Ethereum 2.0 - Too Little, Too Late?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: ETH;

In this two-part series, we will cover why ETH 2.0, a network scalability upgrade for Ethereum, is significant to digital asset investors. In part 1, I will guide readers through why this upgrade is needed and briefly explain what ETH 2.0 is. In the second part, I will provide a more technical look at ETH 2.0 and dive deeper into its implications for investors.

Why does Ethereum need an upgrade to 2.0?

Ethereum is the leading platform for the creation of decentralised applications, known as dApps. These dApps generate value for investors through a variety of ways; most notably decentralised finance, or DeFi*, enables investors to put their digital assets to work through lending, borrowing, staking, or even trading digital monsters (NFTs**). Ethereum is also well known for its token standards (ERC-20, ERC-721) which are widely used by investors and developers.

*(DeFi, also known as decentralised finance, are a subset of dApps that focus around creating financial instruments.)

**(NFTs, also known as non-fungible tokens - tokens that represent a unique asset.)

Ethereum was released in 2015 and now stands as the second most valuable digital asset (by market cap). Purely looking at the 400m dollars’ worth of ETH staked for ETH 2.0, shows the community support that the digital asset has (as of November 28th). However, we have seen support falter in periods of high network congestion, which have been a result of Ethereum’s lack of network capacity.

ETH 2.0, also known as ‘Serenity’, is a network upgrade which will enable the Ethereum network to process more transactions and improve network speed, all while reducing overall gas fees. At ByteTree, we view this upgrade to be the most significant event for Ethereum in its history.

How long has Ethereum had these scalability Issues?

Despite its success, Ethereum scalability is its Achilles heel, and this affects its potential as the leading dApp blockchain. Its scalability issues are not recent problems, with the boom of CryptoKitties in 2017 showing how vulnerable the network was to spikes in network usage, grinding the network to a halt.

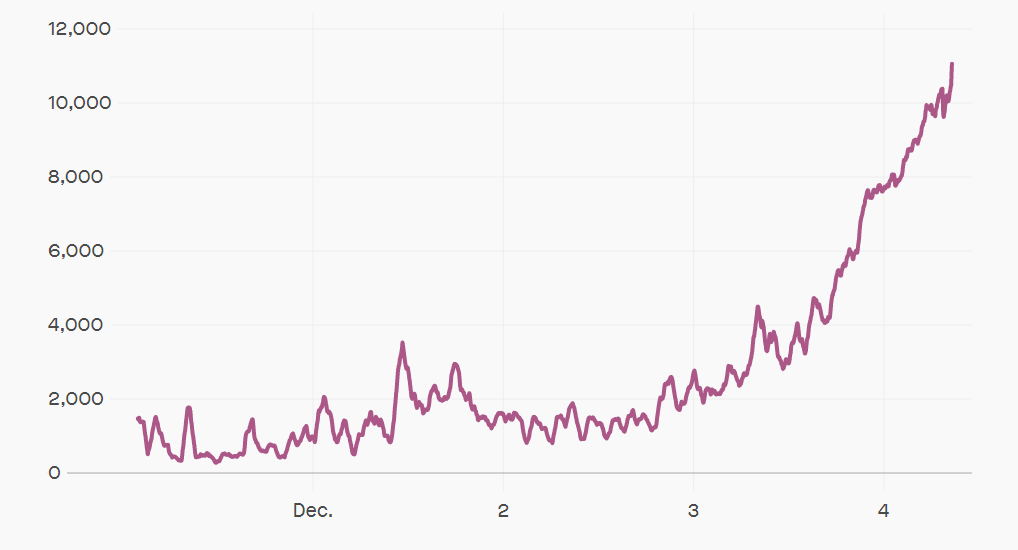

The chart above shows the dramatic increase in pending transactions caused in the days after the initial release of CryptoKitties; a dApp for trading and breeding NFT virtual kittens. Pending transactions drive increased gas fees as miners are incentivised to validate transactions which are the most profitable for them. Meaning that to pass a transaction through a highly congested network, you must incentivise miners with high transaction fees.

CryptoKitties caused significant network congestion and was the first time that investors questioned the longevity of Ethereum. Congestion is a negative result of dApp adoption on the Ethereum blockchain, showing a clear bottleneck as adoption in the digital asset space is generally considered to be positive. Originally fast, low-cost transactions were a substantial factor that drove adoption for digital assets; however, with high network congestion comes high fees. Therefore, one can assume that high congestion results in an inefficient network.

CryptoKitties then, Decentralised Finance now

The chart above puts Ethereum’s scalability issues in perspective. The first circle represents the number of transactions daily on the Ethereum blockchain when CryptoKitties was released; the second circle represents the DeFi summer which is still very much continuing into the new year. If we agree that CryptoKitties congested the network, then we can see from the chart this network congestion has been the same (or more) for three years.

