Bitcoin Institutional Flows Are a Game Changer

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 66

In recent months, Bitcoin funds have scooped up all the bitcoins that have been mined, and then some. The miners have been reducing their inventories (tracked by ByteTree) to meet the insatiable demand. In this piece, I will walk you through what is happening and demonstrate how institutional fund flows have become a major force.

In the early days of Bitcoin, there were no funds, just wallets. They were free to use, which was great, but came with a custody problem that kept institutional investors at bay. This is not a new problem. Prior to the gold ETF in 2003, institutional investors struggled to own it, as they could hardly lock gold bars in the office safe. They needed a security system that would be independently verified and linked to the financial system.

The ETF solved this as it enabled institutional gold ownership to thrive in a safe, audited, and compliant manner. Similarly, the Bitcoin funds solve this problem for institutional investors as they safely connect Bitcoin ownership with their clients. No need for private keys; just press the button and treat Bitcoin like a stock.

Epochs are the periods between Bitcoin halving events

| Epoch 1 | 3 January 2009 to 28 November 2012 |

| Epoch 2 | 29 November 2012 to 9 July 2016 |

| Epoch 3 | 10 July 2016 to 12 May 2020 |

| Epoch 4 | 13 May 2020 to present (est. 6 May 2024) |

There were no known funds in the 1st epoch. The world’s largest Bitcoin Fund, Grayscale (GBTC), was launched in the 2nd epoch on 25th September 2013, and XBT Provider (CoinShares) in early 2015. They remained small for some time, only to collectively break $100m on 17th November 2015. Interestingly, XBT Provider was larger at the time.

