Evaluation of ETH 2.0

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: ETH;

In part 1, I introduced ETH 2.0 and showed readers why there is a definitive need for an Ethereum network upgrade. In this part, we will explore the timescale and implications of ETH 2.0 on investors.

Will ETH 2.0 make the Ethereum blockchain the ‘World Computer’?

Vitalik Buterin, co-founder of Ethereum, often refers to Ethereum as the ‘World Computer’, this relates to how a blockchain distributes shared data;

According to CoinDesk:

Ethereum’s vision is to be a ‘globally decentralised, un-ownable, digital computer for executing peer-to-peer contracts.’

Bitcoin’s blockchain decentralises the storage of financial transactions; for Ethereum, its blockchain decentralises the storage of smart contracts; enabling a shared global resource. The success of Ethereum as a ‘World Computer’ depends on the balance between the value of the data stored and the resources needed for users to access and use that data.

As we discussed above, there are moments in which the number of resources (fees) needed to power the network bottlenecks its scalability. Ethereum 2.0 and its 3-phase plan is a much-anticipated system-wide upgrade; which the community hope will overcome its current capacity hurdle. Think the lightning network* but for Ethereum.

*(The Lightning network is a layer two solution for Bitcoin, which strives to increase the capacity of the network through off-chain microtransactions.)

How does Changing a Consensus Method help Scalability?

| Phases of ETH 2.0 Development | Description | Explanation |

|---|---|---|

| Phase 0 | The ‘Beacon chain’ launch. This relates to the main blockchain of ETH 2.0, which is entirely separate to Ethereum. The recent deposit smart contract is for this , where all deposited Ethereum will be burned and locked up until the end of ETH 2.0. | This relates to the creation of an entirely new PoS system called ‘Casper’. This is the replacement for the power-intensive PoW consensus method on ETH 1.0. The deposit contract participants will act as the ‘new’ type of miners, known as validators. These validators are rewarded for their efforts in securing the network. |

| Phase 1 | Phase 1 will see 64 ‘shards’ being created, all containing entire blockchains whom provide the beacon chain with compressed summaries of their processes and data. | The scaling mechanism that ETH 2.0 will use is referred to as ‘sharding’, which is essentially the creation of a number of individual blockchains (‘shards’), who run seamlessly together as a layer on top of the beacon chain. |

| Phase 1.5 | Deployment of dApps from Ethereum to ETH 2.0. | It is worth noting here that once a dApp is deployed on ETH 2.0 it can not be reserved back to ETH 1.0 (just like the deposit contract). |

| Phase 2 | Increased functionality on ETH 2.0 for dApps and fully merging Ethereum and ETH 2.0 to create a singular Ethereum. | Known as ‘docking’, this signifies the coming together of Ethereum proof of work and ETH 2.0 proof of stake. Where Ethereum will be sharded and connected to the Beacon Chain. |

| Phase 3 | Final touches and increased privacy for ETH 2.0 users through the use of ZK-Starks. | ZK-Starks – Zero Knowledge Scalable Transparent Arguments of Knowledge – these increase the data privacy of ETH 2.0 users by enabling them to have the choice to not disclose data to third parties on the blockchain. |

Source: ByteTree. The phases of ETH 2.0.

It is by no means a quick fix, and until phase 1.5 both the Ethereum and the ETH 2.0 blockchain will exist as entirely separate entities. This is achieved through the original deposit smart contract that closed on 1st December. All the Ethereum staked in this contract is burned, and the equivalent amount is minted on the ETH 2.0 blockchain.

For phase 0, the network will not support any transactions, data storage or any smart contracts. The purpose of this phase is to eliminate bad acting validators and to make sure that Casper (new PoS system) can perform without crashing. Phase 0 presents the most risk as the ETH 2.0 network has been in testnet until its beacon chain launch on December 1st; however, the promise of a 20% annualised return (according to CoinDesk) is worth the risk (for some).

Ethereum will not feel the positive scaling effects of ETH 2.0 until phase 1.5, where dApps will be deployed. Phase 2 is like 1.5, as it plans to increase the functionality of deployment for dApps on ETH 2.0. While also attempting to ‘dock’ Ethereum and ETH 2.0, this will be achieved through merging the two blockchains into one.

After Phase 2, the final step will begin, which intends to improve privacy for users (through ZK-Starks*) and add any final touches which the developers deemed necessary. According to Vitalik Buterin, he estimates that the entire process will take 5 to 10 years to fully complete. As we can see a changing consensus for the 2nd largest digital blockchain (by market cap) is not a simple task; however, it will undoubtedly increase scalability.

*(ZK-Starks – Zero-Knowledge Scalable Transparent Arguments of Knowledge; these increase the data privacy of ETH 2.0 users by enabling them to choose not to disclose data to third parties on the blockchain.)

How will ETH 2.0 affect dApps and their users?

