Trading Crypto-Assets; Centralised or Decentralised Exchanges?

Disclaimer: Your capital is at risk. This is not investment advice.

Exchanges are an entry point for new investors and an important part of the broader crypto-ecosystem. This article will highlight some of the benefits and drawbacks associated with both centralised and decentralised exchanges.

Global economies are reliant on exchanges to perform a critical role in facilitating the exchange of funds between key participants in financial markets. Lending, borrowing and investors are paramount to any financial ecosystem, and exchanges enable each party to interact seamlessly.

The maturation of cryptocurrency exchanges has seen several platforms become the most important cogs in the digital asset space. The 2018 Bitcoin bull market exposed the limited capacity of centralised exchanges, “CEXs”*, with the likes of Coinbase capping the total of daily trading volume per person.

According to a blog post by Coinbase:

“Due to the rapidly changing price of digital currencies, some customers may not have sell limits that are sufficient relative to the value of total digital currency they are storing on Coinbase.”

The December 2017 sell limits were as low as ‘$2,500’ (according to CNN), which presented users that were not in the top tier of identity verification with the issue of finding another way to sell their Bitcoin.

The limited accessibility of centralised exchanges led to the rise of peer-to-peer, or “P2P”, exchanges like Localbitcoins, which enabled users to trade digital assets directly with a counterparty through an online marketplace. Think Craigslist for bitcoin. While this service has proved popular, growth has been limited by the speed of identity verification and transaction implementation, a necessary step to ensure that seller’s funds wouldn’t be used to purchase nefarious items on the dark web.

The limitations of centralised and P2P exchanges highlighted the need for a more efficient, trustless and decentralised counterpart. It is no coincidence that months after the 2017 Bitcoin bull run, UniSwap, now the largest decentralised exchange (“DEX”), was launched.

*(Centralised exchanges, CEXs, are platforms or applications that enable traders to buy, sell, and exchange digital assets with any other asset, including FIAT.)

*(Decentralised exchanges, DEXs, are advanced peer-to-peer trading platforms that allow participants to exchange their assets while retaining sovereignty over their assets.)

| Features | Centralised Exchanges (CEXs) | Decentralised Exchanges (DEXs) |

|---|---|---|

| Top Examples | Binance, Bitstamp, Coinbase, Kraken | UniSwap, Tokenlon, IDEX, Binance DEX |

| Liquidity Source | Order Book - Centralised on exchange | Peer-to-Peer (P2P) or Automated Market Makers |

| Custody | Custodial | Non-Custodial |

| Security | A Variety of Hacking Risks, KYC/AML | Minimal Risk of Hacking, No Identity Verification Needed |

| Transparency | Off-Chain (Exchange Managed) | On-Chain (visible on Blockexplorers) |

| Approx Trading Fee (2020) | Taker - 0.21%, Maker - 0.16% | Taker - 0.02%-0.1% Maker - 0.05%-0.1% |

| Monthly Trading Volume (Oct’20) | $75,700,000,000 = For Binance Alone | $11,000,000,000 - For All DEXs |

| Customer Support | Yes | No |

| Accessibility | Mobile Apps, 2FA | No Mobile App, Need a Web3 Wallet |

| Trading Options | Spot, Perpetual, Derivatives, IEO | Spot |

The role of DeFi in closing the exchange volume gap

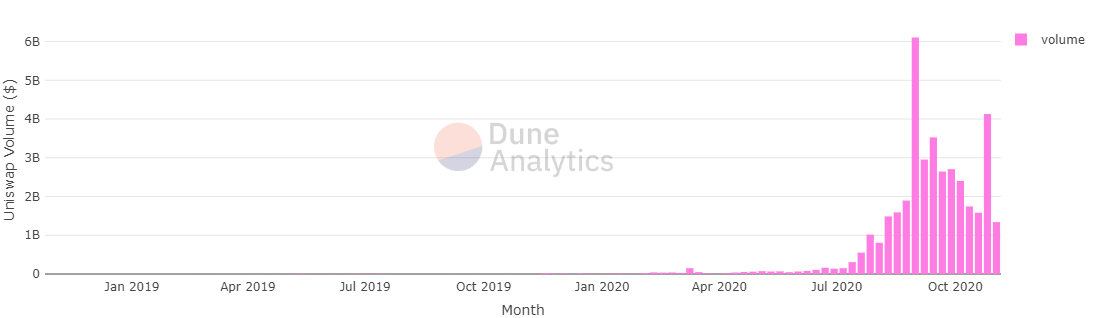

The chart above shows the weekly volume of Uniswap, which holds over 65% of the DEX market share (Source – Dune Analytics). Uniswap often experiences weekly volumes of $2bn; this is very similar to that of a top centralised exchange. A comparison of the September monthly trading volume of Coinbase ($13.5bn) and UniSwap ($15.5bn) shows that DEXs are beginning to challenge CEXs as they mature. However, centralised order books make comparing the trading volume of CEXs and DEXs a difficult task. The largest CEXs like Coinbase and Kraken will have ‘off-chain’ order books; in contrast to DEXs who are wholly transparent.