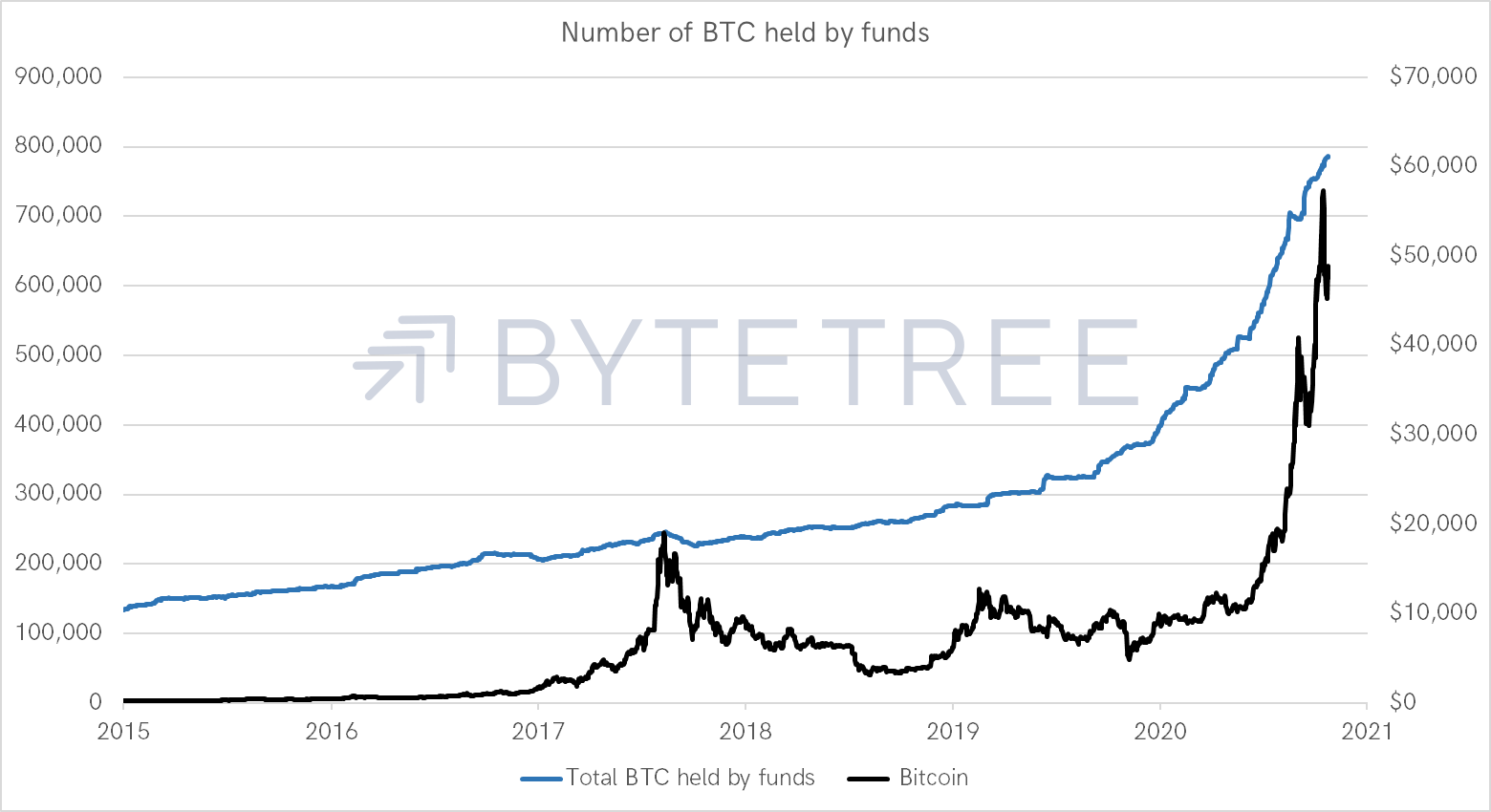

The chart shows the total amount of BTC held by all known publicly traded Bitcoin funds. Having seen just over 135,000 BTC held in early 2015, that has now ballooned to 790,344 BTC as of yesterday.

Fund flows are two-way, as money can come in, and it can also leave. What is remarkable is how few BTC have left the funds, even during the 2018 bear market. Part of that is due to GBTC being a closed-ended fund, and to the best of my knowledge, they have never sold a Bitcoin. In contrast the European ETFs create and redeem shares daily, according to supply and demand.

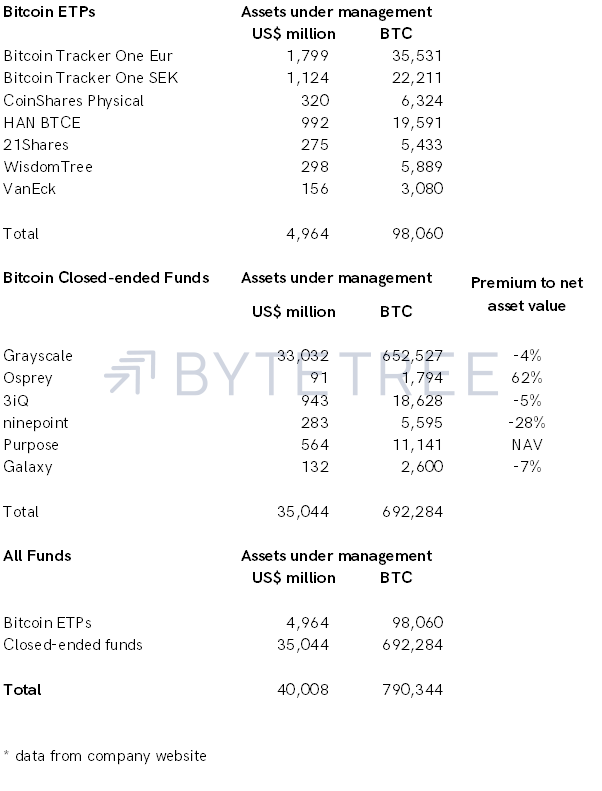

I have excluded multi-coin funds and corporate treasury because we cannot accurately measure the number of BTC held, nor do we have visibility. The funds included are long-only Bitcoin-only, as shown below.

The big difference between European and North American Bitcoin funds is ETFs versus closed-ended funds (CEFs). GBTC accounts for 85% of all BTC held on the list, which is truly remarkable. Supply-and-demand sees ETF flows come and go, whereas the CEFs seem to be one way. As a result, CEF supply-and-demand is reflected by discounts and premiums to net asset value, as opposed to the quantity of BTC held.

