Could This Be Ethereum's Route to Scalability?

Disclaimer: Your capital is at risk. This is not investment advice.

An Evaluation of Ethereum's Gas Issues;

The recent market bull run has left many bewildered at Ethereum’s inability to reach all-time highs, especially considering that Bitcoin doubled for the 19th time in under a year ($31,457 on 2 January 2021), and then continued past $40,000. In the same period, Ethereum only managed to climb $200 shy of its 2017 all-time high of $1448 (according to CoinGecko).

Although Ethereum has not performed as some would hope, overall sentiment is still widely positive. There are two key drivers of Ethereum’s under performance relative to Bitcoin; firstly, its scalability issues, and secondly, the impractical costs for its users.

This piece will focus primarily on the exorbitant network fees that hinder Ethereum’s main value proposition; toppling Bitcoin and becoming the largest digital application platform.

Ethereum’s Gas Issues

‘Gas’ is a network fee every Ethereum user must pay. The fee amount is usually denominated in “gwei” (1 gwei = 0.000000001 ETH), which is comparable to Bitcoin’s ‘satoshi’. Think of gas as a fee that compensates Ethereum miners for their computational power when processing your transaction. It is a fundamental part of the proof-of-work consensus model which secures Etherum’s virtual machine.

Gas plays a vital role in securing the network, as quoted from Ethereum.org:

“By requiring a fee for every computation executed on the network, we prevent actors from spamming the network.”

While network fees are an essential part to the security of any blockchain, many think Ethereum’s unproductive transactional costs are a bottleneck to its valuation. This issue has been the case for several years; initially highlighted by the digital gaming platform, CryptoKitties (read more here). In 2020, a much more complex sector of Ethereum’s ecosystem threatened its value; DeFi.

DeFi brings the Ethereum Network to a halt

The ability to process large quantities of simple transactions without much issue is an area where Ethereum has excelled, and one where Bitcoin has failed in the past. The Bitcoin Network, without layer-two solutions like the Lightning Network (read more here) does not have the capacity to be able to process the same throughput as Ethereum.

But Ethereum is not without its issues. Decentralised Finance, also known as DeFi, has highlighted the inability of Ethereum to perform its role for early adopters. This issue is not that Ethereum cannot support the wide array of new DeFi applications, but that the costs of using the network’s smart contracts render it economically challenging to do so.

The chart above shows the median gas fee paid on the Ethereum network. The large spike in mid to late 2020 represents the ‘DeFi Summer’, where the median cost for a transaction skyrocketed. These high gas prices were driven by the way Ethereum’s fee pricing mechanism operates.

According to Glassnode, in August 2020 (as marked on the chart):

“Over 17,500 ETH (USD $6.8 million) are currently being spent on fees daily on Ethereum.”

As we can see on the chart, the daily fee amount continued to rise into late October, which many coined DeFi’s cooling off period.

Extortionate Fees are a result of Minuscule Block-Size

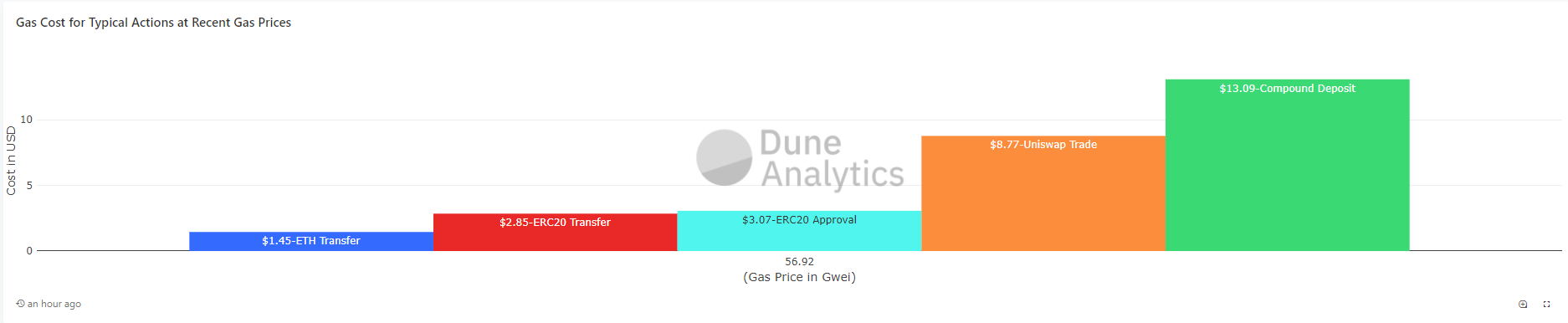

DeFi causes many problems for Ethereum’s network fees due to the complexity of its transactions. Often straightforward transactions such as depositing on Compound.Finance, a lending and borrowing platform, can be 10x more expensive than transferring ETH.

To complete a DeFi transaction, users are often required to approve a number of transactions; each one has a gas fee attached. Ethereum’s current block size only allows up to 12.5Mn gas per block, which means that miners can pick and choose the most lucrative offerings possible.

According to DAppRadar, “DeFi apps accounted for 99% of all transactions on the network”, during the DeFi Summer. This also coincidences with Ethereum miners making $113 million from transaction fees, as highlighted by Glassnode. Clearly, DeFi fees are lucrative, and due to potentially long waiting times, many users opt to pay an unnecessarily large network fee.

