Long-Term Bullish, Short-Term Cautious

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 49

In a world full of Covid-19 and angry US politics, Bitcoin has been scoring home runs. PayPal has come on board, and public perceptions are improving. Central banks are marching ahead with digital currencies (CBDC) with the Bahamian Sand dollar taking the lead. The Bahamas? Their currency is pegged to the US dollar so having gazumped the FED, it’s a clever move. A Chinese digital currency isn’t far behind, and this is all very agreeable for a digital future.

It all helps to validate and legitimize Bitcoin. The traditional financial world has been conditioned to believe that Bitcoin is bad. The banks and regulators have put huge obstacles in its path, yet it has thrived regardless. With CBDCs on the way, the banks will be leapfrogged, and risk being left behind. Our board member and Chairman of CoinShares, Danny Masters, made a good point in a recent interview with Forbes.

“If everyone’s got a digital wallet and CBDCs, which aren’t backed by anything anyway, are de rigueur, then all of a sudden bitcoin looks great. It will assume the role that gold served with regards to legacy money, and all the other digital assets will fall into place. The middle layer—the services layer—will become much more automated, technological and democratic, and the endpoint layer will become a real fight.”

Bitcoin adoption will be accelerated rather than hindered by the launch of CBDCs. Of course, big brother would be watching, but provided you pay your taxes, you ought to be left alone. Last week, I highlighted how Bitcoin was becoming more gold-like, having started to divorce itself from tech. You would expect a new technology to resemble tech stocks in general. But once it becomes established, it should start to make its own way in the world. I believe this what is happening now.

If Bitcoin challenges gold, the price would be over $1 million (I made a case for $2.3 million last week), or seven more doubles from here ($13k, $26k, $52k). Bitcoin has already doubled 17 times in 10 years, so seven more is not too much to ask. But I suspect it would take at least another 10 years, as some serious heavy lifting will be required.

I stress there is a long way to go. CBDCs are coming but are not yet in the public domain. While I see huge potential, it is something to expect over the next decade rather than by the year-end. It is important to remind ourselves that these monumental shifts take time, and the recent Bitcoin strength reflects a bright future, but is ahead of events.