These two events are periods of mass network activity which are typically viewed as positive for a network; however, the hardship (high fees and slow transactions) they have caused Ethereum users creates an undesirable environment for investment. Although an inefficient network accrues negative value, network congestion also causes high fees for users; a foolproof recipe for disaster.

If Ethereum can not fix these issues, then investors can expect to see other blockchains such as Polkadot, Serum, and Cosmos slowly claw users, platforms, and market cap from Ethereum. Dapper Labs, the creators of CryptoKitties, is an example of a major dApp migrating away from the Ethereum Network; raising over $18m, through a Coinlist sale, for the creation of an entirely separate blockchain just for NFTs due to the unscalable nature of Ethereum.

Is ETH 2.0 just a scalability upgrade?

ETH 2.0 is the proposed fix that in many eyes has been the answer to Ethereum’s problems for many years. Most notably, the network upgrade has two main characteristics; a change in consensus method, and a considerable increase in network capacity (sharding). ETH 2.0 will run on a separate blockchain while attempting to gradually merge with Ethereum, to increase overall network efficiency and reduced gas fees; both areas where Ethereum struggles.

| ETH 2.0 Changes | Description |

|---|---|

| Fundamental Economic Changes | Staking - Change from PoW to PoS, ‘validators’ stake to secure the network instead of mining |

| Blockchain Upgrades | Sharding - the creation of 64 individual Ethereum blockchains which all run in parallel. Communicating through the main chain, also known as the ‘Beacon Chain’ |

Source: ByteTree. Main features of ETH 2.0 upgrade.

The table above shows the main upgrades that ETH 2.0 plans to implement. ‘Sharding’ is the more significant of the two with regards to fixing Ethereum’s scalability issues. Staking, which signifies a change from proof of work, is a fix to the glooming realisation that using computational power to validate digitals networks is not energy efficient.

According to IEEE Spectrum;

“the typical Ethereum transaction gobbles more power than an average US household uses in a day”

To put this in perspective, Ethereum only consumes a fraction (11 TWh) of the annual electricity consumption of Bitcoin (77 TWh) (Source: Digiconomist). With the growing spotlight on energy efficiency around the globe, one can expect to see the encouragement of digital assets to move away from proof of work mining, which is computationally expensive, towards proof of stake mining.

What are the features of ETH 2.0?

| Proof of Work | Proof of Stake | |

|---|---|---|

| Age | Introduced in the 1990s | Introduced as a modification of PoW in 2012 |

| How is transaction validation carried out | Miners use computational power to validate transaction blocks. This creates a competitive race to complete each block in order to gain the block reward | Validators stake their tokens to become a part of a system wide collective of nodes. A backend algorithm randomly elects a node to verify transactions in a block, in return for a reward |

| Energy use | The majority of a miner operational cost is energy use. PoW is notorious for using an efficient amount of electricity | A fraction of PoW because machines used as nodes only have to be turned on with the software open |

| Vulnerability | It is much more costly to attempt a 51% attack on a mature PoW system (like Bitcoin). This is because the attacker would have to acquire over 50% of all network computational power | An attacker would need to acquire 51% of all the native currency to expose the weakness of a PoS system |

| Scalability | Less scalable | More scalable |

| Example | Bitcoin, Ethereum, Zcash, Litecoin | ETH 2.0, Algorand, Cosmos, Polkadot, EOS, TRON, Cardano |

Source: ByteTree. A comparison between Proof of Work and Proof of Stake.

The table above explains the difference between the main two consensus methods. ETH 2.0 on a high level is a change in consensus methods; which are essential to the security of a network as they validate transactions to rule out foul play. Currently, Ethereum and Bitcoin both implement a Proof of Work, known as PoW, consensus method; which uses computational power (in the form of miners) to validate each transaction block.

The other mainstream method of consensus is Proof of Stake, known as PoS, which enables validators (the equivalent of miners) to stake the native digital asset to perform the same block validation. Cosmos and Polkadot are key examples of this type of consensus method being successful.

A change in consensus method also enables ETH 2.0 to implement scalability upgrades, this is called ‘Sharding’; which is the act of creating individual blockchains which all communicate to each other through the main chain. The main chain in the case of ETH 2.0, is the beacon chain, which holds condensed data from all its surrounding ‘shards.’

In this piece, I showed readers why ETH 2.0 is paramount to the futureproofing of Ethereum and briefly introduced the main features of the Ethereum upgrade. In the second part, we will explore whether ETH 2.0 will have a positive effect on Ethereum’s value and take a more technical look at the implications of ETH 2.0.

Comments ()