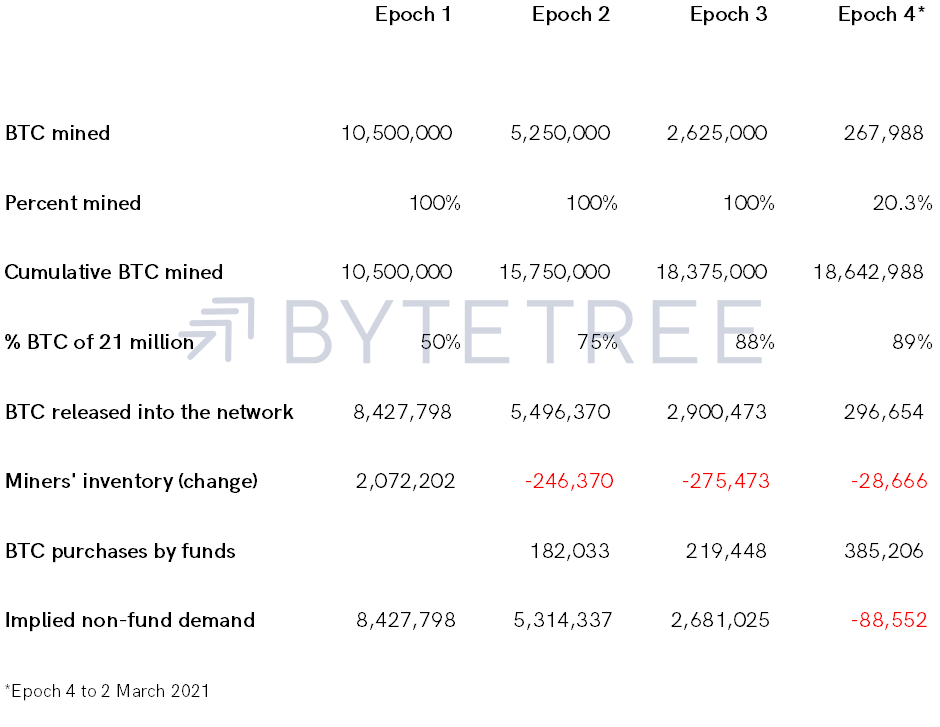

The first epoch saw no fund flows. 182,033 BTC were purchased in the second, 219,448 in the third and 385,206 in the fourth (current). As of 2 March 2021, 18,642988 BTC has been mined, or 89% of the entire future Bitcoin supply.

The miners can HODL too. Bytetree.com calculates First Spend, which measures BTC released into the network, and most likely, sold. The difference between BTC mined and first spent is recorded as inventory. That reached 2,072,2020 in the first epoch, with the number being drawn down in subsequent epochs.

Fund flows kicked off in the second epoch and started to accumulate BTC. In both the second and third epochs, demand from fund flows was small compared to the available supply. Yet in the fourth epoch so far, the funds have acquired 385,206 BTC, when only 267,988 BTC has been mined. Yet 296,654 BTC has been sold by miners because they have reduced their inventory. For the first time, the result is that the funds have scooped up the entire available new BTC supply, and then some.

The bottom line is that the 4th epoch is running a BTC deficit. In the first three epochs, non-fund demand took up the slack via exchanges. This time, the funds have been relentless.