Re-designing Ethereum’s fee structure: EIP-1559 might just be the answer

Ethereum Improvement Proposal 1559, or EIP-1559, was initiated by Eric Conner and Vitalik Butterin (The founder of Ethereum) in 2019. It aims to fix the inefficiency of Ethereum’s current fee pricing mechanism, by offering a faster and more localised solution to Ethereum’s issues. The exact release date of EIP-1559 is unknown, as illustrated by Tim Beiko’s (Core ETH developer) thread in August 2020:

“There are a few challenges (i.e. even if we raised a ton of money, 1559 may still not work!) and it’s hard to commit to timelines (both known unknowns and unknown unknowns)”

| Features of EIP 1559 | Explanation |

|---|---|

| Addition of a base fee | EIP-1559 will change the current mechanism to include a ‘base fee’ in each transaction block. ‘Every transaction included in a block must pay that block’s base fee (per unit of gas), and this payment is burnt rather than transferred to the block’s miner’‘when the network is at >50% capacity, the BASEFEE increments up slightly and when capacity is at <50%, it decrements down slightly.’ |

| Change in Block Size | Transaction blocks will aim for the target size of 12.5m gas, but can either double to 25M or reduce in size. The size of the block will determine the base fee: ‘The base fee is adjusted after every block, with larger-than-target blocks increasing it and smaller-than-target blocks decreasing it’ |

| Special Treatment or ‘miner bribe’ | In periods of rapid demand users have the opportunity to have a fast track. ‘[Users] can supplement the base fee with a transaction tip that is transferred directly to the miner of the block that it includes it.’ To avoid to much bribery: ‘Transactions specify the maximum fee per gas they are willing to give to miners to incentivize them to include their transaction (aka: miner bribe)’ |

The table above shows the main features of the improvement proposal. The scale of these changes should not be taken lightly. Many miners will see a large chunk of their revenue slashed.

According to David Hoffman, the addition of a base fee:

“attempts to generate “the market rate” for gas prices, natively on Ethereum.”

This ‘market rate’ varies algorithmically depending on the network demand for block space at that time. If the network is above 50% capacity then the base fee incrementally rises, vice versa should the capacity be below 50% then the base fee will decrease.

Furthermore, EIP-1559 will enable a capacity increase on each block; doubling the gas limit from 12.5M to 25M. This directly affects the base fee algorithm, the more space available, the lower the base fee per block.

Miner bribes will replace network fees as the secondary part of miner revenue (the other being block reward). According to Hoffman:

“[Users] can supplement the base fee with a transaction tip that is transferred directly to the miner of the block that it includes it.”

Manipulation due to unnecessary bribery is ensured through a maximum fee amount placed on every transaction.

Making Ethereum Deflationary is the Answer

The major update to the fee market that users should be aware of is the move to from a “first-price auction fee” to a “base fee”. A base fee dramatically reduces the typical gas fee for users because there will be a set price per transaction. First-price auctions work by having each user submit a varying gas amount dependant on their desired transactional speed, leading to inflated cost per transaction. According to Eric Conner, EIP-1559 and its base fee will cause “0 to negative issuance of Ether”.

Currently, gas prices are determined by network users. For example, on the MetaMask UX an investor can select ‘slow’, ‘medium’ or ‘fast’. Each of these options determines a gas/gwei amount that ascertains the transactional cost and speed.

Eric Conner states:

“The source of frustration with the current fee system stems primarily from Ethereum’s attempt to price fees using a simple auction mechanism. Known as a first-price auction, this system works by having everyone submit their bid (gas price) for how much they’re willing to pay to have their transaction picked up by a miner. Usually, miners select transactions ranked by the highest fees which results in many users grossly overpaying.”

He continues with stating that the current mechanism causes:

“a large divergence of transaction fees paid by different users in a single block, suggesting that many users often overpay by more than 5x.”

One of Bitcoin’s main value propositions relates to its deflationary supply. Ethereum, through EIP-1559, is attempting to achieve a similar process. In essence, systematically changing from ‘first price auctions’ to a ‘base fee’ will perpetually reduce the supply of Ethereum as fees that currently go to miners will be burned. Burnt fees are removed from the circulating supply indefinitely, and therefore generating additional value for Ethereum holders similar to how stock-buy-backs generate value in traditional finance.

Will it work?

Tim Roughgarden, in his economic analysis of EIP-1559 states:

“EIP-1559 proposes a major change to Ethereum’s transaction fee mechanism” however, “No transaction fee mechanism, EIP-1559 or otherwise, is likely to substantially decrease average transaction fees; persistently high transaction fees are a scalability problem, not a mechanism design problem.”

Furthermore, many speculate over the security issues that could occur due to the ‘base fee’. A large part of keeping a network secure relies on miners being able to keep their machines on. EIP-1559 will mean that miners are only compensated through ‘miner bribes’ and block rewards. If EIP-1559 is not viable for miners, it is possible the network’s security would reduce.

Conclusion

The current solutions to Ethereum’s gas costs are not accessible for the vast majority of investors, as each requires a speciality in either smart contract deployment (chiToken) or futures trading (uGas). Systematic changes like EIP-1559 and ETH 2.0 have great potential to improve the current gas issues. However, it remains to be seen as to whether miners will be incentivised enough to continue to support the network.

Comments ()