An Investor's Guide to NFTs

Disclaimer: Your capital is at risk. This is not investment advice.

Part I: Market Trends and Industry Overview;

Non-fungible tokens, also known as NFTs, are digitally unique and indivisible assets that grant their holders absolute ownership rights, which is unheard of in the traditional world. Fungible tokens, on the other hand, are tokens that can be directly exchanged with each other. For example, Bitcoin is the most successful fungible token because each coin has equal exchange value.

In my previous piece covering the NFT landscape, I mentioned the first hybrid NFT artwork sold by the Christie’s auction house. It is called “block 21” and was created by an artist under the pseudonym of Robert Alice; the piece sold for $131,000.

Block 21 was a significant sale in October 2020 and proved to many that NFTs have real value proposition. However, it has since been dwarfed by Beeple’s NFT titled “The First 5000 Days”, which was auctioned at Christie’s and sold for nearly £70m in March 2021. Perhaps this is the digital Picasso I referenced in my previous article.

This article will provide investors with a beginner’s tool kit to understand the high-level value propositions that NFTs present to the digital asset market.

The History of Non-Fungible Tokens

NFTs are one of the most significant and promising versions of tokenisation. However, this is not a new concept in the space. Coloured coins were the first NFTs to exist and their aim was to distinguish certain bitcoins from others, i.e. making them non-fungible. The feature enabled connected parties to agree that certain time-stamped bitcoins had a value that was separate from a fungible Bitcoin. Vitalik Buterin, the creator of Ethereum, helped to write a paper on them in 2013 and summarises it perfectly;

“These bitcoins can then have special properties supported by either an issuing agent or by public agreement, and have value independent of the face value of the underlying bitcoins”

Ultimately, trust was the downfall of coloured coins. Single points of failure would lead to the weakest party in the joint agreement disagreeing with the others; only one party had to dispute the perceived value of the non-fungible bitcoin and the agreement would break down.

Coloured coins sowed the seed for modern NFTs and network users have attempted to immortalise their unique assets on blockchains ever since. Although Bitcoin was not programmed to house these unique assets, like most things, it passed this narrative over to upcoming blockchains. Currently, the blockchain that has excelled in accommodating the trade and development of these unique assets is the Ethereum Network.

Why do NFTs have value?

In this article, we will focus on a universal macro and technical view of why NFTs generate value for investors and creators. There are a wide variety of NFT sectors, including: art, collectables, gaming, metaverses, unique yield generating assets (like Aavegotchi’s), and many other sectors. We will take a more focused approach on these sectors in upcoming articles, while this piece will cover the first steps in understanding the blanket value propositions that this topical NFT ecosystem has to offer.

Macro Value Proposition

Although we may be coming to the end of the COVID pandemic, we cannot ignore the digital uptake that has occurred from billions of people contributing to the ‘stay-at-home’ economy. The pandemic has had positive impact on digital companies like Zoom, who have experienced exponential growth due to the sudden demand for its product.

When looking at the digital asset ecosystem through this lens, one cannot ignore the vast growth seen in alternative investments. The debasement of FIAT currencies and political uncertainty has led many to seek a different digital store of value. Perhaps, it is not too difficult to see why digital collectables, art and stores of value assets have experienced so much adoption.

Digital vs. Traditional

NFTs are composed of unique metadata, which gives each token attributes that are impossible to recreate or destroy. These are the same characteristics that give traditional art and collectables immense value. For example, there is only one Mona Lisa; it can never be recreated and that scarcity, among other factors, generates tremendous demand and value.

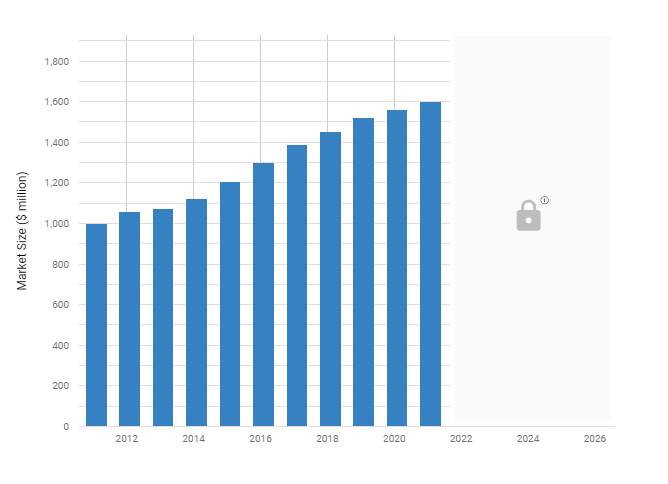

The chart above shows the value that the traditional market has attributed to scarce and collectable items over the last decade in the United States. In 2020, around $1.4 billion in sales were generated by the traditional antiques and collectables market. This does not include the global art market, which was valued at over $50 billion last year, according to UBS.