CEXs consistently outperform the top DEXs when it comes to daily on-platform volume, however, short-term trends and the rise of decentralised finance (“DeFi”), have enabled exchanges like UniSwap to outperform the top CEXs on occasion. This recent uptake in DEX volume is mainly due to lucrative token returns and yields caused by the mass adoption in DeFi.

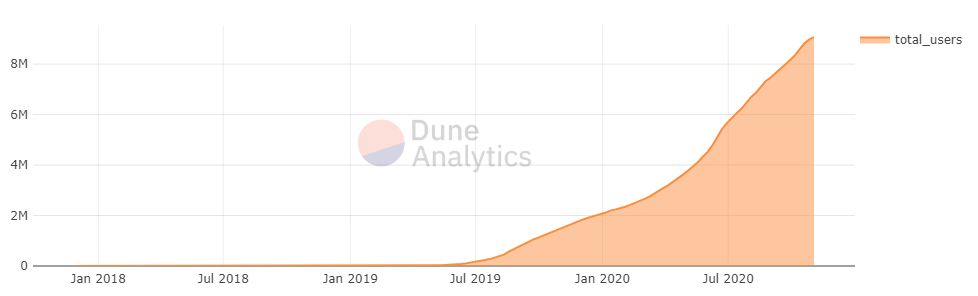

Stablecoins could tip the balance for DEXs

The graph above shows the growth of Tether, USDT, users which is the largest asset-backed stablecoin with a market cap of $17bn (according to CoinGecko). At ByteTree, we believe that there is a definitive correlation between the growth of DeFi and stablecoins. Therefore, we expect that the overall exchange volume will be distributed evenly between CEXs and DEXs if the current supply of stablecoins continues to grow at the current rate. We expect the lucrative returns and bias towards stablecoins on Defi to drive the popularity of DEXs in the future.

Evaluating liquidity; a fundamental requirement for an exchange

An important rule of thumb in trading states; ‘there is always two sides to a trade’. This saying is topical when considering digital asset exchanges because if a pair on a CEX does not have the order book to back a trade, or a DEX has no liquidity, then the platform is entirely useless. Therefore, an investor must look at the liquidity available on an exchange as the deciding factor.

The liquidity contained in a market determines not only whether a maker* can sell their asset for a desirable price, but, also the severity of the taker’s* fee. The difference between what the maker has to sell and the taker has to buy dictates the price at which an asset settles during an exchange.

*Maker – Is someone that puts up an order on the exchange.

*Taker – Is someone that takes that order to initiate the trade.

Centralised Exchanges Champion Liquidity, for now

When considering exchange liquidity CEXs currently have the edge. However, in the digital ecosystem price impact and trading fees are not the only features to consider when choosing a DEX or CEX. A recent trend has seen the adoption of exchange tokens, also known as ExTokens*.

*(ExTokens – are ERC-20 tokens which are linked to either a centralised or decentralised exchange. Exchange participants can use these tokens for a reduction in trading fees, entry to exclusive fundraisers and much more.)

Binance is one of the most significant CEXs; it also holds the largest ExToken, which is called Binance Coin, or BNB. BNB's primary incentive enables token-holders to enjoy discounted trading fees on the Binance exchange; this relates to its SPOT, derivatives, futures, options, mining pool and Initial Exchange Offering hub (or IEO).

BNB Trading Fee Discount

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|

| 50% | 25% | 12.50% | 6.25% | 0% |

Source: BNB Whitepaper. The Trading Discount BNB Offers Holders.

The table above shows the trading fee discount that BNB offers its holders. We are currently in the third year, meaning that the trading fee discount is now 12.50%. This is relevant because the diminishing fee incentive of the ExToken is likely to disincentivise the customers of Binance CEX. Therefore, we could expect to see the migration of CEX users to other platforms, which includes their decentralised counterparts.