Price is ahead of events

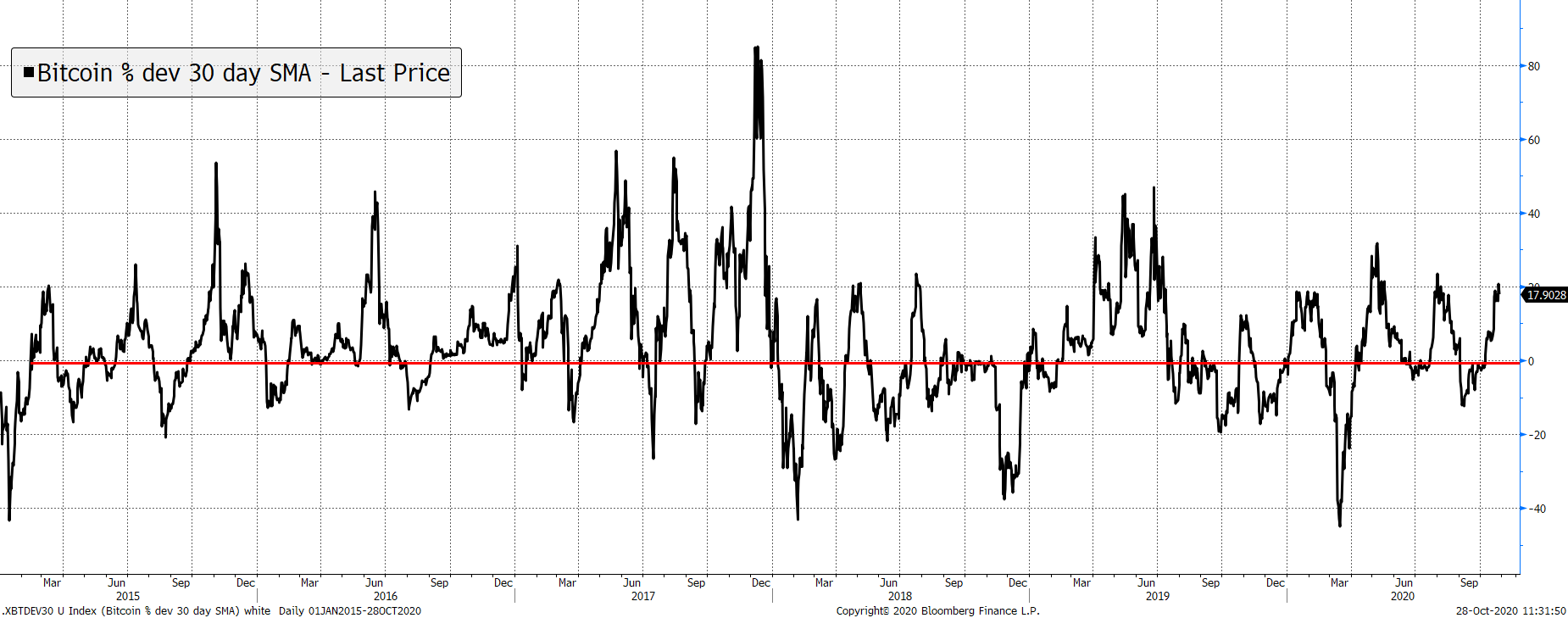

While it has been exciting seeing Bitcoin perform at a time of general stress in financial markets, you can have too much of a good thing. The price surged 20% ahead of the 30-day simple moving average, which is probably not a great time to open a new position. These things can cool off quickly, and I hope they do. What I want to see is a lasting trend as short-term spikes rarely last.

Bitcoin has raced ahead of trend

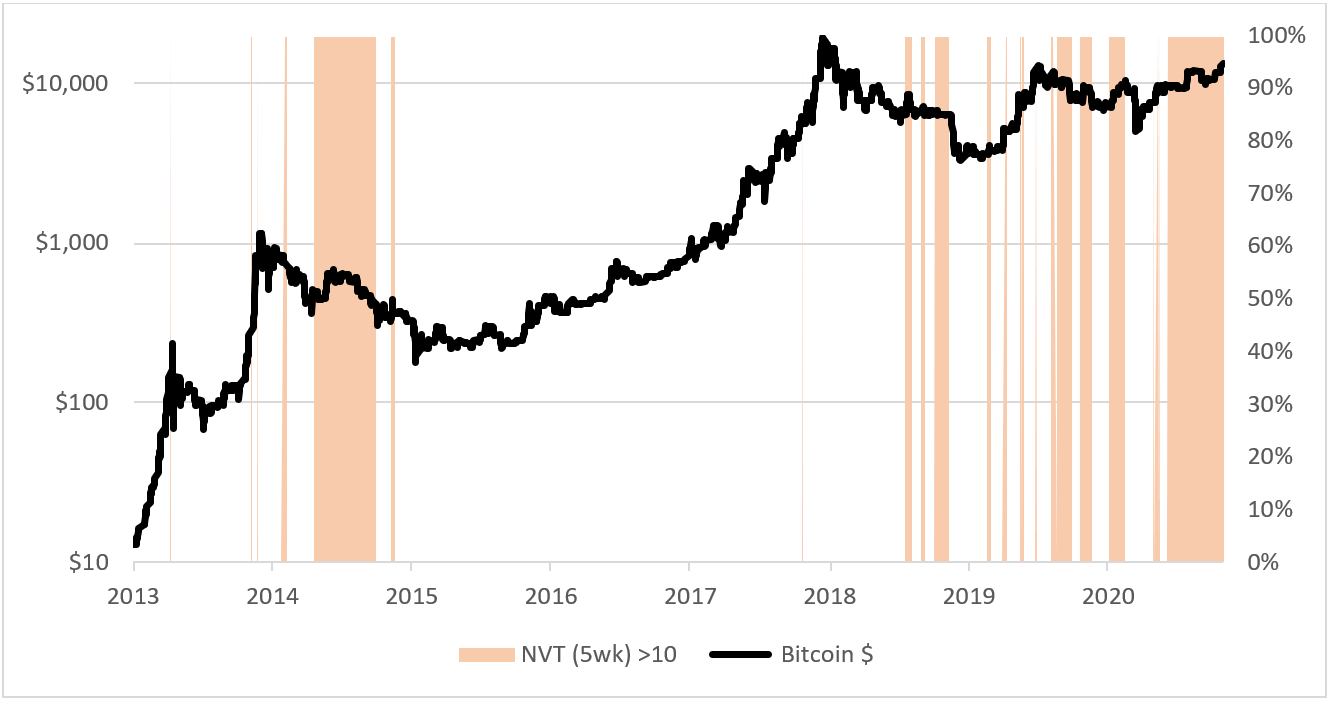

On-chain metrics also point to the price being ahead of itself. The 5-week NVT, a valuation ratio that compares transaction value to network value, is also looking fairly punchy. Statistically, you haven’t made money when the NVT (5wk) has been above 10. It is currently above 14.

High valuations are a headwind

One thing that stands out is how periods where the NVT (5wk) is above 10, have become more common since 2018. For whatever reason, valuations have become structurally higher. Network activity has grown, but one fair criticism is that network value (or market cap) is overstated because many coins have been lost over time, with some estimates as high as 7 million coins. If you adjust for this, valuations come down, as the network value cap is significantly reduced. We have done some work on this behind the scenes, which I intend to publish on the site in due course.