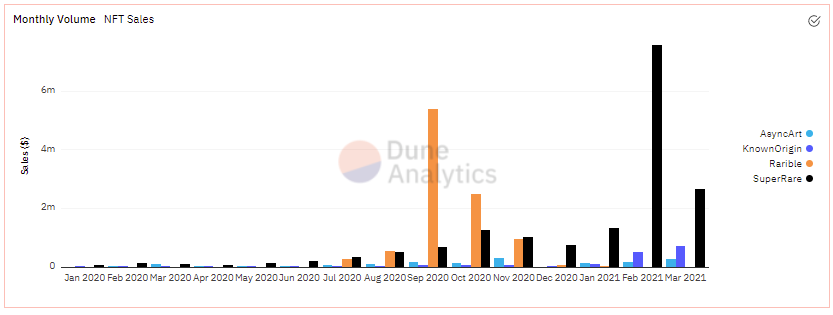

In contrast, around $26 million of sales have been captured by the top NFT marketplaces over the past year. This does not take into account any NFT artworks sold at traditional auction houses, such as Christie’s. Considering that Christie’s annual sales equalled to around $1.2 billion in 2020, according to ArtNews, one could argue that NFTs have significant potential upside.

If NFTs managed to capture just 1% of the traditional art market sales, then sector sales would grow by 19x, creating an immensely positive network effect on early investor holdings. There is reason to believe that NFTs have the potential to gain much more than 1% because they improve on the current traditional collectables, gaming and art sectors.

Technical Value Propositions

Blockchains and smart contracts provide an answer to the problems which many artists and collectors face in the traditional art world, such as; immutable ownership, provable scarcity, highly transportable assets, efficient royalties and creator rights.

Distributed ledger technology and cryptography is responsible for immutable ownership and provable scarcity. Since ledgers are viewable by any entity, one can simply look on a block explorer and view the entire history of an NFT to authenticate any ownership, certification or supply worries they may have, by operating in a trustless environment with no need for third parties.

Highly accessible digital markets provide collectors, investors and creators around the world with a chance to interact with each other on a scale that traditional cumbersome art and collectables have struggled to reach. This, like the entire digital asset ecosystem, provides a much wider product reach and therefore potential for vast adoption.

This highly liquid digital market also provides artists with significant incentives to pursue a more digital career. Smart contracts play a vital role in this, as they enable royalties or ‘creator rights’ to be automated and unquestionable. For example, SuperRare codes a 10% royalty (commission) into NFTs, enabling the creators to profit from a secondary market, potentially for life. This service is completely trustless and requires no effort from the artist’s side, making it undeniably attractive to creators.

At ByteTree, we continue to see new value propositions for NFTs in concentrated sectors. In music, artists are nurturing their fan relationships by tokenising rare songs. The gaming sector also has the capacity to provide essential utility to debasing countries such as Venezuela. For example, Axie Infinity functions on a play to earn economy, which has enabled people from collapsing economies to earn an “effective side hustle”.

Although most value propositions for NFTs rely on the Ethereum token standard, ERC-721, the choice of the blockchain platform to facilitate NFTs is not necessary a driver for customer adoption. NBATopShots was built on FLOW blockchains and has seen hyper-adoption, suggesting that loyalties change as customers just want the blockchain to facilitate throughput. Perhaps their decision to not mention blockchain or digital assets on their homepage removed the confusing technical aspects of NFTs and instead moved the focus onto the benefits of a cost-effective and fast settlement platform.

Summary

Overall, NFTs are a progressive technology that has huge potential to disrupt parts of the traditional art, gaming, collectables and antiquities markets. Although NFT sectors offer participants specific utility and use cases, the real revolution is the ecosystem that provides users with positives that simply do not exist outside a digital world.

We are not saying the sector will overturn traditional alternatives, the sector needs extensive maturation. However, the digital asset industry has a tendency to not reward people who extensively wait, and consequently investors should benefit from the early opportunities that are currently presenting themselves.

Comments ()