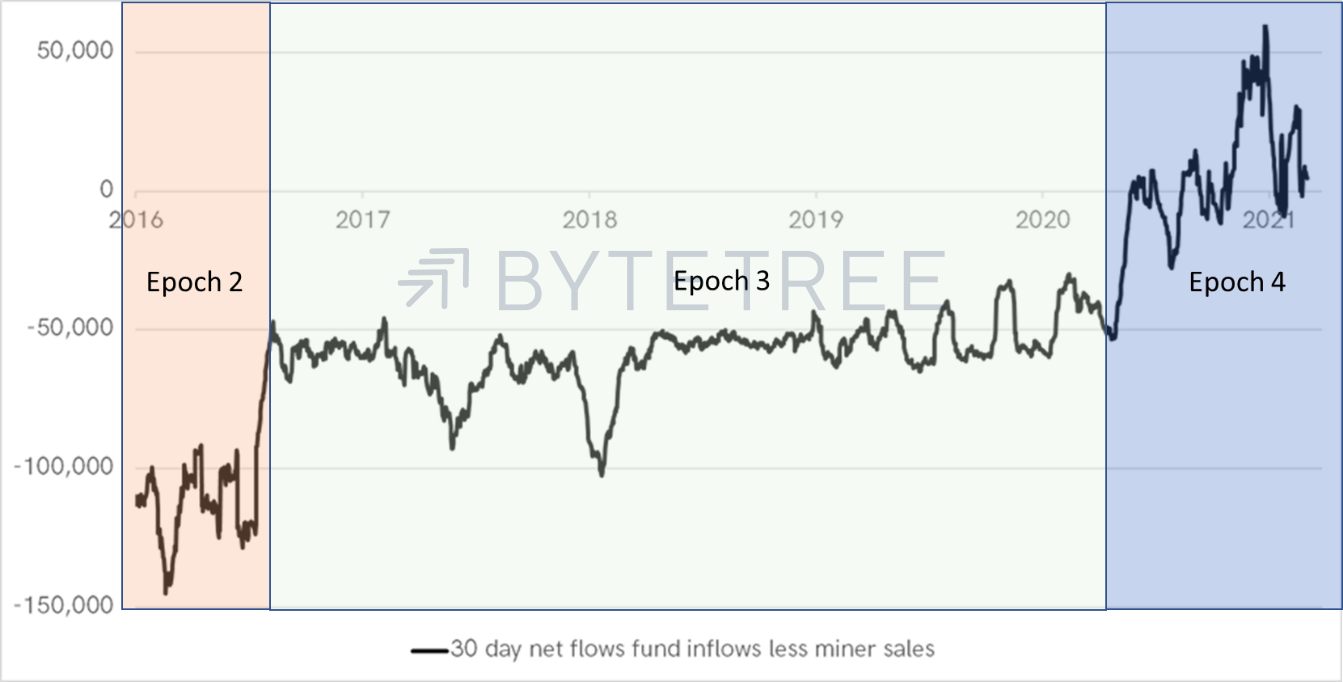

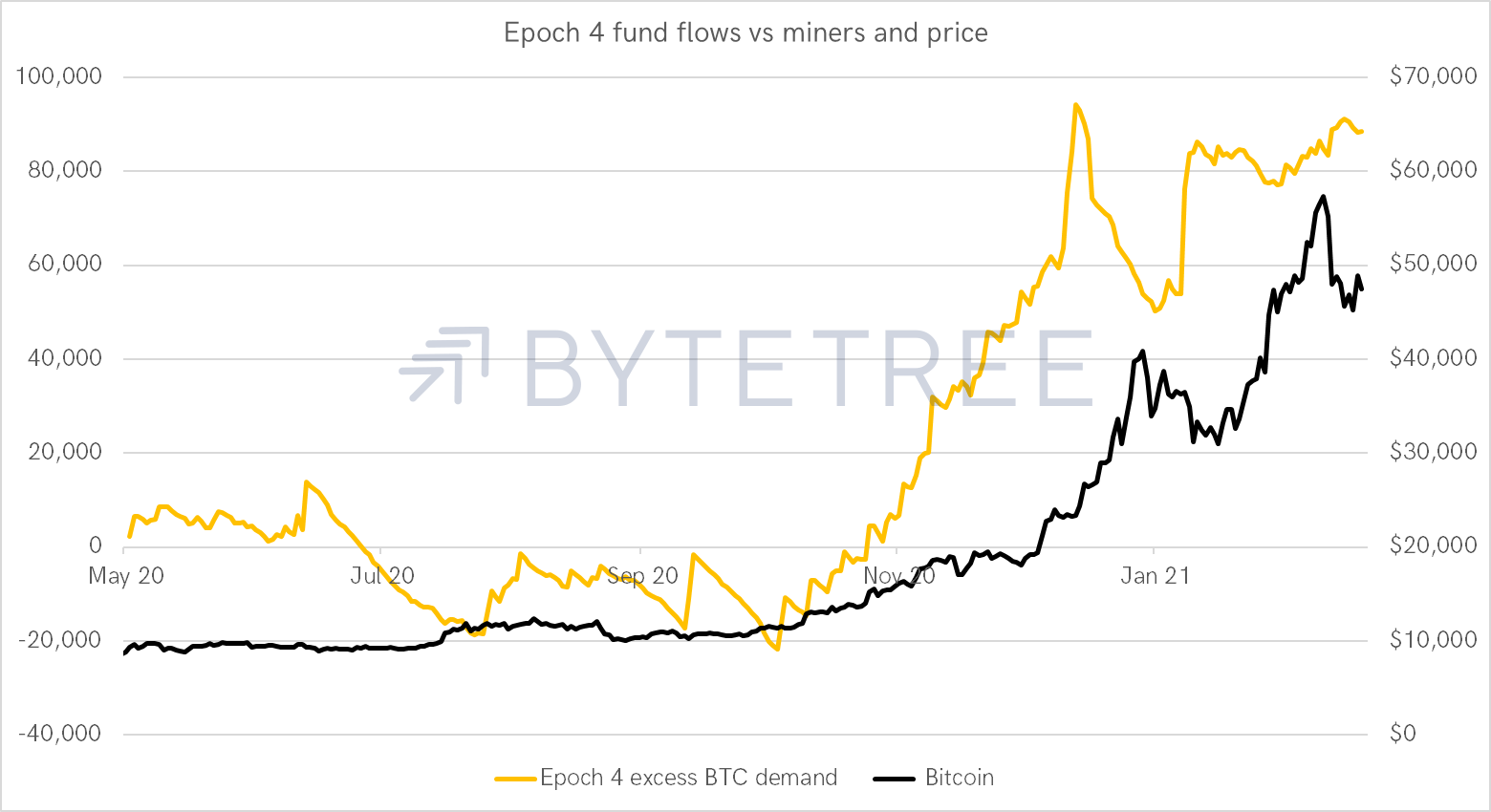

That can be seen by comparing the 30-day net flows between miners First Spend and fund flows by epoch. There has been a step-change through the periods, with the current epoch in surplus. The y-axis is measured in BTC.