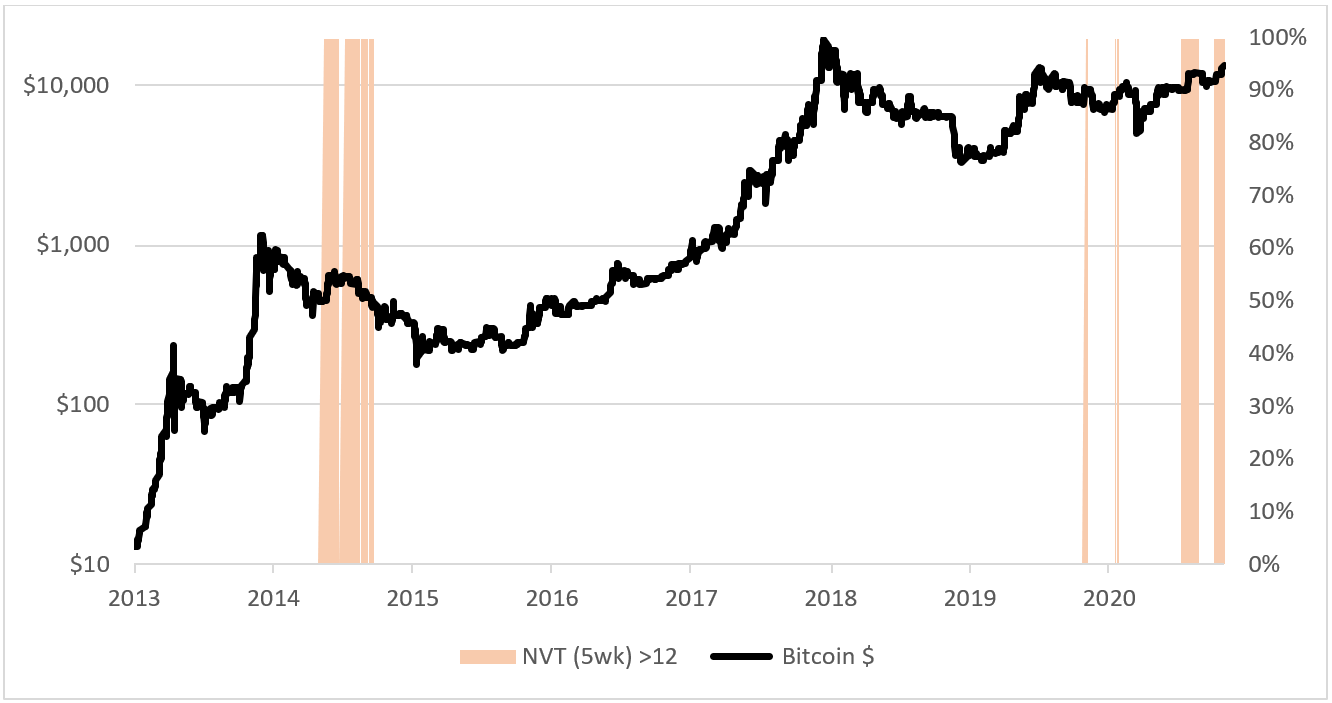

An NVT (5 wk) above 14 really is quite rare, and I have shown instances above 12, which itself is quite rare, on the next chart. Historically, it has hardly been a reliable buy signal.

Rarely is network value so far ahead of network activity

If Bitcoin became the new gold, perhaps valuation doesn’t matter as the asset would dislodge itself from the network effect. Or perhaps not? According to the World Gold Council, gold trades $145.5 billion per day, which is an enormous contributor to its value, as it is liquid at times of stress. If Bitcoin managed to achieve that, using the NVT model, the fair value would be close to $300,000. It is clear that Bitcoin cannot become the new gold without materially higher liquidity.

Looking at other evidence, network fees have spiked, which doesn’t bode well, as it chokes off transactions which have dropped back to 2 million per week. While the network is firmly in growth mode, and I am long-term bullish, I wouldn’t be chasing it here and now.

Network Demand Strategy

The network demand model holds at 5 out of 6. Velocity remains the only indicator on the wrong side of this bullish move. The problem with velocity is a similar argument to the problem with the NVT ratio; an adjustment is needed to allow for inactive coins. But as a concept, an active Bitcoin is a valuable Bitcoin, and velocity is useful in measuring this.

Summary

The 5 bullish remaining signals are unlikely to turn down soon, and the risk of a bear market remains low. Price volatility is low, and the network is growing, which are also healthy signs. The cautious discussion merely suggests that price is ahead of itself, but the longer-term outlook remains very bullish indeed.