The ability to run 64 different blockchains (‘shards’) on top of the main ETH 2.0 chain is a monumental upgrade and certainly will help Ethereum to keep its top spot as the leading dApp platform. However, we are still unclear as to what the new ETH 2.0 environment will look like. We do know that the process of merging the two chains and dApps will not be completely seamless; therefore, it is worth considering the downtime that sectors like DeFi could experience.

For decentralised apps like TokenSets there should be no issues. The only change should be the way that validators profit from securing the Ethereum network.

According to Consensys:

“For most ETH holders—-i.e. the HODLers, the dapp users, the traders—-the answers are: No, you don’t need to do anything. No, there won’t be a hard fork or a migration. No, it does not matter if your ether is on an exchange or not.”

Will ETH 2.0 affect Ethereum’s value?

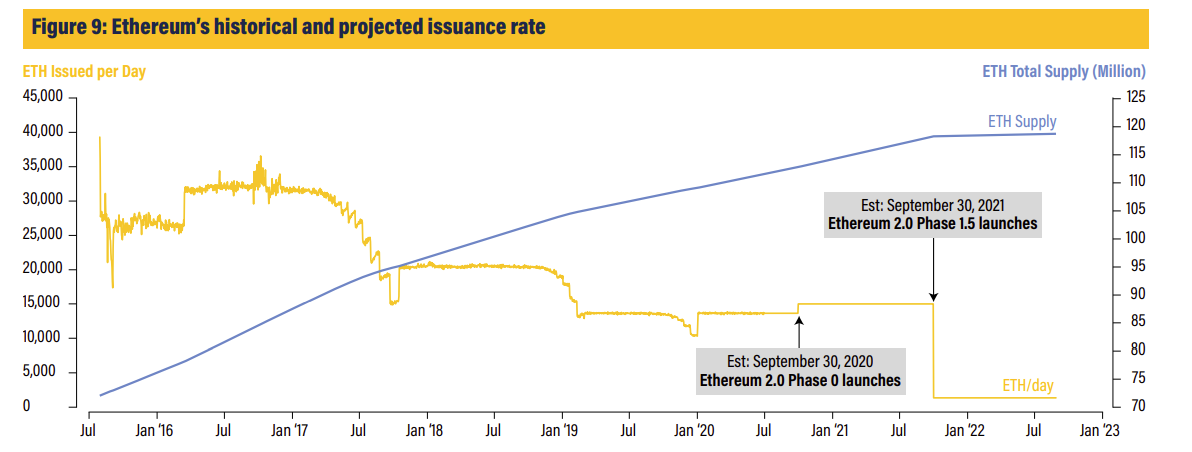

It is worth noting that ETH 2.0 is unlikely to be a new token; instead, ETH 2.0 will use Ethereum ‘as its native currency’. This means that the network issuance (i.e. supply) will increase because validators are rewarded with Ethereum for performing their tasks correctly. According to CoinDesk, the total supply of Ethereum will only increase by between 0.1% and 0.45% which is a small amount but could negatively affect the value of Ethereum as it does not have an upper limit for coin supply (unlike Bitcoin), meaning that the increasing coin supply would devalue existing supply.

On the other hand, the deposit contract is favourable for the current price of Ethereum, as over 500,000 ETH has been taken out of circulation (until docking). By decreasing the number of tokens available, we can assume that the supply will decrease relative to the market demand, which should be unchanged.

Is ETH 2.0 too little too late?

When a digital asset has an infinite supply, investors place a higher value on the application that the associated blockchain has. For Ethereum and other platform-based blockchain competitors like Polkadot, Cosmos and FLOW (for NFTs) making sure their platforms have the most popular dApps is paramount to increasing market dominance.

Ethereum’s scalability issues have not been recent problems; therefore, other digital assets have time to improve and make their blockchains more effective. These ‘Ethereum Killers’ have the opportunity to better Ethereum for the next five years before Vitalik’s predicted ETH 2.0 release date is met (5-10 years). Meaning that investors could expect to see Ethereum’s favour decrease in the short-term, due to an ‘outdated’ network.

With the likelihood of interoperability* between alternative platform based blockchains, an investor could see the relative market cap and subsequent Ethereum asset price fall as a result of more scalable options other than Ethereum.

*(Interoperability relates to the ability of different blockchains to communicate between themselves, enabling for seamless use of each other blockchain’s dApps.)

Overall, when it comes to asset price on a 5-year outlook, we could expect to see positive price action as the supply of Ethereum is perpetually reduced through the deposit contract burn. However, with five more years of a relatively unscalable blockchain, we could expect to see Ethereum lose part of its market dominance to more advanced solutions like Cosmos or Polkadot.

At ByteTree, we believe that in the long-term ETH 2.0 will be drastically positive for the price of Ethereum. Not only will ‘Sharding’ make Ethereum the most scalable network but a change in consensus method makes the asset much more attractive to the new world perspective of energy efficiency. However, one can not ignore that Ethereum’s competitors have the opportunity to capitalise on its older brother’s scalability issues.

Comments ()