The fourth epoch has seen a surplus

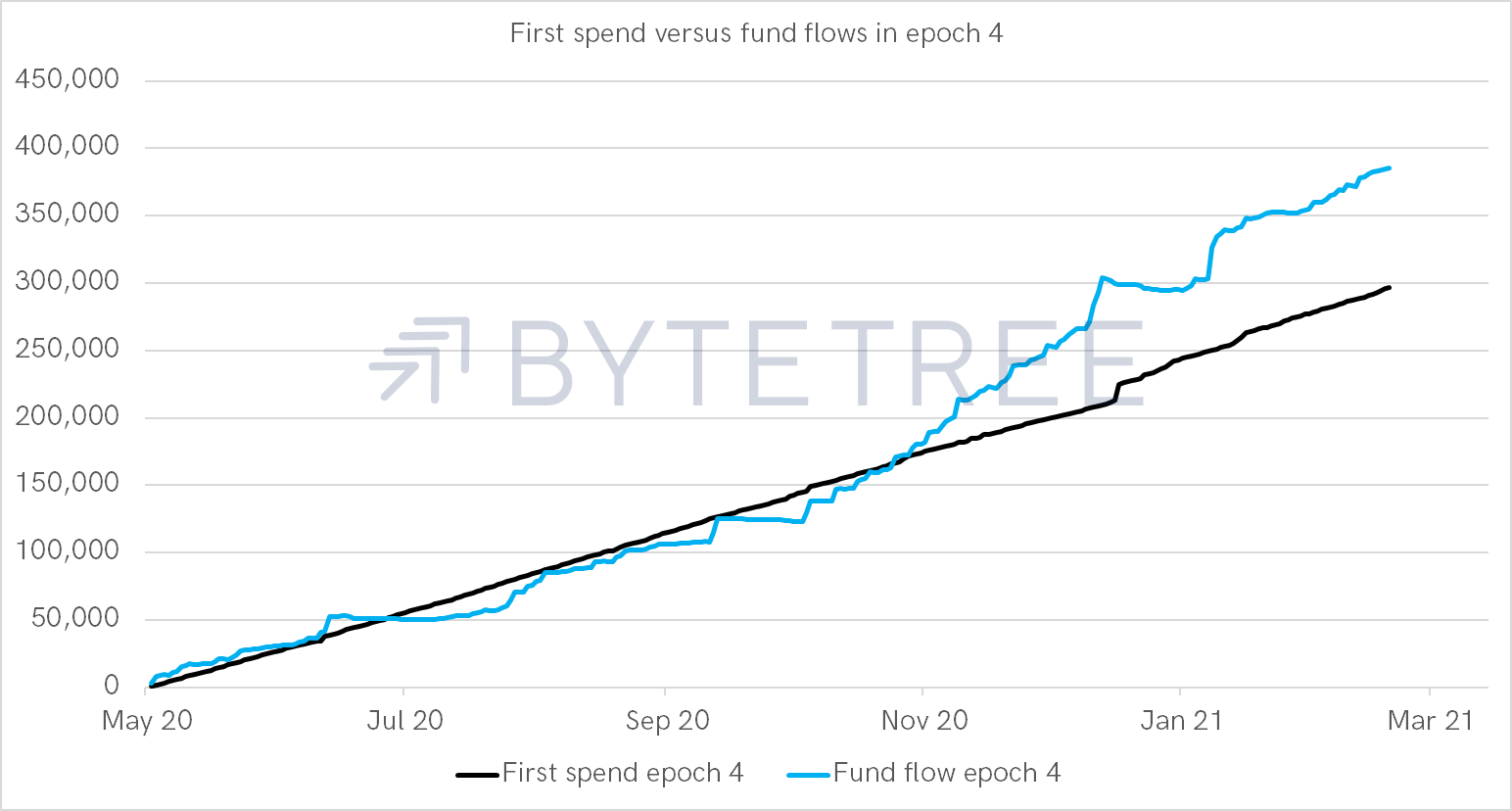

Zooming in on the fourth epoch, we can compare First Spend to fund flows in BTC. Notice how the fund demand crossed over the miners’ supply line in early November 2020.

And finally, I show the excess fund demand, which is the difference between the two lines above, against the price of Bitcoin. It somewhat explains this bull market.

The important point is that institutional demand has become the dominant force in setting the price of Bitcoin. There are 1,044,513 BTC yet to be mined between now and the end of the 4th epoch, estimated to end on 6 May 2024. If the institutional flows can maintain this rate, then all is well. If they can do more, then even higher prices become possible. Yet if they cool, it is not unreasonable to expect the price to follow.

CoinShares IPO

In other industry news, Jersey-based Bitcoin asset manager CoinShares is expected to IPO on Thursday 11th March on the NASDAQ Stockholm, in Sweden. The company will sell 3,364,403 shares priced at SEK 44.90 each. Read the statement here

With Coinbase and others coming to market, the crypto space is gaining ground in the stock market. We see this as positive because it improves visibility, which will, in turn, attract long-term investment.

Disclosure: Daniel Masters, Chairman of CoinShares, sits on the board of Crypto Composite Ltd, the holding company behind ByteTree.com and ByteTree Asset Management.

Perhaps of interest, I recently wrote Atlas Pulse Issue 61, which is an update on the gold market and you will see some new metrics being added to ByteTree Asset Management’s website that value gold, and compare Bitcoin and gold volatility.

Comments ()