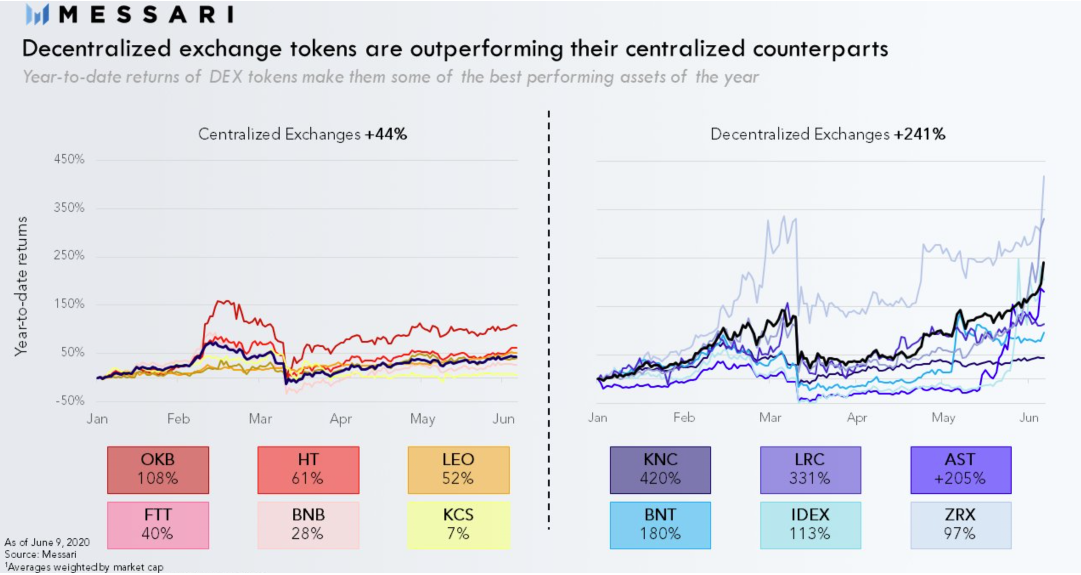

The charts above show the percentage returns of the top 4 CEX ExTokens (Left-side) and the top DEX ExTokens (Right-side). As we can see, these returns present an investor which an unorthodox way of valuing a DEX or CEX. ExToken's tend to generate value through being linked to the revenue generated by the exchanges that issue them (BNB Burn-Back*). Ultimately, an investor that plans to diversify their portfolio to include altcoins will be organically inclined to hold both CEX and DEXs ExTokens.

*(BNB Burn-Back - The ’burn’ initiative is a pledge made by Binance to remove a certain amount of BNB tokens dependent on the quarterly demand for its financial products. These 'Burns' create a deflationary cycle through perpetually reducing supply while increasing buy pressure. This reduction in supply is beneficial to BNB holders as it increases the value of their tokens without reducing demand)

How secure are your digital assets? CEXs and DEXs

Blockchain technology, distributed ledgers and a higher level of asset sovereignty are value generators for the digital asset space. An investor must decide whether they emphasise security (DEXs) or platform maturity (CEXs).

The main issue with the security of CEXs relates to exchange participants not retaining sovereignty over their funds. Not only is sovereignty hindered, but CEXs have the power to block withdrawals and lock accounts. You would like these events to be scarce, but this year alone has seen the customers of Bitmex, Kucoin and OKEx all experience security issues.

In October 2020, US regulatory bodies caused OKEx to suspend all withdrawals on their CEX platform, and this alone caused a 20% drop in the ExToken (without recovery) which can be seen on the chart above (blue circle). The main reason for this suspension was due to a primary key holder (an entity which authorises platform trades) not being available due to involvement in a US bureau investigation. This shows the adverse effects that poor CEX security can have on the sovereignty of users’ funds.

If an investor values security, then DEXs are the appropriate counterpart, it is a common misconception that they are less secure. User privacy and sovereignty are often overlooked when using CEXs. The age-old argument in the digital asset space states ‘Not your keys, not your Bitcoin’. This means that a user is relinquishing direct control of their digital assets with custodial solutions like CEXs; which is not the case with non-custodial DEXs.

Conclusion

There are trade-offs between CEXs and DEXs; however, we believe that many of the issues faced by DEXs will be resolved with further developments within the space. We expect to see protocols such as 0x* generate a much more competitive ecosystem, as both types of exchange fight to incentivise market participants to stay loyal with lower fees and ExToken appreciation.

We believe that the future growth of stablecoins and the DeFi ecosystem will be significant factors in the continued adoption of DEXs. Competitive liquidity will come as a result of these two factors, which some view to be the current bottleneck of DEXs. As transparent pricing and security become higher priorities for traders, decentralised exchanges will take an increasing share of volume away from their centralised counterparts. Finally, we expect to see wider adoption and liquidity of altcoins which are made more accessible through rapid integration with DEX platforms such as UniSwap.

*(0x – an automated market maker, which utilises backend relays to provide decentralised protocols with the best market price by connecting several liquidity pools)

(Satoshi Nakamoto’s and the anarcho-capitalist's vision of a trustless peer-to-peer systems – really cool description of Bitcoin)

Comments ()