unused, generally staying in a wallet or exchange for extended periods of time.

Liquidity Mining – the act of locking your assets into a pool of likeminded users to provide liquidity to a money market.

Stablecoin – a cryptocurrency which intends to mimic the price of an external currency or asset; in most cases stablecoins tend to peg to the dollar.

Yield Farming – the act of leveraging interest rates on DeFi lending and borrowing protocols to achieve the best yield.

Comments ()